Vietnam Bottled Water Market Size, Share, Trends and Forecast by Type, Distribution Channel, Packaging Size, and Region, 2026-2034

Vietnam Bottled Water Market Size and Share:

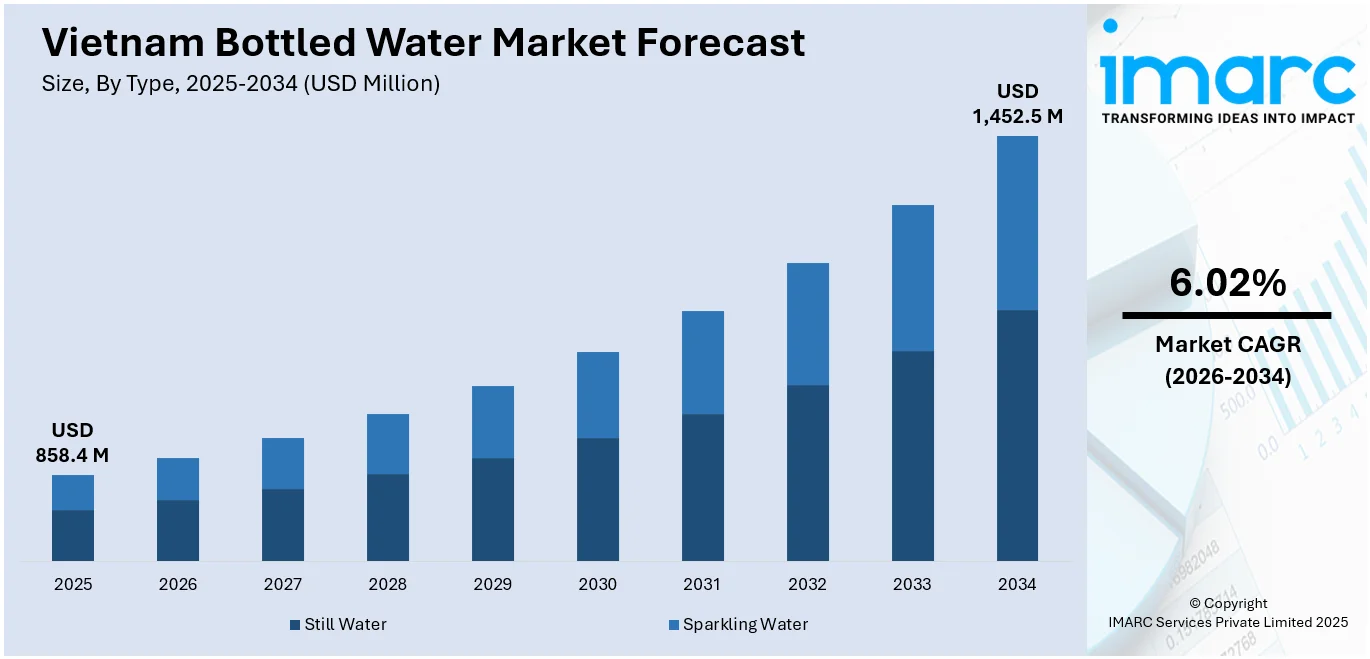

The Vietnam bottled water market size is estimated at USD 858.4 Million in 2025 and is expected to reach USD 1,452.5 Million by 2034, at a CAGR of 6.02% during the forecast period 2026-2034. The growing popularity of products that promote wellness and hygiene is offering a favorable market outlook. This trend, along with the increasing number of people in Vietnam that are shifting to urban areas and embracing quick lifestyles is impelling the market growth. Apart from this, the heightened development of sustainable bottling technology is expanding the Vietnam bottled water market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 858.4 Million |

| Market Forecast in 2034 | USD 1,452.5 Million |

| Market Growth Rate 2026-2034 | 6.02% |

The sector is undergoing a transformation as health awareness is rising throughout the nation. People are becoming increasingly conscious about the need for hydration and the health advantages of having clean and safe drinking water. This change in lifestyle is catalyzing the demand for bottled water, especially among young urban dwellers and office workers. Both local and international brands are present, with organizations continually launching new products and flavors to meet changing consumer tastes. The manufacturers are focusing on green packaging solutions and adopting eco-friendly and recyclable material. Polyethylene terephthalate (PET) bottles are being substituted with biodegradable ones, and firms are highlighting their environmental credentials to keep pace with consumers' expectations.

To get more information on this market Request Sample

Marketing strategies are changing in the Vietnam bottled water industry, with brands prioritizing purity, mineral content, and source authenticity to stand out. Premiumization is emerging as a trend as consumers are willing to pay extra for superior or imported branded bottled water. The market is also shifting, as supermarkets and convenience stores are now carrying a greater selection of bottled water. E-commerce is taking a larger role as consumers turn to it as an increasingly preferred channel for both convenience and bulk buying. Distribution networks are adjusting to provide assured availability in urban as well as rural geographies to facilitate market penetration.

Vietnam Bottled Water Market Trends:

Rising Health Awareness and Changing Lifestyles

Consumers in Vietnam are becoming increasingly health-aware and consequently prioritizing products that promote wellness and hygiene. As awareness about water-borne diseases and risk of contamination in water is on a rise, individuals are moving away from tap water and uncontrolled sources towards bottled water due to its purity and safety. Urban residents are embracing healthier lifestyles and consuming more water during the day to remain hydrated, control weight, and be better overall. This change in behavior is synchronized with other social trends, such as a liking for functional beverages and organic food items, thereby expanding the bottled water market share in Vietnam. Educational campaigns and media coverage are reinforcing the perceived health benefits of bottled water, which is encouraging consumers to make it a regular part of their daily routines. In this context, bottled water is viewed not only as a basic necessity but also as a lifestyle product, which is encouraging continuous product innovation. The IMARC Group predicts that the Vietnam functional beverages market size is projected to attain USD 958.0 Million by 2033.

Expansion of Retail Channels

At present, increasing number of people in Vietnam are shifting to urban areas and embracing quick lifestyles that require convenience, thereby propelling the Vietnam bottled water market growth. The market for convenient, ready-to-drink beverages such as bottled water is consequently growing considerably. Retail infrastructures like convenience stores, supermarkets, and hypermarkets are expanding rapidly in urban and semi-urban regions. These retail channels are continuously inventorying a broad range of bottled water brands, flavor profiles, and pack sizes, providing consumers with more choice and convenience. Concurrently, e-commerce websites are picking up pace and becoming strong distribution channels, particularly for bulk buys and subscription deliveries. Consumers are progressively depending on mobile applications and internet marketplaces for the buying of bottled water as they provide convenience and promotional offers. This omnichannel retail space is facilitating the vast availability of packaged water and guarantees sustained access to markets by both domestic and overseas brands. According to OpenDevelopment Vietnam, by 2040, more than half of Vietnam’s population will be migrating to urban areas, reaching 57.3% by 2050. This will further increase the usage of e-commerce channels for purchasing bottled water.

Environmental Concerns and Shift Towards Sustainable Packaging

Environmental sustainability is emerging as a major concern in Vietnam, and consumers are becoming eco-conscious in their purchasing decisions. Companies manufacturing bottled water are meeting this demand by embracing green practices, such as using recyclable materials and biodegradable containers. Manufacturers are investing more in sustainable bottling technology and restructuring their supply chains to lower their carbon imprints. Marketing initiatives are concentrating on green responsibility, with companies actively promoting their eco-friendly credentials and sustainable practices. This value-based alignment in strategy is boosting brand trust and repeat purchase behavior. Moreover, regulatory authorities are setting more stringent rules for plastic usage and management of waste, encouraging firms to innovate in packaging. National Action Plan established goals for a 50% reduction in marine plastic waste by 2025, rising to 75% by 2030. The nation also targets no single-use plastics or disposable plastic bags in 80% of coastal tourism facilities by 2025, up to 100% by 2030. Vietnam is also targeting to recover 50% of abandoned, lost or discarded fisheries gear by 2025, up to 100% by 2030. Moreover, corporate social responsibility (CSR) initiatives like beach clean-up campaigns and recycling alliances are gaining traction and having a positive impact on public perception. With environmental issues increasingly influencing consumer behavior, the shift towards sustainable bottled water packaging is offering a favorable Vietnam bottled water market outlook.

Vietnam Bottled Water Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam bottled water market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, distribution channel, and packaging size.

Analysis by Type:

- Still Water

- Sparkling Water

Still water holds 85.0% of the market share. Still water segment in the bottled water market in Vietnam is characterized by its broad consumer appeal, primarily driven by daily hydration needs and perceptions of health safety. Consumers in both urban and rural areas are regularly purchasing still water for its convenience and reliable quality, especially in regions where tap water is not considered safe for drinking. Local manufacturers dominate this segment by offering competitively priced products across a wide range of bottle sizes, making them accessible to various income groups. The demand is further fueled by institutional consumption in offices, schools, and hospitals, where still water is commonly provided.

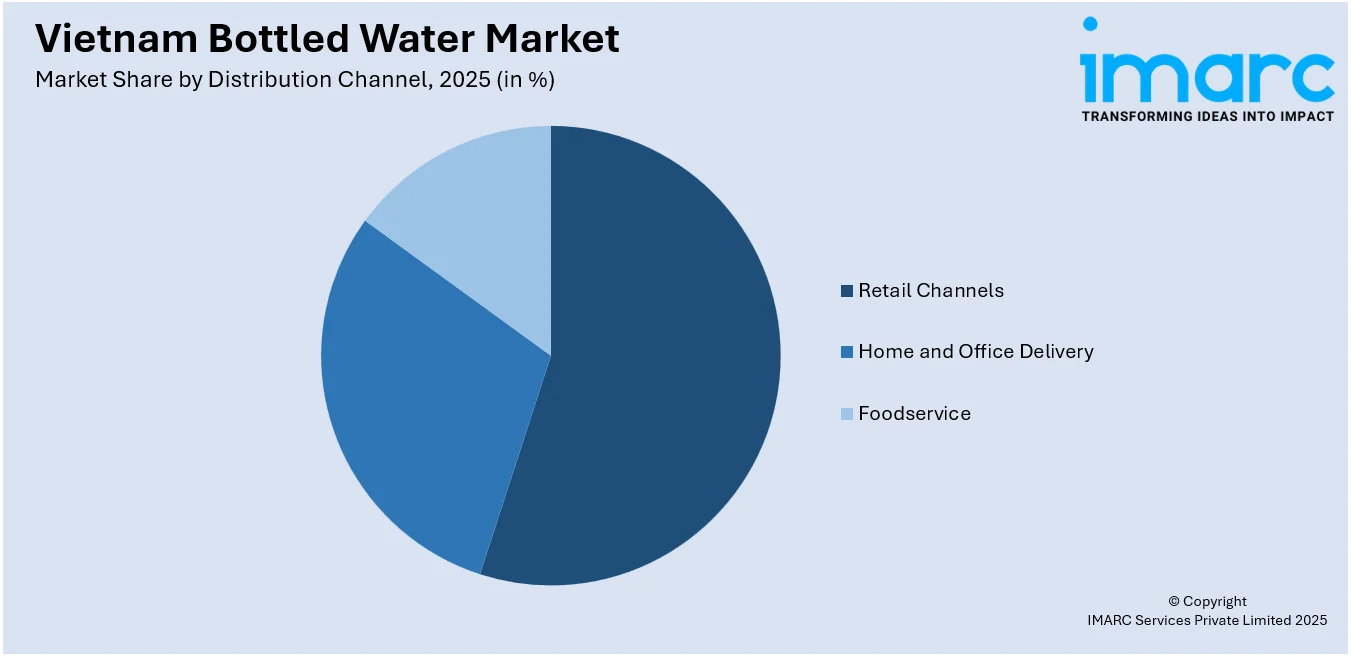

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Retail Channels

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Others

- Home and Office Delivery

- Foodservice

Retail channels (supermarkets/hypermarkets, convenience/grocery stores, and others) hold 55.9% of the market share. They form the backbone of bottled water distribution in Vietnam, catering to a diverse consumer base through supermarkets, hypermarkets, convenience stores, and traditional grocery outlets. These platforms offer high visibility and wide accessibility for bottled water brands, enabling consumers to choose from a broad selection of products in various price ranges and packaging sizes. Organized retail formats provide the advantage of bulk purchasing and promotional discounts, which appeal to budget-conscious shoppers, while convenience stores are ideal for impulse and on-the-go purchases.

Analysis by Packaging Size:

- Less Than 330 ml

- 331 ml - 500 ml

- 501 ml - 1000 ml

- 1001 ml - 2000 ml

- 2001 ml - 5000 ml

- More Than 5001 ml

501 ml-1000 ml holds 35.0% of the market share. Bottles ranging from 501 ml to 1000 ml are well-suited for active individuals, fitness enthusiasts, and those seeking prolonged hydration throughout the day. This segment serves as a preferred option for consumers engaging in outdoor activities, gym workouts, or long commutes. It strikes an optimal balance between volume and portability, providing enough water to last several hours without being too heavy. This segment is practical for keeping at home, in offices, or in vehicles, offering more value per unit and reducing plastic usage per liter.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Southern Vietnam holds 45% of the market share. Southern Vietnam, anchored by Ho Chi Minh City, represents the largest and most dynamic market for bottled water in the country. The high level of industrial activity and dense residential zones contribute to strong and steady demand across all consumer segments. The tropical climate and year-round heat drive higher per capita water consumption, especially among outdoor workers and active urban populations. The region also hosts a vibrant retail sector, including modern trade outlets and e-commerce channels, which enhance product accessibility.

Competitive Landscape:

Companies are introducing flavored, mineral-enriched, and functional water variants targeting specific health benefits such as hydration, energy replenishment, and digestive wellness. Premium offerings, including imported spring water and artisanal mineral water, are gaining popularity among urban and affluent consumers. Environmental sustainability is becoming a central focus for leading market players. To address growing concerns over plastic waste, companies are shifting toward eco-friendly packaging materials such as recycled PET and biodegradable bottles. Some firms are introducing refillable containers and water dispensers to reduce single-use plastic consumption. As per the Vietnam bottled water market forecast, key players are expected to optimize their distribution networks to improve market reach and service efficiency.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam bottled water market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Suntory PepsiCo began construction of a USD 300 million beverage plant in Long An, Vietnam, aimed at increasing production capacity and promoting sustainable practices. The facility was designed to meet growing demand for various beverages, including bottled water.

- January 2025: Suntory Pepsico Vietnam proposed a 65% capacity increase at its Bac Ninh factory, raising annual output from 500 million to 825 million liters. The expansion covered carbonated drinks, bottled water, and other non-carbonated beverages.

- September 2024: Owe Water launched Owe+, a mineralized water with a social mission. The company aimed to reach seven million people by 2030, offering affordable, clean water to underserved families.

Vietnam Bottled Water Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Still Water, Sparkling Water |

| Distribution Channels Covered |

|

| Packaging Sizes Covered | Less Than 330 ml, 331 ml - 500 ml, 501 ml - 1000 ml, 1001 ml - 2000 ml, 2001 ml - 5000 ml, More Than 5001 ml |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam bottled water market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam bottled water market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Vietnam bottled water market was valued at USD 858.4 Million in 2025.

The Vietnam bottled water market is projected to exhibit a CAGR of 6.02% during 2026-2034, reaching a value of USD 1,452.5 Million by 2034.

Key factors driving the Vietnam bottled water market include rising health awareness, increasing urban developments, growth in tourism, and concerns over tap water safety. Expanding retail networks, demand for convenience, and a shift toward premium and functional beverages are also supporting the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)