Vietnam Hospitality Market Size, Share, Trends and Forecast by Type, Segment, and Region, 2026-2034

Vietnam Hospitality Market Size and Share:

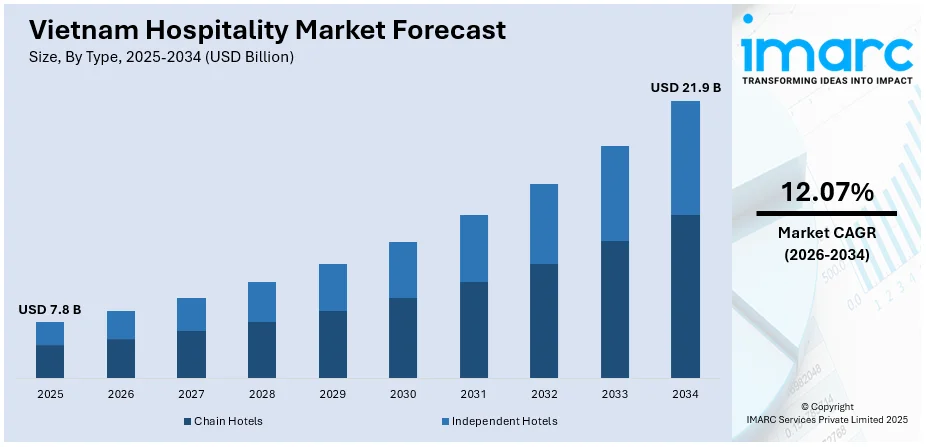

The Vietnam hospitality market size was valued at USD 7.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 21.9 Billion by 2034, exhibiting a CAGR of 12.07% during 2026-2034. The market is driven by improved tourism infrastructure, expanding international air connectivity, rising domestic travel, and increased foreign investment in hotel chains. Government support through visa reforms and destination marketing, along with the country’s appeal as a cost-effective leisure and business travel hub, further strengthens market growth momentum.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.8 Billion |

| Market Forecast in 2034 | USD 21.9 Billion |

| Market Growth Rate 2026-2034 | 12.07% |

One of the key drivers of Vietnam’s hospitality market is the country’s proactive investment in tourism infrastructure and urban development. Significant upgrades in airport facilities, expansion of highway networks, and enhancements in public transportation have improved connectivity across key tourist destinations such as Da Nang, Ha Long Bay, and Ho Chi Minh City. Simultaneously, local governments are incentivizing the development of new hospitality zones, including luxury resorts and coastal entertainment districts. The government's efforts to simplify visa processes and promote long-term e-visas have further increased international tourist arrivals. These infrastructural and administrative improvements are enabling a more consistent inflow of visitors, stimulating demand for hotels, restaurants, and related hospitality services. According to the Ministry of Culture, Sports and Tourism, Vietnam welcomed over 17.5 Million international visitor arrivals in 2024, reflecting a 39.5% increase over 2023, which underscores the surging demand for hospitality and travel services.

To get more information on this market Request Sample

The rising presence of international hotel brands and strategic partnerships with local developers is also propelling Vietnam’s hospitality sector. Global operators are introducing diversified formats—ranging from boutique hotels to premium eco-resorts that cater to a broader demographic of tourists. This trend is reinforced by increasing disposable income among domestic travelers and a growing inclination for weekend getaways and experiential tourism. Additionally, Vietnam’s positioning as a cost-competitive destination for business meetings, international conferences, and cultural events is strengthening the sector’s year-round occupancy rates. For instance, in April 2025, Hyatt and Holding Thanh Duc Joint Stock Company announced the opening of Hyatt Place Ha Long Bay Bai Chay, marking the first Hyatt Place branded hotel in Vietnam. Located in the tourism hub of Ha Long, the 163-room hotel caters to both leisure and business travelers with amenities such as private balconies, all-day dining, event spaces, a 24-hour fitness center, and an outdoor infinity pool. The property emphasizes convenience and flexible design, offering easy access to Ha Long Bay attractions and promoting seamless experiences across work and relaxation. This opening expands Hyatt’s global select-service portfolio into a key Vietnamese market. These developments, as highlighted in the latest Vietnam hospitality industry report, collectively support a dynamic and evolving hospitality ecosystem with robust investor interest.

Vietnam Hospitality Market Trends:

Rise of Sustainable and Eco-Friendly Hospitality Models

A prominent trend in Vietnam’s hospitality market is the increasing emphasis on sustainability and eco-conscious operations. Hospitality providers are actively integrating environmentally responsible practices such as energy-efficient design, reduced plastic usage, and waste management programs. According to Vietnam Electricity, 163 new green buildings were added in 2024 alone, marking significant progress in eco-friendly development and offering lucrative opportunities to industry investors. Resorts in coastal and highland areas are adopting green building standards and incorporating local materials to minimize environmental impact. This shift is driven by rising awareness among both domestic and international travelers, who increasingly prefer accommodations with demonstrable sustainability credentials. Additionally, government policies encouraging environmental stewardship in tourism are influencing investment decisions. As Vietnam’s natural attractions are central to its tourism appeal, sustainable hospitality models are gaining momentum as both a business imperative and a competitive differentiator in the country’s evolving travel landscape.

Growth of Digital-First Guest Engagement

Digital transformation is reshaping guest experiences across Vietnam’s hospitality sector. Hotels and resorts are investing in advanced technologies for contactless check-in, digital concierge services, smart room features, and personalized communication through mobile apps. Online platforms now play a dominant role in travel planning and booking, prompting operators to enhance their digital presence and offer integrated, user-friendly interfaces. This trend is fueled by changing consumer preferences, particularly among younger travelers and urban middle-class customers who value convenience and real-time information. As competition intensifies, digital engagement is not only improving operational efficiency but also enabling brands to differentiate themselves through more tailored and seamless guest experiences. For instance, in March 2025, Hoiana resort in Central Vietnam partnered with Shiji Group to deploy integrated hospitality technologies across its hotels, golf course, dining outlets, and casino. The solutions included POS systems, digital menus, queue and table management, kiosks, and over 100 workstations. This collaboration enhances operational efficiency and guest experience, reinforcing Hoiana’s goal of becoming a tech-driven, multi-service resort. The project marks a major step in Hoiana’s expansion and positions it as a leading hospitality and entertainment destination in the region.

Expansion of Midscale and Budget Hospitality Segments

Vietnam’s hospitality market is witnessing notable growth in midscale and budget accommodations, driven by the expanding domestic tourism base and price-sensitive international travelers. This segment is experiencing heightened investor interest as it offers higher occupancy rates and shorter return-on-investment periods compared to luxury offerings. Chains and independent operators are increasingly focusing on functionality, cleanliness, and accessibility to cater to evolving traveler expectations without compromising on comfort. Urban centers and second-tier cities, including Hai Phong, Nha Trang, and Can Tho, are seeing an uptick in affordable hotel development. Additionally, the rise of young professionals, digital nomads, and domestic group tours is generating steady demand for value-oriented lodging options. This expansion is helping diversify Vietnam’s hospitality landscape and make it more inclusive. For instance, in December 2024, a new international hospitality brand, Wafaifo, was launched in Central Vietnam with the opening of its first project, Wafaifo Resort Hoi An, a 134-room lifestyle property located near Hoi An’s historic center. The launch marks the beginning of a broader strategy that includes the development of a shopping mall, hospitality asset management services, and other tourism ventures. The brand aims to deliver a distinctly Vietnamese guest experience, blending local culture with modern resort living in a rapidly growing travel hub.

Vietnam Hospitality Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam hospitality market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type and segment.

Analysis by Type:

- Chain Hotels

- Independent Hotels

Chain hotels stand as the largest component in 2025, holding around 58.3% of the market. The chain hotels segment dominates the market due to its strong brand recognition, standardized service quality, and access to global distribution networks. International and regional chains benefit from customer trust, loyalty programs, and robust marketing platforms that attract both business and leisure travelers. Their ability to meet international safety and hygiene standards also appeals to a growing segment of discerning tourists. Additionally, these chains often partner with local developers, allowing for rapid expansion in key cities and tourist hotspots. Their financial resilience and operational expertise enable them to adapt quickly to market fluctuations, further reinforcing their leading position in Vietnam.

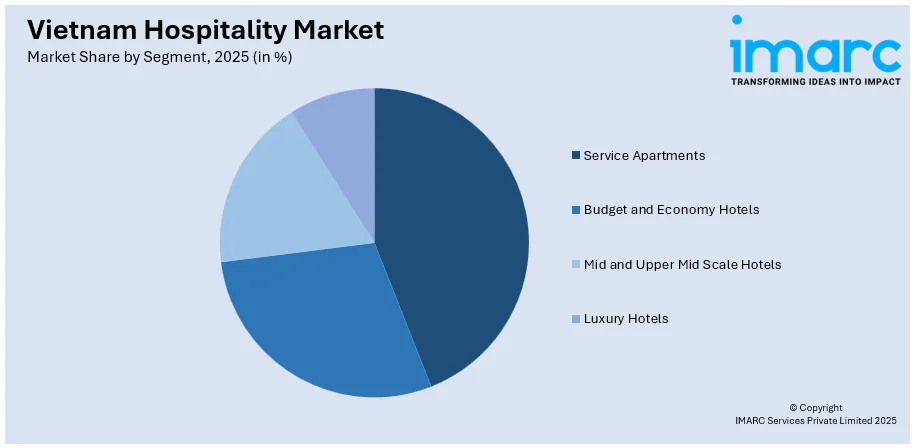

Analysis by Segment:

Access the Comprehensive Market Breakdown Request Sample

- Service Apartments

- Budget and Economy Hotels

- Mid and Upper Mid Scale Hotels

- Luxury Hotels

Mid and upper mid scale hotels leads the market with around 44.7% of market share in 2025. The mid and upper mid-scale hotel segment dominates the market due to its broad appeal across both domestic and international traveler segments. These hotels offer a balanced mix of affordability, comfort, and quality service, catering effectively to middle-income tourists, business travelers, and group tours. With Vietnam experiencing strong growth in domestic tourism and attracting cost-conscious foreign visitors, this segment addresses rising demand for dependable yet reasonably priced accommodations. Additionally, corporate travel, MICE events, and regional tourism campaigns have further reinforced demand for mid-tier hospitality offerings. Their widespread availability in both major cities and emerging destinations enhances accessibility and contributes to consistent occupancy rates

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2025, Southern Vietnam accounted for the largest market share of over 47.8%. The Southern region dominates Vietnam’s hospitality market due to its concentration of major economic hubs, established tourism infrastructure, and diverse travel offerings. Ho Chi Minh City, as the country's financial center, attracts significant business tourism and international arrivals. The region also encompasses key coastal destinations like Vung Tau and Phu Quoc, known for their beaches, luxury resorts, and vibrant nightlife. Strong air, road, and sea connectivity enhances accessibility, while continuous investment in hospitality projects boosts capacity and service standards. For instance, in May 2024, Hilton inaugurated its flagship property, Hilton Saigon, marking its first establishment in Ho Chi Minh City. Situated near Tan Son Nhat Airport and prominent cultural landmarks, the hotel’s architecture draws inspiration from traditional Vietnamese temples, harmonizing with the historic Me Linh Square. Hilton Saigon features over 1,000 square meters of event space, including a grand ballroom and multiple meeting rooms. The hotel emphasizes sustainable and wellness-focused events, aligning with Hilton’s 'Meet with Purpose' initiative. This opening expands Hilton’s presence in Vietnam, contributing to its portfolio of 14 operational and upcoming properties in the country.

Competitive Landscape:

The competitive landscape of Vietnam’s hospitality market features a diverse mix of international operators, regional brands, and local enterprises. Global hotel groups continue to expand their presence in key urban and coastal destinations, leveraging standardized service quality and strong digital platforms. For instance, in March 2025, Radisson Hotel Group announced that it is strengthening its footprint in Vietnam with the upcoming Radisson Blu Hotel in Ha Long Bay, a 352-room, 30-storey property styled after traditional sailing vessels. Featuring luxury amenities and event facilities, it joins a growing portfolio that includes new developments in Hoi An, Mui Ne, and Ho Tram. With Vietnam targeting over 22 million international visitors in 2025 and expanding its airport network, international hotel brands are actively scaling operations across key destinations. At the same time, regional and domestic players focus on delivering culturally tailored experiences and budget-friendly options, appealing to a growing segment of value-conscious travelers. Market players are increasingly investing in technology, service upgrades, and sustainable practices to stay competitive. The competition spans across luxury, upscale, and mid-tier segments, with rising demand from both domestic and international tourists encouraging new developments, strategic collaborations, and ongoing enhancements in service delivery and guest experience across the hospitality ecosystem.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam hospitality market with detailed profiles of all major companies, including:

- Vinpearl.com

- Muong Thanh Hospitality

- Accor

- InterContinental Hotels Group

- Marriott International, Inc.

- Diamond Bay Resort & Spa

- A25 Hotel

- H&K Hospitality

- The Ascott Limited

Latest News and Developments:

- March 2025: Accor opened the Pullman Hai Phong Grand Hotel, its flagship property in Northern Vietnam. Located in the heart of Hai Phong, the hotel blends modern design with cultural aesthetics and offers 364 rooms, including long-stay apartments. It features extensive meeting spaces, including a 1,200 sqm ballroom, multiple dining venues, a rooftop bar, spa, and wellness facilities. This opening strengthens Hai Phong’s position as a growing business and leisure hub and reinforces Accor’s premium segment growth in Vietnam.

- January 2025: Park Hyatt Phu Quoc is slated for a Q3 2025 debut. Nestled on the scenic southern coast of Phu Quoc Island in Vietnam, the resort blends traditional Vietnamese architectural motifs with modern art pieces. The design reflects a refined mix of cultural homage and contemporary sophistication, an approach deeply aligned with Studio 104’s design ethos.

- November 2024: Frasers Hospitality launched Modena by Fraser Vinh Yen, its first hotel residence in Northern Vietnam. Located in Vinh Phuc’s capital, the property featured 88 serviced apartments, diverse amenities, and cultural experiences. It marked the brand’s third entry in Vietnam, complementing properties in Hanoi.

- October 2024: Baker McKenzie Vietnam and its strategic alliance BMVN advised Hung Yen Hospitality on a collaboration to develop luxury hospitality projects in Vietnam. The initiative includes the creation of five-star hotels, championship-style golf courses, and high-end residential estates. This marks the first entry of the involved international hospitality brand into the Vietnamese market, reflecting strong investor confidence in the country’s tourism and hospitality sectors. The deal was led by a team of Baker McKenzie and BMVN professionals under the guidance of Partner Tran Manh Hung.

- May 2024: IHG Hotels & Resorts announced the debut of Hotel Indigo and Vignette Collection in Vietnam, expanding its Luxury & Lifestyle portfolio. Hotel Indigo opened in Ho Chi Minh City, while Vignette Collection launched in Hoi An. IHG aimed to double its Vietnam portfolio to 44 hotels by 2028.

- April 2024: Kempinski Hotels announced its Vietnam debut with the Kempinski Saigon River, a luxury riverside resort designed by Kengo Kuma & Associates. Set to open in 2026 in Dong Nai, the 100-room property blended Vietnamese heritage with modern luxury and featured a spa, dining venues, and event spaces.

Vietnam Hospitality Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chain Hotels, Independent Hotels |

| Segments Covered | Service Apartments, Budget and Economy Hotels, Mid and Upper Mid Scale Hotels, Luxury Hotels |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | Vinpearl.com, Muong Thanh Hospitality, Accor, InterContinental Hotels Group, Marriott International, Inc., Diamond Bay Resort & Spa, A25 Hotel, H&K Hospitality, The Ascott Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam hospitality market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam hospitality market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam hospitality industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Vietnam hospitality market was valued at USD 7.8 Billion in 2025.

The Vietnam hospitality market is growing due to rising international and domestic tourism, improved infrastructure, strategic foreign investments, and government support. Expanding middle-class spending, increased air connectivity, and demand for diversified travel experiences further contribute to the sector's momentum, alongside the emergence of second-tier cities as attractive hospitality development hubs.

IMARC estimates the Vietnam hospitality market to exhibit a CAGR of 12.07% during 2026-2034, reaching USD 21.9 Billion by 2034.

Southern Vietnam accounted for the largest market share in 2025, with around 47.8% of the market share, driven by the strong tourism appeal of Ho Chi Minh City, popular coastal destinations, and robust infrastructure. The region’s diverse offerings for both leisure and business travelers contributed to its dominant position in the sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)