Vietnam Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Vietnam Duty-Free and Travel Retail Market Overview:

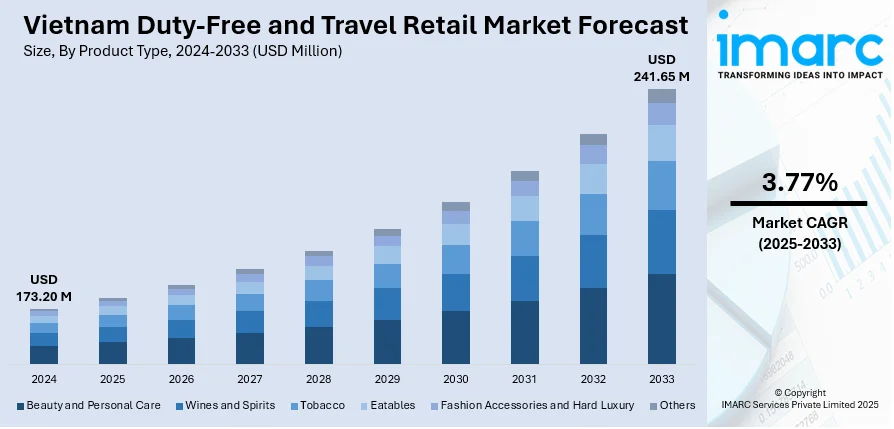

The Vietnam duty-free and travel retail market size reached USD 173.20 Million in 2024. Looking forward, the market is projected to reach USD 241.65 Million by 2033, exhibiting a growth rate (CAGR) of 3.77% during 2025-2033. Rising disposable incomes, expanding tourism, and an increase in foreign visitors are the main drivers of the sector. The Vietnam duty-free and travel retail market share is also being driven by the desire for upscale and convenient products at airports as well as strategic alliances between airlines and shops.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 173.20 Million |

| Market Forecast in 2033 | USD 241.65 Million |

| Market Growth Rate 2025-2033 | 3.77% |

Vietnam Duty-Free and Travel Retail Market Trends:

Rising Tourism and Travel Frequencies

The surge in inbound tourism to Vietnam, coupled with rising travel frequencies, is a key driver of the Vietnam duty-free and travel retail market growth. For instance, in November 2024, Airport Dimensions partnered with Southern Airports Services Joint Stock Company (SASCO) to enhance the airport experience in Vietnam. This collaboration will focus on refurbishing the Rose Lounge at Tan Son Nhat International Airport. The partnership aims to leverage both companies' expertise to improve the quality of airport lounges in Vietnam, positioning the country as a growing regional hub for tourism and business. As more international travelers visit the country, the demand for duty-free products at airports and travel retail outlets has risen. The Vietnamese government’s efforts to improve the tourism infrastructure, including expanding airports and enhancing visa policies, have also contributed to the increase in tourist arrivals. As more travelers seek premium products and local goods at competitive prices, duty-free outlets have capitalized on this demand, offering exclusive product lines and services tailored to international consumers. This trend is expected to continue, further boosting the Vietnam duty-free and travel retail market share.

To get more information on this market, Request Sample

Luxury Goods and Product Diversification

The rising demand for luxury products like cosmetics, fragrances, and high-end alcoholic beverages has led to expansion in the duty-free and travel retail markets in Vietnam. High-end goods are more likely to be purchased as middle-class and upper-class consumers' disposable income rises, particularly at airports and travel retail establishments where they are sometimes offered at reduced costs due to tax exemptions. In order to satisfy the diverse tastes of foreign customers, especially those from China and Korea, retailers have expanded the range of products they provide. The expansion of the Vietnam duty-free and travel retail business has been largely attributed to the availability of a large selection of luxury and regional goods at competitive prices. For instance, in July 2024, Dior announced its first partnership with Lotte Duty Free in Vietnam, launching a summer pop-up at Da Nang International Airport. The pop-up will feature Dior's makeup, skincare, and fragrances, designed to reflect the ambiance of the French Riviera. This collaboration comes amid growing tourism in Da Nang, which saw a 20.7% increase in international visitors in early 2024.

Vietnam Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

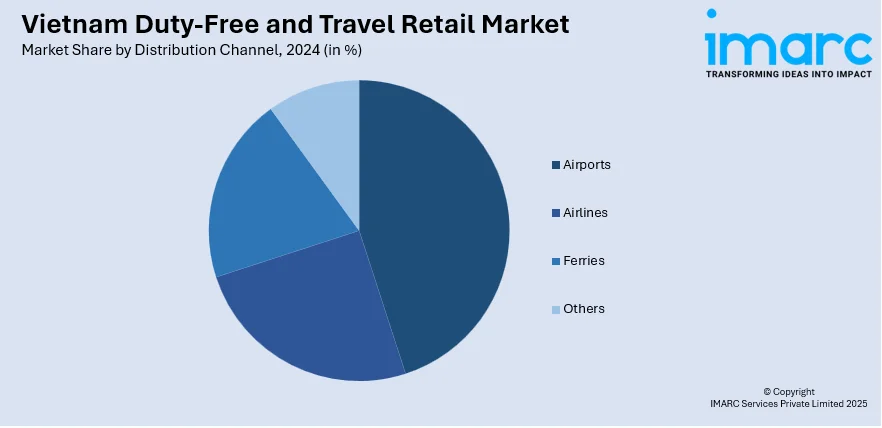

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes airports, airlines, ferries, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Duty-Free and Travel Retail Market News:

- In October 2024, the Estée Lauder Companies, in collaboration with IPP Travel Retail, opened its first duty-paid boutique at Hanoi Noi Bai International Airport. The 120 sq. m store will feature brands like Estée Lauder, Tom Ford, Jo Malone, and MAC. This expansion marks a significant step in ELC's growth in Vietnam’s travel retail sector.

- In June 2024, Vietnamese distributor IPPG partnered with China Duty-Free to open three duty-free stores targeting Chinese tourists. The first store will open in Mong Cai City in 2024, followed by locations in Nha Trang and Ho Chi Minh City. This collaboration aims to strengthen commercial ties between Vietnam and China while boosting the tourism sector.

- In February 2024, Lotte Duty Free strengthened its presence in Vietnam through a partnership with Mode Tour, focusing on combining duty-free shopping with tourism. This collaboration targets key locations like Da Nang, Nha Trang, Phu Quoc, and Da Lat, aiming to expand customer engagement.

Vietnam Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam duty-free and travel retail market on the basis of product type?

- What is the breakup of the Vietnam duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Vietnam duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the Vietnam duty-free and travel retail market?

- What are the key driving factors and challenges in the Vietnam duty-free and travel retail market?

- What is the structure of the Vietnam duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Vietnam duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)