Vending Machine Market Size, Share, Trends and Forecast by Type, Technology, Payment Mode, Application, and Region, 2025-2033

Vending Machine Market Size and Share:

The global vending machine market size is anticipated to reach USD 22.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 30.9 Billion by 2033, exhibiting a CAGR of 4.11% from 2025-2033. The market is driven by rising demand for on-the-go snacks and beverages, especially in busy urban areas.

Market Size & Forecasts:

- The vending machine size is anticipated to reach USD 22.4 Billion in 2025.

- The market is projected to reach USD 30.9 Billion by 2033, at a CAGR of 4.11% from 2025-2033.

Dominant Segments:

- Type: Beverages vending machine stands as the largest component, holding around 54.3% of the market share in 2024. Beverages are a universally consumed product category, appealing to a wide range of consumers across various demographics.

- Technology: Automatic machine leads the market with around 55.5% of market share in 2024. Automatic machines offer a high level of convenience and ease of use for both operators and consumers. They incorporate features such as touch screens, digital interfaces, and cashless payment systems, providing a seamless and interactive purchasing experience.

- Payment Mode: Cash represents the leading market segment, with around 72.8% of market share in 2024. Cash is widely accepted and familiar to consumers across various demographics. It has been a trusted form of payment for centuries, and many individuals still prefer using cash for their transactions.

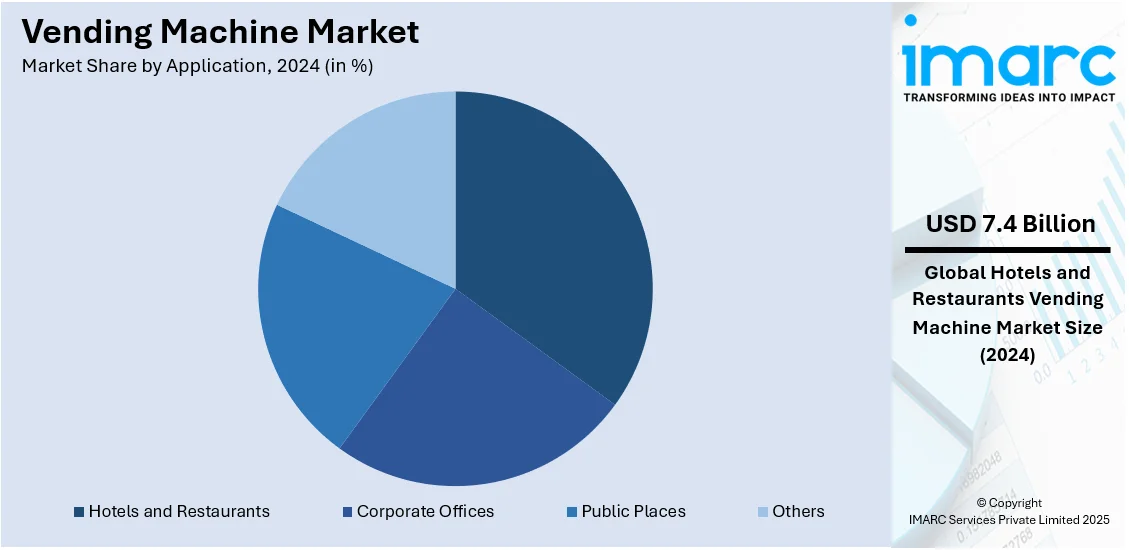

- Application: Hotels and restaurants account for the largest market segment, holding around 34.6% of the market share in 2024. The hospitality industry heavily relies on vending machines to provide convenient and accessible options for their guests. Hotels and restaurants often have high foot traffic, with guests seeking quick and on-the-go solutions for snacks, beverages, and other items.

- Region: North America accounted for the largest market share of over 28.5%. North America has a strong and well-established vending machine infrastructure. Moreover, the region has a large consumer base with high disposable income levels. It has a culture of on-the-go consumption and convenience, where consumers value time-saving solutions.

Key Players:

- Major players in the vending machine market include Aramark Corporation, Azkoyen Group, Bianchi Industry Spa, Crane Payment Innovations (CPI), Evoca Group, Fuji Electric Co., Ltd., Jofemar Corporation, Royal Vendors, Inc., SandenVendo GmbH, Seaga Manufacturing, Inc., Selecta, Westomatic Vending Services Ltd, etc.

Key Drivers of Market Growth:

- Convenience & Accessibility: Vending machines provide easy, round-the-clock access to products in locations like offices, airports, and schools, matching consumer demand for quick, on-the-go purchases without store visits.

- Contactless & Digital Payments: Adoption of cashless payment methods like mobile wallets, QR codes, and cards makes transactions smoother, faster, and safer, meeting changing consumer preferences for touch-free experiences.

- Smart Technology Integration: Use of IoT, AI, and sensors improves machine efficiency by enabling remote monitoring, inventory tracking, real-time updates, and personalized promotions, enhancing the consumer and operator experience.

- Product Variety Expansion: Growing demand for healthy, fresh, and specialty products has diversified vending machine offerings beyond snacks and drinks to include items like meals, electronics, and personal care goods.

- Emerging Market Opportunities: Increased machine installations in workplaces, rural areas, transport hubs, and public spaces provide new growth avenues, helping vendors reach untapped customer segments seeking convenience shopping solutions.

Future Outlook:

- Strong Growth Outlook: Expect deeper AI personalization, autonomous re-stocking, e commerce integration for in machine pickups, energy efficient designs, recyclable packaging, and machines selling high-value goods like electronics and skincare.

- Market Evolution: Expect deeper AI personalization, autonomous re-stocking, e commerce integration for in machine pickups, energy efficient designs, recyclable packaging, and machines selling high-value goods like electronics and skincare.

The vending machine market growth is primarily driven by the increasing consumer demand for convenience and on-the-go solutions, particularly in urban areas, where there is a rising need for convenient, accessible products. As per industry reports, in 2024, 57.5% of the total global population lived in urban cities. Moreover, technological advancements such as cashless payment systems, interactive displays, and smart machines have also improved user experience and boosted market growth. Moreover, the rising preference for healthy snack options is leading to innovation in vending machine offerings. Additionally, growing adoption in emerging economies, along with environmental sustainability trends, such as eco-friendly machines, are creating a positive vending machine market outlook worldwide.

The United States has emerged as a key regional market for vending machines, driven by the growing demand for convenience, as consumers increasingly seek quick, accessible options for snacks, beverages, and other products. Increasing urbanization and a shift toward contactless and sustainable vending solutions are also propelling the vending machine market demand. According to recent reports, 82.8% of the total population in the United States lives in urban areas in 2025. Additionally, the rising trend for healthier snack options in vending machines is also fueling the demand for advanced, healthier product offerings. The expansion of automated retail in various areas with high traffic, including airports, offices, and shopping centers, further supports market growth.

Vending Machine Market Trends:

Increasing consumer demand for convenience

The vending machine market trends indicate that the rising preference for quick and hassle-free transactions is significantly driving the industry across the globe. Vending machines offer a seamless shopping experience by providing 24*7 access to numerous consumer products, eventually eliminating the need for human interaction. In addition to this, the growth in the expansion of commercial spaces, such as retail, hotels & lodging, and manufacturing facilities across various parts of the world, is creating significant demand for vending machines. For instance, Hindustan Unilever (HUL), a leading FMCG company, introduced an in-store vending machine in July 2021, the Smart Fill, for its home care collection. These machines were installed by the company at the Reliance Smart Acme Mall, Mumbai, as an experimental project. Similarly, various other companies from diverse industries are expanding by installing vending machines across different parts of the world. For example, RVM Systems, a vending machine brand based in Sweden, stated in May 2022 that it would establish reverse vending machines across Singapore that can consume approximately 100 containers at the same time. These machines primarily aim to encourage individuals to responsibly discard drink cans and plastic bottles. They also offer shopping rewards, ActiveSG credits, and numerous other incentives.

Significant technological advancements

The integration of advanced technologies has transformed traditional vending machines into smart, interactive devices. Cashless payment systems, such as contactless cards, mobile wallets, and digital currencies, offer convenience and security to consumers. Looking at the vending machine market statistics and the increasing demand for contactless payment systems, various connected vending machine manufacturers are introducing new products, and they are also receiving multiple orders for installations. For example, Tao Bin, a smart beverage vending machine in Thailand that uses a touch panel to take orders and accepts mobile payments, stated in 2023 that it intended to grow its business by installing 6000 units in apartment complexes and train stations throughout the nation. Additionally, various manufacturers have started reshaping their products by launching more innovative connected vending machines. For instance, to give consumers access to fresh and healthful meals, Daalchini Technologies, an Indian food tech startup, installed IoT-enabled vending machines for retail use at a number of locations in April 2023, including hospitals, schools, colleges, and train stations. Moreover, considering the fast-paced lifestyle of working professionals, the vending machine providers are also focusing on developing innovative products. For example, the first ‘RoboBurger’ location was set up in Newport Centre Mall in New Jersey, USA, in March 2022. The newly constructed location is a 12-foot-square box with a robotic system that prepares and delivers fresh beef burgers to patrons in only six minutes. Such initiatives are anticipated to propel the vending machine market share in the coming years.

Availability of diverse product offerings

The vending machines market has experienced notable growth in its product offerings, catering to a diverse range of consumer preferences. Initially focused on snacks and drinks, vending machines now provide a wide range of products, including fresh food, healthy snacks, personal care items, electronics, and even prescription medications. Moreover, the inflating spending power of consumers, along with their elevating lifestyles, is also contributing to the market growth. For example, Census.gov estimates that the United States spent approximately USD 626.8 billion on trading days, holidays, and variations in December 2021. This was a 16.9% rise over the prior year but a 1.9% reduction from the preceding month. Furthermore, the growing need for automated product distribution systems in airports, hospitals, school canteens, railways, and gas stations is propelling the industry forward. For instance, in January 2022, the Chicago-based startup Farmer's Fridge set up 178 vending machines in hospitals and airports that sold salads, bowls, and other healthier options. There are 60 of these machines in airports and 118 in hospitals. Besides this, the government authorities of various nations are taking the initiative to develop smart cities, which is further bolstering the installation of smart vending machines. For example, various governments in the American region are also promoting the adoption of smart cities. For instance, the government of Las Vegas has allocated USD 500 million to test three pilot projects in an effort to connect the entire city by 2025. Such initiatives by the government are projected to increase the vending machine market revenue in the years to come.

Vending Machine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vending machine market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type, technology, payment mode and application.

Analysis by Type:

- Food Vending Machine

- Beverages Vending Machine

- Tobacco Vending Machine

- Others

Beverages vending machine stands as the largest component, holding around 54.3% of the market share in 2024. Beverages are a universally consumed product category, appealing to a wide range of consumers across various demographics. People rely on beverages to quench their thirst, boost their energy levels, and provide refreshments throughout the day. Moreover, refrigerated vending machine products with diverse characteristics are being introduced by specialty retailers, attracting customers and moving the market forward. For Instance, Azkoyen has entered into a partnership with Trugge Getränketechnik to provide vending services for fitness centers and sell Novara Proteins. In just 30 seconds, the sports center vending machine can prepare and provide cold protein shakes for athletes. This product combines the appealing design elements of Azkoyen's Novara brand with unique technology for making protein shakes served at 3°C.

Analysis by Technology:

- Automatic Machine

- Semi-Automatic Machine

- Smart Machine

Automatic machine leads the market with around 55.5% of market share in 2024. Automatic machines offer a high level of convenience and ease of use for both operators and consumers. They incorporate features such as touch screens, digital interfaces, and cashless payment systems, providing a seamless and interactive purchasing experience. Consumers can simply make their selections and complete transactions without the need for manual assistance, enhancing the overall user experience. Moreover, the pandemic has also increased the proliferation of the self-checkout service feature, resulting in the demand for vending machines. According to a study conducted by the Shekel Brainweigh Ltd. poll, 87% of consumers expressed a preference for stores that provide touchless or self-checkout services. Similarly, as per a survey in the United States, over two-thirds of shoppers pay for their groceries through frictionless micro-markets, touchless self-checkout, or self-checkout. This indicates robust growth for automatic vending machines in the coming years.

Analysis by Payment Mode:

- Cash

- Cashless

Cash represents the leading market segment, with around 72.8% of market share in 2024. Cash is widely accepted and familiar to consumers across various demographics. It has been a trusted form of payment for centuries, and many individuals still prefer using cash for their transactions. Cash provides a tangible and immediate means of exchange, allowing consumers to have full control over their spending. Additionally, unlike digital payment methods that may require electronic devices or an internet connection, cash can be used in any situation, making it a reliable and accessible payment option in various settings.

Analysis by Application:

- Hotels and Restaurants

- Corporate Offices

- Public Places

- Others

Hotels and restaurants account for the largest market segment, holding around 34.6% of the market share in 2024. The hospitality industry heavily relies on vending machines to provide convenient and accessible options for their guests. Hotels and restaurants often have high foot traffic, with guests seeking quick and on-the-go solutions for snacks, beverages, and other items. Considering this, vending machine providers are also focusing on developing innovative products. For instance, the first ‘RoboBurger’ location was set up in Newport Centre Mall in New Jersey, USA, in March 2022. The RoboBurger is a 12-foot-square box with a robotic system that prepares and serves fresh beef burgers to clients in only six minutes. Similar to this, a restaurant in the Charente town of France has installed a vending machine in March 2022 so that patrons could purchase fresh gourmet foods such as andouillette, foie gras, or even ris de veau.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 28.5% . North America has a strong and well-established vending machine infrastructure. Moreover, the region has a large consumer base with high disposable income levels. It has a culture of on-the-go consumption and convenience, where consumers value time-saving solutions. Considering this, numerous sectors, including food and beverages and personal care, are installing smart vending machines to facilitate convenient buying and selling of essential products. For instance, in November 2021, OpulenceMDBeauty, a leading beauty company that specializes in eye products, introduced innovative lash vending machines on campuses of the University of Louisville.

Key Regional Takeaways:

United States Vending Machine Market Analysis

In 2024, the United States accounted for over 75.50% of the vending machine market in North America. The U.S. vending machine market is witnessing tremendous growth because consumers seek quick, out-of-home, convenient food and beverages. This is increasing the adoption of smart vending machines, which also employ cashless payment systems, in order to cater to fast-paced American consumer lifestyles. According to industry reports, companies such as Farmer's Fridge have seized this trend and installed more than 1,400 machines across airports, colleges, and hospitals, selling fresh salads and healthy options. Healthy and wellness-conscious consumers also drive the trend for vending machines to dispense healthy snacks and drinks.

Europe Vending Machine Market Analysis

The increasing demand for convenient and automated retail solutions is propelling the growth of the European vending machine market. EVA (European Vending and Coffee Association) estimates that there are around 4.4 Million vending machines in the EU, a true testimony to the strong adoption of self-service technology in the region. Most of these machines are installed in corporate offices and workplaces. Among these, coffee vending machines are the most popular, representing Europe's established legacy in terms of coffee culture. Moreover, rising urbanization, coupled with busy schedules, has created increased demand for speedy meal vending solutions. Tourism remains another sector in which vending machine sales increase demand as tourists require a point of access 24/7 to snacks and beverages. Growing health awareness among consumers also drives the market as operators are increasing their product lines to include organic, sugar-free, or gluten-free vending products. Advancements such as contactless payments and AI-driven restocking improve efficiency and user experience, with Europe fast becoming a hub in the vending machine industry across the globe.

Asia Pacific Vending Machine Market Analysis

The Asia Pacific market for vending machines is rapidly growing, based on urbanization and rising disposable income, which create an increasing need for convenience. As per data from the end of 2021, there were approximately 300,000 vending machines across China. As for density, Japan has an advanced position and offers a diverse range of items, such as beverages and electronics, showing a highly advanced technology ecosystem. The growing use of facial recognition, AI-based inventory management, and cashless payment technologies further improves user experience and operational efficiency. Health-conscious trends are also shaping the market, with vending machines stocking fresh food, organic snacks, and functional beverages. In addition, government initiatives to promote digital payments and smart city infrastructure are further driving market expansion. Besides this, partnerships between local and international vending machine manufacturers are fostering innovation in such technologies, with the Asia Pacific region remaining at the forefront.

Latin America Vending Machine Market Analysis

The Latin American vending machine market is growing significantly, supported by the pace of economic development and the growth of the middle class. According to industrial reports, in Brazil, for instance, the ratio of vending machines to inhabitants is one machine per 2,500 people, while it currently stands at one machine per 90 inhabitants in the United States. This underscores the vast growth potential for the vending machine market in Brazil, hence providing opportunities for increasing penetration. As per recent reports, the industry has been growing at a pace of 20% per annum, and this trend is likely to continue. Technological development, including cashless payment mechanisms, is also adding to the growth of the market. The market dynamics are also being influenced by tie-ups between local operators and international manufacturers, who are introducing innovative products and services in the market.

Middle East and Africa Vending Machine Market Analysis

The Middle East and Africa vending machine market is a fast-emerging market that benefits from increasing urbanization and rising consumer demand for convenient, automated retail solutions in the region. In Saudi Arabia, vending machines are highly widespread. Companies such as Koshk operate over 2,000 vending machines distributed across the country, mainly in airports, as well as in major buildings such as the Saudi Fransi Bank Headquarters in Riyadh, as per reports. The growth areas in the region are the large commercial hubs and various locations with high foot traffic, including office complexes and shopping malls. Premium and health-focused vending options, such as fresh snacks and beverages, are also becoming popular because of the shifting consumer preference for wellness. The market is still developing in Africa, and power supply challenges in remote areas have led to research into solar-powered vending machines. Government initiatives regarding cashless transaction support and digitized payments promote growth in this market, with vending machines becoming more likely to emerge as highly profitable retail outlets, both for cities and upcountry markets.

Competitive Landscape:

The key vending machine market players are focused on integrating emerging technologies such as cashless payments, touchless interfaces, and artificial intelligence systems to improve their consumers' buying experiences. These companies are primarily focused on ensuring healthier snack and beverage options according to the new demands of modern consumers. Increases in vending machine installation in key high-traffic locations such as airport terminals, mall premises, or office buildings stimulate market growth. In addition, some players are adopting sustainable practices by incorporating green materials, reducing the consumption of energy, and introducing recycling-friendly machines. Collaboration with online platforms and implementation of real-time inventory management systems further helps to improve operational efficiency, driving the market.

The report provides a comprehensive analysis of the competitive landscape in the vending machine market with detailed profiles of all major companies, including:

- Aramark Corporation

- Azkoyen Group

- Bianchi Industry Spa

- Crane Payment Innovations (CPI)

- Evoca Group

- Fuji Electric Co., Ltd.

- Jofemar Corporation

- Royal Vendors, Inc.

- SandenVendo GmbH

- Seaga Manufacturing, Inc.

- Selecta

- Westomatic Vending Services Ltd

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- December 2024: Cantaloupe Inc. has introduced its ground-breaking Smart Stores to improve customer experience and address theft, labor shortages, and overall loss. The Smart Stores provide a smooth self-service retail solution for food and beverage vendors as well as larger merchants by using cutting-edge technology that detects products with 99.9% accuracy.

- October 2024: The first vending machine in the world powered by a hydrogen cartridge will be unveiled at the Osaka-Kansai Expo 2025, according to a statement from Coca-Cola Bottlers Japan and Fuji Electric. This cutting-edge vending machine, which showcases the future of vending technology, uses hydrogen cartridges to generate power.

- March 2024: Pearson India has launched its first vending machine that dispenses books in India, reaching a notable milestone in its mission to connect with students directly. With this program, Pearson India hopes to improve the overall shopping experience for its clients by giving them easy and immediate access to a large selection of academic publications.

- February 2024: A Reverse Vending Machine (RVM) has been installed at Jack's Slopeside Grill by Copper Mountain Resort and the POWDR Adventure Lifestyle Corporation in an effort to boost aluminum recycling efforts in the town.

- January 2024: K&R Vending Services, an operator of vending machines based in the United States, has been acquired by Sodexo’s InReach. With this acquisition, Sodexo marks a significant milestone in its broader transformation plan.

Vending Machine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Food Vending Machine, Beverages Vending Machine, Tobacco Vending Machine, Others |

| Technologies Covered | Automatic Machine, Semi-Automatic Machine, Smart Machine |

| Payment Modes Covered | Cash, Cashless |

| Applications Covered | Hotels and Restaurants, Corporate Offices, Public Places, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aramark Corporation, Azkoyen Group, Bianchi Industry Spa, Crane Payment Innovations (CPI), Evoca Group, Fuji Electric Co., Ltd., Jofemar Corporation, Royal Vendors, Inc., SandenVendo GmbH, Seaga Manufacturing, Inc., Selecta, Westomatic Vending Services Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vending machine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global vending machine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the vending machine industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vending machine market size is anticipated to reach USD 22.4 Billion in 2025.

IMARC estimates the vending machine market to exhibit a CAGR of 4.11% during 2025-2033.

The vending machine market is primarily driven by advancements in payment systems and user interface technologies, increasing consumer preference for healthier and customizable snack options, growth in demand for contactless and cashless payment solutions, expansion of vending machines in high-traffic public spaces, and adoption of sustainable and eco-friendly vending machine solutions.

North America currently dominates the market due to high consumer demand for automated solutions, technological innovations, and a large number of commercial establishments.

Some of the major players in the vending machine market include Aramark Corporation, Azkoyen Group, Bianchi Industry Spa, Crane Payment Innovations (CPI), Evoca Group, Fuji Electric Co., Ltd., Jofemar Corporation, Royal Vendors, Inc., SandenVendo GmbH, Seaga Manufacturing, Inc., Selecta, Westomatic Vending Services Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)