Vaccine Market Size, Share, Trends and Forecast by Technology, Patient Type, Indication, Route of Administration, Product Type, Treatment Type, End User, Distribution Channel, and Region, 2026-2034

Vaccine Market Size and Share:

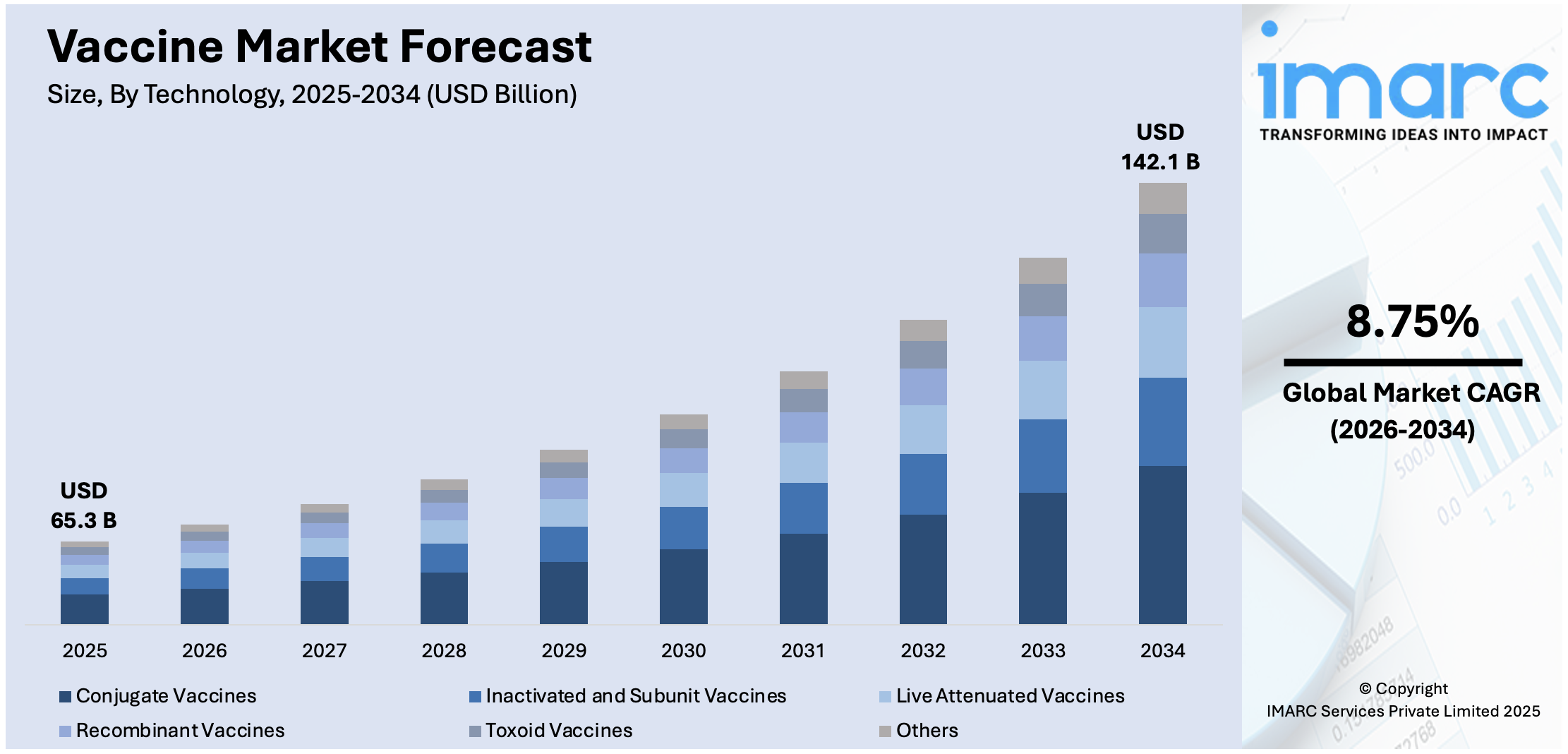

The global vaccine market size was valued at USD 65.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 142.1 Billion by 2034, exhibiting a CAGR of 8.75% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 38.9% in 2025. The implementation of stringent regulations promoting vaccination adoption among individuals, several advances in biotechnology and vaccine development techniques, and growing health awareness among the population about the importance of vaccination are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 65.3 Billion |

| Market Forecast in 2034 | USD 142.1 Billion |

| Market Growth Rate 2026-2034 | 8.75% |

The vaccine market is driven by several key factors, starting with the rising incidence of infectious diseases, including seasonal flu, HPV, and emerging viruses like COVID-19, which continue to elevate demand for effective immunization. Government-led vaccination programs, international health initiatives, and public-private partnerships are also expanding access and awareness globally. Technological advancements, such as mRNA and recombinant vaccine platforms, have revolutionized development timelines and efficacy, further boosting market growth. Increasing investment in R&D by pharmaceutical companies and global health organizations supports innovation in both preventive and therapeutic vaccines. Additionally, growing health consciousness and improved healthcare infrastructure, particularly in developing regions, are encouraging vaccine adoption. Aging population and the need for adult immunization further fuel the vaccine market share.

To get more information on this market Request Sample

The United States vaccine market is driven by strong government support through initiatives like the Vaccines for Children program and adult immunization campaigns. Advances in biotechnology, particularly mRNA and recombinant platforms, have enhanced vaccine development and efficacy. High public awareness of the importance of preventive healthcare fuels demand across all age groups. Robust healthcare infrastructure and favorable reimbursement policies further support widespread vaccine distribution. Additionally, the presence of leading pharmaceutical companies investing in R&D and public-private collaborations ensures a continuous pipeline of innovative vaccines. Seasonal immunization needs, such as for flu and COVID-19, also contribute to sustained market growth and expansion. For instance, in August 2024, the U.S. Food and Drug Administration authorized and approved the emergency use of updated mRNA COVID-19 vaccines (2024-2025 formulation) featuring a monovalent (single) component that targets the Omicron variant KP.2 strain of SARS-CoV-2. The mRNA COVID-19 vaccines have been revised with this formulation to better align with the currently circulating variants and enhance protection against severe outcomes of COVID-19, such as hospitalization and death. Today's measures pertain to the revised mRNA COVID-19 vaccines produced by ModernaTX Inc. and Pfizer Inc.

Vaccine Market Trends:

The implementation of stringent regulations promoting the adoption of vaccination

The market is driven by the enforcement of stringent regulations aimed at promoting vaccination among individuals. In addition, the growing emphasis on vaccine safety and efficacy is augmenting the market growth. Moreover, manufacturers adhere to rigorous testing and quality control measures to ensure that products meet the highest standards of safety, resulting in rising investment in research and development (R&D) to create products that prevent diseases effectively and have minimal adverse effects, thus representing another major growth-inducing factor. Besides this, companies are providing clear and comprehensive information about their products, including potential side effects and contraindications which empowers individuals to make informed decisions about vaccination, thus accelerating the product adoption rate. Along with this, various governments and healthcare authorities are implementing various incentive programs including subsidies, public awareness campaigns, and mandates in some cases encouraging the adoption of vaccination, thus propelling the vaccine market growth.

Several advances in biotechnology and vaccine development techniques

The market is driven by several remarkable advances in biotechnology and vaccine development techniques. It is transforming the way vaccinations are designed and manufactured which is contributing to the development of highly effective and targeted vaccinations. In addition, the utilization of genomics and molecular biology in vaccine development led scientists to decode the genetic information of pathogens with unprecedented speed and precision, enabling them to identify potential vaccine candidates more efficiently, resulting in the development of products against emerging diseases such as COVID-19, thus augmenting the market growth. While disease burden fell between 2010 and 2019, it increased overall since 2019 amid the pandemic, rising by 4.1% in 2020 and by 7.2% in 2021. Moreover, several advancements in recombinant deoxyribonucleic acid (DNA) technology allowed for the creation of recombinant vaccinations, stimulating enhanced immune response without causing the disease itself, which is effective in preventing infectious diseases, including hepatitis B and human papillomavirus, thus representing another major growth-inducing factor. Furthermore, the application of synthetic biology techniques is also contributing to several innovations, allowing scientists to design and synthesize vaccine components with precision, for the development of novel vaccinations against challenging pathogens, thus creating a positive vaccine market outlook.

The growing awareness about the importance of vaccination

The market is driven by the growing health awareness among individuals regarding the importance of vaccination. In addition, the recent onset of the coronavirus disease (COVID-19) pandemic raised public awareness about the value of vaccination, thus augmenting the market growth. A survey conducted between May and September 2023 found that 57.2% of respondents accepted the COVID-19 vaccine, while 63.7% acknowledged vaccines as an effective measure for preventing infectious diseases. Along with this, manufacturers are developing and distributing vaccinations to combat the virus while focusing on vaccine efficacy, safety, and accessibility, thus propelling the market growth. Moreover, the dissemination of accurate information through various channels, including healthcare providers, government agencies, and the media, to safeguard public health, represents another major growth-inducing factor. According to the vaccine market forecast, the rise of social media and digital platforms played a significant part in providing information about vaccinations, enabling individuals to access reliable resources and engage in informed discussions.

Vaccine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vaccine market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on technology, patient type, indication, route of administration, product type, treatment type, end user, and distribution channel.

Analysis by Technology:

- Conjugate Vaccines

- Inactivated and Subunit Vaccines

- Live Attenuated Vaccines

- Recombinant Vaccines

- Toxoid Vaccines

- Others

Conjugate vaccines are expected to boost the vaccine market due to their proven effectiveness in infants and young children, especially against bacterial infections like Hib and pneumococcus. By linking weak antigens to strong carrier proteins, they generate a stronger immune response. Widely used in pediatric immunization programs, these vaccines are also being developed for other diseases like typhoid and meningitis. Their safety, long-term protection, and adoption in global immunization efforts continue to support steady market growth.

Inactivated and subunit vaccines are favored for their safety, stability, and low risk of side effects, making them suitable for a wide population. Inactivated vaccines use killed pathogens, while subunit vaccines contain only essential antigens. They are widely used for influenza, hepatitis B, and pertussis. Their ability to be safely combined with adjuvants for stronger immune response, along with ease of storage and transportation, makes them ideal for national immunization programs and ensures sustained demand globally.

Live attenuated vaccines are highly effective as they mimic natural infections, stimulating strong, long-lasting immunity with fewer doses. Used in diseases like measles, mumps, rubella, and varicella, they play a vital role in both routine immunization and outbreak control. Their success in eradicating diseases in many countries strengthens their position in the market. Ongoing innovation in delivery methods, such as oral or nasal formulations, further enhances their accessibility and supports future growth in the global vaccine landscape.

Analysis by Patient Type:

- Pediatric

- Adult

Pediatrics leads the market with around 56.0% of market share in 2025. The pediatrics segment is driven by the growing emphasis on immunization, thus influencing the market growth. Moreover, governments and healthcare organizations are preventing childhood diseases, leading to increasing vaccination programs and investments in pediatric vaccine research, thus contributing to market growth. Moreover, several advancements in vaccine technology made it possible to develop safer and more effective vaccinations for children, resulting in a steady stream of new vaccinations tailored specifically for pediatric populations, representing another major growth-inducing factor. Additionally, the COVID-19 pandemic underscored the importance of vaccinations for children. Efforts to vaccinate children against the virus further increase the role of pediatrics in the vaccine industry, thus propelling the market growth.

Analysis by Indication:

- Bacterial Diseases

- Meningococcal Disease

- Pneumococcal Disease

- Diphtheria/Tetanus/Pertussis (DPT)

- Tuberculosis

- Haemophilus Influenzae (Hib)

- Typhoid

- Others

- Viral Diseases

- Hepatitis

- Influenza

- Human Papillomavirus (HPV)

- Measles/Mumps/Rubella (MMR)

- Rotavirus

- Herpes Zoster

- Varicella

- Japanese Encephalitis

- Rubella

- Polio

- Rabies

- Dengue

- Others

The market is driven by the growing incidence of bacterial diseases, caused by various bacteria such as Streptococcus pneumoniae and Haemophilus influenzae. In addition, the increasing development of effective vaccinations to prevent these infections is augmenting the market growth. Furthermore, several advancements in vaccine technology are improving bacterial disease vaccinations. Along with this, several innovations in research and development (R&D) yielded vaccinations that are effective and safe for widespread use, which are designed to stimulate the body's immune response, thereby conferring immunity against bacterial pathogens, thus propelling the market growth.

Analysis by Route of Administration:

- Intramuscular and Subcutaneous Administration

- Oral Administration

- Others

Intramuscular administration involves injecting vaccinations directly into the muscle tissue, which offers several advantages. In addition, muscles have an abundant blood supply, allowing for efficient uptake and distribution of the vaccine components, leading to improved immune response, thus influencing the market growth. Along with this, IM injections often require larger needles, which can facilitate the administration of vaccinations with thicker formulations or those containing adjuvants, thus augmenting the market growth. Moreover, subcutaneous administration involves injecting vaccinations into the fatty tissue just beneath the skin, which is preferred for products that are well-suited for slower, sustained release into the bloodstream, thus representing another major growth-inducing factor. It is less invasive and typically uses smaller needles, making it a preferred choice among individuals who may be apprehensive about needles.

Analysis by Product Type:

- Multivalent Vaccine

- Monovalent Vaccine

Multivalent vaccine leads the market with around 66.7% of market share in 2025. Multivalent offers a streamlined approach to immunization by combining antigens from different pathogens into a single vaccine, which reduces the number of injections required, minimizing discomfort for patients and simplifying vaccination schedules, thus augmenting the market growth. Furthermore, multivalent vaccinations are efficient in preventing several diseases. For instance, combination vaccinations such as the measles, mumps, and rubella (MMR) vaccinations are eliminating these diseases in many regions, resulting in extensive research and development (R&D) efforts in the field, thus propelling the market growth. Along with this, multivalent vaccinations offer substantial advantages, as the production, distribution, and administration of a single vaccine covering multiple diseases are more efficient and economical compared to individual vaccinations for each pathogen, thus accelerating the product adoption rate among healthcare systems and patients.

Analysis by Treatment Type:

- Preventive Vaccine

- Therapeutic Vaccine

Preventive vaccinations lead the market with around 56.2% of market share in 2025. Preventive vaccinations are designed to proactively protect individuals from contracting specific diseases. They achieve this by stimulating the immune system to produce antibodies that recognize and neutralize pathogens, such as viruses or bacteria, should the individual be exposed to them in the future has proven to be highly effective in reducing the incidence and severity of various illnesses. Moreover, it has immense success in eradicating or controlling life-threatening diseases. Some historical examples include the near-eradication of smallpox through vaccination and the significant reduction in polio cases, which are essential in fighting against infectious diseases. Furthermore, the rapid development and distribution of products to combat the virus and save countless lives are propelling the market growth.

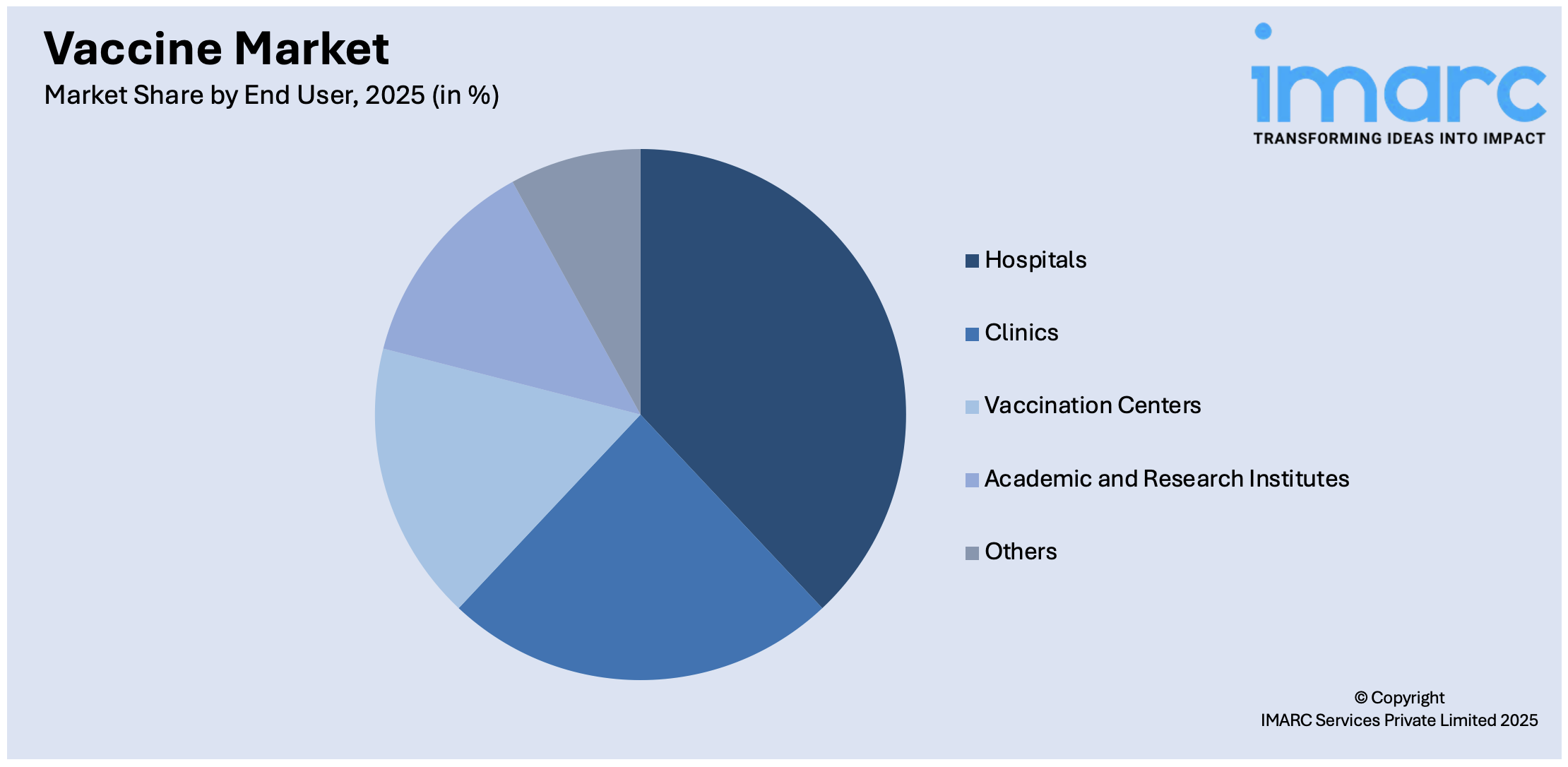

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Clinics

- Vaccination Centers

- Academic and Research Institutes

- Others

Hospitals leads the market with around 57.3% of market share in 2025. The hospital industry is driven by its strategic position as a primary healthcare provider. In addition, hospitals serve as the frontline of defense against infectious diseases, making them the ideal setting for vaccine dissemination, which possesses the necessary infrastructure, medical personnel, and resources to efficiently handle the storage, distribution, and administration of products, thus propelling the market growth. Furthermore, hospitals are essential in vaccination advocacy and education. They are trusted sources of healthcare information, and their healthcare professionals serve as product advocates through patient consultations, seminars, and informational campaigns. Along with this, hospitals are promoting the importance of vaccination, contributing to higher vaccination rates and public awareness. Along with this, hospitals also engage in product research and development (R&D), partnering with pharmaceutical companies and research institutions to conduct clinical trials and assess vaccination efficacy, thus contributing to market growth.

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Institutional Sales

- Others

Hospital pharmacies are located at the heart of healthcare facilities, which ensures that vaccinations are easily accessible to healthcare professionals and patients. Hospitals are often the first point of contact for individuals seeking vaccination, whether it's for routine immunizations or during public health emergencies. Moreover, hospital pharmacies have the infrastructure and trained staff necessary to handle and administer products safely while adhering to strict quality control and storage protocols, ensuring the integrity and efficacy of vaccinations throughout the distribution process, thus representing another major growth-inducing factor. This reliability and commitment to maintaining the cold chain are essential for preserving the potency of products. Along with this, hospital pharmacies benefit from established relationships with healthcare providers and government agencies responsible for vaccination programs, which allows for seamless coordination in vaccination procurement, distribution, and administration, thus propelling the market growth. Also, hospitals serve as vaccination hubs during mass immunization campaigns, further solidifying their role in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- GCC Countries

- Israel

- Others

In 2025, Asia-Pacific accounted for the largest market share of over 38.9%. The Asia Pacific market is driven by the growing pharmaceutical and biotechnology sector. In addition, several countries such as India and China are investing heavily in the development of their healthcare infrastructure, research capabilities, and manufacturing capacities, allowing them to produce vaccines at scale, often at a lower cost than their Western counterparts. thus, contributing to the market growth. Additionally, the rising pool of skilled scientists, researchers, and healthcare professionals is augmenting the market growth. These experts are driving innovation and ensuring the quality and safety of vaccinations produced in the region. Furthermore, the region offers ample opportunities for clinical trials and testing, allowing for the accelerated development of new products, thus accelerating the sales demand. Apart from this, the strategic partnerships and collaborations among pharmaceutical companies in the region are facilitating technology transfer, knowledge sharing, and access to critical resources, strengthening the region's position in the market.

Key Regional Takeaways:

North America Vaccine Market Analysis

The vaccine market in North America is driven by several key factors. Primarily, the rising prevalence of infectious diseases and the need for effective prevention measures fuel demand. Increased awareness about the benefits of vaccination, particularly in preventing widespread outbreaks, plays a significant role. The ongoing advancements in vaccine technology, including mRNA-based vaccines and improvements in vaccine delivery methods, further boost market growth. Government initiatives, such as vaccination programs and funding for research and development, also support market expansion. Additionally, the COVID-19 pandemic has significantly raised public and institutional focus on vaccine development, increasing investment in immunization efforts. An aging population and growing concerns about public health continue to drive demand for vaccines in North America.

United States Vaccine Market Analysis

In 2024, the United States accounted for over 92.30% of the vaccine market in North America. The United States vaccine market is primarily driven by the increased federal funding for vaccine research and development, including initiatives from the National Institutes of Health (NIH) and the Biomedical Advanced Research and Development Authority (BARDA). Similarly, the growing demand for combination vaccines, particularly for influenza, COVID-19, and respiratory syncytial virus (RSV), is driving market expansion. The rising adoption of mRNA technology, allowing for faster production and improved efficacy, is revolutionizing market development. Furthermore, expanding immunization programs, supported by the Centers for Disease Control and Prevention (CDC), are increasing market accessibility. Besides this, private investment is also playing a significant role, with Blackstone Life Sciences committing up to USD 750 Million to fund Moderna’s influenza vaccine program. While Moderna retains full control of the program, Blackstone will receive milestones and royalties. This collaboration supports late-stage vaccine development and advances mRNA-based medicines. Additionally, the rising threat of antimicrobial resistance combating emerging infectious diseases, reinforcing the need for continuous investment and technological advancements in vaccine development is impelling the market. Moreover, strengthened regulatory support from the Food and Drug Administration (FDA) is expediting vaccine approvals, and fostering market growth.

Europe Vaccine Market Analysis

The Europe market is expanding due to strong government support through initiatives such as Horizon Europe driving vaccine research and innovation. In addition to this, the European Medicines Agency (EMA) streamlining regulatory approvals to accelerate the introduction of new vaccines is propelling the market growth. Furthermore, increasing investments in pandemic preparedness fostering the development of next-generation vaccines for emerging infectious diseases is fostering market expansion. Similarly, increased funding for mRNA and vector-based technologies enhancing production efficiency and efficacy is supporting market demand. As such, CEPI committed USD 5 Million to Ethris for the development of spray-dried RNA vaccines that remain stable at room temperature and support mucosal delivery, reducing cold-chain dependence and improving outbreak response. Apart from this, growing partnerships between pharmaceutical companies and research institutions driving ongoing developments in vaccine technology is stimulating the market appeal. The expanding immunization programs, including mandatory vaccination policies in several countries, are increasing coverage rates and encouraging higher adoption of the product. Moreover, rising consumer demand for personalized vaccines, driven by continual advancements in genomics and precision medicine, is positive;y shaping market trends.

Asia Pacific Vaccine Market Analysis

The Asia Pacific vaccine market is experiencing significant growth attributed to increasing government investments in domestic vaccine production reducing reliance on imports and enhancing supply chain resilience is impelling the market. Similarly, the rising demand for childhood immunization programs, driven by national healthcare policies in countries like India and China, is further accelerating market growth. Additionally, expanding research in next-generation vaccine technologies, such as nanoparticle-based and thermostable vaccines, is improving market development. Besides this, increasing public-private partnerships fostering innovation, with multinational pharmaceutical companies collaborating with regional manufacturers for large-scale production is supporting market demand. Moreover, the growing prevalence of infectious diseases, such as dengue and tuberculosis, creating a greater need for targeted vaccine solutions is providing an impetus to the market. According to the Department of Biotechnology, India’s disease burden, measured by the DALY rate, is 2.5 to 3.5 times higher than the global average for diseases like diarrhoeal diseases, iron-deficiency anaemia, and tuberculosis.

Latin America Vaccine Market Analysis

The Latin America market is influenced by favorable government immunization initiatives, including expanded national vaccination programs, improving coverage across the region. In accordance with this, increased investments in domestic vaccine manufacturing, particularly in Brazil and Argentina, reducing reliance on imports is bolstering market growth. A key development is Brazil's commitment of BRL 57.4 billion (USD 10.44 billion) to enhance vaccine production will enable the country to produce 120 million vials annually, augmenting health security. Additionally, increased funding for clinical research and biotechnology innovation is accelerating the development of novel vaccines and impelling the market. Besides this, rising collaborations with global health organizations, improving access to affordable vaccines, and supporting equitable immunization in underserved populations are positively influencing the market.

Middle East and Africa Vaccine Market Analysis

The Middle East and Africa vaccine market is growing due to increasing investment in local vaccine production to enhance self-sufficiency and reduce reliance on imports. In accordance with this, the rising prevalence of infectious diseases, including malaria, cholera, and meningitis, driving demand for targeted immunization programs is impelling the market. According to the Meningitis Research Foundation, 70% of global TB meningitis cases occur in Southeast Asia and Africa, highlighting the urgent need for expanded vaccination efforts. Apart from this, strengthened partnerships with global health organizations, such as Gavi and the WHO, are improving market accessibility and affordability. Additionally, continual advancements in cold-chain logistics are enhancing vaccine distribution in remote and underserved areas, ensuring broader immunization coverage, is creating lucrative market opportunities.

Competitive Landscape:

The global vaccine market is highly competitive, dominated by major pharmaceutical players such as Pfizer, Moderna, GlaxoSmithKline (GSK), Sanofi, and Johnson & Johnson. These companies lead in innovation, manufacturing capabilities, and global distribution networks. The market is driven by rising demand for preventive healthcare, government immunization programs, and the emergence of new infectious diseases. Recent advancements in mRNA and recombinant technologies have reshaped the landscape, intensifying R&D efforts. Additionally, regional players in Asia and Latin America are gaining ground through cost-effective vaccines and public health partnerships. Strategic collaborations, patent exclusivity, and regulatory approvals significantly influence market positioning. The sector continues to evolve rapidly, with growing investments in pipeline vaccines for cancer, influenza, and emerging viral threats.

The report provides a comprehensive analysis of the competitive landscape in the vaccine market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Astellas Pharma Inc.

- AstraZeneca Plc

- Bharat Biotech International

- Bavarian Nordic A/S

- CSL Limited

- Daiichi Sankyo Company Limited

- Emergent BioSolutions Inc.

- GlaxoSmithKline Plc

- Inovio Pharmaceuticals Inc.

- Johnson & Johnson

- Merck & Co. Inc.

- Mitsubishi Tanabe Pharma Corporation (Mitsubishi Chemical Holdings Corporation)

- Novavax Inc.

- Panacea Biotec Ltd.

- Pfizer Inc.

- Sanofi Pasteur SA (Sanofi SA)

- Serum Institute of India Pvt. Ltd.

- Takeda Pharmaceutical Company Limited.

Latest News and Developments:

- In February 2025, IAVI and Biofabri initiated the IMAGINE clinical trial to evaluate the MTBVAC tuberculosis vaccine in 4,300 participants across South Africa, Kenya, and Tanzania. Supported by major global funders, the trial aims to prevent TB in adolescents and adults, addressing a disease that caused 1.25 million deaths in 2023.

- In December 2024, Valneva and Serum Institute of India signed an exclusive license agreement to expand access to Valneva’s chikungunya vaccine in Asia. Supported by CEPI’s USD 41.3 Million funding, the partnership aims to accelerate vaccine availability in India amid a severe outbreak and ensure affordable supply for low- and middle-income countries.

- In July 2024, GSK and CureVac restructured their collaboration into a new licensing agreement, granting GSK full rights to develop, manufacture, and commercialize mRNA vaccines for influenza and COVID-19. CureVac will receive EUR 400 Million upfront, with potential milestone payments of up to EUR 1.05 Billion and tiered royalties.

- In May 2024, Sanofi and Novavax signed a co-exclusive licensing agreement to co-commercialize a protein-based COVID-19 vaccine and develop flu-COVID-19 combination vaccines. Novavax will receive up to USD 1.2 Billion, while Sanofi will handle sales, development, and commercialization, aiming to enhance accessibility and protection against respiratory viruses.

- In March 2024, Moderna advanced multiple vaccine programs to late-stage clinical trials, including flu-COVID-19 and CMV vaccines. The company secured up to USD 750 Million from Blackstone Life Sciences for flu vaccine development. Moderna also expanded its mRNA portfolio with promising candidates for RSV, Epstein-Barr virus, norovirus, and herpes viruses.

Vaccine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Conjugate Vaccines, Inactivated and Subunit Vaccines, Live Attenuated Vaccines, Recombinant Vaccines, Toxoid Vaccines, Others |

| Patient Types Covered | Pediatric, Adult |

| Indications Covered |

|

| Route of Administrations Covered | Intramuscular and Subcutaneous Administration, Oral Administration, Others |

| Product Types Covered | Multivalent Vaccine, Monovalent Vaccine |

| Treatment Types Covered | Preventive Vaccine, Therapeutic Vaccine |

| End Users Covered | Hospitals, Clinics, Vaccination Centers, Academic and Research Institutes, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Institutional Sales, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, GCC Countries, Israel |

| Companies Covered | Abbott Laboratories, Astellas Pharma Inc., AstraZeneca Plc, Bharat Biotech International, Bavarian Nordic A/S, CSL Limited, Daiichi Sankyo Company Limited, Emergent BioSolutions Inc., GlaxoSmithKline Plc, Inovio Pharmaceuticals Inc., Johnson & Johnson, Merck & Co. Inc., Mitsubishi Tanabe Pharma Corporation (Mitsubishi Chemical Holdings Corporation), Novavax Inc., Panacea Biotec Ltd., Pfizer Inc., Sanofi Pasteur SA (Sanofi SA), Serum Institute of India Pvt. Ltd., Takeda Pharmaceutical Company Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vaccine market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global vaccine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vaccine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vaccine market was valued at USD 65.3 Billion in 2025.

The vaccine market is projected to exhibit a CAGR of 8.75% during 2026-2034, reaching a value of USD 142.1 Billion by 2034.

The vaccine market is driven by rising global disease outbreaks, increased government immunization initiatives, technological advancements like mRNA platforms, and growing awareness of preventive healthcare. Expanding healthcare infrastructure in emerging economies and strong public-private partnerships further support market growth, alongside demand for both pediatric and adult immunization solutions.

Asia Pacific currently dominates the vaccine market due to rising disease outbreaks, technological advancements, government immunization programs, public awareness, and increased R&D investment.

Some of the major players in the vaccine market include Abbott Laboratories, Astellas Pharma Inc., AstraZeneca Plc, Bharat Biotech International, Bavarian Nordic A/S, CSL Limited, Daiichi Sankyo Company Limited, Emergent BioSolutions Inc., GlaxoSmithKline Plc, Inovio Pharmaceuticals Inc., Johnson & Johnson, Merck & Co. Inc., Mitsubishi Tanabe Pharma Corporation (Mitsubishi Chemical Holdings Corporation), Novavax Inc., Panacea Biotec Ltd., Pfizer Inc., Sanofi Pasteur SA (Sanofi SA), Serum Institute of India Pvt. Ltd., Takeda Pharmaceutical Company Limited., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)