Vietnam E-Wallet Market Size, Share, Trends and Forecast by Type, Ownership, Technology, and Vertical, 2025-2033

Vietnam E-Wallet Market Size and Share:

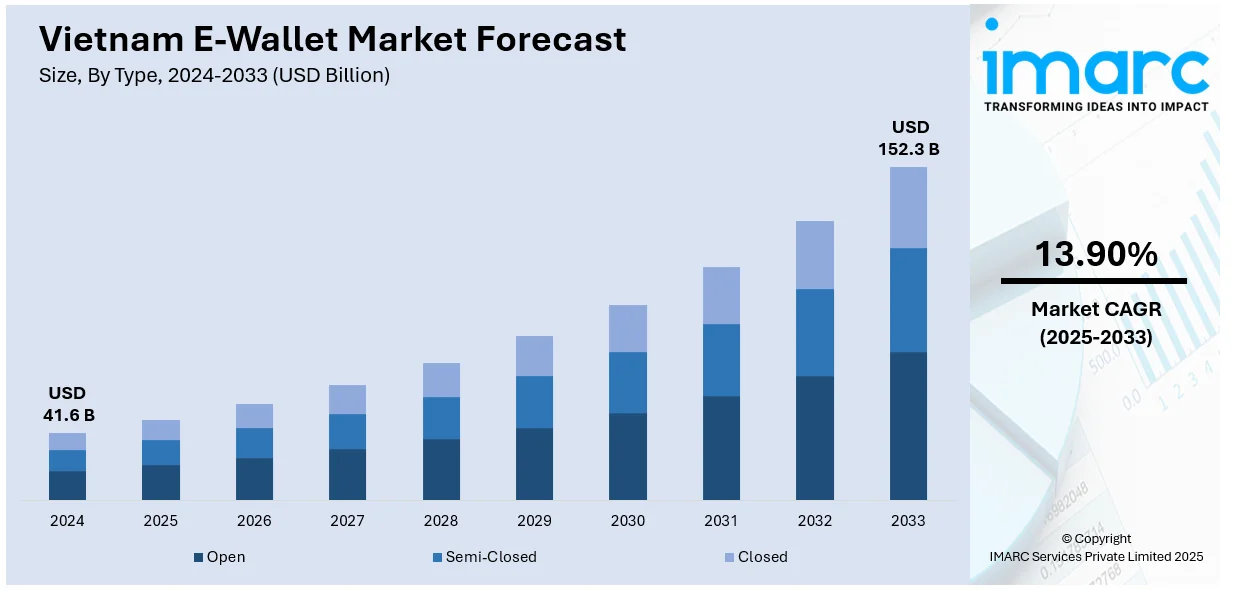

The Vietnam e-wallet market size was valued at USD 41.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 152.3 Billion by 2033, exhibiting a CAGR of 13.90% from 2025-2033. The fast-growing internet and smartphone user base is positively influencing the market. The Government of Vietnam is strongly promoting the uptake of electronic payment systems, such as e-wallets, as a central part of its overall drive to increase financial inclusion. The fast expansion of e-commerce and online services is expanding the Vietnam e-wallet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 41.6 Billion |

|

Market Forecast in 2033

|

USD 152.3 Billion |

| Market Growth Rate 2025-2033 | 13.90% |

The Vietnamese e-wallet market is seeing tremendous growth because of a number of key trends and drivers. Citizens are increasingly using digital payment platforms as the digital infrastructure of the country is growing. E-wallets are becoming popular because they are convenient and can provide safe, fast, and cashless transactions. The market is changing at a fast pace as more people are shifting from conventional payment methods to digital ones, fueled by high smartphone penetration and internet access. Banks and technology firms are joining hands to strengthen their e-wallet offerings, which is leading to broader acceptance. Providers are constantly enhancing their platforms by adding more services, including mobile top-ups, bill payments, and peer-to-peer transferals, making e-wallets more diverse and attractive.

The Government of Vietnam is also actively supporting digital payment systems as part of its initiative to minimize the use of cash and enhance financial inclusion. Efforts like e-commerce expansion and financial literacy initiatives are making more individuals use e-wallets. Additionally, the growing merchant acceptance of e-wallets is increasing the market coverage, further consolidating the place of digital payments in everyday life. The constant innovation of mobile payment solutions is also being driven by the increasing number of international players entering the market, coupled with local startups experimenting with customized products and services. People enjoy varied choices and competitive pricing, driving a vibrant and fast-changing market.

Vietnam E-Wallet Market Trends:

Increasing Smartphone and Internet Penetration

Vietnam's fast-growing internet and smartphone user base is positively influencing the market. As mobile phones are becoming cheaper and internet penetration is increasing, people are getting easier access to digital platforms. Individuals are using smartphones to conduct transactions, check balances, and make payments, thus increasing the adoption of e-wallets. As data speeds on mobile devices improve and coverage widens, individuals are increasingly using e-wallets to make daily purchases and transactions. Mobile phones are becoming the replacement for conventional payment methods such as cash and credit cards in both urban and rural areas due to ease of access and convenience. This development is part of a larger digital revolution, in which e-wallets are perceived as a safer, more convenient option to using cash, especially in a nation where digital literacy is growing. As per an article by Vietnam Plus, Vietnam is about to experience a digital revolution with estimates that the nation will have 100 million Internet subscribers by 2029. The prediction was announced during the Internet Day 2024 conference and exhibition which officially opened in Hanoi, November 27.

Government Support and Financial Inclusion Initiatives

The Government of Vietnam is strongly promoting the uptake of electronic payment systems, such as e-wallets, as a central part of its overall drive to increase financial inclusion and advance the modernization of the economy, thereby contributing to the Vietnam e-wallet market growth. Steps are being taken at the regulatory level to streamline the use of e-wallets and cut costs for both businesses and individuals. Government initiatives are contributing to the development of the public's awareness about digital finance, fostering a situation in which e-wallets are viewed as a secure and reliable means of payment. In addition, the Government is encouraging cashless transactions to reduce corruption, enhance tax collection, and promote the development of the formal economy. Public awareness programs, digital literacy efforts, and incentives for firms embracing digital payment mechanisms are fostering a shift toward a more inclusive and technology-driven economy. The Vietnamese Government, on May 15, 2024, declared Decree No. 52/2024/ND-CP on cashless payments, which shall be effective from July 1, 2024. It supersedes Decree No. 101/2012/ND-CP (amended and supplemented). It was a key legal milestone of Vietnam cashless payments, affecting different sectors, organizations, and individuals concerned. The new decree formed a core and solid legal framework for Vietnam cashless payment operations, encouraging cashless payment practices, facilitating the digitalization of the banking sector, and innovating new, convenient, and secure payment products and services at affordable prices.

Growing E-Commerce and Online Services

The fast expansion of e-commerce and online services is offering a favorable Vietnam e-wallet market outlook. As more people use digital platforms for shopping, entertainment, and other services, they are also embracing e-wallets to make these transactions. Online retailers, food delivery companies, and ride-hailing services are integrating e-wallets as a main payment option, enabling people to make purchases with ease. This growing acceptance of digital payments is also driven by promotions, discounts, and loyalty programs offered by business firms in collaboration with e-wallet providers. In addition, increased usage of online banking services and digital marketplaces is creating an ecosystem where e-wallets are becoming a daily transaction tool. With e-commerce growing, e-wallets are becoming the new favorite payment method for more Vietnamese people. The IMARC Group predicts that the Vietnam e-commerce market size is expected to exhibit a growth rate (CAGR) of 28% from 2025-2033.

Vietnam E-Wallet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam e-wallet market, along with forecasts at the country level from 2025-2033. The market has been categorized based on type, ownership, technology, and vertical.

Analysis by Type:

- Open

- Semi-Closed

- Closed

Open stands as the largest component in 2024, accounting 62% of the Vietnam e-wallet market size. Open e-wallets are electronic wallets that enable users to conduct transactions not only within a specific ecosystem but also across a wide spectrum of merchants and service providers, both online and offline. These wallets enable direct transfers to third-party accounts, which makes them extremely convenient and flexible for users who need flexibility in their transactions. They are usually offered by authorized financial institutions like banks, with easy integration with users' bank accounts. This segment is gaining fast traction in Vietnam with people preferring the flexibility to use their e-wallets for different payments, ranging from shopping and bill payments to money transfers across platforms. As the use of smartphones increases and mobile payments expand, open e-wallets are becoming a necessary tool in the digital payment ecosystem, providing greater financial convenience and accessibility.

Analysis by Ownership:

- Banks

- Telecom Companies

- Device Manufacturers

- Tech Companies

Tech companies lead the market with 55.0% of market share in 2024. They are developing digital payment solutions that are platform-agnostic, enabling users to make transactions across various devices and platforms. Major players in this segment are expanding their digital payment services for catering to a wide range of users. These companies often leverage their existing customer bases and digital ecosystems to promote e-wallet adoption, offering various features such as online purchases, peer-to-peer transfers, and bill payments. In Vietnam, tech companies are capitalizing on the growing demand for digital payment options, especially with the increasing number of users adopting social media and e-commerce platforms. Through strategic partnerships and integration with local merchants, these tech companies are positioning themselves as dominant players in the e-wallet space.

Analysis by Technology:

- Near Field Communication

- Optical/QR Code

- Digital Only

- Text-Based

Optical/QR Code leads the market with 70.3% of market share in 2024. The optical/QR code technology segment in the e-wallet market focuses on enabling digital transactions through the scanning of quick response (QR) codes. This method allows users to complete payments by simply scanning a merchant's or peer's unique QR code with their smartphones. QR code-based payments have gained significant traction in Vietnam due to their simplicity, low-cost infrastructure, and widespread accessibility. Both people and businesses benefit from this technology, as it does not require specialized point-of-sale hardware. The growing number of retail shops, food vendors, and service providers adopting QR code payments is further contributing to the popularity of this method. For users, QR codes offer a fast, secure, and convenient way to pay, while merchants appreciate the ease of integration with existing smartphones and minimal setup costs, thereby driving the Vietnam e-wallet market demand.

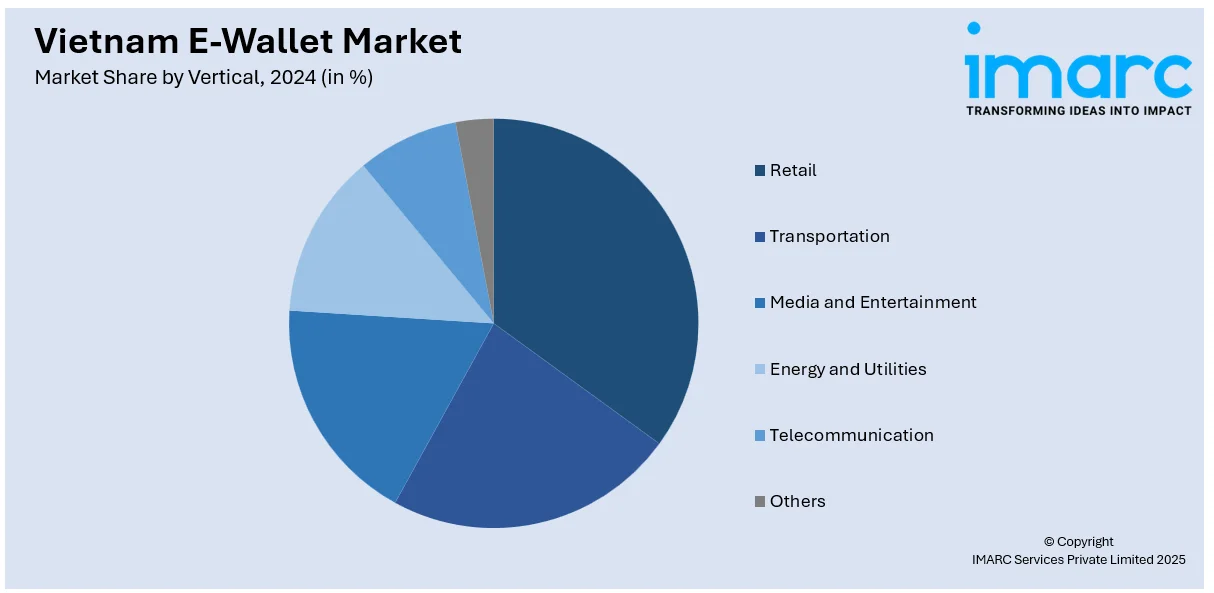

Analysis by Vertical:

- Retail

- Transportation

- Media and Entertainment

- Energy and Utilities

- Telecommunication

- Others

Retail leads the market with 44.3% of market share in 2024. In the retail vertical, e-wallets are revolutionizing the way people make purchases both in-store and online. Retailers are increasingly adopting e-wallet payment solutions to streamline checkout processes, offering people a faster and more convenient method to complete transactions. In Vietnam, e-wallets are becoming particularly popular in brick-and-mortar retail stores, wherein they enable contactless payments and reduce the need for physical cash or credit cards. This segment is seeing significant growth as retailers partner with e-wallet providers to offer promotions, loyalty programs, and special discounts, which encourage repeat usage. Online retailers, including those in e-commerce platforms, are also integrating e-wallet systems to provide seamless purchasing experiences, catering to the demand for quick and secure online transactions. According to Vietnam e-wallet market forecasts, as user preferences shift towards digital payment methods, the retail vertical is expected to remain a major driver of e-wallet adoption.

Competitive Landscape:

Many e-wallet providers are broadening their service offerings to attract a wider customer base. They are increasingly integrating various services like bill payments, mobile top-ups, movie ticket bookings, and even online shopping into its platform, aiming to become a one-stop digital payment solution. By offering a wide range of services, these platforms are enhancing their value proposition, making them indispensable for everyday transactions. E-wallet providers are forming strategic partnerships with a wide range of merchants, both online and offline, to increase the acceptance of their payment methods. This collaboration helps integrate e-wallets into the daily shopping and payment habits of individuals. Several e-wallet providers are focusing on financial inclusion by making digital payment solutions accessible to unbanked or underbanked populations.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam e-wallet market with detailed profiles of all major companies, including:

- MOCA System Inc.

- M-Pay Technology and Trading Service Joint Stock Company

- Vietnam Payment Solution Joint Stock Company (VNPAY)

- VinID Pay (Vingroup)

- VNPT Electronic Payment Joint Stock Company

- ZaloPay (ZION Joint Stock Company)

Latest News and Developments:

- April 2025: IDEMIA Secure Transactions (IST) entered into a strategic partnership with the National Payment Corporation of Vietnam (NAPAS) to strengthen Vietnam’s digital payment infrastructure. With this new digital capability, NAPAS will be better positioned to meet the growing demand for contactless and digital payments in Vietnam. The integration will enable people to make secure in-store payments through their smartphones, using mobile wallets for Android devices and Apple Pay for iOS users.

- September 2024: Woori Bank launched multiple digital offers in Vietnam, enhancing its localized strategy. With Vietnam leading Southeast Asia in digital payments, Woori Bank expands partnerships to optimize user experience. The bank focuses on e-wallets and QR payments, aligning with consumer trends. It’s WON App strengthens digital banking convenience for Vietnamese customers.

- August 2024: KogoPAY launched Version 3 of its mobile wallet, expanding to Vietnam and enhancing cross-border payments. The update enables seamless transactions in Vietnamese Dong via VietQR, improving convenience for users. CEO Dr. Narisa Chauvidul-Aw tested the feature firsthand in Vietnam. This advancement addresses the challenge of card payment acceptance at local businesses.

- May 2024: Visa partnered with MoMo, VNPAY, and Zalopay to enhance seamless payments for cardholders at small and medium enterprises in Vietnam. This collaboration enables Visa cards to be used as a funding source for QR-based transactions via these e-wallets. The initiative supports Vietnam's shift to a cashless society, aligning with rising consumer adoption of digital payments.

Vietnam E-Wallet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open, Semi-Closed, Closed |

| Ownerships Covered | Banks, Telecom Companies, Device Manufacturers, Tech Companies |

| Technologies Covered | Near Field Communication (NFC), Optical/QR Code, Digital Only, Text-Based |

| Verticals Covered | Retail, Transportation, Media and Entertainment, Energy and Utilities, Telecommunication, Others |

| Companies Covered | MOCA System Inc., M-Pay Technology and Trading Service Joint Stock Company, Vietnam Payment Solution Joint Stock Company (VNPAY), VinID Pay (Vingroup), VNPT Electronic Payment Joint Stock Company and ZaloPay (ZION Joint Stock Company) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam e-wallet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam e-wallet market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam e-wallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-wallet market in the region was valued at USD 41.6 Billion in 2024.

The growth of the Vietnam e-wallet market is driven by increasing smartphone and internet penetration, government support for digital payments, the expansion of e-commerce, and a shift towards cashless transactions. Financial inclusion efforts also contribute significantly.

The e-wallet market is projected to exhibit a CAGR of 13.90% during 2025-2033, reaching a value of USD 152.3 Billion by 2033.

The open e-wallet segment accounted for the largest share of 62% in the Vietnam e-wallet market in 2024, due to its flexibility and ability to conduct transactions across a wide range of merchants and service providers.

Some of the major players in the Vietnam e-wallet market include MOCA System Inc., M-Pay Technology and Trading Service Joint Stock Company, Vietnam Payment Solution Joint Stock Company (VNPAY), VinID Pay (Vingroup), VNPT Electronic Payment Joint Stock Company, ZaloPay (ZION Joint Stock Company), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)