Usage-Based Insurance Market Size, Share, Trends and Forecast by Type, Technology, Vehicle Type, Vehicle Age, and Region, 2025-2033

Usage-Based Insurance Market Size and Share:

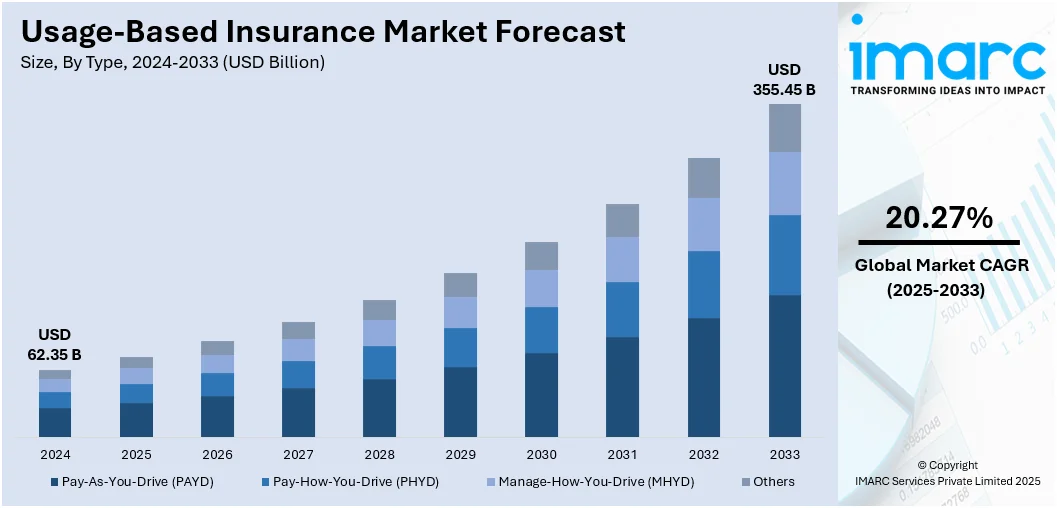

The global usage-based insurance market size was valued at USD 62.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 355.45 Billion by 2033, exhibiting a CAGR of 20.27% from 2025-2033. North America currently dominates the market, holding a market share of 40.6% in 2024. The extensive utilization of telematics technology by insurers to collect real-time data remotely from vehicles for monitoring consumer driving habits is driving the market. Moreover, the escalating demand for insurances as a proactive solution to incentivize safer driving behaviors is contributing to the market growth. Furthermore, the rising adoption of advanced technologies is catalyzing the overall demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 62.35 Billion |

|

Market Forecast in 2033

|

USD 355.45 Billion |

| Market Growth Rate 2025-2033 | 20.27% |

The usage-based insurance (UBI) market is growing robustly as insurers are increasingly embedding telematics technologies to evaluate driving behavior and tailor premiums. The market is seeing heightened demand since consumers are looking for more transparent and equitable pricing models that respond to individual driving habits instead of more traditional demographic attributes. Insurers are reacting by scaling up UBI programs that are concentrating on pay-how-you-drive and pay-as-you-drive models. Technology suppliers are constantly combining cutting-edge data analytics, artificial intelligence (AI), and Internet of Things (IoT) solutions, which are making more precise risk appraisal possible. Car manufacturers are also collaborating with insurers and are directly installing telematics hardware in vehicles, which is making easy adoption of UBI policies possible. Alongside this, smartphone-based solutions are becoming popular because they are lowering implementation costs and bringing UBI within reach of a larger group of people.

To get more information on this market, Request Sample

The United States UBI market is growing consistently as insurers are increasingly utilizing telematics to assess driver behavior and tailor premiums. People are demonstrating interest in these types of products, as they are recognizing the potential for insurance models that tie premiums to actual driving ability instead of broad demographic characteristics. Insurers are consequently introducing new UBI initiatives that are emphasizing affordability, transparency, and driver engagement. Adoption of technology is accelerating as insurers incorporate connected car data, mobile apps, and sophisticated analytics to make programs more efficient. Motor manufacturers are building telematics functionality into vehicles, which is making data gathering faster and facilitating collaborations between insurance companies and automobile makers. Smartphone-enabled telematics is also on the upswing as it is reducing barriers to entry and allowing greater masses to participate in UBI policies. In 2024, Stellantis Financial Services US, the automotive finance subsidiary of Stellantis in North America, announced a collaboration with bolt, the insurtech that boasts the largest tech-enabled insurance exchange globally, to assist customers of Chrysler, Dodge, Jeep®, Ram, Fiat, and Alfa Romeo. Through bolt's technology, Stellantis customers will be able to buy auto insurance via Stellantis brand websites and mobile applications featuring various insurers' products. This distinctive collaboration was intended to streamline and tailor the automotive insurance buying experience, offering personalized coverage choices via various distribution avenues. The offerings were expected to expand to incorporate usage-based options by utilizing telematics, data, and analytics.

Usage-Based Insurance Market Trends:

Rising Demand for Remote Diagnostics to Monitor Consumer Driving Behavior

The extensive utilization of telematics technology by insurers to collect real-time data remotely from vehicles for monitoring consumer driving habits, such as acceleration, speed, and braking is primarily driving the UBI market statistics. Moreover, the widespread availability of remote diagnostics allows insurance providers to offer accurate premium calculations to consumers, which is also propelling the market growth. For instance, according to Ptolemus, a mobility-focused research and strategic consulting organization with headquarters in Brussels, about 20 million of the 875 million motor insurance plans in force last year were usage-based. Additionally, in August 2023, Citroen India, with the help of ICICI Lombard General Insurance, introduced Usage-Based Insurance for EC3 Customers to encourage safe driving among owners. Furthermore, in September 2023, Definity launched a new usage-based insurance (UBI) offering to provide drivers unprecedented control over their premiums while promoting safer driving practices.

Increasing Need to Reduce Road Accidents and Promote Driver Safety

The escalating demand for UBI as a proactive solution to incentivize safer driving behaviors, owing to the increasing number of road accidents causing human and economic losses, is stimulating the usage-based insurance market growth. For instance, according to the WHO Global Status Report on Road Safety, there were 1.3 million deaths in road traffic and 20 to 50 million people were injured or impacted due to road incidents. More than 93% of road traffic accidents happen in low- and middle-income countries. Moreover, government bodies are launching various policies to ensure road safety and reduce the occurrence of road accidents. For example, New South Wales collaborated with partners, stakeholders, and members of the NSW community in establishing the 2026 Road Safety Action Plan. Their consultations were well-attended and eventually aided in developing several programs. The Engagement Summary for the 2026 Road Safety Action Plan gives a snapshot of the engagement activities and responses received throughout NSW during the consultation. Furthermore, the National Safety Council, part of the US federal government, has created the Road to the Zero project to eradicate highway fatalities by 2050.

The Rapid Adoption of Advanced Technologies

One of the major usage-based insurance market trends include the rising adoption of advanced technologies, such as smartphone-based UBI and hybrid-based insurance. In addition, the integration of advanced technologies into insurance practices to improve accuracy in personalized premium calculation, risk assessment, and real-time data analysis is catalyzing the usage-based insurance market demand. For instance, Citroen India partnered with ICICI Lombard General Insurance to provide greater everyday value and convenience where it matters most to consumers. Moreover, Mastercard‐™s U.S. usage-based Insurance card products empower cardholders with access to over USD 60 Billion in meaningful rewards and benefits. Besides this, CerebrumX platform collaborated with Ford connected vehicle data to support its data-driven usage-based insurance (UBI)-as-a-Service model for Insurers. This model offers a quicker and more cost-effective implementation of UBI programs by using embedded telematics for eligible Ford and Lincoln connected vehicles. Furthermore, in September 2023, Floow and Otonomo Technologies Ltd partnered with Definity and Munich Re to bring a new, innovative, usage-based auto insurance product to Canada. Further, such strategies drive market growth.

Usage-Based Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global usage-based insurance market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, vehicle type, and vehicle age.

Analysis by Type:

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

- Manage-How-You-Drive (MHYD)

- Others

Pay-as-you-drive (PAYD) stands as the largest component in 2024, holding around 55.2% of the market. The PAYD insurance model is gaining immense popularity, as it allows policyholders to pay premiums based on the distance driven. This type of insurance is particularly appealing to individuals who drive frequently, environmentally conscious individuals, and people seeking equitable insurance pricing. For instance, Edelweiss General Insurance introduced India’s first telematics-based motor insurance called 'SWITCH.' This on-demand policy generates a real-time driving score and dynamically rates the premium. Moreover, it detects motion and automatically activates insurance when the vehicle is driven, making it convenient and hassle-free for users. Additionally, PAYD is encouraging safer and more sustainable driving habits. Since policyholders are aware that every mile impacts their premium, they are often reducing unnecessary trips, which is contributing to lower accident risks and decreased traffic congestion. At the same time, reduced mileage is supporting environmental goals, as fewer miles driven are resulting in lower fuel consumption and reduced emissions.

Analysis by Technology:

- OBD II

- Black Box

- Smartphones

- Others

Black box stands as the largest component in 2024, holding around 40.3% of the market. Black box insurance, or telematics insurance, is bringing notable advantages to both motorists and insurers through the use of in-car technology to track driving habits. Among the major benefits is that it is facilitating more equitable pricing since premiums are now being determined by how safely and responsibly one drives instead of just on age or location. This is permitting safe drivers, particularly inexperienced or young ones, to secure cheaper insurance. The black box system also promotes safer driving. With the tracking of speed, braking, acceleration, and cornering, drivers are more aware of how they drive. Insurers are providing feedback via apps or websites, which is assisting drivers in enhancing their skills and minimizing accident threats. From the environmental point of view, black box insurance is encouraging lower mileage and fuel efficiency since drivers are encouraged to use smoother driving techniques. Insurers are gaining useful real-time data through the technology that is enhancing claim management and risk assessment. Another advantage is stolen vehicle tracking since numerous black box systems are facilitating recovery.

Analysis by Vehicle Type:

- Light-duty Vehicle (LDV)

- Heavy-duty Vehicle (HDV)

Light-duty vehicle (LDV) leads the market with around 85.8% of market share in 2024. LDVs are offering a wide range of benefits across economic, environmental, and operational dimensions, making them an essential part of both personal and commercial transportation. One of the key advantages is fuel efficiency, as LDVs are typically consuming less fuel compared to heavier vehicles. This is translating into cost savings for drivers and fleet operators while also contributing to reduced greenhouse gas emissions. LDVs are also providing greater flexibility and convenience. Their smaller size is allowing easier maneuverability in urban areas, making them well-suited for personal commuting, last-mile delivery, and ride-sharing services. Businesses are increasingly relying on LDVs for logistics operations, as they are balancing cargo capacity with lower operating costs. From an environmental standpoint, LDVs are playing a crucial role in supporting the adoption of electric mobility. Electric and hybrid LDV models are becoming more widespread, which is helping reduce reliance on fossil fuels and supporting global sustainability goals. Additionally, LDVs are offering lower maintenance costs due to simpler designs compared to heavy-duty alternatives, which is improving long-term affordability.

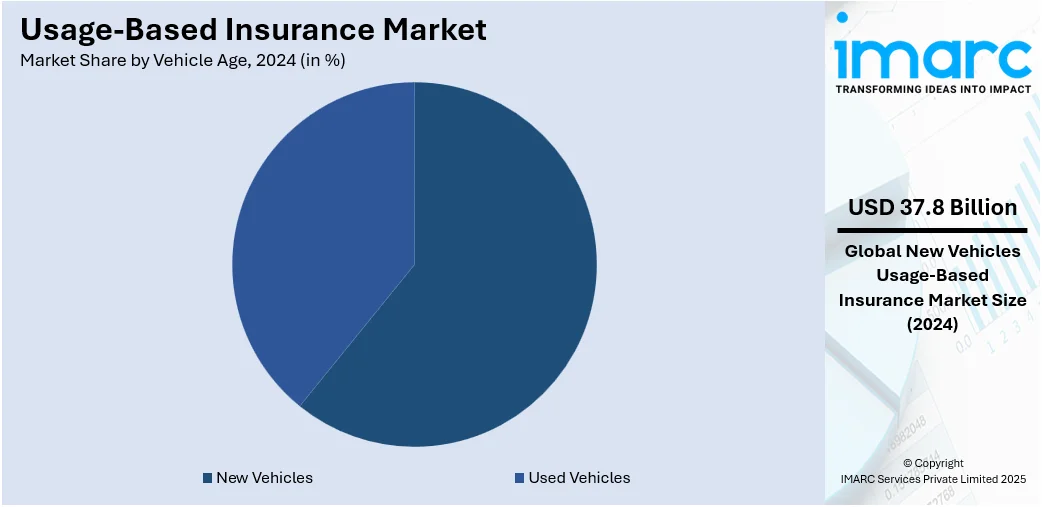

Analysis by Vehicle Age:

- New Vehicles

- Used Vehicles

New vehicles lead the market with around 60.6% of market share in 2024. They are increasingly becoming the vehicle of choice for usage-based insurance (UBI) programs due to their high connectivity and telematics features. New vehicles are incorporating factory-installed sensors, onboard diagnostics, and Internet of Things (IoT) technologies that are making it possible to collect real-time driving data without the need for aftermarket devices. This makes their use obsolete, lowering setup costs and increasing data accuracy for insurers. Insurers are favoring new cars for UBI implementation because these vehicles are backing smartphone apps, inbuilt telematics units, and sophisticated driver assistance systems (ADAS). These amenities are not only improving behavioral data quality but are also allowing insurers to offer extra services such as driver feedback, car health monitoring, and alerts for safety. Car manufacturers are cooperating aggressively with insurance companies, thereby making new vehicles pre-configured to UBI programs before sale.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 40.6%. The North America UBI market is growing rapidly as insurers are increasingly relying on telematics and connected car technologies to design personalized policies. Consumers are showing strong interest in these solutions, as they are recognizing that premiums are being aligned with actual driving behavior instead of broad demographic categories. This demand is encouraging insurers to expand UBI programs that are focusing on affordability, fairness, and digital engagement. Automakers across the region are integrating telematics capabilities into new vehicles, and partnerships with insurers are strengthening the adoption of embedded insurance models. At the same time, smartphone-based telematics solutions are gaining popularity, as they are lowering implementation costs and making UBI more accessible to a wider base of drivers. Advanced analytics, artificial intelligence, and cloud platforms are being deployed to process large volumes of driver data, which is supporting accurate risk assessment and efficient claims management.

Key Regional Takeaways:

United States Usage-Based Insurance Market Analysis

The United States holds 86.60% share in North America. The market is primarily driven by increasing regulatory support for telematics and data privacy frameworks. In accordance with this, ongoing advances in AI and machine learning enable more precise risk assessments and personalized premiums, propelling market growth. The rising consumer demand for flexible, pay-as-you-drive insurance models is reshaping traditional offerings and impelling the market. According to reports, 48% of respondents favor a digital-first approach complemented by the ability to speak with a representative when necessary, highlighting the growing demand for hybrid engagement models that balance efficiency with personalized support. Similarly, the proliferation of connected and autonomous vehicles generates vast driving data, enhancing UBI capabilities. Furthermore, strategic partnerships between insurers and technology providers are accelerating digital transformation and improving user engagement, which is stimulating market appeal. The growing urban congestion and traffic incidents are incentivizing safer driving through UBI programs, thereby enhancing market appeal. Additionally, widespread mobile app penetration facilitates real-time monitoring and customer interaction, expanding market accessibility. Apart from this, heightened environmental awareness encourages eco-friendly driving behaviors rewarded by UBI, further creating lucrative market opportunities.

Europe Usage-Based Insurance Market Analysis

The Europe market is experiencing growth due to increasing regulatory focus on sustainability and emissions reduction. In line with this, the rise in fuel prices and broader economic pressures is driving consumer interest in insurance products aligned with actual vehicle usage. Similarly, rising investments in telematics infrastructure and connected mobility under EU-backed digital programs are supporting data-driven innovations across the sector. As such, in July 2025, Kia partnered with LexisNexis Risk Solutions to integrate driving behavior analytics into its app across 28 countries, enabling personalized insurance through real-time risk profiling and supporting Europe’s shift toward data-driven usage-based insurance. The growing preference among younger, tech-savvy consumers for personalized and transparent insurance products is accelerating the shift toward behavior-based models. Additionally, the expansion of car-sharing and micro-mobility services across European cities is augmenting demand for flexible, on-demand insurance coverage. The strategic partnerships between insurers and OEMs are enabling seamless integration of UBI systems at the vehicle point-of-sale. Moreover, continual advancement in AI-powered behavior analytics is refining risk assessment and underwriting practices, further driving market expansion.

Asia Pacific Usage-Based Insurance Market Analysis

The Asia Pacific market is largely driven by the accelerated integration of connected vehicle technologies, which provide insurers with access to real-time driver data and enable behavior-based pricing models. As such, BAIC invested over RMB 100 Billion in R&D by 2030 to advance connected vehicle technologies, including intelligent driving, smart cockpits, and electronic control units, supported by world-class testing facilities and 35,000+ patent filings. Furthermore, the region’s expanding 5G infrastructure, which supports low-latency data transfer essential for advanced telematics applications, is stimulating market appeal. As of March 2025, China has exceeded 4.39 million 5G base stations, with 5G user penetration reaching 75.9%, according to the Ministry of Industry and Information Technology (MIIT). Similarly, the region’s growing middle-class population is demanding flexible, usage-linked insurance plans that reward responsible driving. Additionally, the increasing adoption of factory-fitted telematics systems by leading OEMs is streamlining data acquisition for insurers. Moreover, the rise in partnerships between insurers and app developers is enhancing user experience and engagement, driving widespread adoption of mobile-based driving assessments, and enabling deeper market penetration.

Latin America Usage-Based Insurance Market Analysis

In Latin America, the market is growing due to rising smartphone penetration, which enables the integration of mobile telematics for real-time driver monitoring and risk assessment. Industry analysis highlights Brazil as the leading frontier for smartphone vendors in Latin America. With a population of 212 million and an active installed base of 175 million smartphones in 2024, Brazil stands out by a significant margin. In addition to this, increased urban congestion and higher accident rates are encouraging insurers to adopt behavior-based pricing models that promote safer driving habits. Furthermore, supportive regulatory frameworks in countries such as Brazil and Mexico, fostering the digitization of insurance services, are driving market expansion. Moreover, the expansion of the gig economy, particularly in ride-hailing and last-mile delivery, is strengthening demand for flexible insurance products tailored to irregular and high-frequency vehicle usage, thus advancing UBI adoption across diverse user segments.

Middle East and Africa Usage-Based Insurance Market Analysis

The market in the Middle East and Africa is propelled by significant investments in telematics infrastructure, supported by government smart mobility initiatives. Accordingly, in July 2025, Saudi Arabia’s financial reforms under Vision 2030 promoted telematics adoption in insurance, with gross written premiums rising to SAR 76.1 Billion in 2024. The Insurance Authority introduced TELEMATICS, a unified platform for driver behavior tracking and claims simplification. Furthermore, the rising number of young, first-time vehicle owners is increasing demand for affordable motor insurance products. The increasing regulatory support for data-driven insurance models is encouraging insurers to adopt usage-based policies, further accelerating market expansion. Moreover, the proliferation of fintech partnerships is facilitating digital distribution and improving customer engagement across diverse populations.

Competitive Landscape:

Market players in the global usage-based insurance market are actively expanding their offerings by integrating advanced telematics, artificial intelligence, and data analytics into insurance products. Insurers are forming strategic partnerships with automakers, technology providers, and mobility platforms to enhance real-time data collection and streamline policy adoption. Many companies are focusing on developing smartphone-based telematics applications, which are lowering costs and increasing accessibility for a broader customer base. Leading insurers are also introducing reward programs and personalized feedback systems to encourage safer driving behaviors and strengthen customer engagement. In addition, as per the usage-based insurance market forecasts, investments in electric and connected vehicle ecosystems are expected to rise, as market players are aligning with evolving mobility trends and regulatory requirements worldwide.

The report provides a comprehensive analysis of the competitive landscape in the usage-based insurance market with detailed profiles of all major companies, including:

- Aioi Nissay Dowa Insurance UK Ltd

- Allianz SE

- Allstate Insurance Company

- American International Group Inc.

- Assicurazioni Generali S.p.A.

- AXA

- Liberty Mutual Insurance Company

- Mapfre S.A.

- Progressive Casualty Insurance Company

- State Farm Automobile Mutual Insurance Company

- TomTom International BV.

- UnipolSai Assicurazioni S.p.A. (Unipol Gruppo S.p.A)

Latest News and Developments:

- June 2025: Zuno General Insurance launched India’s first crash detection-enabled car insurance through its Zuno Smart Drive app. Using mobile telematics, it offers real-time crash alerts, instant roadside assistance, and faster claims processing, enhancing safety and customer experience without requiring additional devices or setup.

- May 2025: If P&C Insurance launched an embedded car-sharing insurance product on Socotra’s cloud-native platform. Self-implemented in five months, the solution enables usage-based, on-demand coverage, expanding If’s presence in the sharing economy and enhancing agility through Socotra’s open APIs and configurable policy core.

- August 2024: Zuno General Insurance launched the "Pay How You Drive" add-on using mobile telematics to assess driving behavior via its app. The feature offers personalized premiums and rewards safe driving with discounts during renewals, marking India’s first usage-based insurance model based on driving behavior.

- July 2024: IMS received the Frost & Sullivan North American Technology Innovation Leadership Award for its telematics solutions. IMS offers advanced usage-based insurance products, enhancing driver safety, claims processing, and risk assessment through innovative apps and sensors, positioning itself as a leader in the global connected car insurance market.

Usage-Based Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD), Others |

| Technologies Covered | OBD II, Black Box, Smartphones, Others |

| Vehicle Types Covered | Light-duty Vehicle (LDV), Heavy-duty Vehicle (HDV) |

| Vehicle Ages Covered | New Vehicles, Used Vehicles |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, China, Brazil, Mexico |

| Companies Covered | Aioi Nissay Dowa Insurance UK Ltd, Allianz SE, Allstate Insurance Company, American International Group Inc., Assicurazioni Generali S.p.A., AXA, Liberty Mutual Insurance Company, Mapfre S.A., Progressive Casualty Insurance Company, State Farm Automobile Mutual Insurance Company, TomTom International BV., UnipolSai Assicurazioni S.p.A. (Unipol Gruppo S.p.A) etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the usage-based insurance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global usage-based insurance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the usage-based insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The usage-based insurance market was valued at USD 62.35 Billion in 2024.

The usage-based insurance market is projected to exhibit a CAGR of 20.27% during 2025-2033, reaching a value of USD 355.45 Billion by 2033.

The market is being driven by the extensive adoption of telematics technologies for real-time driving behavior monitoring, rising demand for fair and transparent premium models, increasing emphasis on road safety, and the rapid integration of artificial intelligence, IoT, and smartphone-based solutions in insurance practices.

North America currently dominates the usage-based insurance market, accounting for a share of 40.6% in 2024, driven by high telematics adoption, connected car integration, and growing consumer demand for personalized, technology-enabled insurance models.

Some of the major players in the usage-based insurance market include Aioi Nissay Dowa Insurance UK Ltd, Allianz SE, Allstate Insurance Company, American International Group Inc., Assicurazioni Generali S.p.A., AXA, Liberty Mutual Insurance Company, Mapfre S.A., Progressive Casualty Insurance Company, State Farm Automobile Mutual Insurance Company, TomTom International BV., UnipolSai Assicurazioni S.p.A. (Unipol Gruppo S.p.A) etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)