Vaginal Slings Market Report Size, Share, Trends and Forecast by Type, Product Type, Type of Urinary Incontinence, End User, and Region, 2025-2033

Vaginal Slings Market Size and Share:

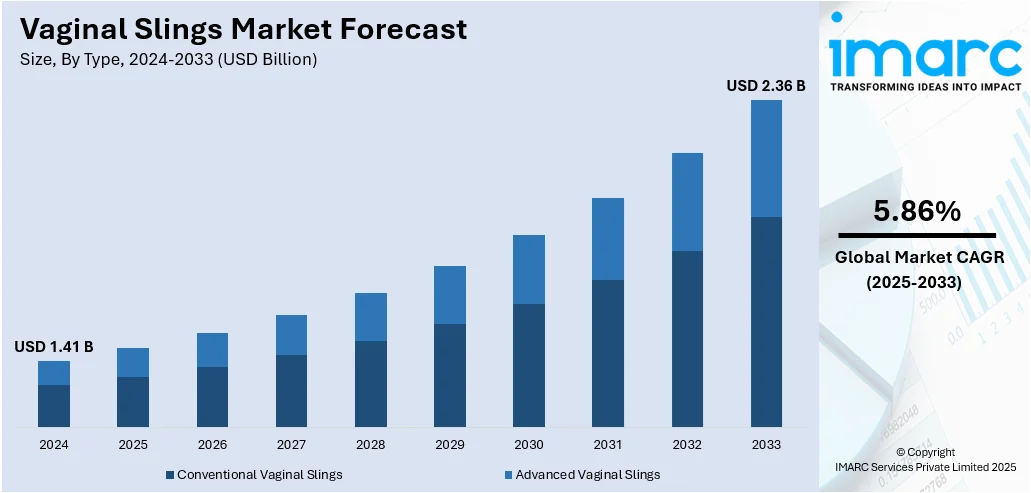

The global vaginal slings market size was valued at USD 1.41 Billion in 2024. The market is projected to reach USD 2.36 Billion by 2033, exhibiting a CAGR of 5.86% during 2025-2033. North America currently dominates the market, holding a significant market share of around 42.0% in 2024. The market is fueled by the rising prevalence of stress urinary incontinence among women, particularly in aging populations. Besides that, advancements in minimally invasive sling procedures and improved biocompatible materials have enhanced patient outcomes and surgeon preference, thereby supporting market growth. Additionally, growing awareness of pelvic floor disorders, coupled with increased healthcare expenditure and improved access to specialized treatments in developing regions, are collectively augmenting the vaginal slings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.41 Billion |

|

Market Forecast in 2033

|

USD 2.36 Billion |

| Market Growth Rate (2025-2033) | 5.86% |

The global market is benefiting from the increasing availability of advanced urogynecological training programs, which improve surgical outcomes and clinician confidence in sling procedures. The standard surgical approach for managing stress urinary incontinence (SUI) currently involves the insertion of a mid-urethral sling (MUS), often referred to simply as a “sling.” This technique is widely recognized for its clinical efficacy, with reported success rates nearing 80%, which continues to drive strong procedural adoption and reinforce demand for sling-related products. Moreover, hospitals and specialty centers are investing in upgraded pelvic floor rehabilitation technologies, supporting postoperative care, and reducing recurrence rates. Additionally, reimbursement models in several developed regions have shifted to support outpatient procedures, increasing accessibility and reducing costs for both providers and patients. There's also growing interest in patient-tailored mesh options and minimally invasive single-incision slings, which reduce operative time and enhance recovery. Besides, one of the growing vaginal slings market trends is that the increased collaboration between device manufacturers and academic institutions has resulted in faster clinical validation of newer sling designs.

To get more information on this market, Request Sample

In the United States, the market is driven by an aging women's population and a structured regulatory pathway that facilitates quicker adoption of novel sling materials. According to industry reports, women represent 78% of the centenarian population in the U.S in 2024. Over the next 30 years, the number of Americans aged 100 and above is projected to surge from approximately 101,000 to 422,000 by 2054. Apart from this, ambulatory surgical centers have expanded their role in urogynecological care, making sling procedures more available outside major hospitals. In addition to this, patient awareness campaigns around urinary incontinence are better funded, helping to reduce stigma and encourage earlier intervention. Furthermore, private health insurance often covers mid-urethral sling procedures, which increases demand. Additionally, integration of electronic health records with urogynecology practice has streamlined patient follow-up, improving long-term outcome tracking. Also, investments in pelvic health innovation by major U.S.-based medtech firms contribute to a more competitive and responsive market landscape.

Vaginal Slings Market Trends:

Rising Prevalence of Stress Urinary Incontinence (SUI)

Stress urinary incontinence is a primary clinical indication for the use of vaginal slings, and its increasing prevalence is directly contributing to the market’s expansion. Aging demographics, higher obesity rates, and post-childbirth complications are among the most common factors driving the incidence of SUI. Postmenopausal hormonal changes further weaken pelvic support structures, increasing the need for intervention. An industry study reveals that 13% of women who underwent urodynamic testing had their diagnosis revised to urodynamic stress incontinence, leading to changes in their treatment strategies, highlighting the critical role of accurate diagnostics and effective treatment options like vaginal slings. As more healthcare systems globally shift toward early screening and diagnosis, more women are being identified for potential surgical treatment, including sling procedures. Increased awareness and destigmatization of urinary incontinence, especially in urban and semi-urban settings, has also prompted a rise in patient consultations. This is supported by clinical guidelines that now more readily recommend slings as a first-line surgical option for moderate-to-severe cases, especially when conservative management fails.

Increase in Hysterectomy Rates and Post-Surgical Complications

The global rise in hysterectomy procedures, particularly in women, is contributing to the vaginal slings market growth. According to an industry report, about 3.3% women between the ages of 15 and 49 have undergone a hysterectomy. Post-hysterectomy patients often experience pelvic organ prolapse or bladder dysfunction due to the removal of uterine support structures. These complications can result in stress urinary incontinence, making slings a preferred solution for restoring continence. In certain regions, notably parts of Asia-Pacific and Latin America, hysterectomy is still commonly performed for conditions such as fibroids, chronic pelvic pain, and endometriosis, sometimes at earlier-than-necessary stages due to limited access to conservative alternatives. This creates a downstream effect, such as increased surgical interventions to manage incontinence symptoms. Hospitals and outpatient surgical centers are seeing more referrals for pelvic floor repair procedures. Urologists and gynecologic surgeons often include sling implantation during or after hysterectomy if incontinence is anticipated. This procedural bundling and proactive approach to pelvic health contribute to steady growth in sling adoption.

Technological Advancements and Mini-Sling Innovations

Technological improvements in sling design and materials have had a measurable impact on adoption rates. This trend is positively impacting the vaginal slings market outlook. Traditional mid-urethral slings required longer recovery times and were associated with certain risks, such as mesh erosion or post-operative voiding difficulties. Newer mini-slings and single-incision systems are changing that. These devices offer shorter operative times, less post-operative pain, and lower risk of complications, making them especially suitable for outpatient and day-care surgical settings. Research study published in June 2925 reported on the Contasure‑Needleless® (C‑NDL) mini‑sling for stress urinary incontinence in women. Short‑term results (six‑month follow‑up) showed high subjective cure rates, with over 54.17 of patients reporting they were “much” or “very much” better, and significant improvements in incontinence severity scores, with minimal complications observed. The study concludes that C‑NDL mini‑sling is a safe and effective minimally invasive option for managing stress urinary incontinence in the short term. Furthermore, better fixation mechanisms and tension-free designs have helped reduce procedural variability and improve long-term outcomes. Training programs for surgeons have also expanded to cover these newer technologies, increasing their usage across urology and urogynecology departments. Besides, the emergence of robotic-assisted and image-guided sling placement techniques in certain markets further illustrates how innovation continues to push procedural efficiency and patient safety.

Vaginal Slings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vaginal slings market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, product type, type of urinary incontinence, and end user.

Analysis by Type:

- Conventional Vaginal Slings

- Advanced Vaginal Slings

Conventional vaginal slings lead the market in 2024 due to their clinical use and proven efficacy in stress urinary incontinence management. These slings made from synthetic mesh or autologous tissue, are implanted by surgery for the support of the urethra and the bladder neck. Their well-documented safety record and broad acceptance by urologists and gynecologists are reasons why they remain the preferred choice, especially in situations that call for long-lasting, durable results. Conventional slings are particularly applicable in situations where experience with the procedure and standard surgical protocols are at a premium. With the growing interest in newer and more minimalistic approaches, traditional vaginal slings remain a tried-and-tested solution, especially in patients with intricate anatomical issues or prior failed surgeries. Their dominance is further reinforced by the availability of reimbursement in many healthcare systems, making them accessible to a broad patient population. With clinical outcomes continuing to confirm their effectiveness, they hold a consistent market share.

Analysis by Product Type:

- Transobturator Slings

- Tension-free Vaginal Tape Sling

- Others

Transobturator slings leads the market with around 38.1% of market share in 2024. These slings are minimally invasive and possess a lower risk of bladder or bowel injury than retropubic methods. Specifically created to be inserted through the obturator foramen, these slings provide beneficial support to the urethra with fewer complications and quicker return to normal function. Their increasing popularity is both an indication of surgeon preference and demand by patients for procedures with decreased postoperative pain and quicker return to normal activity. Transobturator slings are especially popular in outpatient conditions, which has helped increase their percentage of the overall market. Clinical studies have repeatedly shown positive results, validating their application in the treatment of stress urinary incontinence. With improvement in surgical methods and materials, these slings are fast becoming a standard of care in primary repairs as well as in specifically selected reoperations. Their safety, effectiveness, and ease of insertion guarantee ongoing utility in diverse clinical practices.

Analysis by Type of Urinary Incontinence:

- Stress Urinary Incontinence

- Urge Urinary Incontinence

- Mixed Urinary Incontinence

Stress urinary incontinence leads the market with around 41.2% of market share in 2024. The segment is responsible for a vast majority of procedures conducted worldwide. Characterized by the sudden leakage of urine with activities like coughing, sneezing, or exercise, SUI impacts quality of life considerably, particularly among middle-aged and elderly women. Vaginal slings are the commonly adopted surgical treatment for moderate to severe SUI, providing durable and effective relief from symptoms. Incidence of SUI is on the rise with the growing aging population, lifestyle changes, and childbirth-related pelvic floor injuries, all of which result in increased treatment rates. The excellent clinical outcomes and long history of use of sling procedures for SUI have established them as a staple in both urologic and gynecologic surgical practices. As the awareness and access to specialist care in developing nations increase, the rate of treatment for SUI is likely to increase, maintaining its relevance in the market.

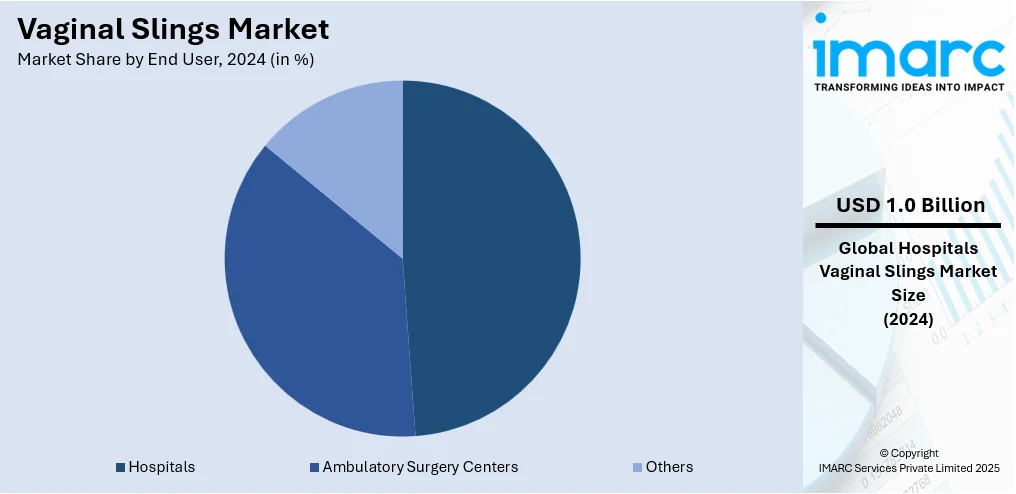

Analysis by End User:

- Hospitals

- Ambulatory Surgery Centers

- Others

Hospitals lead the market with around 48.7% of market share in 2024. This segment is the main site for diagnosis, surgical procedure, and postoperative treatment of urinary incontinence. Hospitals are well-equipped with sophisticated surgical facilities and highly trained specialists who are preferable for both open and minimally invasive sling surgeries. They manage a greater number of patients with complicated cases and are typically the initial point of care for individuals requiring assessment and treatment of stress urinary incontinence. Hospitals also gain from greater access to an assortment of sling devices, sustained by institutional procurement infrastructures and reimbursement policies. Their ability to address surgical complications and deliver complex patient care sustains the preference for hospital-based interventions. In both industrialized and developing countries, hospitals continue to be crucial to patient access and are important factors in training surgeons, assessing new procedures, and conducting clinical studies. Their controlling position in the end-user market guarantees a significant impact on product demand and adoption patterns.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.0%. The region has a well-established healthcare infrastructure, high awareness levels of urinary incontinence, and prevalent use of sophisticated surgical methods. Moreover, the market in the region is driven by a large pool of trained urologists and gynecologists, as well as the availability of a vast number of FDA-approved sling products. Beneficial reimbursement practices and regular screening habits lead to prompt diagnosis and increased treatment rates, particularly in the elderly female population. Besides, local efforts in research and development (R&D) also promote innovation in sling design, materials, and surgical techniques. The presence of specialized urogynecology clinics and outpatient surgical centers also enables higher procedure volumes. Although issues regarding complications from mesh have affected regulatory control and patient attitudes, overall demand for effective incontinence treatment is strong. North America continues to drive global market trends through clinical trials, adoption of new technology, and patient education programs.

Key Regional Takeaways:

United States Vaginal Slings Market Analysis

The market in the United States is witnessing steady growth due to the increasing number of outpatient surgeries and advancements in minimally invasive procedures. The strong presence of technologically advanced healthcare facilities and widespread insurance coverage are promoting the adoption of vaginal slings. According to an industry report, nearly one-quarter of women in the U.S. experience pelvic floor disorders, including urinary incontinence and pelvic organ prolapse, which significantly drives demand for surgical intervention. Furthermore, growing awareness among the female population regarding early intervention for pelvic floor disorders has led to a rise in diagnostic rates and treatment uptake. The availability of specialized urogynecology centers and a robust clinical research ecosystem is fostering innovation in sling design and surgical techniques. In addition, the rising focus on postpartum pelvic health and the increasing involvement of women in physically demanding lifestyles are contributing to the demand for long-term solutions like vaginal slings. Digital health platforms that offer educational resources and teleconsultation services are also helping to bridge knowledge gaps and support informed treatment decisions. Favorable regulatory frameworks and expedited approval processes continue to enable the timely introduction of new sling technologies into the market.

Europe Vaginal Slings Market Analysis

In Europe, the vaginal slings market is expanding due to growing emphasis on quality of life and functional recovery following pelvic floor surgeries. The region’s aging demographic is a significant driver, with a rising number of elderly women seeking surgical management for stress urinary incontinence. The Urology Foundation notes that the NHS estimates approximately 14 Million individuals in the UK are living with bladder problems, about 1 in 5 people, demonstrating a large potential patient base for sling-related procedures. Additionally, the integration of pelvic health into national public health agendas has amplified access to surgical treatments. The region benefits from a collaborative research environment that promotes clinical innovation and evidence-based practices. Healthcare infrastructure investments, particularly in surgical training programs, are improving procedural success rates and patient outcomes. Day-care surgical models, supported by efficient reimbursement structures, are increasing procedure volumes. Public awareness campaigns and advanced sling materials enhance biocompatibility and surgical acceptance.

Asia-Pacific Vaginal Slings Market Analysis

The vaginal slings market in Asia-Pacific is growing rapidly owing to increased urbanization and rising healthcare expenditure. A significant factor contributing to this growth is the expanding middle-class population with better access to specialized healthcare services. According to reports, the prevalence of at least one pelvic floor dysfunction among women in India stands at 23.7%, while 2.9% experience pelvic organ prolapse, indicating both treatment needs and potential underdiagnosis. Lifestyle changes and growing awareness about pelvic health issues are leading more women to seek medical treatment for incontinence and prolapse. The proliferation of private hospital chains and specialty clinics is improving the availability of urogynecological procedures. Additionally, government-led initiatives promoting women's health and wellness are enhancing early diagnosis and intervention rates. The rise in medical tourism in the region is boosting the use of advanced pelvic floor surgeries, with increased collaboration between healthcare providers and global technology firms promoting modern surgical techniques.

Latin America Vaginal Slings Market Analysis

In Latin America, the market is gaining traction due to growing patient awareness and evolving healthcare delivery systems. The Organization for Economic Cooperation and Development (OECD) states that Brazil’s Unified Health System (SUS) accounts for 42% of overall health spending, creating a substantial public-sector opportunity for women’s health procedures. Expansion of health insurance coverage in urban centers is making surgical solutions like vaginal slings more financially accessible to a larger population. In parallel, improved physician training and access to specialized medical education are contributing to enhanced procedural expertise. Public-private partnerships are playing a key role in modernizing healthcare facilities, which supports the integration of advanced pelvic floor surgical options. Additionally, shifting cultural perceptions around women’s health and proactive wellness practices are driving early medical consultations and increasing demand for curative treatments such as slings.

Middle East and Africa Vaginal Slings Market Analysis

The market in the Middle East and Africa is experiencing gradual growth, supported by rising investments in women's health services. The Saudi Arabian government plans to raise the private sector’s share of healthcare from 40% to 65% by 2030. This initiative includes the privatization of 290 hospitals and 2,300 primary healthcare centers. The expansion of private healthcare networks and the establishment of specialty clinics are increasing access to pelvic floor treatments. Awareness programs focusing on maternal health and aging-related conditions are encouraging more women to seek surgical interventions. Technological advancements introduced through international collaborations facilitate the use of modern sling systems. Furthermore, the growing presence of trained surgical professionals in metropolitan areas enhances procedural confidence, thereby expanding the patient base for vaginal sling procedures in the region.

Competitive Landscape:

The market is characterized by a mix of established and emerging players offering a range of synthetic and biological options. Moreover, surgical methods continue to shift, with a growing interest in minimally invasive procedures. Also, the market demand is heavily influenced by the increasing number of women experiencing stress urinary incontinence and greater awareness about treatment options. Besides, safety concerns and regulatory scrutiny over mesh-based products have led to a rise in demand for alternatives, affecting product development and adoption rates. Apart from this, pricing pressure from regional players and the need for clinical validation also contribute to competitive intensity. According to the vaginal slings market forecast, the market is projected to grow steadily over the next few years, propelled by an aging female population, wider healthcare access in developing regions, and ongoing improvements in sling design and surgical outcomes. Furthermore, competition will likely sharpen as companies race to introduce safer, more effective materials and strengthen distribution across hospitals, specialty clinics, and ambulatory surgical centers.

The report provides a comprehensive analysis of the competitive landscape in the vaginal slings market with detailed profiles of all major companies, including:

- A.M.I. GmbH

- B. Braun SE

- Betatech Medical

- Boston Scientific Corporation

- Caldera Medical

- Coloplast Corp

- Cousin Surgery

- Promedon GmbH

- UroCure

Vaginal Slings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Conventional Vaginal Slings, Advanced Vaginal Slings |

| Product Types Covered | Transobturator Slings, Tension-free Vaginal Tape Sling, Others |

| Type of Urinary Incontinences Covered | Stress Urinary Incontinence, Urge Urinary Incontinence, Mixed Urinary Incontinence |

| End Users Covered | Hospitals, Ambulatory Surgery Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A.M.I. GmbH, B. Braun SE, Betatech Medical, Boston Scientific Corporation, Caldera Medical, Coloplast Corp, Cousin Surgery, Promedon GmbH, UroCure, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vaginal slings market from 2019-2033.

- The vaginal slings market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vaginal slings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vaginal slings market was valued at USD 1.41 Billion in 2024.

The vaginal slings market is projected to exhibit a CAGR of 5.86% during 2025-2033, reaching a value of USD 2.36 Billion by 2033.

The market is driven by the rising prevalence of stress urinary incontinence among women, growing awareness of minimally invasive treatment options, increasing adoption of advanced surgical procedures, and supportive reimbursement policies. Aging populations and rising healthcare expenditures further contribute to market growth.

North America currently dominates the vaginal slings market with a market share of around 42.0%. The dominance is fueled by the region’s well-established healthcare infrastructure, high awareness about women’s health issues, favorable reimbursement frameworks, and a growing elderly female population. Additionally, the presence of leading medical device manufacturers supports continued market expansion in the region.

Some of the major players in the vaginal slings market include A.M.I. GmbH, B. Braun SE, Betatech Medical, Boston Scientific Corporation, Caldera Medical, Coloplast Corp, Cousin Surgery, Promedon GmbH and UroCure, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)