US Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

US Vegan Cosmetics Market Overview:

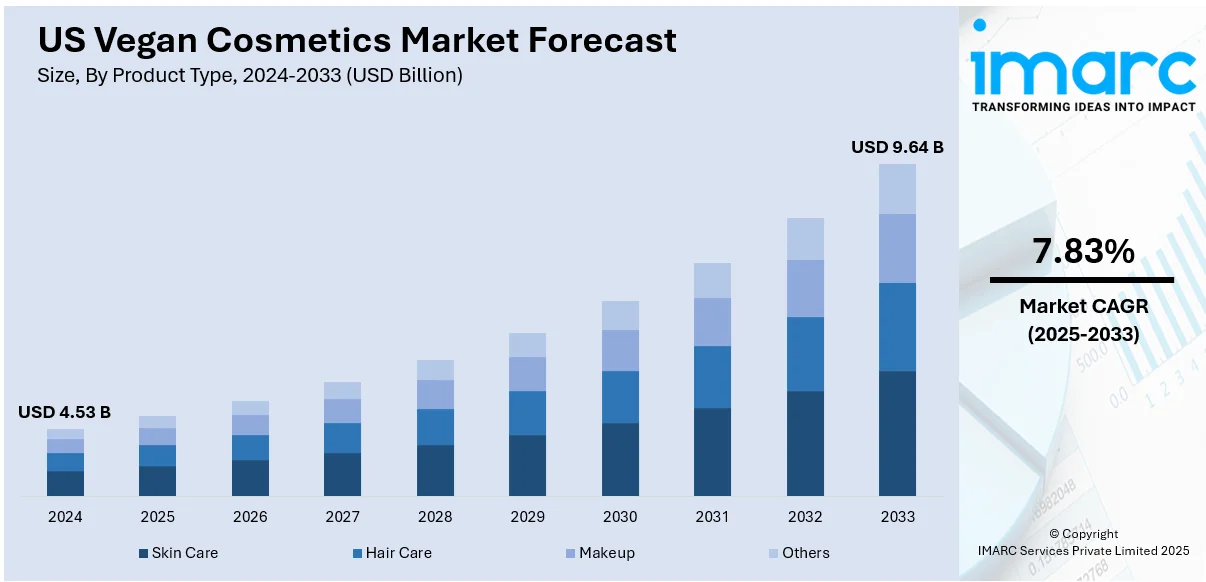

The US vegan cosmetics market size reached USD 4.53 Billion in 2024. Looking forward, the market is expected to reach USD 9.64 Billion by 2033, exhibiting a growth rate (CAGR) of 7.83% during 2025-2033. The market is driven by increasing consumer recognition of ethical sourcing and animal protection, due to social media personalities and ecological activists who bring attention to cruelty-free living. Advancements in technology have also paved the way for high-performance substitute products, while greener packaging is harmonious with environmentally responsible consumers. Regulatory changes, like transparent labeling regulations and prohibitions on certain animal-derived ingredients, also continue to foster faith in vegan certifications which adds to visibility and accessibility of the US vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.53 Billion |

| Market Forecast in 2033 | USD 9.64 Billion |

| Market Growth Rate 2025-2033 | 7.83% |

US Vegan Cosmetics Market Trends:

Clean Beauty and Plant-Based Innovation

The US vegan beauty market is becoming increasingly influenced by the clean beauty trend, with companies incorporating plant-based innovations to appeal to consumer interest in purity and transparency. Companies in America are turning to novel botanical actives—from superfoods like turmeric and kale to adaptogenic herbs like ashwagandha and holy basil—providing high-performance solutions free from animal-derived ingredients. This shift is supported by a wellness- and mindfulness-oriented culture where consumers themselves consciously look for products that are both gentle on skin and on the planet. In addition, R&D centers in California and New York are leading the way with lab-stable vegan peptides, biotech-derived actives to substitute for conventional animal-derived proteins, putting the US at the forefront of ethical cosmetic innovation. Together, this creates a distinctly American alignment between innovation, sustainability, and the ethics of conscious consumption.

To get more information on this market, Request Sample

Retail Evolution and Bringing Ethical Beauty Mainstream

Mainstream US retailers and beauty conglomerates are revolutionizing the vegan makeup market by pushing the boundaries of ethical choices. High-end beauty chains such as Sephora and Ulta Beauty now have separate clean or vegan departments, while Wilco and Target routinely partner with plant-based companies to launch exclusive ranges. This retail revolution is a cultural one—vegan and cruelty-free goods are no longer niche-advocated or niche-marketed; they are part of mainstream best-sellers. Pop-up events within urban landscapes, including Brooklyn's ethical beauty galleries or Los Angeles' eco-beauty expos, highlight next-generation US vegan brands, creating communities and building grassroots activism. The omnichannel reach—brick-and-mortar shops, online stores, subscription boxes—provides that vegan beauty is offered both in coastal market hubs and heartland towns, fostering mass acceptance of responsible beauty throughout the nation, and further contributing to the US vegan cosmetics market share.

Cultural Motivators and Social Factors in Vegan Beauty

Culturally, US consumers are heavily impacted by digital activism and social campaigns that promote vegan and cruelty-free values. Influencers and content creators on TikTok, Instagram, and YouTube have propelled the vegan beauty dialogue, nudging product reviews and tutorials towards clean and animal‑friendly ingredients. Campaigns such as "Meatless Mondays" and plant‑based challenges have opened doors for beauty analogues across social media platforms. High-profile American celebrities have also launched or supported vegan beauty brands, further establishing ethical branding while reaching mainstream markets. With increased environmental consciousness—fueled by worries over plastic pollution, forest destruction, and dwindling biodiversity—US vegan beauty companies frequently focus on biodegradable ingredients, refillable packaging systems, and transparently traced supply lines from cruelty-free Oregon or Colorado farms. Combined, these social and green drivers support a uniquely American narrative of innovation, virtue, and mindful consumption within the US vegan beauty sector.

US Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

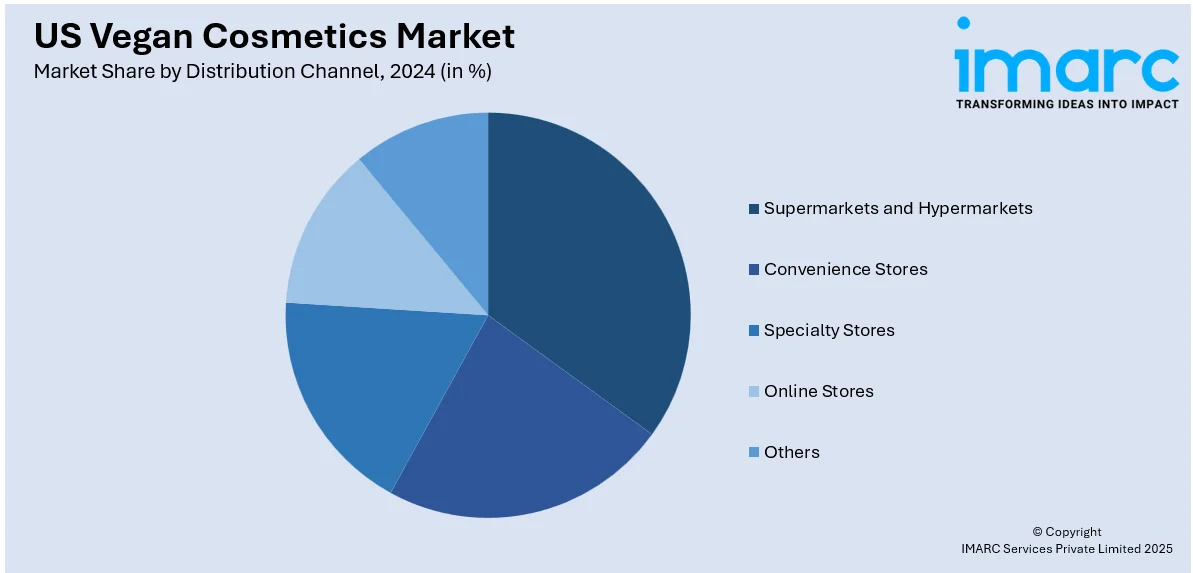

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Vegan Cosmetics Market News:

- In May 2025, a legally binding deal was reached by e.l.f. Beauty to acquire Rhode, a quickly growing, multi-category lifestyle beauty brand founded by Hailey Bieber and known for its line of premium, skin-focused products. The two companies' shared emphasis on disruption and product innovation is the foundation of this vibrant collaboration between e.l.f. Beauty and Rhode, opening the door for revolutionary global expansion.

US Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the US vegan cosmetics market on the basis of product type?

- What is the breakup of the US vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the US vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the US vegan cosmetics market?

- What are the key driving factors and challenges in the US vegan cosmetics market?

- What is the structure of the US vegan cosmetics market and who are the key players?

- What is the degree of competition in the US vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)