Vietnam Digital Marketing Market Report by Digital Channel (Email Marketing, Search Engine Optimization (SEO), Interactive Consumer Website, Online/Display Advertising, Blogging and Podcasting (Including Microblogging), Social Network Marketing, Mobile Marketing, Viral Marketing, Digital OOH Media, Online Video Marketing, and Others), End Use Industry (Automotive, BFSI, Education, Government, Healthcare, Media and Entertainment, and Others), and Region 2025-2033

Vietnam Digital Marketing Market Insights:

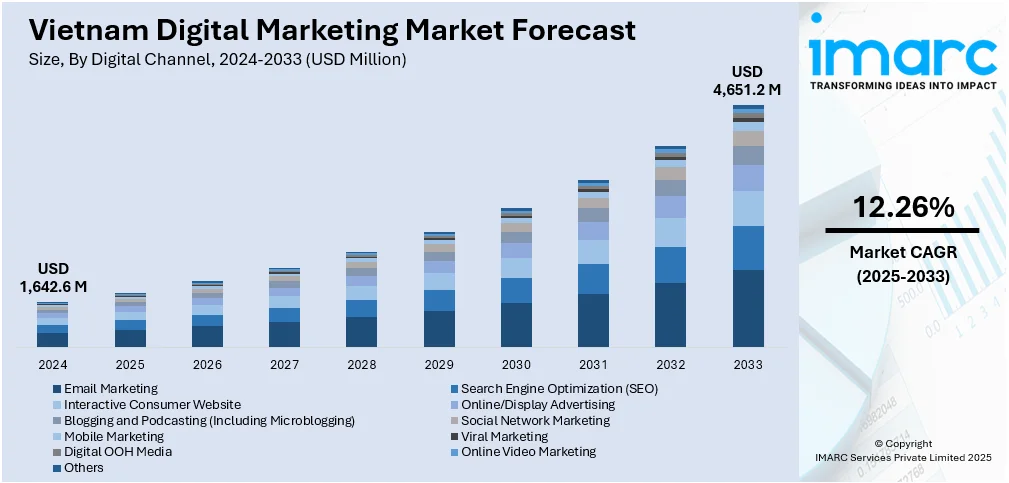

Vietnam digital marketing market size reached USD 1,642.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,651.2 Million by 2033, exhibiting a growth rate (CAGR) of 12.26% during 2025-2033. The market is undergoing rapid transformation, driven by increasing internet penetration, widespread smartphone usage, and a young, tech-savvy population. Businesses are leveraging diverse platforms to reach consumers, with e-commerce, social commerce, and influencer marketing emerging as key trends. The government's supportive digital policies and rising digital payments adoption are also accelerating the sector's expansion.

Key Insights:

- The Vietnam digital marketing market reached a value of USD 1,642.6 Million in 2024.

- By 2033, the market is expected to hit USD 4,651.2 Million, growing at a CAGR of 12.26% between 2025-2033.

- Vietnam has 78.44 million internet users, accounting for a 79.1% internet penetration rate.

- There are 72.70 million social media users in Vietnam, representing 73.3% of the population.

- E-commerce boom: Vietnam's e-commerce market is projected to exceed USD 16.18 Billion by 2025, boosting digital ad spending.

- High youth engagement: Over 50% of the population is under 35, making them prime targets for digital campaigns.

To get more information on this market: Request Sample

Vietnam Digital Marketing Market Trends:

Video Content Marketing

Video content is dominating Vietnam’s digital marketing landscape, as consumers increasingly prefer short, engaging, and informative formats. Platforms like TikTok, YouTube, and Facebook Reels are central to brand storytelling, influencer collaborations, and live commerce strategies. Vietnamese users, especially Gen Z and Millennials, engage heavily with video for product discovery and reviews. Live-streaming for e-commerce is growing rapidly, turning real-time engagement into direct sales. Brands are investing more in short-form videos, interactive content, and behind-the-scenes storytelling to drive emotional connection and trust. With Video Content Market consumption habits deeply rooted in mobile behavior, successful marketing campaigns now prioritize localized, mobile-optimized video content to boost engagement, conversions, and customer retention.

Digital Payment Adoption Patterns

Digital payment solutions adoption in Vietnam is accelerating, transforming both consumer behavior and digital marketing strategies. With mobile wallets like MoMo, ZaloPay, and VNPay gaining popularity, seamless payment experiences are now expected. Government initiatives promoting a cashless economy and strong fintech growth have increased the trust and usage of digital transactions. This shift enables brands to integrate direct-to-consumer (D2C) strategies, personalized checkout experiences, and in-app purchase funnels within digital campaigns. Digital payments also provide valuable user data that enhances ad targeting and customer segmentation. As e-commerce integration becomes more seamless and digital banking becomes more mainstream, marketers are aligning their messaging to promote ease, speed, and security in every stage of the customer journey.

E-commerce and Digital Services Growth

Vietnam's e-commerce sector is experiencing rapid growth, driven by increased internet access, mobile penetration, and consumer trust in online shopping. Platforms like Shopee, Lazada, and TikTok Shop have transformed shopping behavior, encouraging digital marketers to create sales-driven, performance-oriented content. Beyond retail, digital services in education, healthcare, and financial technology are also gaining ground. Brands are expanding their digital presence with omnichannel strategies, seamless customer experiences, and AI-driven personalization. Social commerce is particularly influential, combining entertainment and instant purchasing. Marketers now focus on real-time engagement, loyalty programs, and localized content to capture Vietnam’s young, tech-savvy consumer base. This growth reinforces the importance of e-commerce integration within the marketing industry in Vietnam, positioning it as a vibrant and competitive digital marketplace.

Mobile-First Marketing Strategies

With over 70% of the population using smartphones, Vietnam is inherently a mobile-first market. Mobile apps, social media platforms, and messaging services are the primary touchpoints for brand interaction. Marketers prioritize mobile-friendly websites, app-based promotions, and push notifications to engage users effectively. Mobile advertising—including in-app ads, SMS marketing, and geo-targeted campaigns—is driving stronger ROI as users spend more time on mobile than desktop. Additionally, mobile commerce and Digital Payment Solutions are simplifying the purchase journey. Success in Vietnam’s digital space increasingly depends on responsive design, mobile SEO, and fast-loading content. As 5G expands and smartphone penetration deepens, mobile-first marketing will remain essential to thriving in the video content market and beyond.

Vietnam Digital Marketing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on digital channel and end use industry.

Digital Channel Insights:

- Email Marketing

- Search Engine Optimization (SEO)

- Interactive Consumer Website

- Online/Display Advertising

- Blogging and Podcasting (Including Microblogging)

- Social Network Marketing

- Mobile Marketing

- Viral Marketing

- Digital OOH Media

- Online Video Marketing

- Others

The report has provided a detailed breakup and analysis of the market based on the digital channel. This includes email marketing, search engine optimization (SEO), interactive consumer website, online/display advertising, blogging and podcasting (including microblogging), social network marketing, mobile marketing, viral marketing, digital OOH media, online video marketing, and others.

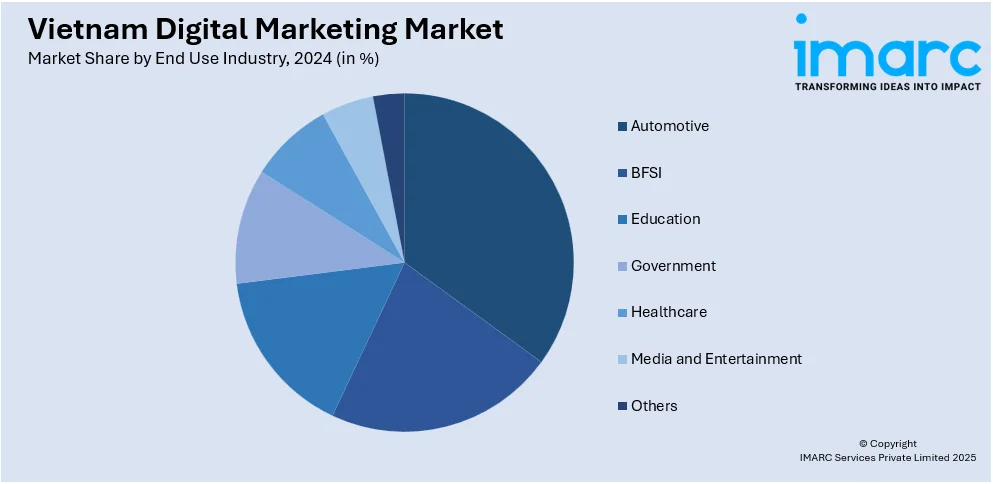

End Use Industry Insights:

- Automotive

- BFSI

- Education

- Government

- Healthcare

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, BFSI, education, government, healthcare, media and entertainment, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

Top Digital Marketing Companies in Vietnam:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Markdao Digital Marketing Agency

- On Digitals Company Limited

- Phuong Nam Digital

- Prodima

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Vietnam Digital Marketing Market News:

- In June 2025, KFC Vietnam appointed WPP Media as its new media agency. The agency will handle integrated media planning, buying, analytics, and influencer marketing via GOAT. WPP Media, recently rebranded from GroupM, is now an AI-powered, integrated media unit. This partnership reflects KFC Vietnam’s focus on growth and media excellence, while WPP continues to evolve its brand and leadership across Asia.

- In June 2025, Moloco aims to transform Vietnam’s digital advertising by leveraging machine learning to offer performance-driven, scalable ad solutions outside big tech ecosystems. As Vietnam’s app economy grows rapidly, Moloco enables local businesses to use their own first-party data for smarter targeting and monetization. The platform supports over 3 million apps and reaches 2 billion users daily.

- In November 2024, AnyMind Group partnered with South Korean cosmetics brand FORENCOS to support its expansion into Vietnam’s e-commerce market. Leveraging its BPaaS model, AnyMind will provide end-to-end solutions including e-commerce operations (AnyX), influencer marketing (AnyTag), logistics (AnyLogi), digital marketing (AnyDigital), and AI-powered livestreaming (AnyLive).

Vietnam Digital Marketing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Digital Channels Covered | Email Marketing, Search Engine Optimization (SEO), Interactive Consumer Website, Online/Display Advertising, Blogging and Podcasting (Including Microblogging), Social Network Marketing, Mobile Marketing, Viral Marketing, Digital OOH Media, Online Video Marketing, Others |

| End Use Industries Covered | Automotive, BFSI, Education, Government, Healthcare, Media and Entertainment, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | Markdao Digital Marketing Agency, On Digitals Company Limited, Phuong Nam Digital, Prodima, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam digital marketing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam digital marketing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam digital marketing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Vietnam digital marketing market reached USD 1,642.6 Million in 2024.

The Vietnam digital marketing market is expected to exhibit a CAGR of 12.26% during 2025-2033, reaching a value of USD 4,651.2 Million by 2033.

The market is witnessing substantial growth due to increasing internet penetration, rising use of smartphones, growing popularity of social media platforms, expanding e-commerce sector, and government initiatives supporting digital transformation across industries.

Some of the major players in the Vietnam digital marketing market include Markdao Digital Marketing Agency, On Digitals Company Limited, Phuong Nam Digital, Prodima, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)