Vietnam Fintech Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

Vietnam Fintech Market Summary:

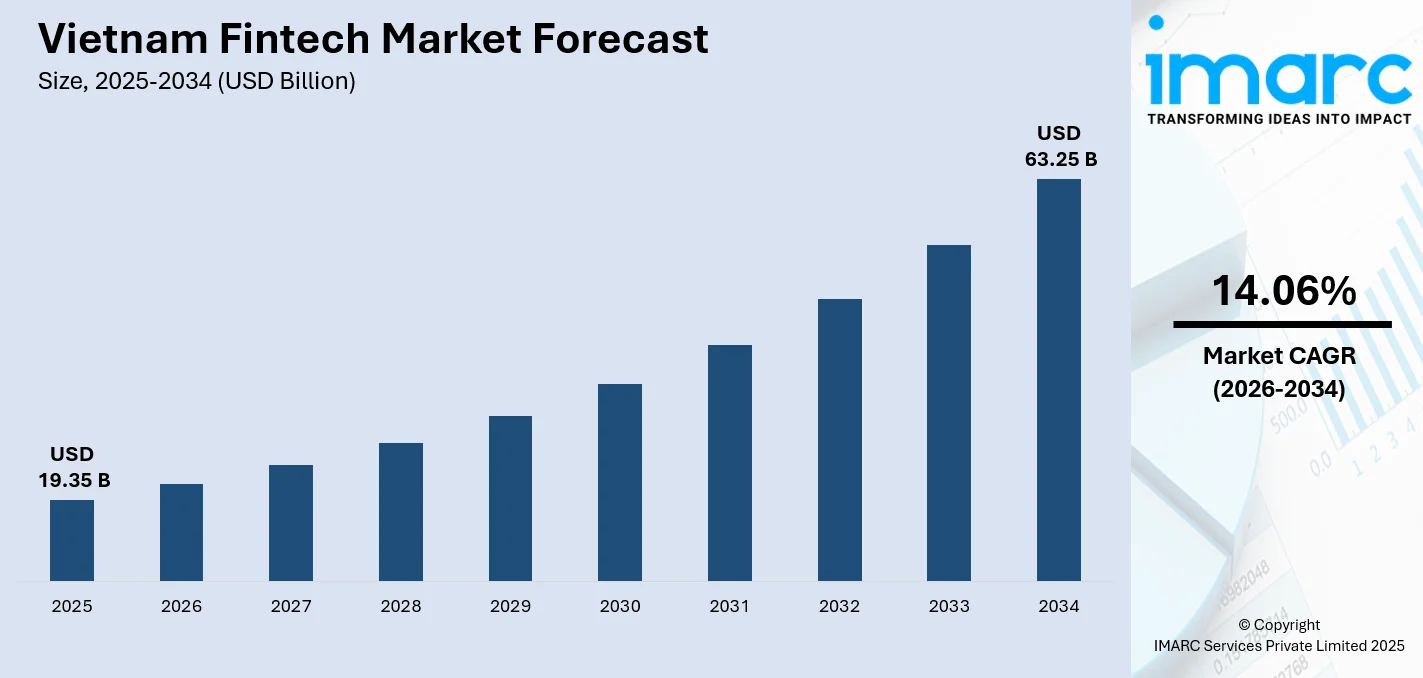

The Vietnam fintech market size was valued at USD 19.35 Billion in 2025 and is projected to reach USD 63.25 Billion by 2034, growing at a compound annual growth rate of 14.06% from 2026-2034.

The Vietnam fintech market is witnessing rapid growth fueled by widespread smartphone usage, rising internet access, and increasing consumer demand for digital financial services. Government policies promoting financial inclusion, combined with a young, tech-savvy population, are accelerating the adoption of mobile wallets, digital payments, and other innovative financial solutions. These trends are reshaping the country’s financial ecosystem, driving greater convenience and accessibility for consumers, and significantly expanding the market share of fintech providers across Vietnam’s evolving digital economy.

Key Takeaways and Insights:

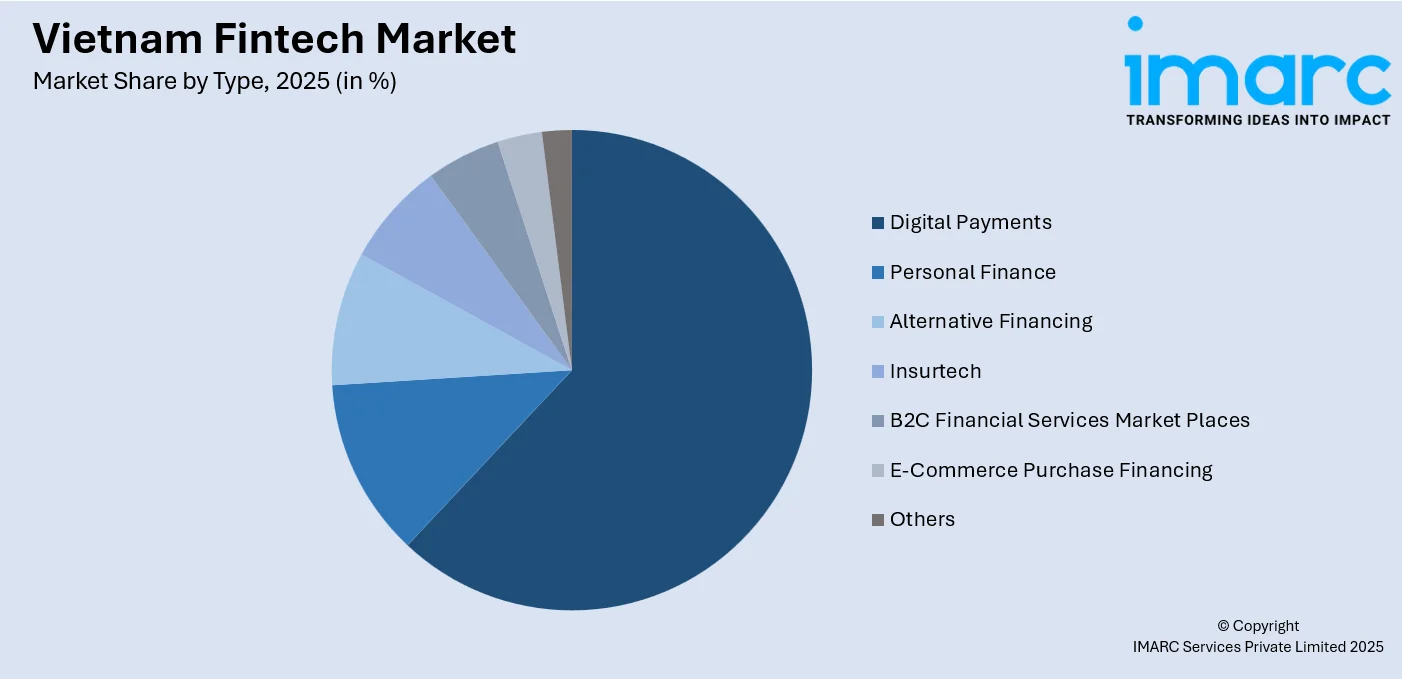

- By Type: Digital payments dominate the market with a share of 62% in 2025, driven by widespread adoption of mobile wallets, QR code payments, and convenient online banking solutions that cater to the country’s increasingly cashless consumer preferences.

- By Region: Southern Vietnam leads the market with 48.5% share in 2025, attributed to the concentration of commercial and financial activities in Ho Chi Minh City, higher technology adoption rates, and a robust ecosystem of fintech startups and traditional financial institutions.

- Key Players: The Vietnam fintech market exhibits dynamic competitive intensity, with both domestic and international players actively competing across digital wallets, lending, and insurtech segments. Strategic partnerships between banks and technology companies are accelerating innovation and expanding service offerings.

To get more information on this market Request Sample

The Vietnam fintech market is advancing rapidly as the country embraces digital transformation across its financial services sector. Rising smartphone penetration and expanding internet connectivity are enabling consumers to access a wide range of digital financial products, from mobile payments to peer-to-peer lending platforms. The government’s commitment to promoting a cashless economy and enhancing financial inclusion is creating favorable conditions for fintech innovation. E-wallets have gained significant traction in urban centers, while alternative financing solutions are addressing credit gaps for underserved populations and small businesses. The Vietnam e-wallet market size was valued at USD 41.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 152.3 Billion by 2033, exhibiting a CAGR of 13.90% from 2025-2033. The young demographic profile, combined with increasing comfort with digital transactions, is accelerating the shift toward modern financial services. Collaborations between established banks and fintech startups are fostering technological advancements and expanding service accessibility across the country.

Vietnam Fintech Market Trends:

Rapid Adoption of Mobile Payment Solutions

Mobile payment adoption is rapidly increasing in Vietnam as consumers shift toward cashless transactions for everyday spending. QR code-based payments are now widely accepted in retail stores, restaurants, and service outlets. Cashless transactions in Việt Nam have risen significantly this year, driven by a sharp increase in QR code–based payments. According to the State Bank of Vietnam, the total value of QR transactions recorded a growth of over 150% during the first nine months of the year, highlighting the rapid shift toward digital payment methods across the country. The ease, speed, and security offered by mobile wallets are fueling this change, especially among younger, tech-savvy users who routinely incorporate digital payments into their daily activities. This growing preference for convenient, secure cashless solutions is a key driver of the expanding Vietnam fintech market.

Expansion of Digital Lending Platforms

Digital lending platforms are increasingly prominent in Vietnam, providing alternative financing solutions for individuals and small businesses. By leveraging technology, these platforms simplify loan applications, credit assessments, and fund disbursements. Rising demand for accessible credit, coupled with advanced risk evaluation algorithms, allows previously underserved populations to obtain financial services that were largely inaccessible through traditional banking channels, driving greater financial inclusion and supporting the broader growth of Vietnam’s fintech ecosystem.

Integration of Advanced Technologies in Financial Services

Vietnam’s fintech ecosystem is increasingly integrating advanced technologies such as artificial intelligence, blockchain, and biometric authentication. These innovations strengthen security, enhance customer experiences, and enable the development of personalized financial products. Financial institutions are investing in robust digital infrastructure to offer seamless services, streamline operations, and provide real-time transaction capabilities. By adopting these technologies, providers can better meet evolving consumer expectations, improve operational efficiency, and support the growth of digital financial solutions, positioning Vietnam as a rapidly advancing market in the global fintech landscape.

Market Outlook 2026-2034:

The Vietnam fintech market is set for strong growth over the forecast period as ongoing digital transformation reshapes the country’s financial services sector. Supportive government policies promoting financial inclusion, increasing smartphone usage, and improving digital infrastructure are expected to maintain market momentum. At the same time, the rapid expansion of innovative payment solutions and rising consumer trust in digital financial platforms will continue to encourage adoption. Together, these factors are likely to support steady revenue growth and broader fintech penetration across Vietnam. The market generated a revenue of USD 19.35 Billion in 2025 and is projected to reach a revenue of USD 63.25 Billion by 2034, growing at a compound annual growth rate of 14.06% from 2026-2034.

Vietnam Fintech Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Digital Payments |

62% |

|

Region |

Southern Vietnam |

48.5% |

Type Insights:

Access the comprehensive market breakdown Request Sample

- Digital Payments

- Online Purchases

- POS (Point of Sales) Purchases

- Personal Finance

- Digital Asset Management Services

- Remittance/ International Money Transfers

- Alternative Financing

- P2P Lending

- SME Lending

- Crowdfunding

- Insurtech

- Online Life insurance

- Online Health Insurance

- Online Motor Insurance

- Others

- B2C Financial Services Market Places

- Banking and Credit

- Insurance

- E-Commerce Purchase Financing

- Others

Digital payments lead the market with a share of 62% of the total Vietnam fintech market in 2025.

Digital payments lead the Vietnam fintech market due to their strong alignment with everyday consumer needs and rapid lifestyle digitalization. Widespread smartphone usage, affordable mobile internet, and a young, tech-savvy population have accelerated the adoption of mobile wallets and QR code–based payments. Consumers increasingly prefer cashless transactions for retail, food services, transportation, and peer-to-peer transfers because of convenience and speed. The integration of digital payments with e-commerce platforms, ride-hailing apps, and super apps further reinforces their dominance.

Another key driver is a strong ecosystem and regulatory support that encourages cashless transactions. Government initiatives promoting financial inclusion and reducing cash dependency have boosted merchant acceptance of digital payments nationwide. Banks, fintech firms, and retailers actively collaborate to expand QR networks, incentives, and loyalty programs. Additionally, enhanced security features such as biometric authentication and real-time monitoring have increased consumer trust. These factors collectively position digital payments as the most mature, widely used, and revenue-generating segment within Vietnam’s fintech market.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Southern Vietnam represents the largest regional share at 48.5% of the total Vietnam fintech market in 2025.

Southern Vietnam is a key growth engine for the fintech market due to its strong economic base and high level of urbanization. Major commercial hubs such as Ho Chi Minh City host a dense concentration of enterprises, startups, and digitally engaged consumers, creating strong demand for cashless payments and digital financial services. High smartphone penetration, widespread internet access, and a young, working-age population accelerate the adoption of mobile wallets, online banking, and e-commerce–linked fintech solutions across retail and service sectors.

The region also benefits from a vibrant fintech and startup ecosystem supported by private investment and innovation-friendly policies. Southern Vietnam attracts venture capital, incubators, and technology talent, enabling the rapid development of payment platforms, digital lending, and financial management apps. Strong merchant acceptance, integration with ride-hailing and delivery platforms, and growing trust in digital transactions further support fintech expansion. These factors collectively position Southern Vietnam as a leading contributor to Vietnam’s overall fintech market growth.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Fintech Market Growing?

Rising Smartphone Penetration and Internet Connectivity

The rapid expansion of smartphone ownership and mobile internet access is fundamentally transforming Vietnam’s financial services sector. At the beginning of 2025, Vietnam had approximately 79.8 million internet users, with online penetration reaching nearly 79% of the population. Widespread device availability enables consumers across urban and rural areas to access digital banking, mobile payments, and investment platforms directly from their handheld devices. Improved network coverage and affordable data plans are eliminating barriers to digital financial service adoption. This technological foundation supports the proliferation of fintech applications and services that deliver convenience, speed, and accessibility to previously underserved populations. The mobile-first approach of Vietnamese consumers creates substantial opportunities for innovative financial solutions.

Government Support for Financial Inclusion and Digital Economy

Government initiatives promoting financial inclusion and cashless transactions are creating favorable conditions for fintech growth in Vietnam. Regulatory frameworks are being developed to balance innovation with consumer protection, encouraging responsible fintech development. National strategies targeting digital economy expansion include provisions for electronic payments, digital banking licenses, and fintech sandboxes that allow controlled testing of new financial products. These supportive policies are attracting domestic and international investment in the fintech sector while building consumer confidence in digital financial services. The alignment of government objectives with industry capabilities is accelerating market development.

Young Demographics and Changing Consumer Preferences

Vietnam’s young, technology-oriented population is driving demand for modern financial services that align with digital lifestyles. More than 24 million people fall within the school-age bracket, accounting for nearly one-quarter of the population. In addition, over 65% of residents are of working age. Millennials and Generation Z consumers demonstrate strong preferences for mobile-first banking experiences, instant payment capabilities, and seamless integration with e-commerce platforms. This demographic cohort values convenience, transparency, and personalized financial products over traditional banking relationships. Their comfort with technology and openness to new financial solutions create receptive market conditions for fintech innovation. As these consumers mature and increase their financial activity, they continue to drive the adoption of digital payment, lending, and wealth management solutions.

Market Restraints:

What Challenges the Vietnam Fintech Market Facing?

Regulatory and Compliance Complexities

Fintech companies in Vietnam face increasing pressure from evolving regulatory and compliance requirements. Managing licensing processes, data privacy rules, and anti-money laundering standards requires significant time, expertise, and financial resources. Unclear or changing regulations can delay product launches and raise operating costs, particularly for smaller or newer players. These complexities make market entry more challenging and can slow innovation as firms balance regulatory adherence with the need to scale efficiently.

Cybersecurity Concerns and Fraud Risks

The rapid growth of digital financial transactions has heightened exposure to cybersecurity threats and fraud risks. Fintech providers must continuously invest in advanced security systems to protect user data and transaction integrity. Any security breach or fraud incident can weaken consumer confidence and hinder adoption. As a result, strong risk management frameworks, real-time monitoring, and user awareness initiatives are essential to maintain trust and support sustained fintech market growth.

Limited Financial Literacy in Rural Populations

While digital infrastructure is improving, financial literacy remains limited in many rural and underserved areas of Vietnam. Potential users often lack understanding of digital financial products and may be cautious about adopting new technologies. Addressing this challenge requires ongoing education programs, clear communication, and user-friendly platforms. Simplified interfaces and targeted outreach efforts are critical to encouraging adoption and ensuring inclusive fintech growth across both urban and rural regions.

Competitive Landscape:

The Vietnam fintech market has active competitive dynamics with local and foreign players seeking opportunities in the market in various segments. The digital wallets, peer-to-peer lending, insurtech and mobile payment services are some of the primary battlegrounds, where the players are differentiated by their technological innovation, experience and access to the service. Conventional financial institutions are also collaborating with technology companies to augment their digital offerings and compete with pure play fintech companies. Competitive intensity is being fuelled by strategic alliances, investments in technology and customer acquisition efforts. The flow of foreign investment into the market is still surging because foreign players have realized that Vietnam has the potential to grow. Changes in the regulatory environment affect competitive positioning and the operators that meet the regulations benefit. The competition in the market is prioritizing the creation of service portfolios, platform growth, and brand trust to gain a market share in this fast-paced industry.

Recent Developments:

- December 2025: Vietnam-based credit-focused neobank Circle Asia Technologies has partnered with Brazilian core banking provider Pismo and global payments company Visa to introduce what it calls the country’s first fully AI-driven PayLater card.

- November 2024: Solarvest Holdings Berhad, a prominent clean energy specialist, has introduced its Powervest solar financing solution in Vietnam, aimed at helping local businesses adopt renewable energy. The launch, held alongside the DEX Connex Vietnam 2024 initiative organized by the Malaysia Digital Economy Corporation, marks an important milestone in Solarvest’s expansion across the regional market.

Vietnam Fintech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam fintech market size was valued at USD 19.35 Billion in 2025.

The Vietnam fintech market is expected to grow at a compound annual growth rate of 14.06% from 2026-2034 to reach USD 63.25 Billion by 2034.

Digital payments represent the largest market share of 62% in 2025, driven by widespread mobile wallet adoption, extensive QR code payment acceptance, and growing consumer preference for convenient cashless transactions across retail and service establishments.

Key factors driving the Vietnam fintech market include rising smartphone penetration and internet connectivity, supportive government policies promoting financial inclusion, young demographics with strong digital adoption preferences, expanding e-commerce activities, and continuous technological innovation in payment and lending solutions.

Major challenges include evolving regulatory and compliance requirements, cybersecurity concerns and fraud risks, limited financial literacy in rural areas, infrastructure gaps in underserved regions, and competition from traditional financial institutions adapting their digital capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)