US Seaweed Market Size, Share, Trends and Forecast by Environment, Product, Application, and Region, 2026-2034

US Seaweed Market Overview:

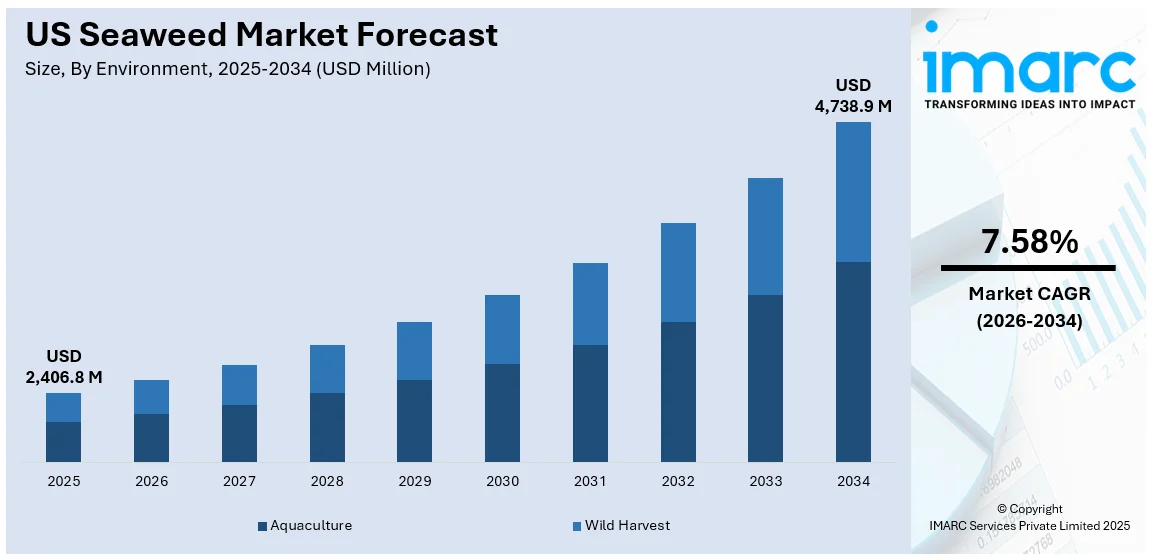

The US seaweed market size reached USD 2,406.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 4,738.9 Million by 2034, exhibiting a growth rate (CAGR) of 7.58% during 2026-2034. The market is driven by increasing incorporation of seaweed in livestock feed to promote environmental sustainability and improve agricultural efficiency. Functional foods and nutraceuticals utilizing seaweed extracts are meeting consumer demand for clean, nutrient-rich dietary options. Expanding use of seaweed in organic agriculture, biostimulants, and eco-friendly industrial processes is further augmenting the US seaweed market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,406.8 Million |

| Market Forecast in 2034 | USD 4,738.9 Million |

| Market Growth Rate 2026-2034 | 7.58% |

US Seaweed Market Trends:

Expanding Applications in Livestock Feed

The integration of seaweed into livestock feed formulations has gained significant momentum in the United States. Producers and agricultural stakeholders are prioritizing sustainable solutions that address environmental challenges linked to animal husbandry. Specific seaweed species are being evaluated for their potential to reduce methane emissions in ruminants while enhancing nutritional profiles. Feed innovators are working closely with agricultural cooperatives and sustainability initiatives to develop scalable supply chains for red and brown seaweed variants suitable for large-scale deployment in the feed sector. Research institutions continue to collaborate with feed manufacturers to optimize formulations that balance digestibility, nutrient absorption, and environmental benefits. The emphasis on sustainable agriculture is creating tangible pathways for the increased cultivation and processing of native and cultivated seaweed species. Partnerships between aquaculture operators and agribusiness companies are emerging to secure reliable inputs for future demand cycles. A recent study confirms that seaweed farming can sequester carbon in ocean sediments at rates comparable to mangroves and seagrasses, positioning it as a major Blue Carbon solution. Conducted across 20 farms worldwide, the research suggests that scaling seaweed farming could remove up to 140 million tons of CO₂ annually by 2050. Additionally, regulatory discussions regarding the formal approval of specific seaweed-derived feed ingredients are gaining traction, providing a framework for growth. Market participants recognize the long-term potential of these feed additives as part of integrated sustainability strategies within livestock farming, firmly establishing a new commercial opportunity. This alignment of agricultural innovation and environmental stewardship is a foundational driver for US seaweed market growth.

To get more information on this market Request Sample

Sustainable Agriculture and Industrial Uses

Beyond food and feed, seaweed plays an increasingly vital role in sustainable agriculture and industrial production processes across the United States. Seaweed-derived extracts are widely valued for their ability to support soil vitality, enhance nutrient absorption in crops, and contribute to environmentally conscious farming practices. Agricultural producers are incorporating these extracts into fertilizer regimes, capitalizing on bioactive properties that stimulate plant growth and improve resilience. Simultaneously, seaweed-based biostimulants are becoming integral to organic and regenerative farming frameworks, further advancing ecological goals in mainstream agricultural operations. The industrial sector is also utilizing seaweed-derived compounds in product formulations for personal care, cosmetics, and packaging innovations. These applications support circular economy strategies by providing biodegradable alternatives to synthetic materials and contributing to resource-efficient manufacturing. Emerging partnerships between aquaculture farms, agricultural cooperatives, and industrial processors highlight a dynamic shift toward localized supply chains for marine-based ingredients. This ecosystem-oriented approach strengthens regional production systems and minimizes transportation-related environmental impacts. Regulatory engagement and academic research continue to bolster market pathways, encouraging investment in scalable cultivation technologies. The U.S. Department of Energy (DOE) has launched the HAEJO (Harnessing Autonomy for Energy Joint Ventures Offshore) program, a USD 25 million initiative to develop deep-water seaweed farming for energy and industrial markets. The program leverages the U.S.’s vast ocean territory and partners with South Korea to advance seaweed cultivation technologies. Key goals include cutting farming costs by 75%, boosting domestic production 1,000-fold, and supporting energy-focused markets. As these applications diversify and expand, seaweed’s role as a sustainable input solidifies its importance within key production ecosystems across industries in the United States.

US Seaweed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on environment, product, and application.

Environment Insights:

- Aquaculture

- Wild Harvest

The report has provided a detailed breakup and analysis of the market based on the environment. This includes aquaculture and wild harvest.

Product Insights:

- Red

- Brown

- Green

The report has provided a detailed breakup and analysis of the market based on the product. This includes red, brown, and green.

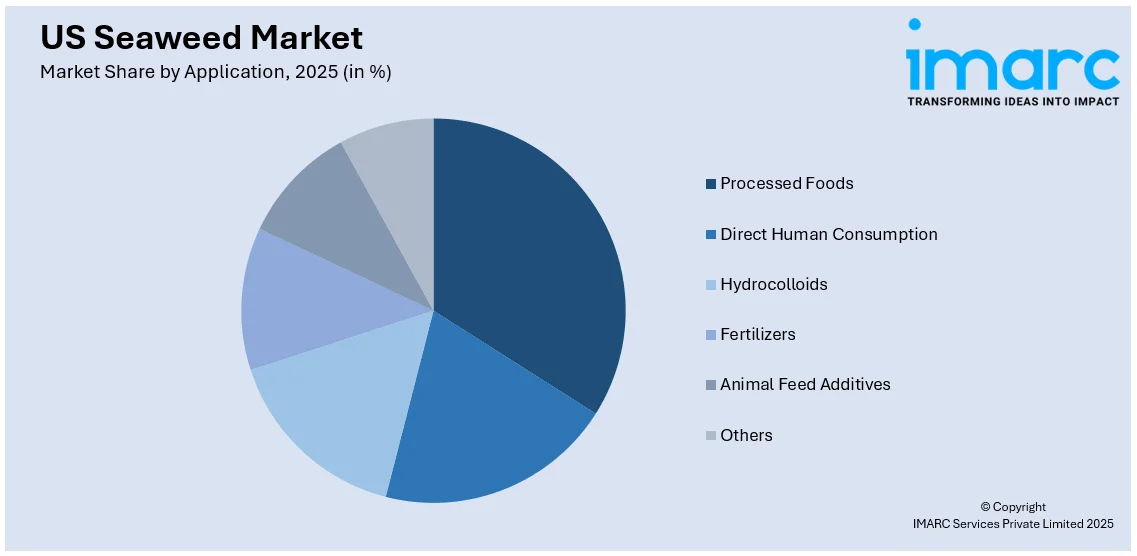

Application Insights:

Access the comprehensive market breakdown Request Sample

- Processed Foods

- Direct Human Consumption

- Hydrocolloids

- Fertilizers

- Animal Feed Additives

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes processed foods, direct human consumption, hydrocolloids, fertilizers, animal feed additives, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all major regional markets. This includes Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Seaweed Market News:

- On November 21, 2024, U.S.-based seaweed innovators Sway and Umaro secured USD 1.5 Million in funding from the U.S. Department of Energy under its Mixed Algae Conversion Research Opportunity (MACRO) grant to develop sustainable bioplastics from seaweed. The collaboration will transform alginate sidestreams from Umaro’s seaweed protein production into bioplastic products using Sway’s TPSea™ technology, supporting U.S. innovation in compostable materials.

US Seaweed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Aquaculture, Wild Harvest |

| Products Covered | Red, Brown, Green |

| Applications Covered | Processed Foods, Direct Human Consumption, Hydrocolloids, Fertilizers, Animal Feed Additives, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US seaweed market performed so far and how will it perform in the coming years?

- What is the breakup of the US seaweed market on the basis of environment?

- What is the breakup of the US seaweed market on the basis of product?

- What is the breakup of the US seaweed market on the basis of application?

- What is the breakup of the US seaweed market on the basis of region?

- What are the various stages in the value chain of the US seaweed market?

- What are the key driving factors and challenges in the US seaweed market?

- What is the structure of the US seaweed market and who are the key players?

- What is the degree of competition in the US seaweed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US seaweed market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US seaweed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US seaweed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)