US Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

US Vegetable Oil Market Overview:

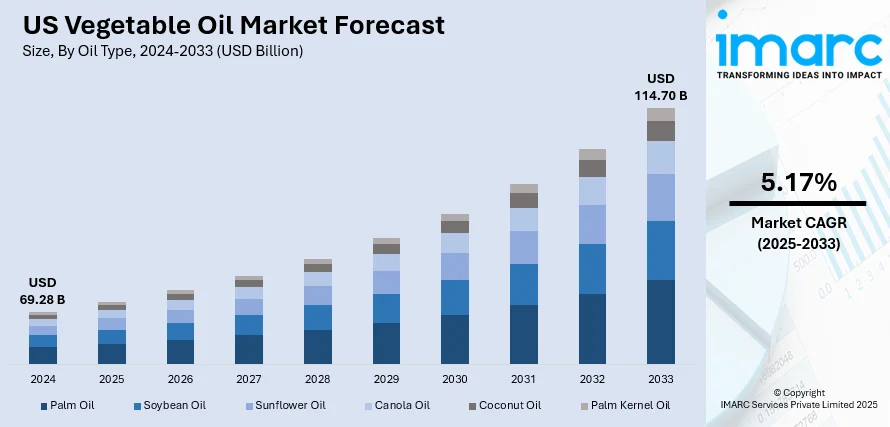

The US vegetable oil market size reached USD 69.28 Billion in 2024. Looking forward, the market is projected to reach USD 114.70 Billion by 2033, exhibiting a growth rate (CAGR) of 5.17% during 2025-2033. The market is driven by robust biodiesel and renewable fuel policies that redirect vegetable oil into energy production. Product innovations across culinary, functional, and industrial sectors supports diversified end‑use demand. Additionally, strong domestic production capabilities and export competitiveness, reinforced by trade logistics and risk management, are further augmenting the US vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 69.28 Billion |

| Market Forecast in 2033 | USD 114.70 Billion |

| Market Growth Rate 2025-2033 | 5.17% |

US Vegetable Oil Market Trends:

Diversification of Culinary and Functional Uses

Beyond fuel, vegetable oils, particularly soybean, sunflower, and canola, are experiencing broadened application across food manufacturing, retail cooking, and industrial uses. In 2024, soybean oil was the most widely consumed edible oil in the United States, with approximately 12.51 million metric tons used. This significantly surpassed palm oil consumption, which totaled around 1.8 million metric tons that year. Consumer preferences for heart-healthy oils high in unsaturated fats are driving product reformulations by the food industry. Oils serve as emulsifiers, carrier agents, and functional ingredients in baked goods, plant-based protein products, and nutraceuticals. Additionally, vegetable oil derivatives are being used in biodegradable lubricants, coatings, and biodegradable packaging, linking agricultural output to circular-economy efforts. Private–public partnerships are funding research into fractionation techniques, antioxidants stabilization, and cold-pressed processing to enhance value-added applications. As the culinary, health, and industrial sectors expand their demand for advanced oil products, this diversification serves to buffer vegetable oil markets from commodity-price instability and provides premium-margin opportunities beyond traditional markets. This highlights a systemic shift that underpins US vegetable oil market growth.

To get more information on this market, Request Sample

Domestic Production Resilience and Global Export Competitiveness

The United States remains the world’s largest producer of soybean oil, benefiting from advanced seed genetics, precision agronomy, and consolidated farm operations. In 2023, soybean production in the United States reached roughly 4.2 Billion bushels, rising from about 3.5 Billion bushels in 2019. The Midwest remained the leading region for soybean output, with Illinois, Iowa, and Minnesota being the top-producing states. Despite global market volatility, domestic production infrastructure has strengthened yield consistency and extraction efficiency. Export channels through Gulf and West Coast ports position US vegetable oils favorably in international markets, supported by logistics improvements and trade agreements. Quality certification and GMO-tracing programs maintain buyer confidence in Europe and Asia. Additionally, backup storage capacity and responsive crushing capacity enable producers to navigate seasonal pressure and supply chain disruptions. Enhanced risk management, via futures, hedging, and crop insurance, helps stabilize grower income and maintain processing margins. As global demand for plant oils increases for food, feed, and fuel, the United States is well positioned to serve global markets with reliable, high-volume oil output and continues to fortify its position in global agricultural trade.

US Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

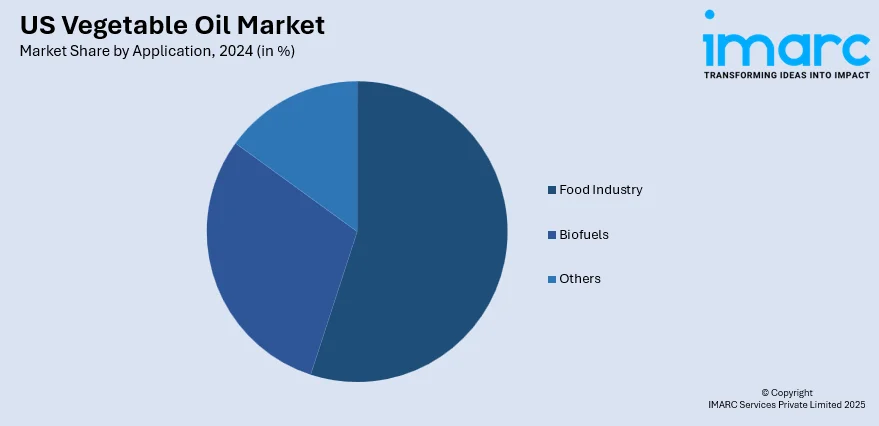

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all major regional markets. This includes Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Vegetable Oil Market News:

- On April 10, 2023, Bunge announced its acquisition of a newly constructed multi-oil refinery in Avondale, Louisiana, from Fuji Oil New Orleans, LLC. The facility, situated at a key port location, enhances Bunge's capacity to serve North American food, feed, and fuel markets, with commercial operations expected to begin in Q2 2023. This strategic move strengthens Bunge’s footprint in the U.S. vegetable oil market and aligns with its long-term goal of expanding value-added oil offerings.

US Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the US vegetable oil market on the basis of oil type?

- What is the breakup of the US vegetable oil market on the basis of application?

- What is the breakup of the US vegetable oil market on the basis of region?

- What are the various stages in the value chain of the US vegetable oil market?

- What are the key driving factors and challenges in the US vegetable oil market?

- What is the structure of the US vegetable oil market and who are the key players?

- What is the degree of competition in the US vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)