Vegan Ice Cream Market Size, Share, Trends and Forecast by Source, Flavor, Sales Type, Distribution Channel, and Region, 2026-2034

Vegan Ice Cream Market Size and Share:

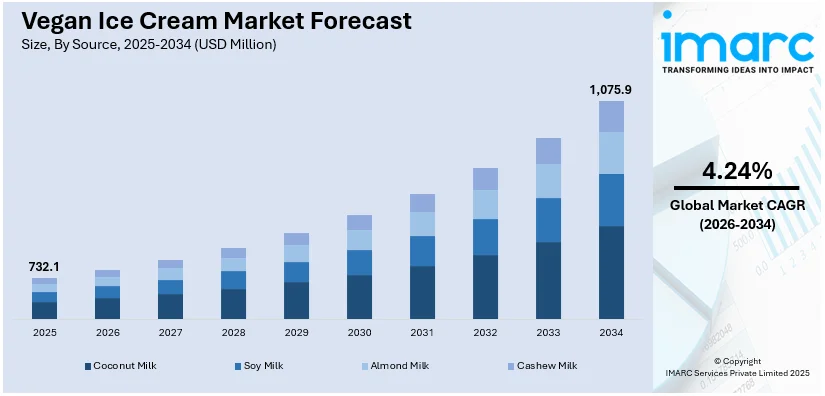

The global vegan ice cream market size was valued at USD 732.1 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,075.9 Million by 2034, exhibiting a CAGR of 4.24% from 2026-2034. Europe currently dominates the market. The European region is driven by the heightened awareness about the harmful implications of dairy farming, increasing concerns related to animal welfare, and rising occurrence of lactose intolerance among people.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 732.1 Million |

|

Market Forecast in 2034

|

USD 1,075.9 Million |

| Market Growth Rate (2026-2034) | 4.24% |

People nowadays are making big changes in their lives to enhance their quality of life on account of the rising awareness among the masses about overall health and wellness. Most people who are prepared to spend money on vegan ice cream are aware of the harmful consequences of eating dairy products, such as elevated blood sugar and cholesterol. A significant element influencing the market is sustainability. This is making consumers choose plant-based options like vegan ice cream to lower the dairy farming impact associated with greenhouse gas emissions, deforestation, and water resource exploitation. Overall, the carbon footprint of producing vegan ice cream is lower than that of dairy-based ice cream, making it attractive to environmentally conscious consumers. Ethical considerations linked to animal welfare also play a role here: numerous individuals opt for vegan diets to refrain from supporting industries tied to animal exploitation.

To get more information on this market Request Sample

The United States has emerged as a key region in the vegan ice cream market due to the increasing preferences for consumption of plant based diets. This shift is driven in part by the rising awareness about the environmental impact of dairy production, including greenhouse gas emissions, water usage, and deforestation. According to the World Population Review, around 3 per cent of people in the US are vegan in 2024. Health consciousness is also becoming a major factor for consumer purchasing behavior in the US, particularly among younger demographics. Many consumers are turning to plant based alternatives to avoid issues related to lactose intolerance, allergies, and the high saturated fat content associated with dairy products. Vegan ice creams, typically made from plant based milk provide a healthier option for these individuals. Flavor diversity is also becoming a major factor contributing to the market growth in the country. Classic flavors like chocolate, vanilla, and strawberry remain popular and many brands are introducing other unique and exotic options to cater to adventurous palates.

Vegan Ice Cream Market Trends:

Rising Awareness About Environmental Sustainability and Animal Welfare Concerns

The growing consciousness of consumers toward the environment-friendly nature of food consumption and animal welfare is supporting the market's growth. Along with this, growing issues related to greenhouse gas (GHG) emissions, water usage, and deforestation associated with traditional dairy farming are encouraging many individuals to look for sustainable and ethical alternatives. Vegan ice creams contain no animal-derived ingredients and are perceived as an eco-friendlier option. Apart from nutritional requirements, ethical factors like concern over animal welfare and the demand to minimize the exploitation of animals also promote the vegan ice cream demand. Because of this reason, many ice cream companies are manufacturing vegan ice creams and bringing out new flavors. Magnum recently introduced its vegan blueberry cookie ice cream with sorbet center in the market, in February 2024. The ice cream is coated with vegan milk chocolate and comes in sticks and a pack of three as well.

Prevalence of Lactose Intolerance and Dairy Allergies Among People

The primary factor driving market growth is the prevalence of lactose intolerance and dairy allergies in the general population. A significant percentage of the world's population suffers from lactose intolerance, which is the inability of digesting sugar that is found in dairy products. This situation is creating an elevated requirement for vegan ice cream. Like this, allergies resulting from dairy items are severe in nature and can be deadly. And so, victims of such diseases require dairy-free alternatives, which is fueling the positive outlook for the vegan ice cream market. Such ice creams are manufactured using cashew, almond, coconut, or soy as a substitute for milk from plants. Furthermore, big companies are diversifying their products to suit individuals who face such issues. In 2024, Unilever's Breyers launched a new ice cream that is lactose and cholesterol-free, utilizing animal-free whey protein.

Health Consciousness and Escalating Demand for Plant-Based Products

With increasing demand for plant-based diets and awareness about health issues, the vegan ice cream consumption is growing. People who are health-conscious need healthier alternatives that do not compromise on taste or enjoyment. Vegan ice creams are made without cholesterol or saturated fats, a component present in regular dairy-based ice cream, making it a healthy option. As per an industrial report, 60% of North America's population prefers healthier confectionery, desserts, and ice cream. High prevalence of lactose intolerance, as observed in India, further supports the demand for vegan alternatives. Moreover, plant-based diets are in vogue recently due to their health benefits such as better weight control and cardiac health. As a result, consumers are embracing plant-based diets and considering vegan ice cream as a more satisfying dessert that fits within their goal of keeping their health at its best.

Vegan Ice Cream Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vegan ice cream market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on source, flavor, sales type, and distribution channel.

Analysis by Source:

- Coconut Milk

- Soy Milk

- Almond Milk

- Cashew Milk

Due to its nutty flavor and creamy texture, almond milk, which is the popular plant-based milk substitute, is an appropriate base for vegan ice creams. It appeals to consumers looking for dairy-free solutions due to its inherent sweetness and lower calorie content in comparison with cow milk. This milk substitute provides high calcium and vitamin E content, which proves to be helpful in improving the nutritional value of vegan ice creams. In addition to these features, it's lactose-free, meaning an ideal product for individuals diagnosed with dairy allergies or have difficulties metabolizing lactose. All this feature brings to this line of vegan ice cream from almond milk, increasing market reach towards fulfilling consumer needs who desire a dairy-free frozen treat that remains equal in terms of both flavor and texture.

Analysis by Flavor:

- Chocolate

- Caramel

- Coconut

- Vanilla

- Coffee

- Fruit

A popular flavor, caramel is characterized by its rich, sugary, and buttery flavor, making it extremely delightful and fulfilling to individuals when combined with the smooth and creamy texture of vegan ice cream produced from plant-based milk substitutes like soy, almond, or coconut. Additionally, the increasing demand for caramel vegan ice cream among those suffering from lactose intolerance or dairy allergies as it contains no animal-derived ingredients is contributing to the growth of the market. Apart from this, consumers are looking for alternatives that are in line with their values and preferences but do not compromise on flavor and indulgence. Moreover, the increasing interest in plant-based diets and the desire for varied gourmet dessert options are positively impacting the market. Companies in the market introduce caramel flavors to attract a wider consumer base. For instance, on May 9, 2024, the plant-based ice cream company Over The Moo introduced a new chocolate flavor to their assortment of little frozen delights in the United Kingdom. The snacks, which come in vanilla and caramel flavors, are made up of bits of coconut-based ice cream covered in dark chocolate.

Analysis by Sales Type:

- Impulse

- Take Home

- Artisanal

The take homes sales type segment is driven by consumer demand for convenient and accessible options that allow people to enjoy vegan food products like ice creams in the comfort of their homes. Take home options are often available as pints and tubs and cater to families as well as individuals seeking ready to consume desserts that align with health, ethical, and dietary preferences. Plant based diet consumption is increasing and also awareness about vegan alternatives is rising as companies are launching various vegan products both on online and offline retail channels. Supermarket hypermarkets often dedicate substantial amount of space for take home vegan ice cream products, making them effortlessly available to consumers. The convenience of storage, coupled with the ability to consume at one’s leisure is solidifying take home vegan ice cream as a preferred choice among the masses globally.

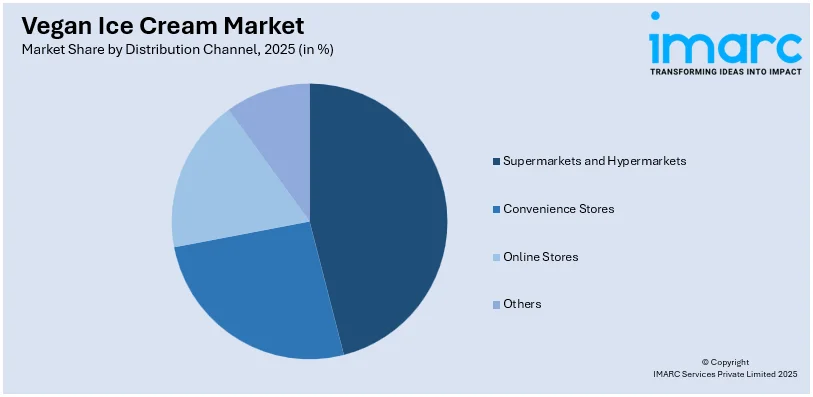

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

For food purchases, supermarkets and hypermarkets are one-stop shops. To reach a wider group of customers, they provide a large selection of vegan ice cream options. Additionally, as veganism and plant-based products gain popularity, these retail behemoths are giving vegan ice cream options from a wider variety of brands and flavors greater shelf space. Furthermore, vegan ice cream makers' active marketing and promotional operations in these retail environments are increasing their exposure and generating customer interest, which is driving rising demand for vegan ice cream through supermarkets and hypermarkets. Supermarkets and hypermarkets are essential for influencing customer decisions and enhancing market expansion as the demand for plant-based substitutes rises. In addition to this, businesses are putting money into launching physical stores.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe is witnessing a significant rise in health consciousness and a growing interest in plant-based diets as people look for healthier and more sustainable food options. Vegan ice creams, made from plant-based milk substitutes, satisfy people's dietary requirements while providing a guilt-free treat. Second, ethical concerns about animal welfare and environmental sustainability are driving a rise in the number of people in the area embracing vegan and vegetarian lifestyles. Besides, producers are launching a wide variety of cutting-edge flavors and high-end products to boost sales of vegan ice cream. Besides this, the accessibility of vegan ice creams in several supermarkets, specialty stores, and online stores is making them available to buyers across Europe and thus contributing to its popularity, which is driving the expansion in the region. Latvian ice cream company Vesma of the Tio brand launched a novel retro form design, a new and light flavor along with a waffle cone, two absolutely new and vegan-friendly sorbet ice creams on sticks in 2024.

Key Regional Takeaways:

United States Vegan Ice Cream Market Analysis

Growing health consciousness and dietary preferences for plant-based goods are driving the vegan ice cream business in the United States. According to recent studies, about 6% of American consumers identify as vegan, which has increased demand for dairy-free substitutes. The trend towards vegan ice cream products is further supported by the increasing awareness of lactose intolerance, which affects about 36% of Americans. Owing to their flavor profiles and health advantages, popular foundation ingredients including oat milk, almond milk and coconut milk, have gained popularity. Innovation in vegan ice cream flavors and textures has been fueled by the growth of plant-based diets, which has been aided by celebrity endorsements and greater media exposure. Due to the entry of well-known companies like Ben & Jerry's and Häagen-Dazs, the market has grown. Additionally, consumers are becoming interested in companies that offer clean-label products and distinctive flavors. Accessibility is also fueled by the growth of e-commerce and growing availability in specialty shops and supermarkets. Furthermore, customers are moving towards sustainable plant-based alternatives due to environmental issues around dairy farming.

Europe Vegan Ice Cream Market Analysis

The demand for vegan ice cream in Europe is driven by consumers' significant interest in ethical and sustainable food choices. According to the stats by World Population Review, the UK has more vegans than any other country in the world. Over the last four years, the number of searches for vegan restaurants with vegan-only menus has tripled. The total searches for vegan eateries ascended from 60,000 in 2017 to more than 200,000 during 2020. In the UK, veganism is becoming more and more popular owing to numerous commercials and well-known media figures promoting its many advantages. Switzerland, Austria, Germany, and Sweden are among the other European nations having sizable vegan populations. Plant-based product innovation is further encouraged by the European Union's strict food labelling laws and dedication to sustainability. With an increase in vegan ice cream offerings in retail and foodservice channels, nations like Germany and the UK are spearheading the vegan movement. Innovative flavors made using rice milk, almond milk, and oat milk as basis appeal to consumers. Additionally, vegan ice cream is valued by health-conscious European consumers because it is lower in calories and cholesterol than regular dairy versions. Climate change awareness has increased the appeal of ethical eating options, such as vegan desserts. To capitalize on this expanding market, big businesses and regional artisanal firms are investing in clean-label and organic products.

Asia Pacific Vegan Ice Cream Market Analysis

Growing health consciousness, increasing disposable budgets, and fast urbanization are driving the vegan ice cream market in Asia-Pacific. One important factor is lactose intolerance, which affects about 90% of individuals in East Asia. The growing popularity of plant-based diets in nations like China, Japan, and India is driving up demand for vegan goods. The region's traditional use of using soy and coconut milk in desserts makes the switch to vegan ice cream a logical one. Asia has a significant population of vegans and vegetarians. For instance, according to the data by World Population Review, India’s population has around 30% vegetarians and 9% vegans. Moreover, Australia ranks as the country with the second-highest number of vegans. Searches for vegan restaurants have increased significantly in Australia, especially during the past four years. Diverse customer tastes are catered to by creative flavors that are influenced by regional cuisines, such as mango in India or matcha in Japan. Plant-based alternatives are also becoming more popular as environmental concerns gain more attention. The market landscape is becoming more competitive because of local startups and international companies entering the market.

Latin America Vegan Ice Cream Market Analysis

The market for vegan ice cream is expanding in Latin America as a result of rising plant-based diets and health consciousness. Due to the prevalence of lactose intolerance and the growing number of vegetarians, Brazil, the largest market in the area, is at the forefront of vegan innovation. Using cashew and almond milk bases, local firms are launching tropical flavors like guava and passion fruit. The demand for plant-based products is rising because of the region's emphasis on sustainability and ethical consumerism. Additionally, the popularity of vegan and vegetarian celebrations in nations like Mexico is making vegan ice cream a common dessert choice, which is propelling the expansion of this niche industry. As per the first survey in Latin America, which happened in January 2023, for measuring Veganuary’s participation, 5% of respondents were from Chile, 7% from Argentina and Mexico, and 8% in Brazil contributed to Veganuary during the month.

Middle East and Africa Vegan Ice Cream Market Analysis

With environmental sustainability and health awareness in the forefront of consciousness throughout the Middle East and Africa, the vegan ice cream market is moving forward in that region. Plant-based diets are trending among young people in that region of the world, especially within South Africa and the United Arab Emirates. Moreover, as recent research into the effects of weight-management dieting programs on health outcomes in a Saudi university community has indicated, almost 16 percent of participants were vegetarian. Dairy-free substitutes, often consisting of almond and coconut milk, are growing increasingly popular; indeed, these products often appeal especially to customers with a condition known as lactose intolerance. The role of Westernized foodways in fueling this development is furthered through the increased offering of vegan product lines by retailers. Thanks to the booming health-conscious food franchises and online grocery shopping platforms, vegan ice cream is now available practically everywhere.

Competitive Landscape:

The competitive landscape of the global vegan ice cream market is characterized by intense competition among established manufacturers and the emergence of new players. Numerous companies are aiming to capitalize on the rising demand for plant-based frozen desserts. Established ice cream manufacturers are diversifying their product portfolios to include vegan offerings. At the same time, numerous specialized and niche brands are focusing solely on vegan ice cream production, catering to the specific dietary requirements of vegan and health-conscious consumers. On 14 November 2023, Singapore's oat milk producer OATSIDE launched a range of vegan ice creams in the city, beginning with three flavors. The ice creams are available in flavors such as chocolate, peanut butter cookie dough, and coffee with mini chocolate chips, and are noted for their creamy texture complemented by the malty foundation of oat milk.

The report provides a comprehensive analysis of the competitive landscape in the vegan ice cream market with detailed profiles of all major companies, including:

- Arctic Zero

- Booja-Booja

- Double Rainbow Ice Cream

- HappyCow

- Morrisons

- NadaMoo!

- Over The MOO

- Perry's Ice Cream

- SorBabes

- Tofutti Brands Inc.

- Unilever PLC

- Van Leeuwen Ice Cream.

Latest News and Developments:

- March 2024: Eclipse Foods, a vegan ice cream brand, unveiled Eclipse Bonbons. In order to replicate the rich flavors and creamy texture typically seen in dairy-based ice cream, an award-winning chef created a line of non-dairy ice cream bonbons, which are the latest addition to the company's repertoire.

- February 2024: Unilever’s ice cream company Magnum announced its plans of expanding its vegan or plant-based product range with a brand new flavor, Chill Blueberry Cookie ice cream sticks.

Vegan Ice Cream Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Coconut Milk, Soy Milk, Almond Milk, Cashew Milk |

| Flavors Covered | Chocolate, Caramel, Coconut, Vanilla, Coffee, Fruit |

| Sales Types Covered | Impulse, Take Home, Artisanal |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arctic Zero, Booja-Booja, Double Rainbow Ice Cream, HappyCow, Morrisons, NadaMoo!, Over The MOO, Perry's Ice Cream, SorBabes, Tofutti Brands Inc., Unilever PLC, Van Leeuwen Ice Cream, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, vegan ice cream market forecast, and dynamics from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global vegan ice cream market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vegan ice cream industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of vegan ice cream companies.

Key Questions Answered in This Report

Vegan ice cream is a dairy-free frozen dessert made from plant-based ingredients such as soy milk, almond milk, coconut milk, or cashew milk. It is free from animal-derived components, catering to consumers seeking sustainable, ethical, and health-conscious alternatives to traditional dairy ice cream.

The vegan ice cream market was valued at USD 732.1 Million in 2025.

IMARC estimates the global vegan ice cream market to exhibit a CAGR of 4.24% during 2026-2034.

The global vegan ice cream market is driven by rising health consciousness, increasing prevalence of lactose intolerance, growing consumer awareness of environmental sustainability, and ethical concerns regarding animal welfare. Advancements in plant-based alternatives and innovative flavor offerings further contribute to market growth.

Almond milk leads the market by source due to its creamy texture and its high demand among consumers looking for dairy-free solutions on account of its inherent sweetness and lower calorie content in comparison with cow milk.

Caramel leads the market by flavor owing to its rich, buttery profile and compatibility with plant-based milk bases like soy and almond, offering indulgence without dairy.

The take-home segment is the leading segment by sales type, driven by the convenience of ready-to-eat pints and containers, allowing consumers to enjoy vegan ice cream at home.

The supermarkets and hypermarkets segment is the leading distribution channel, driven by wide product availability, increased shelf space, and aggressive marketing efforts targeting diverse consumer bases.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Europe currently dominates the global market, driven by heightened health and sustainability awareness.

Some of the major players in the global vegan ice cream market include Arctic Zero, Booja-Booja, Double Rainbow Ice Cream, HappyCow, Morrisons, NadaMoo!, Over The MOO, Perry's Ice Cream, SorBabes, Tofutti Brands Inc., Unilever PLC, Van Leeuwen Ice Cream, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)