Video Streaming Market Size, Share, Trends and Forecast by Component, Streaming Type, Revenue Model, End User, and Region, 2025-2033

Video Streaming Market Size and Trends:

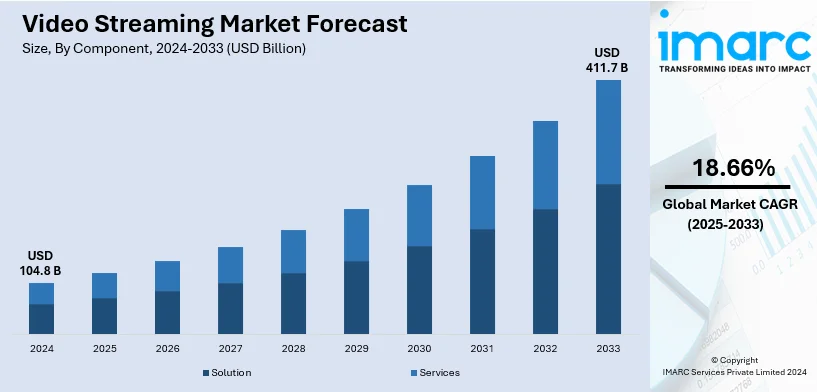

The video streaming market size was valued at USD 104.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 411.7 Billion by 2033, exhibiting a CAGR of 18.66% from 2025-2033. North America currently dominates the market, driven by the growing enhancement in streaming capabilities, increasing integration of virtual reality (VR) and augmented reality (AR) to improve user experiences, and rising utilization of mobile devices for streaming content.

Key Market Insights:

- High-speed internet and advanced streaming features have propelled North America to the forefront of the video streaming market.

- Technological developments strengthen user experience and increase streaming options, particularly 5G and VR/AR.

- The market is expanding due to shifting viewer preferences toward on-demand content and mobile-first experiences.

- To draw in and keep users, streaming services are spending money on original productions and a variety of content libraries.

- The market is dominated by subscription-based business models, which provide reliable access to vast content libraries.

The increasing availability of high-speed internet has been a cornerstone in the expansion of video streaming services. At the beginning of 2024, there were 331.1 million internet users in the United States of America, when internet penetration stood at 97.1 percent. Also, a total of 396.0 million cellular mobile connections were active in the United States during this period, with this figure equivalent to 116.2 percent of the total population. This extensive connectivity facilitates seamless streaming experiences across diverse demographics. Broadband adoption has also seen substantial growth in the country. In 2023, 79% of U.S. adults reported having high-speed broadband service at home, up from previous years. The deployment of 5G networks further enhances streaming capabilities, offering faster and more reliable connections, which is crucial for high-definition (HD) and live streaming content thus strengthening the video streaming market growth.

The United States is at the forecast in this market, leading its way to be the most dominating country. The is attributed to the increasing need among American consumers for on-demand viewing over traditional scheduled programming. This preference is reflected in the substantial revenues generated by subscription video-on-demand (SVOD) services, as an average US households spent US$61 per month on SVOD services in the year 2023. The convenience of watching content anytime has led to a decline in traditional TV viewership, with streaming platforms accounting for 41.4% of total TV usage in July 2024.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 104.8 Billion |

|

Market Forecast in 2033

|

USD 411.7 Billion |

| Market Growth Rate 2025-2033 | 18.66% |

To get more information on this market, Request Sample

Video Streaming Market Trends:

Technological Advancements

One of the primary drivers of the video streaming market is the rapid advancement in technology. With increasing internet speeds, particularly the roll-out of 5G networks, streaming high-quality video content is becoming more feasible and efficient. This enhancement in streaming capabilities is allowing for smoother viewing experiences, reduced buffering, and higher-resolution content, which are vital for user satisfaction. Moreover, advancements in cloud computing are enabling streaming platforms to offer vast libraries of content that are accessible from virtually anywhere. A notable example is Comcast Corporation’s strategic move to spin off NBCUniversal’s cable networks and digital assets into a new independent company, "SpinCo," which will target 70 million U.S. households. This new entity, focused on news, sports, and entertainment, reflects the industry’s shift toward utilizing technological advancements to improve content delivery. Moreover, as streaming platforms adopt innovative features like virtual reality (VR) and augmented reality (AR), the user experience continues to evolve, opening up new possibilities for immersive and interactive content consumption.

Changing Viewer Preferences

One of the key factors driving the market's expansion is the change in viewer behavior toward on-demand entertainment. Streaming services, which provide the flexibility to watch material at any time and from any location without being restricted by a set schedule, are steadily overtaking traditional broadcast television (TV). Younger consumers are especially impacted by this change, favoring streaming services because of their capacity to offer a wide variety of programs, customize material, and include social media elements for a more engaging experience. Furthermore, as streaming services are frequently geared for mobile viewing and provide a customized user experience that fits with many people's modern, on-the-go lifestyles, the trend is being accelerated by the development of mobile devices as the major way of consuming content.

Expansion of Content Libraries and Original Productions

The growth of the industry is largely fueled by the variety and extension of content libraries. To appeal to a wide range of customers with different interests, streaming services are making significant investments in obtaining a variety of material, including foreign films and TV series. In addition to drawing in a larger audience, this globalization of content makes platforms more distinctive in a crowded market. Furthermore, a lot of streaming providers are starting to prioritize making large investments in original content. By providing unique, superior material that is unavailable elsewhere, original content not only acts as a differentiator to draw in new customers but also aids in keeping hold of current ones.

Video Streaming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global video streaming market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, streaming type, revenue model, end user and region.

Analysis by Component:

- Solution

- IPTV

- Over-the-top

- Pay TV

- Services

- Consulting

- Managed Services

- Training and Support

The solution segment accounts for the largest market share. It comprises internet protocol television (IPTV), over-the-top (OTT) platforms, and pay TV. IPTV, delivered over a dedicated network, offers high-quality, reliable broadcast experiences, often with the ability to integrate interactive features and video-on-demand (VOD) services. OTT platforms, on the other hand, are gaining immense popularity by offering streaming services directly over the internet, bypassing traditional distribution channels. Pay TV still holds a significant market share, especially in regions with less developed internet infrastructure. It includes traditional cable and satellite television services, offering bundled content packages. The dominance of the solutions segment is attributed to the vast viewer base that prefers diverse and accessible content offerings provided by these platforms.

Analysis by Streaming Type:

- Live/Linear Video Streaming

- Non-Linear Video Streaming

The live/linear video streaming type is dominating the market share. It refers to the real-time broadcasting of events or scheduled television content over the internet. This type of streaming is akin to traditional television (TV) broadcasts but delivered through internet protocols. The growing popularity of live streaming is driven by its ability to offer real-time engagement and immediacy, making it highly attractive for sports events, live concerts, news, and special live broadcasts. The increased adoption of this format by social media platforms and dedicated live-streaming services is propelling its growth. Additionally, the integration of interactive features like live chats and instant feedback is enhancing viewer engagement, making live/linear streaming a preferred choice for events requiring real-time participation thereby creating a video streaming market outlook.

Analysis by Revenue Model:

- Subscription

- Transactional

- Advertisement

- Hybrid

The subscription revenue model leads the market share. It operates on a basis where users pay a recurring fee to access the content library of a platform. Its popularity stems from its value proposition of providing extensive content at a predictable cost, eliminating the need for individual purchases. Additionally, the recurrent revenue stream of the model provides platforms with a stable financial base, facilitating further investment in content acquisition and technology enhancements. This model appeals to people seeking a comprehensive and continuous entertainment experience without the interruption of advertisements.

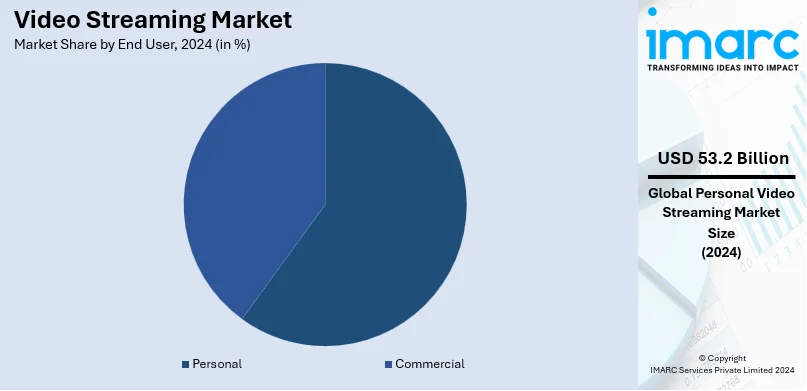

Analysis by End User:

- Personal

- Commercial

The personal segment dominates the video streaming market share. It comprises private users who access video streaming services for their own amusement and convenience. The increasing popularity of on-demand entertainment, made possible by the widespread availability of high-speed internet and the development of smart devices such as smartphones, tablets, and smart TVs, is driving this segment's domination. Movies, TV series, documentaries, and user-generated material are among the many types of content that are available to personal users who often subscribe to or access video streaming services. Users may view their favorite material at any time and from any location because to the segment's ease, flexibility, and tailored content.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the video streaming market forecast, North America dominance in this market is a result of the region’s high penetration rates of streaming services, driven by the presence of major players. The rising focus on content diversification and original production is strengthening the market growth. Technological advancements and high internet speeds support the consumption of high-definition and 4K content. The trend towards cord-cutting, where people move away from traditional cable television (TV) to online streaming options, is also prominent in this region. Additionally, there is an increasing interest in niche and specialized streaming services catering to specific interests or demographics.

Key Regional Takeaways:

United States Video Streaming Market Analysis

The U.S. video streaming market is on an upswing due to a burgeoning demand for on-demand content among consumers and advances in technology. According to an industrial report, the U.S. number of streaming video subscribers increased to 235 million in 2023, representing a 5% rise compared to 2022. The market witnessed one major announcement in Comcast Corporation's plan to establish a new publicly traded company called SpinCo, where NBCUniversal's cable networks such as USA Network, CNBC, MSNBC, Oxygen, and more will be housed. It will bring together a combined reach of about 70 million U.S. households in one of the most competitive markets out there, streaming and television space. This spin-off will therefore bolster Comcast's ability to offer diversified and high-quality news, sports, and entertainment offerings to its customers, ultimately helping it maintain its strong leadership position in the fast-changing media landscape. With shifting consumer preferences toward streaming, Comcast's strategic move is reflective of rising demand for a diverse content offering.

Asia Pacific Video Streaming Market Analysis

The Asia Pacific video streaming market is growing rapidly due to rising disposable incomes, improving connectivity, and a rich content landscape. The region is expected to add 93 million SVOD subscriptions by 2029, reaching 687 million subscriptions, up from 594 million in 2023. China will lead this expansion, generating 378 million subscriptions by 2029. India will contribute 22 million, followed by Japan (14 million), South Korea (9 million), and Indonesia (8 million). Although China has limited access to the United States' streaming outlets, Netflix and Prime Video will still lead in regions, with 61.9 million and 55.8 million subscribers each. The region-specific sites also continue to expand from the local streaming platforms for UNext in Japan, and Disney+ Hotstar in India, with some offering region-specific content for diversity. By 2029, Asia Pacific's SVOD revenue is projected to reach US$ 49 billion, local, and international players adjusting to regional preferences.

Europe Video Streaming Market Analysis

A news article reports that U.S. video streaming platforms lead the Europe's streaming landscape, while Netflix, Prime Video, and Disney+ make up 85% of all the viewership in streaming. Despite the U.S. content dominating the screen, the European productions take up 30% of the SVOD viewing time, while EU-made content takes up 21%. Netflix has managed to meet the EU's 30% local content mandate, which is meant to ensure that European works are appropriately represented. Data from the European Audiovisual Observatory has shown that streaming services, such as Netflix and Amazon Prime Video, are increasingly making investments in European content, with Netflix offering about 30% European titles across most of the EU. However, countries like the U.K. and Ireland are slightly below this quota. Despite regulatory pressure, U.S. streamers continue to garner significant market share, wherein a large portion of their catalogues are comprised of European content not national in nature.

Latin America Video Streaming Market Analysis

The Latin American video streaming market is growing rapidly, spurred by an increase in internet penetration and changing consumer behavior. Notably, NBC News Now started operations in Mexico and Brazil to be the first US-based news channel streamed in Samsung TV+ channels. This development underscores the increase in digital media consumption in Latin America, where streaming adoption is almost universal, with Mexico at 96.9% and Brazil at 95.8% above the global average, according to GWI. In Brazil, where internet users spend an average of 2 hours and 40 minutes daily with online press, NBC News Now is ready to take advantage of this trend, with ad-supported, free-to-access news content. This aligns well with the demand for credible, digital-first news sources in the region.

Middle East and Africa Video Streaming Market Analysis

Video streaming is growing rapidly across the Middle East and Africa amid a shift in entertainment patterns and an increasing mobile internet penetration trend. As per a news article, leading the growth are the UAE, Saudi Arabia, and South Africa, where, interestingly, Saudi Arabia had streaming subscription growth of 20% just in 2023. Tapping local content is a clear focus area, with platforms such as Shahid in the Middle East and Showmax in South Africa offering region-specific shows. The growth in 4G and 5G networks is also providing improvements in video streaming, as has been seen in countries such as Egypt and Kenya. Growth in streaming subscriptions is also spurred by an increasing number of tech-savvy young consumers, contributing to the region's robust growth in the area. Local partnerships, along with international agreements, will be crucial in providing expanded access and reach for such services.

Competitive Landscape:

Key players in the video streaming market are actively engaging in strategies to enhance user experience and expand their market presence. This includes investing heavily in original content production to offer exclusive and diverse programming, which is crucial for attracting and retaining subscribers. Additionally, top companies are leveraging advanced technologies like artificial intelligence (AI) and machine learning (ML) for personalized content recommendations, improving user engagement. There's also a focus on expanding global reach, with platforms increasingly offering content tailored to regional tastes and languages. Partnerships with content creators, telecom operators, and hardware manufacturers are common to enhance distribution and accessibility. Moreover, top companies are experimenting with different pricing models and subscription plans to cater to a broader range of viewers, including offering ad-supported versions or mobile-only subscriptions in price-sensitive markets. This multifaceted approach reflects the dynamic and competitive nature of the video streaming industry.

The report provides a comprehensive analysis of the competitive landscape in the video streaming market with detailed profiles of all major companies, including:

- Akamai Technologies

- Amazon.com, Inc.

- Apple Inc.

- Brightcove Inc.

- Comcast Corporation

- Google LLC (Alphabet Inc.)

- Hulu LLC (The Walt Disney Company)

- Image Future Investment (HK) Limited

- International Business Machines Corporation

- Kaltura

- Netflix Inc.

- WarnerMedia Direct, LLC

- Wowza Media Systems LLC

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- November 2024: Brightcove Inc. announced that Bending Spoons acquired it, in an all-cash deal worth roughly USD 233 Million. The USD 4.45 per-share cash that Brightcove shareholders would receive represents an approximately 90% premium over a 60-day volume weighted average share price of Bending Spoons acquired target. The deal thus marks Bending Spoons' entry into the enterprise SaaS market while utilizing their technology expertise in enhancing its platform and achieving growth for the company.

- November 2024: Comcast Corporation plans to spin off its cable television networks and digital assets. A new independent publicly traded company will be formed, which will be referred to as "SpinCo." These assets include NBCUniversal's cable networks, such as USA Network, CNBC, MSNBC, Oxygen, E!, SYFY, and Golf Channel, as well as digital assets like Fandango, Rotten Tomatoes, GolfNow, and Sports Engine. It is focused on news, sports, and entertainment, targeting 70 million US households. It will spin off tax-free in one year. Comcast continues its efforts to remain focused on residential broadband, wireless, business services, and streaming, studios, and theme parks by NBCUniversal.

- September 2024: Hallmark and Accedo expanded their partnership to enhance Hallmark's digital offerings and improve user experience through advanced technology solutions provided by Accedo. Hallmark launched Hallmark+, a revamped streaming service on 10 September 2024. This service combines ad-free viewing with exclusive retail benefits. Hallmark+ features original content, including holiday series and reality shows, and offers a membership program with perks like monthly store coupons and free eCards for $7.99 per month or $79.99 annually.

- August 2024: Bharti Airtel and Apple formed a strategic partnership to offer exclusive access to Apple TV+ and Apple Music for Airtel customers in India. This collaboration allows Airtel Xstream customers to enjoy premium content on Apple TV+.

Video Streaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Streaming Types Covered | Live/Linear Video Streaming, Non-Linear Video Streaming |

| Revenue Models Covered | Subscription, Transactional, Advertisement, Hybrid |

| End Users Covered | Personal, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akamai Technologies, Amazon.com, Inc., Apple Inc., Brightcove Inc., Comcast Corporation, Google LLC (Alphabet Inc.), Hulu LLC (The Walt Disney Company), Image Future Investment (HK) Limited, International Business Machines Corporation, Kaltura, Netflix Inc., WarnerMedia Direct, LLC, Wowza Media Systems LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the video streaming market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global video streaming market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the video streaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Video streaming is the real-time delivery of video content over the internet, allowing users to watch movies, shows, or live events without downloading them. The content is transmitted as a continuous stream of data and played instantly, offering on-demand access through various platforms.

The video streaming market was valued at USD 104.8 Billion in 2024.

IMARC estimates the global video streaming market to exhibit a CAGR of 18.66% during 2025-2033.

Key factors driving the global video streaming market include the increasing internet penetration, growing demand for high-quality original content, rising adoption of smart devices, ongoing shift towards on-demand viewing, and growth of ad-supported and freemium models.

According to the report, solution represented the largest segment by component, as they provide comprehensive tools for content delivery, management, and security, meeting diverse user needs.

Live/linear video streaming leads the market by streaming type as they attract viewers with real-time events, including sports, news, and concerts, fostering immediate engagement.

Subscription is the leading segment by revenue model, due to its predictable revenue and access to exclusive, high-quality content.

Personal is the leading segment by end user, as streaming services cater to individual preferences with tailored content and recommendations.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global video streaming market include Akamai Technologies, Amazon.com, Inc., Apple Inc., Brightcove Inc., Comcast Corporation, Google LLC (Alphabet Inc.), Hulu LLC (The Walt Disney Company), Image Future Investment (HK) Limited, International Business Machines Corporation, Kaltura, Netflix Inc., WarnerMedia Direct, LLC, Wowza Media Systems LLC, etc.

The outlook for the video streaming industry is strong, with continued growth driven by, technological advancements, changing viewer preferences and expansion of content libraries and original productions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)