U.S. Two Wheeler Market Report by Type (Scooters, Mopeds, Motorcycle, Electric Two-Wheeler), Technology (ICE, Electric), Transmission (Manual, Automatic), Engine Capacity (<100cc, 100-125cc, 126-180cc, 181-250cc, 251-500cc, 501-800cc, 801-1600cc, >1600cc), Fuel Type (Gasoline, Petrol, Diesel, LPG/CNG, Battery), End User (Personal, Commercial), Distribution Channel (Offline Channels, Online Channels), and Region 2026-2034

Market Overview:

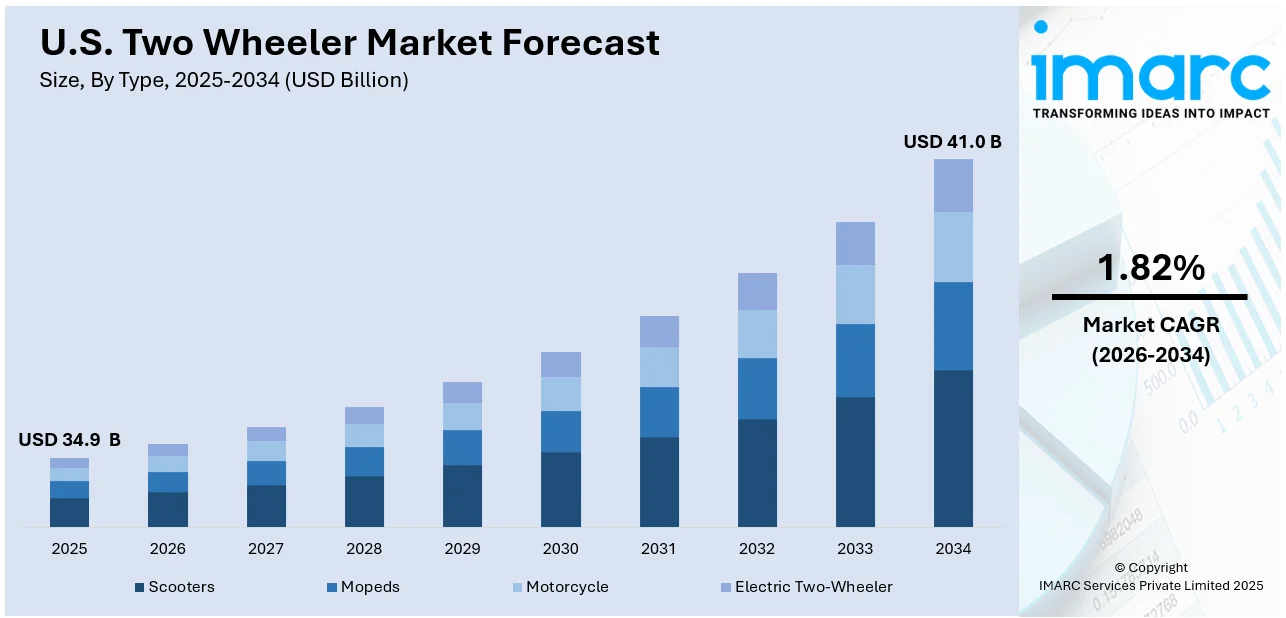

U.S. two wheeler market size reached USD 34.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 41.0 Billion by 2034, exhibiting a growth rate (CAGR) of 1.82% during 2026-2034. The increasing innovations in technology, such as the development of electric two-wheelers, connected features, and improved safety systems, that can attract consumers looking for modern and advanced transportation options, are driving the market.

U.S. Two Wheeler Market Insights:

- Rising demand for electric two-wheelers fueled by sustainability and technology.

- Congested cities are transforming commuter choice towards nimble, compact mobility.

- Technology advancements such as GPS, safety features enhance premium segment attractiveness.

- Economic offerings such as subscription favor affordability among gig economy workers.

- Government incentives and emissions policies drive electric vehicle market uptake.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 34.9 Billion |

| Market Forecast in 2034 | USD 41.0 Billion |

| Market Growth Rate (2026-2034) | 1.82% |

A two-wheeler refers to a type of vehicle that is powered by a two-stroke or four-stroke engine and is designed to be ridden on two wheels. These compact and maneuverable vehicles are commonly known as motorcycles, scooters, or mopeds. Two-wheelers are popular for their agility, fuel efficiency, and ease of navigation through congested traffic. Motorcycles, with their powerful engines and sleek designs, are favored by enthusiasts for their speed and performance. Scooters, on the other hand, are known for their convenience, especially in urban areas, offering an accessible and economical mode of transportation. Two-wheelers are widely used for commuting, leisure riding, and even professional racing, making them an integral part of the transportation landscape. Their versatility and fuel efficiency contribute to their widespread adoption, catering to a diverse range of riders and preferences.

To get more information on this market Request Sample

U.S. Two Wheeler Market Trends:

Fuel Costs and Urban Traffic

In United States, the consistent rise in the cost of fuel and increasing congestion in cities are fueling a change in transport preference to two-wheelers. Motorcycles, scooters, and e-bikes are being viewed as viable solutions for day-to-day commuting, providing quicker movement through heavy traffic and dramatically reduced fuel consumption. In city hubs where parking is scarce and costly, two-wheelers are an accessible substitute for automobiles, enabling commuters to steer clear of hours in traffic congestion and save daily travel time. As per the sources, in January 2025, Hopp by Bolt rolled out more than 700 smart scooters in Washington, D.C., making its United States debut with accessibility-driven features, safety features, and complimentary rides for low-income residents. Moreover, the low cost of two-wheelers, both in acquiring and running them, finds appeal across the broad population base—from young adults to gig workers. With the shift of remote work into hybrid modes, intra-city short-distance travel is increasingly becoming a norm, further fueling the need for small, fuel-efficient personal mobility solutions. This increased dependence on two-wheelers is part of an overarching trend where city dwellers' transportation is adjusting to economic constraints and infrastructural limitations.

Environmental Concerns

Environmental awareness is increasingly responsible for shaping the United States two-wheeler market. With heightened public awareness of pollution, carbon footprint, and global warming, consumers increasingly seek sustainable modes of transportation. Electric scooters and motorcycles have risen as alternatives to gas-powered vehicles and are gaining popularity among those who want to minimize their ecological imprint without sacrificing mobility. State-level incentives and pro-urban policies are promoting the use of environmentally friendly two-wheelers. Green mobility is not just an individual preference but also becoming a mainstream factor in city planning, with cities embracing cleaner air through car emission controls and low-emission zones. The industry is adapting by investing in battery technology and building electric model ranges to serve this growing demand. The intersection of consumer demand, governmental policy, and green responsibility is redefining the two-wheeler space as a central part of sustainable urban transportation in the United States.

Technological Advances and Economic Empowerment

Technological development and the quest for economic self-reliance are heavily transforming the United States two-wheeler market. Developments in electric powertrains, battery technology, smart connectivity, and safety systems have significantly enhanced the convenience and value of two-wheelers. Components such as GPS connectivity, theft recovery, app-based controls, and regenerative braking are improving the riding experience, especially in the premium and city commuter segments. At the same time, two-wheelers are increasingly becoming instruments of economic empowerment among delivery personnel, gig workers, and small enterprise owners seeking low-overhead mobility for work or small business. Low-cost financing and subscription-based ownership are making two-wheelers affordable to a wider part of the population. Technology in this changing scenario not only improves product performance but also enhances economic opportunities as it facilitates micro-entrepreneurship and flexible work paradigms. Together, these forces are shaping a more inclusive and innovation-driven market where mobility solutions keep pace with modern lifestyles and aspirations.

U.S. Two Wheeler Market Challenges:

The United States two-wheeler market, though growing, is still plagued by a number of subtle issues. Automobile cultural choices are still deeply ingrained within society, frequently restricting the mass use of two-wheelers for daily travel. Safety issues, especially in regions without dedicated bike lanes or motorcycle roads, discourage riders further. Besides, varying regulatory standards in states make it difficult to expand electric two-wheelers since licensing, insurance, and vehicle classification norms change. Inclement weather in most geographies also limits all-weather usage, affecting market consistency. Further, the paucity of charging outlets is a limiting factor for the use of electric two-wheelers, particularly in non-metro areas. Awareness among consumers for new, technologically equipped two-wheelers is still in nascent stages, necessitating continuous education. Overcoming such challenges will necessitate concerted action by policymakers, producers, and community leaders to create a climate wherein two-wheelers are seen as safe, convenient, and dependable options in America's changing mobility environment.

U.S. Two Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, technology, transmission, engine capacity, fuel type, end user, and distribution channel.

Type Insights:

- Scooters

- Mopeds

- Motorcycle

- Electric Two-Wheeler

The report has provided a detailed breakup and analysis of the market based on the type. This includes scooters, mopeds, motorcycle, and electric two-wheeler.

Technology Insights:

- ICE

- Electric

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes ICE and electric.

Transmission Insights:

- Manual

- Automatic

The report has provided a detailed breakup and analysis of the market based on the transmission. This includes manual and automatic.

Engine Capacity Insights:

- <100cc

- 100-125cc

- 126-180cc

- 181-250cc

- 251-500cc

- 501-800cc

- 801-1600cc

- >1600cc

A detailed breakup and analysis of the market based on the engine capacity have also been provided in the report. This includes <100cc, 100-125cc, 126-180cc, 181-250cc, 251-500cc, 501-800cc, 801-1600cc, and >1600cc.

Fuel Type Insights:

- Gasoline

- Petrol

- Diesel

- LPG/CNG

- Battery

The report has provided a detailed breakup and analysis of the market based on fuel type. This includes gasoline, petrol, diesel, LPG/CNG, and battery.

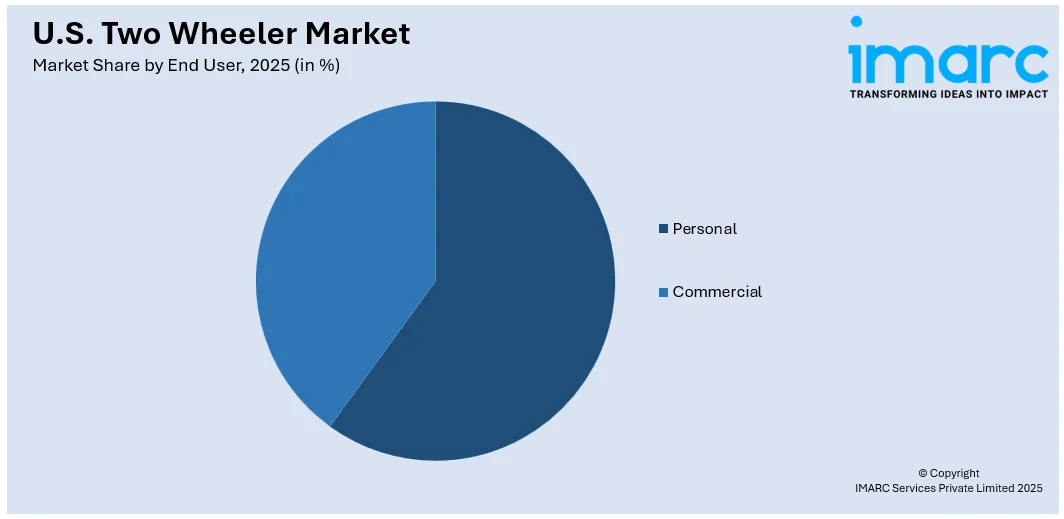

End User Insights:

Access the comprehensive market breakdown Request Sample

- Personal

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal and commercial.

Distribution Channel Insights:

- Offline Channels

- Online Channels

The report has provided a detailed breakup and analysis of the market based on distribution channel. This includes offline channels and online channels.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In June 2025, Buell Motorcycles introduced its Super Cruiser following its split from Harley-Davidson. The new motorcycle is hand-assembled at Grand Rapids, Michigan, and is set to compete with legendary motorcycle companies in terms of bold styling and high-quality craftsmanship, as the company targets growth and an enthusiastic group of American riders.

- In May 2025, Infinite Machine launched the Olto, a sit-down electric scooter for city commuting on bike lanes. With app connectivity, theft prevention, twin batteries, and curb-side parking functionality, the Olto is set to revolutionize city mobility with a chic, functional alternative to conventional e-bikes and scooters.

- In June 2024, Honda announced the updated 2025 Grom launch for U.S. and Japan sale. The small bike has new colors, better transmission, and a top speed of 60 mph, making it more attractive to urban commuters and beginner motorcyclists looking for a stylish and fuel-efficient alternative to scooter riding.

U.S. Two Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Scooters, Mopeds, Motorcycle, Electric Two-Wheeler |

| Technologies Covered | ICE, Electric |

| Transmissions Covered | Manual, Automatic |

| Engine Capacities Covered | <100cc, 100-125cc, 126-180cc, 181-250cc, 251-500cc, 501-800cc, 801-1600cc, >1600cc |

| Fuel Types Covered | Gasoline, Petrol, Diesel, LPG/CNG, Battery |

| End Users Covered | Personal, Commercial |

| Distribution Channels Covered | Offline Channels, Online Channels |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. two wheeler market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the U.S. two wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. two wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The two-wheeler market refers to the industry encompassing vehicles that operate on two wheels, such as motorcycles, scooters, mopeds, and e-bikes. These vehicles are valued for their fuel efficiency, maneuverability, and affordability. The market includes both traditional internal combustion engine models and electric variants, serving purposes ranging from daily commuting to recreation and commercial deliveries.

The U.S. two wheeler market was valued at USD 34.9 Billion in 2025.

The U.S. two wheeler market is projected to exhibit a CAGR of 1.82% during 2026-2034, reaching a value of USD 41.0 Billion by 2034.

Key drivers of the U.S. two wheeler market include rising urban traffic congestion, high fuel costs, and growing environmental awareness. Technological advancements in electric mobility and connectivity features are boosting consumer interest. Additionally, demand from gig workers and young professionals for affordable, efficient transportation and government support for electric vehicles further contribute to market growth and adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)