Vietnam Construction Market Size, Share, Trends and Forecast by Sector and Region, 2026-2034

Vietnam Construction Market Size and Share:

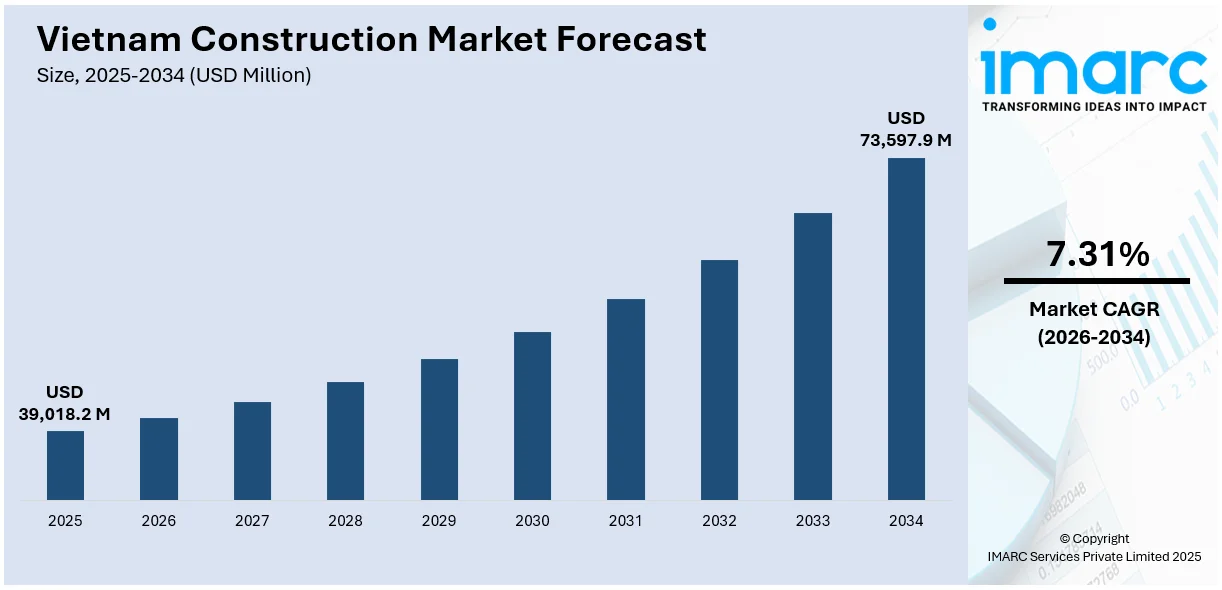

The Vietnam construction market size was valued at USD 39,018.2 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 73,597.9 Million by 2034, exhibiting a CAGR of 7.31% during 2026-2034. Southern Vietnam dominated the market, holding a significant market share of over 35.0% in 2025. The increasing demand for cloud services and big data analytics, rising need for more reliable and scalable data processing and storage facilities, and stringent regulatory compliance represent some of the key factors contributing to the Vietnam construction market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 39,018.2 Million |

| Market Forecast in 2034 | USD 73,597.9 Million |

| Market Growth Rate (2026-2034) | 7.31% |

The market is fueled by several key factors. Rapid urbanization is increasing the demand for residential and commercial properties, especially in major cities like Ho Chi Minh City and Hanoi. Government infrastructure projects, such as highways, bridges, and public transport systems, further boost the sector. Foreign direct investment (FDI) plays a significant role in driving construction activities, especially in industrial zones and real estate development. Policies supporting economic growth, such as favorable regulations for foreign investors and public-private partnerships, are also enhancing market conditions. Additionally, the growing industrial and manufacturing sectors require new facilities, contributing to demand for construction services. The government’s focus on sustainable development and green building practices is encouraging innovative construction solutions, helping to reinforce Vietnam construction market growth.

To get more information on this market Request Sample

In Vietnam, the construction sector sees growth as high-tech facilities, particularly in the aquaculture industry, are built to boost productivity and sustainability. Innovative construction projects, like processing plants utilizing advanced freezing technologies, are enhancing product quality and operational efficiency in key economic zones, signaling further investments in industry modernization. For instance, in June 2025, Australis Aquaculture, a renowned producer of ocean-farmed barramundi in the aquaculture industry, started construction on a new cutting-edge processing plant in Vietnam. The new plant, which is situated well in Khanh Hoa Province's Van Phong Economic Zone, would greatly improve productivity, sustainability, and the quality of products through its advanced nitrogen-freezing technology.

Vietnam Construction Market Trends:

Urban Growth and Housing Expansion

Vietnam’s rapid urbanization is fueling a surge in demand for housing, retail, and office space, especially in major cities like Hanoi and Ho Chi Minh City. Mid-rise and high-rise developments are becoming the standard in response to limited land availability. As reported, nationwide, there were 37.4 million people living in urban areas, equivalent to 37.55% of the country's population in 2022. Developers are adjusting to market pressure with high-density residential models. This pattern is reshaping the Vietnam construction market outlook, with building construction projects now focusing more on vertical expansion and integrated community planning to accommodate shifting demographics. Investment in infrastructure is rising as Vietnam prioritizes better connectivity and regional development. Public funds are flowing into roads, bridges, and industrial zones. These shifts in policy and budgeting are reshaping how firms approach building and construction standards in both urban and peri-urban zones.

State-Led Infrastructure Development

Government-led projects across Vietnam are transforming mobility and logistics. Investments in expressways, ports, and rail upgrades are reshaping regional connectivity. Cities like Da Nang and Can Tho are seeing rising activity in logistics hubs and export zones. For instance, in April 2025, the Prime Minister of Vietnam officially launched the construction of 80 significant national projects and large-scale development projects in the country. More than USD 17.2 Billion has been invested in the projects collectively. They include 40 transportation projects, 12 civil and industrial construction projects, 12 education projects, 9 projects in the social and culture sector, 5 public healthcare projects, and 2 irrigation projects. These infrastructure projects often come with tax incentives and long-term leasing plans, attracting both domestic and foreign firms. This boom has also led to increased demand for specialized equipment and smarter workflows, strengthening the market for construction machinery providers operating in Vietnam. Foreign capital continues to flow into infrastructure and real estate across the country. This influx brings not only money but also modern design standards, driving momentum in green-certified and energy-efficient projects. It’s changing developer preferences and raising interest in the Vietnam green building market.

Foreign Capital Reshaping Project Standards

Vietnam is seeing major real estate partnerships with investors from South Korea, Japan, and Singapore. These deals are reshaping standards across large urban projects. Many of these foreign-backed developments now include public spaces, underground parking, and digital controls for lighting and energy. Their presence also increases pressure on domestic players to upgrade planning and compliance. Several of these projects are integrated into digital infrastructure programs, contributing to the evolution of Vietnam smart city construction in both first-tier and emerging cities. Modern tools like BIM and 3D simulation are being widely adopted by contractors. As per the Vietnam construction market forecast, these upgrades are expected to enhance accuracy and reduce delays, which is crucial in today’s high-volume urban projects. This shift is aligning with national goals to support Vietnam sustainable construction practices.

Tech Integration and Digital Workflows

New construction methods are improving speed and accuracy in everything from residential towers to large industrial complexes. The application of tools like BIM, digital twins, and modular design is helping contractors work more efficiently. Small and medium-sized firms are also starting to adopt these methods, thanks to falling costs and better training. These technologies are reshaping how developers approach residential layouts, materials, and scheduling, and are having a direct influence on Vietnam residential construction trends. The total value of ongoing and planned projects shows a healthy pipeline through the next few years. This momentum reflects policy consistency and investor confidence. Based on recent data, the Vietnam construction market 2024 is set to exceed earlier growth forecasts, especially in housing and transport.

Real Estate Market Outlook

Vietnam’s real estate sector is shifting toward tech-driven and environmentally conscious development, with strong backing from both domestic and foreign investors. For instance, in March 2025, the Vietnam Green Building Council (VGBC) and Arup, in partnership with Dr Cary Chan, inked a groundbreaking Memorandum of Understanding (MoU) to support Vietnam’s 2050 carbon neutrality objectives through sustainable construction operations. The project aims to integrate energy-efficient designs, low-carbon operation, and cutting-edge technology to lower the operational carbon of the current construction industry in Vietnam. A growing middle class is driving demand for condominiums, gated communities, and mixed-use spaces. Developers are integrating AI-based scheduling, carbon tracking, and modular methods in residential and commercial projects to cut costs and speed up delivery. Tier-1 cities like Hanoi and Ho Chi Minh City remain hotspots, while tourism-heavy and industrial regions are seeing targeted growth. According to the latest Vietnam construction industry report, the real estate pipeline shows rising interest in smart home features, wellness-oriented design, and prefabricated components aimed at enhancing both efficiency and lifestyle appeal.

Vietnam Construction Industry Segmentation:

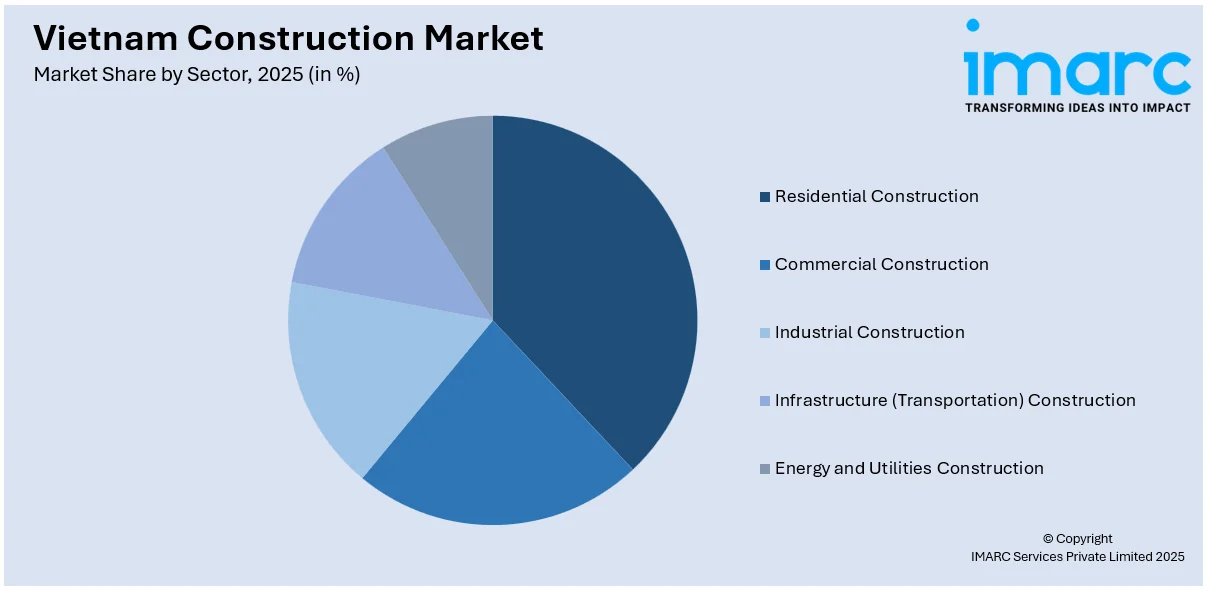

IMARC Group provides an analysis of the key trends in each segment of the Vietnam construction market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on sector.

Analysis by Sector:

Access the Comprehensive Market Breakdown Request Sample

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure (Transportation) Construction

- Energy and Utilities Construction

Residential construction stood as the largest sector in 2025, holding around 37.6% of the market due to a combination of factors. The country is experiencing rapid urbanization, with a growing middle class and increased demand for affordable housing. As more people migrate to cities in search of better job opportunities, the need for residential buildings has surged. The government's focus on infrastructure development and favorable policies also supports growth in this sector. Additionally, rising disposable incomes and changing lifestyles have led to higher demand for modern, quality housing. These Vietnam construction market trends are attracting both local and foreign investors, making residential construction a central component of Vietnam’s booming real estate sector. This, in turn, fuels further market expansion and drives demand for construction materials and services.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2025, Southern Vietnam accounted for the largest market share of over 35.0%, primarily driven by its rapid economic development and urbanization. Ho Chi Minh City, the economic hub, attracts significant investments in infrastructure, residential, and commercial projects. The region benefits from a growing middle class, increased industrialization, and expanding real estate sectors. Additionally, its strategic location as a trade and logistics center boosts demand for warehouses, transport infrastructure, and other construction projects. The region's strong industrial base, including manufacturing and high-tech sectors, further fuels the need for infrastructure improvements. Moreover, the government's focus on enhancing Southern Vietnam's connectivity, such as the expansion of roads, ports, and airports, has spurred the construction boom. This combination of factors positions Southern Vietnam as the largest and most active player in the national construction market.

Competitive Landscape:

The construction sector in Vietnam is seeing strong growth, fueled by government-backed infrastructure projects and public-private partnerships (PPPs). These collaborations are becoming a common practice as the government focuses on expanding transportation networks and modernizing urban areas. There's also an increase in foreign investment, reflecting confidence in the market's potential. The push for sustainability is significant, with the government promoting green building practices and energy-efficient designs. In addition, various partnerships between local and international firms are leading to new product launches and innovative solutions in the sector. Research and development in construction technologies and materials are gaining traction, helping improve efficiency and environmental impact.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam construction market with detailed profiles of all major companies, including:

- An Phong Construction Joint Stock Company

- Central Construction Joint Stock Company

- Construction Joint Stock Company

- Coteccons Construction JSC

- CTCI Vietnam Co. Ltd.

- GS E&C Vietnam

- Newtecons

Latest News and Developments:

- June 2025: Singapore's CapitaLand Development officially started construction of The Fullton, a high-end, low-rise residential complex with a gross development value of nearly USD 800 Million. The project is CLD's first low-rise construction in northern Vietnam and is well situated inside Vinhomes Ocean Park 3 in Hung Yen province.

- May 2025: Amata City Ha Long Joint Stock Company inked a Land Use Right Sublease Agreement with CapitaLand SEA Logistics Fund (CSLF) to launch the construction of the Avatar Vietnam project, the first ready-built industrial development in Song Khoai Industrial Park. Spanning 6.4 Hectares, the Avatar Vietnam project will include three zones, eight factories, and supporting infrastructure, with a total investment of USD 23.3 Million.

- April 2025: Vingroup, a renowned Vietnamese corporation, formally started construction on Vinhomes Green Paradise, a cutting-edge contemporary tourism complex in Can Gio. With an investment of more than USD 8.44 Billion, the project seeks to develop a world-class urban region in Vietnam in accordance with Environment-Social-Governance (ESG) guidelines.

- March 2025: Vingroup officially commenced construction of the Vinhomes Green City, a USD 1.1 Billion mixed-use urban project in the Mekong Delta province of Long An. The project, which spans 197.2 hectares in the Duc Hoa district's Hau Nghia township, Duc Lap Thuong commune, and Tan My commune, is anticipated to attract investment and support the area's affluent growth.

Vietnam Construction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sectors Covered | Residential Construction, Commercial Construction, Industrial Construction, Infrastructure (Transportation) Construction, Energy and Utilities Construction |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | An Phong Construction Joint Stock Company, Central Construction Joint Stock Company, Construction Joint Stock Company, Coteccons Construction JSC, CTCI Vietnam Co. Ltd., GS E&C Vietnam, Newtecons, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction market in Vietnam was valued at USD 39,018.2 Million in 2025.

The Vietnam construction market is projected to exhibit a CAGR of 7.31% during 2026-2034, reaching a value of USD 73,597.9 Million by 2034.

The Vietnam construction market is driven by urbanization, growing infrastructure investments, government policies supporting economic growth, foreign direct investment (FDI), and increased demand for residential and commercial properties. Additionally, the expanding industrial sector and construction of transportation networks play crucial roles in market growth.

Southern Vietnam accounted for the largest share, holding around 35.0% of the market in 2025 due to its booming economic growth, large urban centers like Ho Chi Minh City, and high demand for infrastructure, residential, and commercial projects.

Some of the major players in the Vietnam construction market include An Phong Construction Joint Stock Company, Central Construction Joint Stock Company, Construction Joint Stock Company, Coteccons Construction JSC, CTCI Vietnam Co. Ltd., GS E&C Vietnam, Newtecons, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)