Vietnam Eyewear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2026-2034

Vietnam Eyewear Market Size and Share:

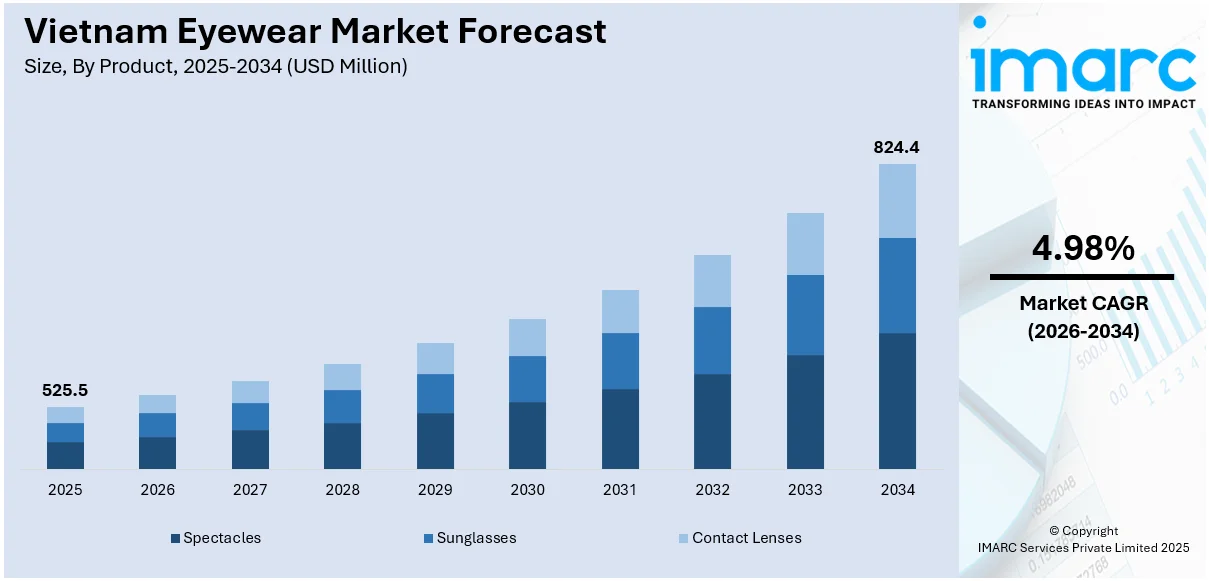

The Vietnam eyewear market size reached USD 525.5 Million in 2025 and is projected to reach USD 824.4 Million by 2034, with a CAGR of 4.98% during 2026-2034. The market is seeing strong growth driven by heightened eye health awareness, growing digital screen exposure, and enhanced fashion-seeking behavior for eyewear. The demand for both style and vision correction is increasing, with growing demand for spectacles, sunglasses, and contact lenses. Broader distribution networks and internet penetration also underpin market growth. As lifestyles change and disposable income grows, the market evolves, contributing to accelerating Vietnam eyewear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 525.5 Million |

| Market Forecast in 2034 | USD 824.4 Million |

| Market Growth Rate 2026-2034 | 4.98% |

The growth in the use of digital devices throughout Vietnam is strongly fueling demand in the eyewear industry. As more people depend on smartphones, laptops, tablets, and televisions for work, learning, and entertainment, consumers are seeing more instances of digital eye strain and associated vision problems. This change in behavior is leading to mount in demand for blue light filtering lenses and prescription eyewear designed for screen protection. Both in urban and semi-urban regions, screen exposure has sped up with the rise of digital learning platforms and remote work culture, especially in the case of younger generations and professionals. As internet penetration and digital literacy continue to increase throughout the country, so does demand for corrective and protective eyewear solutions. Optics retailers are broadening their product lines to meet this demand, with particular emphasis on glare-reducing lenses, which enhance clarity, and offer extended eye comfort. For example, in April 2025, Ho Chi Minh City saw the Vietnam-based SEESON Eyewear add to the local eyewear market with its flagship, combining handcrafted cellulose acetate frames, optometry services, and lifestyle retail in a single venue. Furthermore, this growth reflects the changing Vietnamese consumer lifestyle, where digital screen protection becomes a key driver for the eyewear market.

To get more information on this market Request Sample

Vision care services expansion and greater public health outreach are also driving Vietnam eyewear market growth over the long term. For instance, in August 2024, HMK Eyewear, with more than 40 stores in Vietnam, provided a vast array of fashionable eyewear and lenses from brands such as Essilor, serving over 350,000 customers in 2023. Moreover, Vietnam has witnessed advances in primary healthcare infrastructure, including the creation of eye clinics and mobile vision test units in urban and rural areas. Public education campaigns from health institutions have encouraged the early detection and correction of refractive errors, preventive care, and regular eye check-ups. The availability has not only made diagnosis easier but also boosted prescription and buying of eyewear among all socioeconomic groups. Furthermore, schools and universities are incorporating regular vision screenings, particularly with increasing childhood myopia as a national issue. With greater access to ophthalmologists and optometrists, patients are becoming more proactive in treating their eyes. These systemic processes, along with government-sponsored drives, are paving the way in which the application of eyeglasses and contacts is becoming more of a habitual and health-centric behavior.

Vietnam Eyewear Market Trends:

Growing Vision Correction Demand Propelling Eyewear Demand

Growing incidences of vision disorders in Vietnam are a key driver for the demand for prescription eyewear and contact lenses. Myopia prevalence in school-leaving adolescents has grown exponentially from 20%–30% to as high as 80%–90% in recent years, mostly caused by extensive screen use and study pressure, the National Library of Medicine states. This increase in eye problems has hastened the demand for corrective eyewear, particularly among students and youth. To meet this, the market is experiencing a boom in demand for technologically sophisticated and comfortable lenses. According to IMARC Group, the contact lenses market in Vietnam alone stood at USD 36.0 million in 2024 and is anticipated to reach USD 54.0 million by 2033. This upward trajectory is an indicator of strong market demand to meet vision health needs and frame corrective eyewear as a requirement over a preference for a broad group of the population.

Eyewear as a Fashion Statement Among Style-Conscious Consumers

Wearing spectacles in Vietnam is now being universally accepted as a fashion accessory, a change from functional to self-expression. Consumers, particularly urban-dwellers, are not just looking for vision correction but are opting for glasses as an accessory to top off their overall appearance. This is reinforced by Vietnam's increased exposure to international fashion and an accelerating middle class with raised disposable incomes. The eyewear market in Vietnam now includes trendy, varied styles in different shapes, material, and colors. This style revolution is directly associated with the boom in luxury fashion in the country, which hit USD 370.6 million by 2024. The blending of form and function has seen eyewear companies launch seasonal offerings and partner with designers. With the luxury fashion market of Vietnam expected to reach USD 639.0 million by the year 2033, glasses will increasingly dominate fashion and consumers are likely to desire premium, on-trend product offerings.

Rising Awareness for UV Protection and Eye Health

The Vietnamese consumers are increasingly aware of the long-term dangers of UV exposure and digital eye fatigue, driving the market for protective eyewear in the forms of sunglasses and anti-blue light glasses. Sunglasses are not seasonal wear anymore; rather, they are popular for their ability to shield against detrimental ultraviolet rays and cut glare, particularly in Vietnam's climate of sun and warmth. Moreover, the amplified use of screens by people of all ages thanks to online learning, remote employment, and mobile entertainment has driven demand for blue light filtering glasses. This consciousness is driving purchasing decisions, with consumers increasingly choosing good-quality lenses that provide eye protection as well as fashion. Optical stores and online websites are emphasizing these aspects in their marketing campaigns, further driving the need for eye care. This trend is consistent with regions overall health-oriented consumer trend and underpins long-term growth in the functional and fashion segments of the Vietnam eyewear market outlook.

Vietnam Eyewear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam eyewear market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, gender, and distribution channel.

Analysis by Product:

- Spectacles

- Sunglasses

- Contact Lenses

In 2025, Spectacles held the leading 73.0% share of the eyewear market in Vietnam. Spectacles' strong lead is fueled by the soaring prevalence of vision disorders like myopia, hyperopia, and astigmatism among children and working adults, as well as the overall population. Prolonged screen time as a result of extensive use of digital devices like smartphones, tablets, and computers has boosted demand for spectacles with blue-light filtering effect. Also, increasing interest in eye care and vision improvement has prompted eye checkups to become a part of regular schedules, driving purchases of new eyewear. Variability in fashion designs, material, and lens technology—such as lightweight frames, anti-glare finish, and photochromic lenses meets both functional requirements and fashion tastes. Domestic as well as overseas brands keep abreast of fashionable consumer demands through continuous innovation. Spectacles also continue to be affordable and widely available, through wide distribution from optical shops, pharmacies, and the internet. Such a strong, multi-channeled base of demand for spectacles maintains the market's pillar status.

Analysis by Gender:

- Men

- Women

- Unisex

In 2025, unisex glasses ruled Vietnam's market with a 49.5% share, showing changing consumer attitudes toward universal, minimalist, and functional designs. The attraction of unisex products is their global styling, which does away with the confusion of gender-specific lines and offers wider consumer choice. With evolving fashion standards and growing popularity of androgynous looks, unisex glasses are becoming more popular among younger, fashion-forward consumers. Stores gain from simplified inventories and the capacity to appeal to wider audiences with single-item marketing. Moreover, most unisex patterns are multi-environment friendly and can be appropriate for both everyday and work environments, also increasing their functionality. Technological implementations like virtual try-on technologies and personalized suggestions also enhance customers' confidence in buying unisex frames online or offline. The trend is supported by international brands introducing gender-neutral collections and campaigns, and local producers using simplified, universal frame designs to meet this growing demand. The unisex segment is likely to continue growth in the face of changing lifestyle and fashion trends.

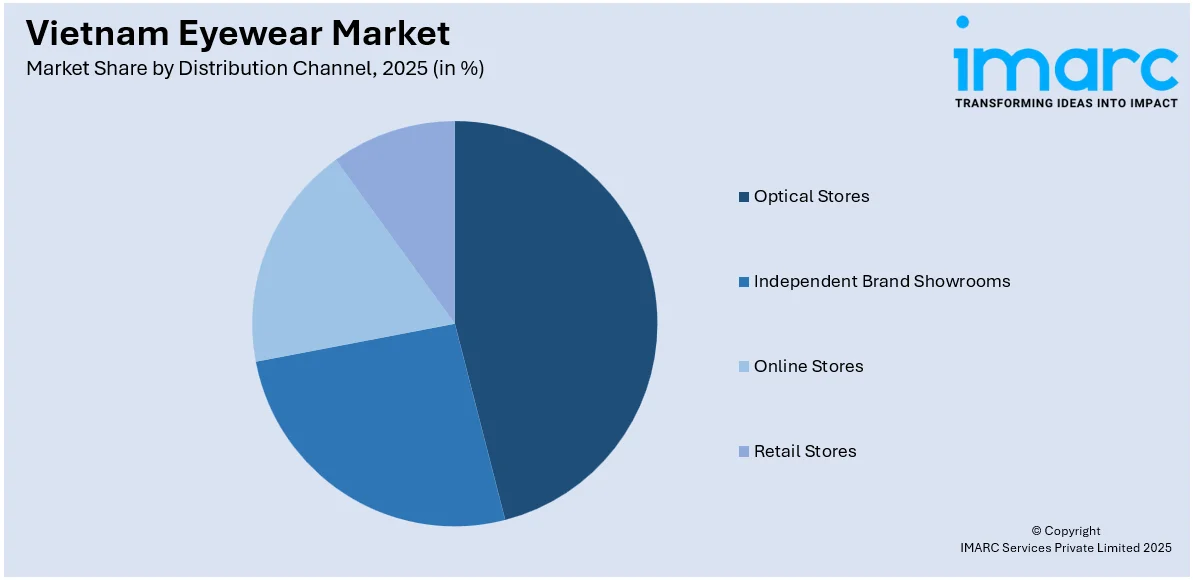

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Optical Stores

- Independent Brand Showrooms

- Online Stores

- Retail Stores

Optical stores held the top 50.4% market share of Vietnam's eyewear market in 2025, reflecting their ongoing significance in providing personalized service and high-trust retailing experiences. These physical locations are still the go-to destination for shoppers purchasing prescription eyewear because they provide vital services like professional eye exams, precise fittings, and post-purchase fittings. Most of Vietnam's optical retailers have ophthalmologists as partners or conduct business alongside vision clinics, ensuring a smooth, doctor-supervised buying process. They also offer consumers exposure to a comprehensive lineup of local and foreign brands, servicing both mass and luxury market tiers. As eye care consciousness improves among consumers, particularly in cities, the need for in-store consultation and trusted counsel increases accordingly. Additionally, top optical chains are spending money on digital equipment such as virtual try-on kiosks and e-booking platforms to make it even more convenient. This combination of trust, convenience, and specialist service establishes optical stores as the foundation of eyewear distribution in Vietnam.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Southern Vietnam dominated the country's eyewear market in 2025 with a dominant 44.3% share, fueled primarily by the high concentration of urban areas, economic activity, and expanding middle-class consumer base in the region. Ho Chi Minh City, in fact, is the commercial and retail hub, featuring many modern optical stores, malls, and clinics that provide convenient access to eyewear products and services. Increased disposable incomes, tech-savviness, and fashion-conscious consumers in the region drive high demand for prescription and non-prescription eyewear. Individuals living in Southern Vietnam also have increased exposure to digital screens and environmental factors such as harsh sunlight and dust, creating high demand for protective eyewear such as anti-glare lenses and UV-filter sunglasses. The region is well served by strong logistics infrastructure, enabling fast restocking and delivery for optical retailers. Southern Vietnam's confluence of healthcare access, lifestyle-driven demand, and retail maturity guarantees its dominance in Vietnam's changing and competitive eyewear market.

Competitive Landscape:

The competitive dynamics in the Vietnam eyewear market future outlook are very dynamic, with both domestic and international brands competing for market share. Companies address a broad base of consumers across various distribution channels, such as optical shops, independent brand outlets, online stores, and retail stores. The market is increasingly influenced by a mix of functionality and fashion, as consumers require eyewear that provides both vision correction and fashionable styles. Brands are, in turn, venturing into diversified portfolios of different product categories, such as prescription eyewear, sunglasses, and contact lenses, and integrating advanced materials and technologies for greater comfort, longevity, and eye protection. Customization capabilities and special collections have emerged as differentiators for brands looking to engage fashion-savvy consumers looking for distinctive and personalized eyewear. As the economy develops and urbanization becomes faster, competition increases with firms constantly needing to innovate in order to push product offerings, refine customer experience, and have an edge over the rapidly changing market.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam eyewear market with detailed profiles of all major companies, including:

- Concept Eyewear

- Luxottica group

- Rodenstock GmbH

Latest News and Developments:

- July 2024: Japanese eyewear retailer JINS Holdings established a wholly owned subsidiary, JINS Vietnam Co., Ltd., in Ho Chi Minh City, marking its entry into Vietnam's growing eyewear market. The first retail store is scheduled to open in 2025.

- March 2024: Taiwan-based Pegavision began constructing a USD 200 million contact lens factory in Thai Binh, Vietnam. Spanning 10 hectares, the facility aims to begin operations in 2028, employ 1,140 people, and generate USD 113.61 million in annual revenue.

Vietnam Eyewear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Spectacles, Sunglasses, Contact Lenses |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Optical Stores, Independent Brand Showrooms, Online Stores, Retail Stores |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | Concept Eyewear, Luxottica group, Rodenstock GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam eyewear market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam eyewear market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam eyewear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The eyewear market in the Vietnam was valued at USD 525.5 Million in 2025.

The Vietnam eyewear market is projected to exhibit a CAGR of 4.98% during 2026-2034, reaching a value of USD 824.4 Million by 2034.

Major drivers of the Vietnam eyewear market are growing urbanization, heightened awareness of eye care, the rising incidence of vision issues such as myopia, and the increasing demand for stylish eyewear. Moreover, the growth of e-commerce, rising disposable income, and a thriving luxury fashion industry are also driving market growth.

Southern Vietnam possesses the biggest market share of the Vietnam eyewear market in 2025 at 44.3%. This is due to increased urbanization, increased consumer awareness, and better access to retail infrastructure, which fuels high demand for both functional and fashion eyewear in the region.

Some of the major players in the Vietnam eyewear market include Concept Eyewear, Luxottica group, Rodenstock GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)