Vietnam Kitchen Appliances Market Size, Share, Trends and Forecast by Product Type, Structure, Fuel Type, Application, Distribution Channel, and Region, 2025-2033

Vietnam Kitchen Appliances Market Overview:

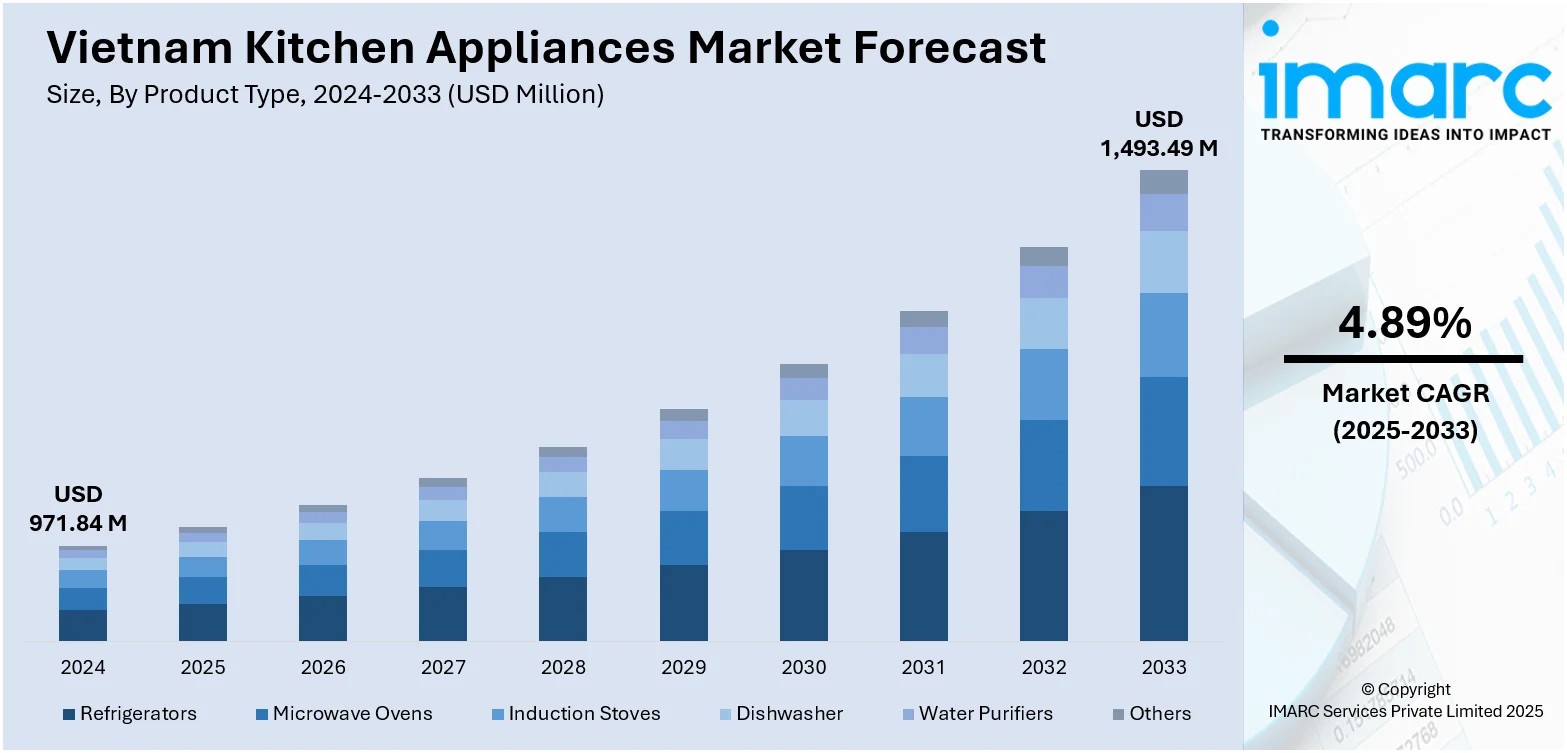

The Vietnam kitchen appliances market size reached USD 971.84 Million in 2024. Looking forward, the market is expected to reach USD 1,493.49 Million by 2033, exhibiting a growth rate (CAGR) of 4.89% during 2025-2033. The market is expanding due to rising urbanization, growing middle-class incomes, and shifting lifestyles favoring modern, multifunctional devices. Consumers seeking energy-efficient, smart, and compact appliances, and rapid expansion of e-commerce and retail innovations are also enhancing market access. Manufacturers are further emphasizing innovation, quality, and local production to meet demand. This dynamic evolution contributed to the Vietnam kitchen appliances market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 971.84 Million |

| Market Forecast in 2033 | USD 1,493.49 Million |

| Market Growth Rate 2025-2033 | 4.89% |

Vietnam Kitchen Appliances Market Trends:

Urbanization and Rising Middle-Class Incomes

Vietnam’s rapid urbanization and expanding middle-class population are key drivers of the kitchen appliances market. As more people migrate to urban areas and household incomes rise, there is a growing demand for modern housing equipped with up-to-date kitchen facilities. The middle-income consumers are becoming more prone to buy durable and efficient appliances that make their lives easier on a day-to-day basis. The busy urban lifestyles that are characterized by time crunch and space shortage are also a driving force behind the increased use of multifunctional, small-designed kitchen goods. The increasing number of dual-income families has also facilitated the trend towards automated and convenient appliances. Such a change in demographics and lifestyle preferences is the main driver in increasing the demand for innovative kitchen solutions in cities across Vietnam, sustaining the market growth.

To get more information on this market, Request Sample

Expansion of Retail and E-commerce Channels

Vietnam’s retail sector, both offline and online, is rapidly evolving, significantly impacting kitchen appliance sales. Large electronics chains, supermarkets, and dedicated appliance stores offer customers wide access to international and local brands. At the same time, the booming e-commerce sector, supported by improved logistics, digital payment options, and internet penetration, has revolutionized the way consumers shop for appliances. Online platforms provide product variety, reviews, and price comparisons, empowering consumers to make informed choices. Retailers are also offering flexible payment plans, warranties, and delivery services to enhance the buying experience. This robust retail ecosystem is not only widening consumer access but also accelerating brand visibility and product reach, making it a critical driver of the Vietnam kitchen appliances market growth.

Growing Demand for Smart and Energy-Efficient Appliances

Vietnamese consumers are becoming more conscious of energy savings and environmental impact, leading to an increasing preference for smart and energy-efficient kitchen appliances. Appliances with IoT features, app integration, and automation are gaining popularity, especially among younger, tech-savvy buyers. This trend is driven by a desire for convenience, cost savings on electricity, and better performance. Government initiatives and policies encouraging energy-efficient technologies are also influencing consumer choices. Moreover, rising electricity costs are prompting households to adopt products with higher energy ratings. Local and international brands are responding by launching smart appliances tailored to the needs of the Vietnamese market, further intensifying competition and innovation. This technological shift plays a central role in driving the market forward.

Vietnam Kitchen Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, structure, fuel type, application, and distribution channel.

Product Type Insights:

- Refrigerators

- Microwave Ovens

- Induction Stoves

- Dishwasher

- Water Purifiers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes refrigerators, microwave ovens, induction stoves, dishwasher, water purifiers, and others.

Structure Insights:

- Built-In

- Free Stand

A detailed breakup and analysis of the market based on the structure have also been provided in the report. This includes built-in and free stand.

Fuel Type Insights:

- Cooking Gas

- Electricity

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes cooking gas, electricity, and others.

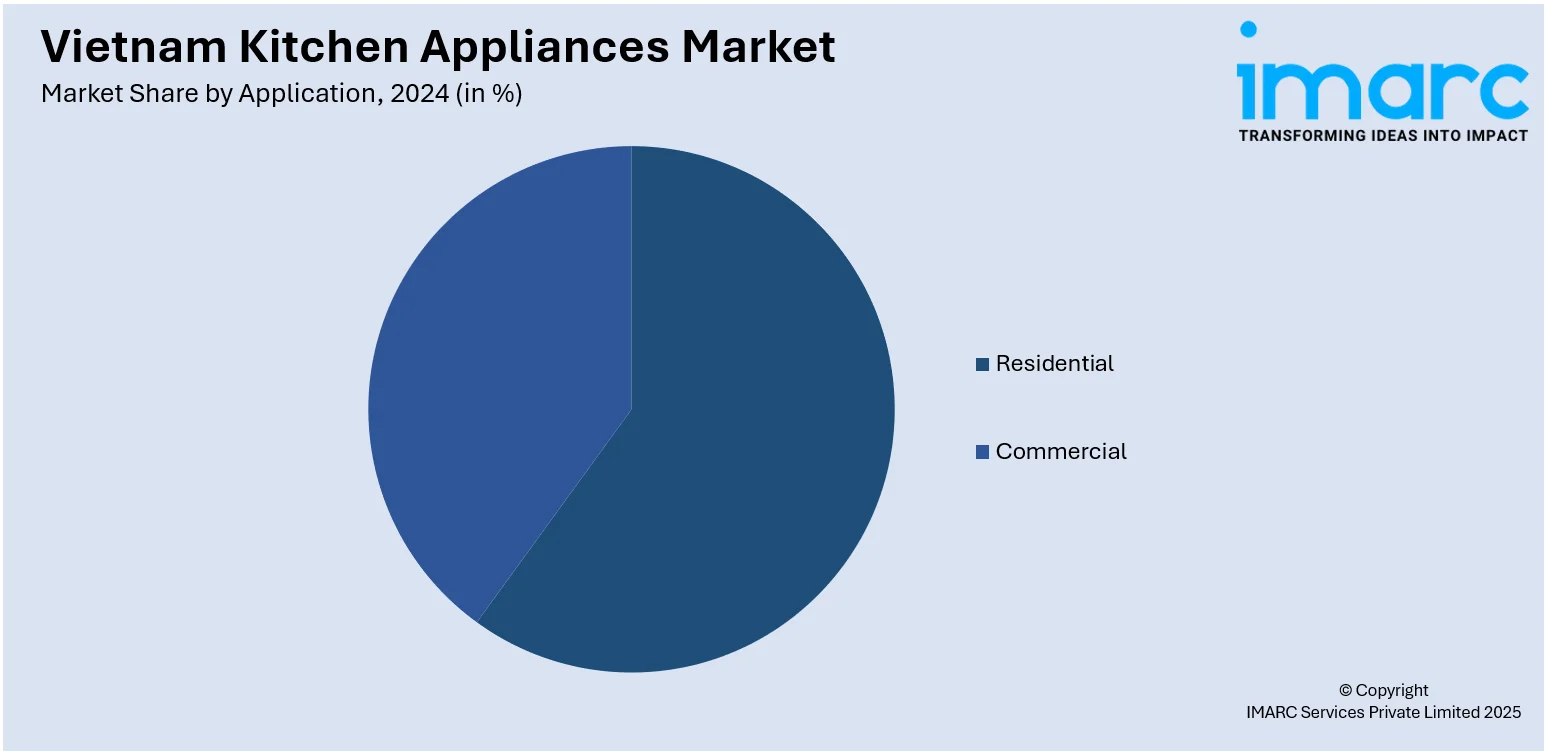

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Departmental Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, departmental stores, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Kitchen Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Refrigerators, Microwave Ovens, Induction Stoves, Dishwasher, Water Purifiers, Others |

| Structures Covered | Built-In, Free Stand |

| Fuel Types Covered | Cooking Gas, Electricity, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Specialty Stores, Online Stores, Departmental Stores, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam kitchen appliances market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam kitchen appliances market on the basis of product type?

- What is the breakup of the Vietnam kitchen appliances market on the basis of structure?

- What is the breakup of the Vietnam kitchen appliances market on the basis of fuel type?

- What is the breakup of the Vietnam kitchen appliances market on the basis of application?

- What is the breakup of the Vietnam kitchen appliances market on the basis of distribution channel?

- What is the breakup of the Vietnam kitchen appliances market on the basis of region?

- What are the various stages in the value chain of the Vietnam kitchen appliances market?

- What are the key driving factors and challenges in the Vietnam kitchen appliances market?

- What is the structure of the Vietnam kitchen appliances market and who are the key players?

- What is the degree of competition in the Vietnam kitchen appliances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam kitchen appliances market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam kitchen appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)