Vietnam Cloud Computing Market Size, Share, Trends and Forecast by Service, Deployment, Organization Type, End User, and Region, 2025-2033

Vietnam Cloud Computing Market Size and Share:

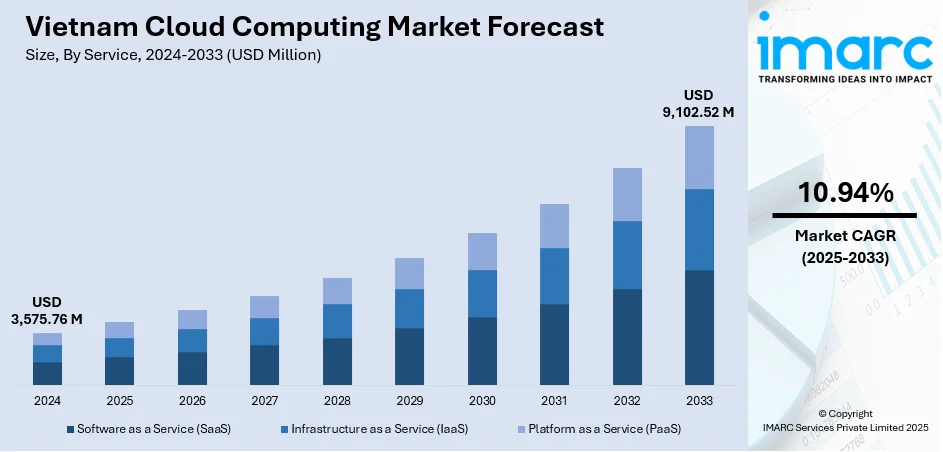

The Vietnam cloud computing market size was valued at USD 3,575.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 9,102.52 Million by 2033, exhibiting a CAGR of 10.94% during 2025-2033. The market is fueled by a synergy of government-initiated digital transformation programs, rising digital consumption, and a thriving e-commerce industry. The emergence of startups and the need for affordable IT infrastructure also drive adoption. Favorable government policies, such as data localization policies and investment subsidies, are also nudging domestic and foreign cloud service providers to increase their footprint in Vietnam, further boosting the Vietnam cloud computing market share on different industries and customer segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,575.76 Million |

| Market Forecast in 2033 | USD 9,102.52 Million |

| Market Growth Rate 2025-2033 | 10.94% |

One of the most significant growth drivers for Vietnam's cloud computing market is the government's firm backing for digital transformation efforts. The Vietnamese government has recognized digital infrastructure, which comprises cloud computing, as one of the pillars for economic modernization and growth. This drive is reflected in country policies that promote public and private organizations to shift to cloud platforms, particularly in key sectors like education, healthcare, finance, and public administration. Local telecommunication titans and state-owned companies are also being geared up to build local cloud ecosystems, weaning the country off foreign infrastructure and providing safe, sovereign data spaces. Moreover, initiatives aimed at augmenting internet connectivity to rural and semi-urban areas are widening the market base for cloud services. The adoption of cloud into wider digital economy plans like smart city growth, digital ID rollout, and e-government services also adds to its position as a sustainable driver of innovation and efficiency, while also contributing to the Vietnam cloud computing market growth.

To get more information on this market, Request Sample

Another significant driver of cloud computing adoption in Vietnam is the country’s rapidly growing digital consumer base and vibrant startup ecosystem. Young, tech-savvy users are increasingly engaging with mobile applications, online services, and social platforms, which all require scalable backend infrastructure. This behavioral shift is pushing businesses from e-commerce platforms to fintech startups to adopt cloud solutions for agility, cost efficiency, and real-time data processing. Vietnam's startup ecosystem is especially vibrant, with most early-stage companies opting for cloud-native approaches to eschew the high upfront capital cost of traditional physical servers. In addition, cloud computing enables these startups to prove and scale goods quickly in a tight market. Domestic centers of innovation, incubators, and accelerators are also promoting cloud adoption as part of best digital business practices. As this environment matures, increasing numbers of businesses are choosing sophisticated cloud features like machine learning, big data analytics, and integrated security, further integrating cloud technology into Vietnam's entrepreneurial and consumer-oriented economy.

Vietnam Cloud Computing Market Trends:

National Digital Transformation Strategy Driving Cloud Adoption

According to the Vietnam cloud computing market forecast, the region’s aggressive digital transformation strategy is a major catalyst of the nation's growing market for cloud computing. With national initiatives aimed at establishing a digital government, smart cities, and industry-driven by technology, the cloud has been earmarked as a key pillar for future infrastructure. Ministries, state-owned companies, and private corporations are increasingly shifting operations to cloud environments in order to enhance scalability, improve cybersecurity, and automate operations. Such a shift is particularly high in industries such as banking, education, healthcare, and manufacturing, where digitization is gaining momentum. For instance, in June 2020, the Prime Minister of Vietnam announced the National Digital Transformation Program, which aims to implement various digital development initiatives nationwide. Furthermore, in September 2021, the Government of Vietnam established the Vietnam National Committee on Digital Transformation, focusing on developing the country’s digital economy. As a result, the digital economy of Vietnam accounted for more than 12% of the GDP of the country in 2023 and is projected to reach USD 45 Billion in 2025, according to the International Trade Administration (ITA). The government's strong support for such measures has also resulted in collaboration with leading telecom operators and local tech firms to create cloud frameworks that are compatible with national standards. In addition, the promotion of cloud solutions in rural and disadvantaged regions is slowly narrowing the digital gap. These efforts put together are placing Vietnam at the forefront as an emerging digital center in Southeast Asia, stimulating the development of both homegrown and foreign cloud service providers.

E‑Commerce Boom Driving Cloud Infrastructure Expansion

The swift expansion of Vietnam's e-commerce sector is also heavily impacting the growth of cloud computing. With the prevalence of smartphones, rising confidence in Internet payments, and a digitally savvy population becoming more common, online retail sites are seeing explosive growth. According to reports, during the last four years, Vietnam's e-commerce market has grown at an average yearly rate of 16–30%. This growth necessitates scalable, agile, and secure infrastructure domains where cloud platforms have the upper hand. Companies are increasingly relying on cloud platforms to manage everything from customer relationship systems and inventory systems to payment systems and AI-driven product recommendations. The demand for real-time data analysis to tailor customer experiences and streamline supply chains is also driving e-commerce participants further towards cloud technology. Small local startups and large local platforms are spending money on public and hybrid cloud infrastructure to handle high traffic loads during sale events and promotional campaigns. This e-commerce boom, coupled with Vietnam's young population and internet penetration, is building a sustainable and expanding customer base for cloud providers, while also contributing to the development of the Vietnam cloud computing market outlook.

Regulatory Support and Global Cloud Infrastructure Expansion

The Vietnam cloud computing market also showcases the changing regulations and rising global interest in cloud infrastructure in the country. Recent government policies that concentrate on international company data security, privacy, and storage localization are influencing the way overseas firms provide services. For instance, in April 2024, Viettel Group launched the largest data center in Vietnam, the Viettel Hoa Lac Data Center in Hanoi, with a 30 MW capacity. This is the very first data center in Vietnam with a capacity double that of the average, demonstrating Viettel's strong commitment to developing cutting-edge digital infrastructure in Vietnam and meeting the rising local demand for AI development. Moreover, the market is bolstered by the increasing penetration of global cloud giants setting up infrastructure in Vietnam, providing businesses with a range of cloud services that are reliable, scalable, and secure. For instance, in August 2024, Singapore-based Cloud4C established a new data center in Hanoi to provide Vietnamese businesses with fully managed, domestically compatible hyperscale cloud computing solutions and support their rapidly expanding digitalization initiatives. This local presence reduces latency, enhances data sovereignty compliance, and improves overall service quality. Moreover, beneficial tax breaks and simplified regulations for foreign investment and ownership are making Vietnam a desirable destination for overseas cloud providers. These Vietnam cloud computing market trends, hence, help to serve big companies, making it possible for small and medium-sized firms in Vietnam to get high-quality cloud solutions, and further driving the digital economy of the entire economy faster.

Vietnam Cloud Computing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam cloud computing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on service, deployment, organization type, and end user.

Analysis by Service:

- Software as a Service (SaaS)

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

SaaS is quickly gaining momentum in Vietnam as enterprises want agile and affordable solutions for operations, CRM, and productivity. SMEs are attracted to SaaS platforms because of low setup and subscription pricing. Remote work, scalability, and integration are supported through this model, which is favorable for Vietnam's quick-paced digital transformation process.

Infrastructure as a Service (IaaS) is a major segment in Vietnam's cloud market, providing scalable networking, computing resources, and storage. With enterprises modernizing legacy environments and transforming to hybrid setups, IaaS enables cost-effective infrastructure management. Demand is especially strong among big businesses and government agencies requiring secure, localized, and dependable cloud infrastructure.

Platform as a Service (PaaS) is becoming an important enabler for Vietnam's expanding developer and startup community. It delivers tools and environments for building applications without the hassle of dealing with hardware and software layers. Adoption of PaaS is increasing in technology innovation clusters, encouraging quicker deployment, experimentation, and cloud-native application development in Vietnam's digital economy.

Analysis by Deployment:

- Public

- Private

- Hybrid

Public cloud deployment is popular in Vietnam because it is affordable, flexible, and scalable. It is particularly popular with startups, SMEs, and e-commerce websites that need fast deployment without the burden of costly infrastructure spending. Public cloud players provide Vietnamese companies affordable, pay-as-you-go configurations, which help fuel their digital journey and growth in domestic and regional markets.

Private cloud deployment is picking up in Vietnam among the government sector, banks, and large enterprises that value data security, customization, and compliance. It provides more control over infrastructure and data, conforming to Vietnam's strict data protection regulations. Private cloud solutions are for industries where confidentiality, consistency of performance, and compliance are critical.

Hybrid cloud deployment is turning into a strategic option in Vietnam's cloud market, blending public and private cloud advantages. It allows organizations to balance scalability with control, particularly in dealing with sensitive information along with public workloads. Vietnamese businesses favor hybrid models for higher flexibility, easy integration, and optimization of cost in complicated IT environments.

Analysis by Organization Type:

- Small and Medium-sized Enterprises

- Large Enterprises

Vietnamese Small and Medium-sized Enterprises (SMEs) are quickly adopting cloud computing to drive operational effectiveness and lower IT expenses. With limited budget for conventional infrastructure, SMEs favor scalable and subscription-based cloud models that provide flexibility and ease of implementation. Cloud services enable these companies to streamline processes, enhance data management, and encourage innovation. With digital transformation gathering pace, cloud computing is emerging as a key driver for Vietnamese SMEs wanting to remain competitive and grow locally and globally.

Vietnamese large enterprises are also pouring money into cloud computing to facilitate digital modernization, enhance security, and deal with huge volumes of data. Hybrid or private clouds are the preferred choices for such companies to exert control while leveraging scalability. With operations across several industries, cloud platforms allow for real-time analysis, effortless collaboration, and effective management of resources. Vietnam's biggest companies, especially those in finance, manufacturing, and telecom, are using cloud technologies to improve innovation, customer interaction, and sustainable business durability.

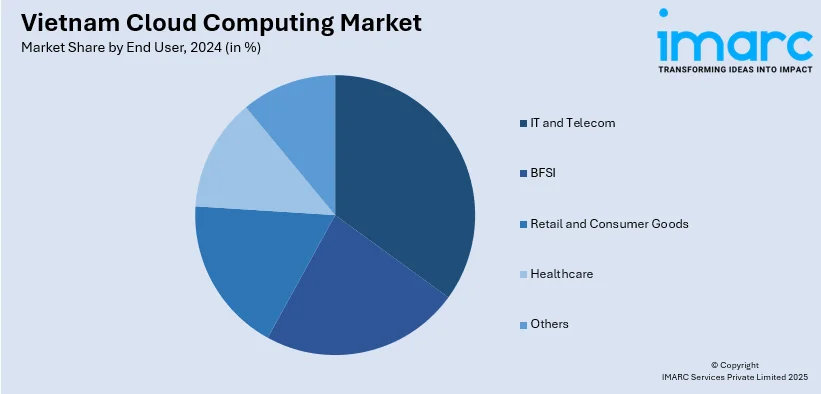

Analysis by End User:

- IT and Telecom

- BFSI

- Retail and Consumer Goods

- Healthcare

- Others

Vietnam's IT and telecommunications sectors are driving cloud adoption, utilizing scalable infrastructure to develop software, store data, and deliver digital services. Cloud computing enables innovation, instant communication, and service delivery, facilitating telecom operators and IT organizations to address increasing demand for connectivity, data processing, and digital transformation in industries.

The financial services, insurance, and banking (BFSI) industry in Vietnam is embracing cloud solutions to improve security, customer data handling, and the efficiency of services. Cloud computing supports real-time transactions, detection of fraud, and regulation of data, facilitating digital transformation in banks and enhancing customer experience in the urban and rural financial ecosystems.

Vietnamese retail and consumer goods firms use cloud platforms for managing supply chains, inventory, and customized customer interactions. Cloud services facilitate the expansion of e-commerce, enable point-of-sale integration, and rationalize logistics. The agility and information supplied by cloud systems allow retailers to react to changing consumer patterns and market forces.

The healthcare sector in Vietnam is implementing cloud computing to enhance patient record keeping, telemedicine, and diagnostics. Centralized storage, real-time access, and secure information exchange between departments are enjoyed by clinics and hospitals. Cloud technology optimizes healthcare provision, facilitates digital health programs, and allows for integration with new medical and administrative platforms.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam, especially Hanoi, is a center for state institutions and large businesses, where there is high demand for cloud computing. This region enjoys major investment in infrastructure and policy initiatives, which position it as a prime location for cloud data centers, public sector transformation, and business process renewal across different sectors.

Central Vietnam is slowly becoming a cloud computing growth region, with Da Nang being positioned as a hub for tech and innovation. The region's increasing pool of tech talent and smart city strategy are driving adoption of the cloud. Cloud services are being used more and more by educational institutions and technology startups here to boost digital capability.

Southern Vietnam, spearheaded by Ho Chi Minh City, controls the nation's cloud computing industry. It is a commercial and financial hub with many technology firms, banks, and startups. High digital usage and fast enterprise digitization are major drivers of cloud infrastructure growth and service adoption in this vibrant region.

Competitive Landscape:

Major players in the Vietnam cloud computing market are heavily investing in infrastructure, alliances, and domesticized services to fuel growth and adoption. Large international cloud players like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud are increasing their presence in the country through the setting up of data centers and partnerships with domestic technology companies. The moves are intended to respond to increasing demand and keep pace with Vietnam's data localization policy. Local champions such as Viettel and FPT Telecom are also playing an important role by creating indigenous cloud platforms suited to Vietnamese language and regulatory requirements. These companies are providing aggressive pricing models and specialized support for small and medium-sized businesses (SMEs), which constitute a significant percentage of the country's economy. Along with infrastructure, main players are undertaking educational programs and certification schemes to create qualified cloud professionals in Vietnam. Firms are also partnering with government departments to facilitate digital transformation initiatives, particularly in public administration, healthcare, and education industries. Through localization, affordability, and ecosystem development focus, these players are increasing the availability of cloud solutions and contributing to long-term sustainability of the cloud business in Vietnam. Their consistent efforts are pivotal toward creating a competitive and innovative digital future.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam cloud computing market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Vietnam Airlines and international technology company FPT inked a Memorandum of Understanding to improve operational capabilities, enhance customer experience, and expedite end-to-end digital transformation. As part of this agreement, Vietnam Airlines and FPT will work together to co-design and deploy a wide range of cutting-edge technological solutions, including cloud computing, to improve operations and reimagine the passenger experience across all touchpoints.

- April 2025: Viettel Group formally hosted the groundbreaking event for the Viettel High-Tech Data Center & Research and Development Complex in Ho Chi Minh City. In order to support the city's digital economy and society, this cutting-edge data center will encourage the use of cutting-edge technologies like cloud computing, enhancing digital human resources and creating high-value jobs.

- April 2025: The Da Nang International Data Centre JSC formally opened the biggest hub of its kind at the Hi-tech Park in Da Nang, providing a 1,000-rack system with seamless operation. This novel data center features ten racks for cloud computing services, cybersecurity, and AI applications, with a USD 32 Million investment in the first phase.

- April 2025: Westcon-Comstor revealed that it has extended its distribution agreement with Amazon Web Services (AWS) in order to become the first authorized AWS distributor in Vietnam. As part of this partnership, Westcon-Comstor will leverage its cloud capabilities to promote partners and encourage end-user adoption of the AWS Cloud and AWS Marketplace as a means for distributors and consumers to transact Independent Software Vendor (ISV) solutions.

- June 2024: VNG Cloud officially introduced the first multi-region cloud computing infrastructure in Vietnam, revolutionizing the way enterprises may access data storage and security services. With the construction of this second domestic cloud infrastructure in Hanoi, VNG Cloud has established the first multi-region infrastructure in Vietnam that complies with international standards.

Vietnam Cloud Computing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Software as a Service (SaaS), Infrastructure as a Service (IaaS), Platform as a Service (PaaS) |

| Deployments Covered | Public, Private, Hybrid |

| Organization Types Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Users Covered | IT and Telecom, BFSI, Retail and Consumer Goods, Healthcare, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam cloud computing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam cloud computing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam cloud computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Vietnam cloud computing market was valued at USD 3,575.76 Million in 2024.

The Vietnam cloud computing market is projected to exhibit a CAGR of 10.94% during 2025-2033, reaching a value of USD 9,102.52 Million by 2033.

The Vietnam cloud computing market is driven by rapid digital transformation, a booming e-commerce sector, and supportive government policies including data protection laws and tax incentives. Increasing investments from global cloud providers also accelerate market growth, fostering enhanced infrastructure and broader adoption across industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)