Vietnam E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2025-2033

Vietnam E-Invoicing Market Overview:

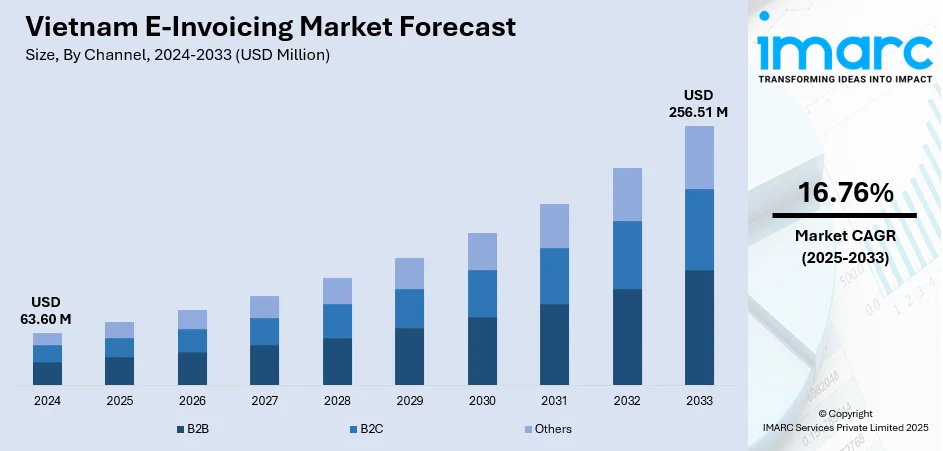

The Vietnam e-invoicing market size reached USD 63.60 Million in 2024. The market is projected to reach USD 256.51 Million by 2033, exhibiting a growth rate (CAGR) of 16.76% during 2025-2033. The market is driven by the strong government mandates pushing nationwide adoption, growing digital transformation across industries, and businesses’ demand for greater transparency and efficiency in tax compliance. Enterprises seek to reduce manual errors, streamline financial operations, and enhance data accuracy through automated invoicing systems. The rise of e-commerce and cashless payments also fuels the need for integrated e-invoice solutions. Additionally, tax authorities' focus on real-time monitoring and fraud prevention encourages broader adoption among small, medium, and large enterprises thus supporting the Vietnam e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 63.60 Million |

| Market Forecast in 2033 | USD 256.51 Million |

| Market Growth Rate 2025-2033 | 16.76% |

Vietnam E-Invoicing Market Trends:

Strengthening Regulatory Framework and Enforcement

Vietnam’s e-invoicing market is undergoing strong regulatory transformation, with the government expanding mandatory adoption across a wider range of businesses, including foreign e-commerce platforms. The authorities aim to unify invoice practices for domestic and cross-border transactions, ensuring greater transparency in tax reporting. Businesses, regardless of size or sector, are being drawn into this framework to minimize tax evasion and standardize VAT collection. This regulatory shift also introduces clear guidelines on invoice correction, digital archiving, and real-time reporting. As enforcement tightens, companies are urged to adapt quickly or face potential legal and financial risks. Overall, the government’s strategic push reflects its ambition to modernize Vietnam’s tax ecosystem in line with global digital economy standards, fostering trust between taxpayers and authorities while supporting economic digitalization.

To get more information on this market, Request Sample

Rising Adoption of Cash-Register E-Invoices

The use of cash-register-generated e-invoices is becoming mainstream across Vietnam’s retail and service sectors. This Vietnam e-invoicing market trend reflects businesses' recognition of the system’s benefits in reducing manual processes and enhancing data accuracy. By automatically linking point-of-sale systems with e-invoice generation, enterprises streamline daily transactions and meet tax obligations effortlessly. Retailers, restaurants, and small service providers are increasingly favoring these solutions as they lower administrative burdens and enable real-time tax reporting. Government incentives and stricter tax policies are also motivating businesses to adopt this model, turning e-invoicing from a regulatory requirement into a tool for operational efficiency. As this practice spreads, companies are finding that automated invoicing not only supports compliance but also helps optimize inventory management, financial tracking, and customer data insights.

Technology-Driven Transformation and Integration

Technology plays a pivotal role in reshaping Vietnam’s e-invoicing landscape, driving widespread adoption among businesses—including over 3.6 million household enterprises issuing e-invoices as of Q1 2025. Cloud computing, AI, and blockchain are transforming invoicing processes by enabling faster issuance, automatic anomaly detection, enhanced data security, and real-time financial analysis. Companies are increasingly integrating e-invoicing systems with ERP platforms and accounting software to streamline operations and create connected financial ecosystems. This digital shift reduces manual errors, lowers operational costs, and improves scalability for businesses of all sizes. Tax authorities also benefit through improved data consistency and real-time monitoring, enhancing overall transparency in tax collection thus strengthening the Vietnam e-invoicing market growth. Importantly, this tech-driven transformation goes beyond mere regulatory compliance; it signals a broader move toward smarter, more efficient financial management, reinforcing Vietnam’s progress toward a fully digital, transparent, and automated economy.

Vietnam E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and Others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

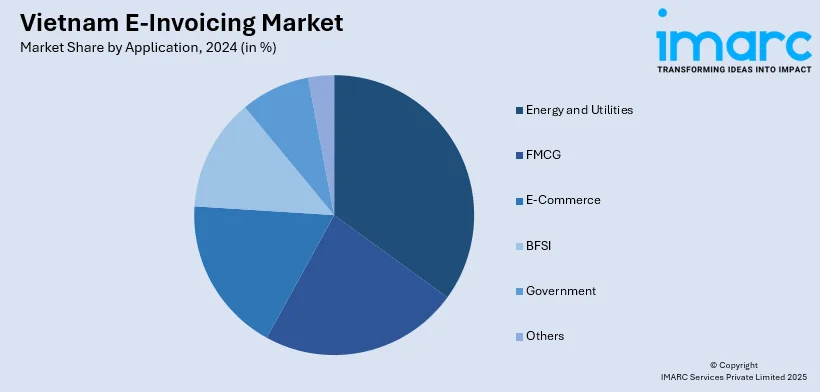

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes energy and utilities, FMCG, E-commerce, BFSI, government, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam e-invoicing market on the basis of channel?

- What is the breakup of the Vietnam e-invoicing market on the basis of deployment mode?

- What is the breakup of the Vietnam e-invoicing market on the basis of application?

- What is the breakup of the Vietnam e-invoicing market on the basis of region?

- What are the various stages in the value chain of the Vietnam e-invoicing market?

- What are the key driving factors and challenges in the Vietnam e-invoicing market?

- What is the structure of the Vietnam e-invoicing market and who are the key players?

- What is the degree of competition in the Vietnam e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)