Used Car Market Report by Vehicle Type (Hatchbacks, Sedan, Sports Utility Vehicle, and Others), Vendor Type (Organized, Unorganized), Fuel Type (Gasoline, Diesel, and Others), Sales Channel (Online, Offline), and Region 2026-2034

Used Car Market Size & Trends Forecast 2034:

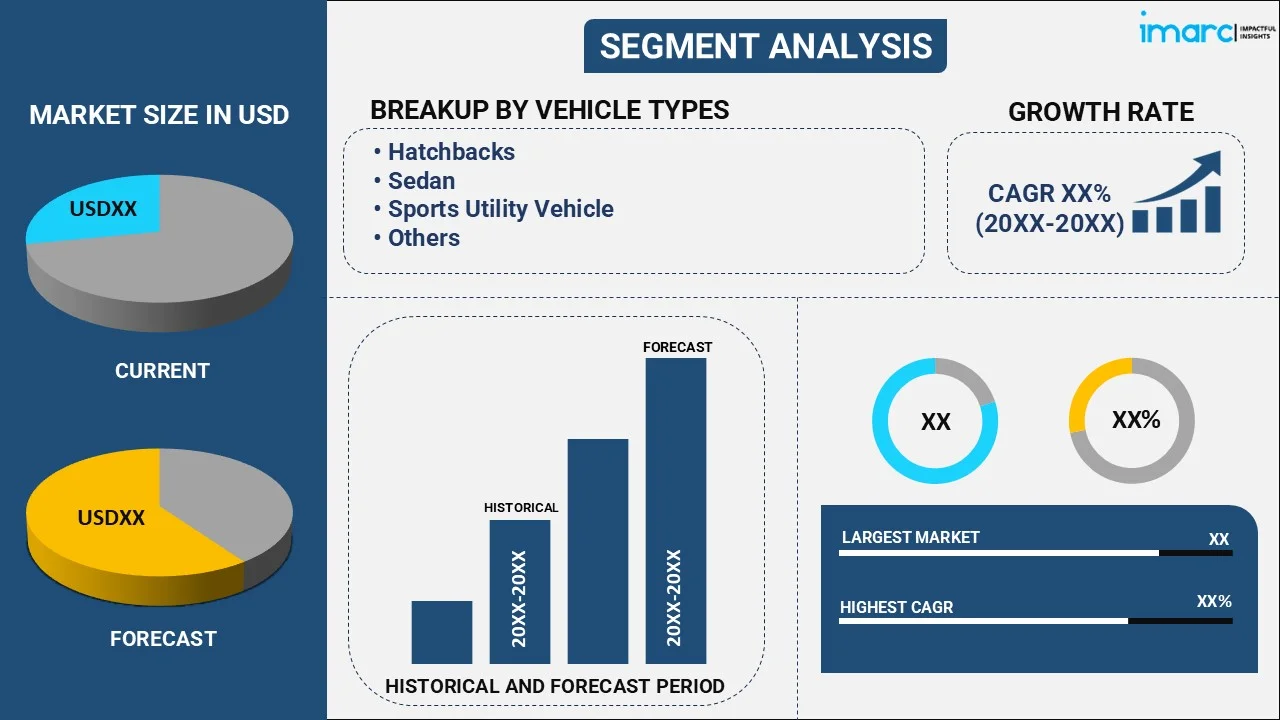

The global used car market size reached USD 1,139.90 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2,201.50 Billion by 2034, exhibiting a growth rate (CAGR) of 7.59% during 2026-2034. The market is experiencing steady growth driven by the growing preferences for eco-friendly and fuel-efficient vehicles, wide accessibility of financing options, and introduction of features like adaptive cruise control, lane-keeping assistance, and advanced infotainment systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,139.90 Billion |

|

Market Forecast in 2034

|

USD 2,201.50 Billion |

| Market Growth Rate 2026-2034 | 7.59% |

Used Car Market Analysis:

- Market Growth and Size: The market is witnessing strong growth, driven by increasing preferences for fuel-efficient and eco-friendly used cars to reduce their carbon footprint, along with the aging vehicle fleets.

- Technological Advancements: Innovative safety features and improved durability in modern cars make used vehicles more attractive. In addition, online platforms assist in enhancing the transparency in the buying process.

- Industry Applications: Used cars have a broad range of applications, ranging from personal transportation to rental and fleet services. It caters to a diverse consumer base, including individuals and organizations.

- Geographical Trends: Asia Pacific leads the market, driven by the rising focus on environmental sustainability. However, North America is emerging as a fast-growing market due to the thriving automotive sector.

- Competitive Landscape: Key players in the market are focusing on strengthening their online presence by engaging in partnerships with online marketplaces or developing their own e-commerce platforms.

- Challenges and Opportunities: While the market faces challenges, such as regulatory changes, it also encounters opportunities in leveraging online platforms for sales.

- Future Outlook: The future of the used car market looks promising, with the increasing demand for electric and hybrid used cars. In addition, rising environmental concerns among individuals are expected to propel the used car market growth.

To get more information on this market Request Sample

Used Car Market Trends:

Technological advancements

Technological advancements in the automotive industry assist in improving durability, safety features, and reliability in modern vehicles. In line with this, new cars are becoming more robust and offer advanced safety technologies. Moreover, the introduction of features, such as adaptive cruise control, lane-keeping assistance, and advanced infotainment systems in new cars is leading to increasing interest in used cars equipped with similar features. Furthermore, technological advancements are making it easier for individuals to access information about used cars, including vehicle history reports. This feature is beneficial in enhancing transparency and trust in the used car buying process. Apart from this, the wide availability of online platforms and mobile apps allows individuals to browse and purchase used cars. Additionally, buyers can access a vast inventory of used vehicles, compare prices, view detailed vehicle histories, and even complete transactions entirely online, which is propelling the used car market demand. Advanced imaging technologies and mobile apps allow sellers and buyers to conduct virtual vehicle inspections.

Rising preferences for eco-friendly and fuel-efficient vehicles

Increasing preferences for eco-friendly and fuel-efficient used cars among the masses is key trend in the used car market outlook. Besides this, the growing awareness among individuals about climate change and its consequences is offering a positive market outlook. In addition, people are increasingly purchasing eco-conscious transportation options. Apart from this, eco-friendly vehicles, such as hybrid and electric cars, emit fewer greenhouse gases and contribute to reducing air pollution, aligning with the desire to minimize carbon footprint. Moreover, rising fuel prices are making fuel efficiency a significant consideration for buyers. Fuel-efficient vehicles not only save money for individuals but also reduce their reliance on fossil fuels, mitigating the impact of oil price fluctuations. Furthermore, governing agencies of various countries are offering numerous tax incentives and rebates on the purchase of eco-friendly vehicles, which is impelling the market growth. Additionally, the development of fast-charging infrastructure allows people to charge their used cars conveniently, which is bolstering the market growth.

Accessible financing options

Accessible financing options with competitive interest rates are making used cars affordable for a wide range of buyers. In line with this, people can easily compare and choose the loan terms that best suit their needs, whether it is the duration of the loan or the down payment requirements. Moreover, the digitization of the lending process assists in streamlining and simplifying the application and approval procedures. Online applications and digital verification reduce the time and effort required to secure a used car loan, making it more accessible to a broader range of individuals across the globe. Furthermore, low-interest rates, often influenced by central bank policies, contribute to the affordability of financing. These rates reduce the overall cost of borrowing, which makes monthly payments more manageable for buyers. Apart from this, flexible financing packages, such as options for individuals with varying credit histories, enable more convenience for people to access financing for used cars. Lenders are also offering tailored solutions to accommodate diverse financial situations.

Used Car Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on vehicle type, vendor type, fuel type, and sales channel.

Breakup by Vehicle Type:

To get detailed segment analysis of this market Request Sample

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

Sports utility vehicle accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchbacks, sedan, sports utility vehicle, and others. According to the report, sports utility vehicle represented the largest segment.

Sports utility vehicle (SUV) is known for their spacious interiors and versatility. It is widely available in various categories, such as compact, midsize, and full-size, accommodating a broad range of preferences. It is suitable for families and individuals seeking more cargo space and higher ground clearance. Apart from this, it often features all-wheel drive or four-wheel drive capabilities, making it suitable for various road conditions and off-road adventures.

Hatchbacks often appeal to individuals looking for compact and versatile vehicles. In addition, they are popular for city driving due to their smaller size, maneuverability, and fuel efficiency. Moreover, the rising adoption of hatchbacks among budget-conscious buyers on account of their affordability is supporting the growth in the used car market forecast.

Sedan offers a balance of comfort, space, and fuel efficiency, making them a preferred choice for various individuals. They are available in different sizes, ranging from compact to full-size, catering to diverse needs. Besides this, they are usually used for daily commuting and family transportation.

Breakup by Vendor Type:

- Organized

- Unorganized

Unorganized holds the largest share

A detailed breakup and analysis of the market based on the vendor type have also been provided in the report. This includes organized and unorganized. According to the report, unorganized accounted for the largest market share.

Unorganized vendors encompass a wide range of sellers, such as private individuals, small independent dealerships, and informal car sellers. They involve smaller-scale operations with less standardized processes and limited regulatory oversight. In line with this, they often have a diverse inventory of used cars, including older models and vehicles in varying conditions. Moreover, the rising adoption of used cars from unorganized vendors, as prices and terms can be more flexible, is propelling the market growth.

Organized vendors are established and well-structured companies, such as franchised dealerships, certified pre-owned programs, and large used car retailers. These vendors often offer a wide selection of used cars, including certified pre-owned vehicles that undergo rigorous inspections and come with warranties. Organized vendors assist in providing a higher level of transparency and financing options while enhancing the trust and satisfaction of individuals.

Breakup by Fuel Type:

- Gasoline

- Diesel

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes gasoline, diesel, and others.

Gasoline-powered vehicles are preferred for their ease of refueling. Moreover, gasoline engines often provide a balance of performance and fuel efficiency. In line with this, gasoline-powered used cars are common in both compact and larger vehicle categories, catering to a wide range of preferences of individuals.

Diesel-powered vehicles are known for their high torque and fuel efficiency, making them suitable for long-distance travel and heavy-duty applications. Besides this, the rising adoption of diesel cars among individuals prioritizing fuel savings and highway driving is bolstering the market growth. Diesel-powered used cars are prevalent in segments, such as SUVs, trucks, and certain sedan models.

Breakup by Sales Channel:

- Online

- Offline

Offline accounts for the majority of the market share

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes online and offline. According to the report, offline accounted for the largest market share.

Offline sales are the method of purchasing used cars through physical dealerships, private sellers, and auctions. People can visit dealerships, inspect vehicles in person, take test drives, and negotiate prices face-to-face with sellers. In line with this, offline sales channels offer a level of personal interaction, trust-building, and the opportunity to physically examine the vehicles.

Online sales involve purchasing used cars through digital platforms, websites, and online marketplaces. Moreover, people can browse a wide range of vehicles, compare prices and features, access vehicle history reports, and often arrange financing online. Online sales offer convenience due to the wide accessibility of cars and allow individuals to shop from the comfort of their homes.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest used car market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to the growing demand for affordable transportation solutions among individuals. Apart from this, the rising need for personal vehicles due to rapid urbanization is propelling the growth of the market. In addition, increasing preferences for fuel-efficient and eco-friendly used cars to reduce carbon footprint is contributing to the growth of the market in the region.

North America stands as another key region in the market, driven by the thriving automotive sector. Besides this, the wide availability of various ranges of used car models in enhanced condition is supporting the growth of the market. Furthermore, the presence of organized vendors, including franchised dealerships and certified pre-owned programs, ensures a high level of trust and transparency, which is impelling the market growth in the region.

Europe maintains a strong presence in the market, with the rising adoption of fuel-efficient and eco-friendly vehicles. In line with this, the presence of well-established automakers is bolstering the growth of the market. Moreover, key players are organizing several certified pre-owned programs, which is propelling the market growth. Furthermore, there is an increase in awareness about environmental sustainability among the masses in Europe.

Latin America exhibits growing potential in the used car market on account of rising preferences for online platforms that offer a wide range of used cars. In addition, the increasing demand for convenient and affordable transportation solutions among individuals is supporting the market growth.

The Middle East and Africa region shows a developing market for used car, primarily driven by the increasing demand for luxury used cars among the masses. Apart from this, the rising utilization of online platforms for used cars, as they offer enhanced convenience and transparency to individuals, is contributing to the growth of the market in the region.

Leading Key Players in the Used Car Industry:

Key players in the market are focusing on strengthening their online presence by engaging in partnerships with online marketplaces or developing their own e-commerce platforms. This allows them to reach a broader consumer base and offer more transparent and convenient buying experiences. In line with this, manufacturers are organizing certified pre-owned (CPO) programs, which involve inspecting, refurbishing, and certifying used cars to meet specific quality standards. Moreover, these programs enhance trust among buyers in used cars. Apart from this, companies are incorporating advanced technologies, such as artificial intelligence (AI) and data analytics to improve inventory management, pricing strategies, and engagement of individuals.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alibaba Group Holding Limited

- Arnold Clark Automobiles Limited

- Asbury Automotive Group Inc.

- AutoNation Inc.

- CarMax Business Services LLC

- Cox Automotive Inc. (Cox Enterprises Inc.)

- eBay Inc.

- Group1 Automotive Inc.

- Lithia Motors Inc.

- Pendragon PLC

- TrueCar Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- In July 2025, Cars24 launched Care+, an all-in-one ownership plan for used cars. It includes up to 3 years/45,000 km extended warranty, annual servicing, 24x7 roadside assistance, and assured buyback with resale value from Day 1. Services include certified maintenance, free pickup/drop, and real-time tracking. Initially launched in 3 cities with over 1,000 users, it will expand nationwide soon. Care+ aims to address common post-sale concerns among used car buyers in India.

- In June 2025, Spinny introduced an industry-first 3-year standard warranty on its used cars, setting a new benchmark in the pre-owned vehicle market. Alongside the warranty, it offers a 5-day return guarantee. This move surpasses rivals like Cars24, Maruti True Value, and Mahindra First Choice, which offer shorter warranty periods. The announcement is supported by a new ad campaign featuring Sachin Tendulkar, visible on Delhi cabs and Mumbai buses.

Used Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alibaba Group Holding Limited, Arnold Clark Automobiles Limited, Asbury Automotive Group Inc., AutoNation Inc., CarMax Business Services LLC, Cox Automotive Inc. (Cox Enterprises Inc.), eBay Inc., Group1 Automotive Inc., Lithia Motors Inc., Pendragon PLC, TrueCar Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the used car market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global used car market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the used car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global used car market to exhibit a CAGR of 7.59% during 2026-2034.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in the demand fluctuations for used cars.

The rising environmental consciousness, along with the growing consumer preference for refurbished cars, as they provide convenience and enhanced travel experience with no registration fees and other charges, is primarily driving the global used car market.

Based on the vehicle type, the global used car market can be categorized into hatchbacks, sedan, sports utility vehicle, and others. Among these, sports utility vehicle currently exhibits clear dominance in the market.

Based on the vendor type, the global used car market has been segmented into organized and unorganized, where unorganized vendors hold the largest market share.

Based on the sales channel, the global used car market can be bifurcated into online and offline. Currently, offline channel accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global used car market include Alibaba Group Holding Limited, Arnold Clark Automobiles Limited, Asbury Automotive Group Inc., AutoNation Inc., CarMax Business Services LLC, Cox Automotive Inc. (Cox Enterprises Inc), eBay Inc., Group1 Automotive Inc., Lithia Motors Inc., Pendragon PLC, and TrueCar Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)