Vietnam MICE Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

Vietnam MICE Market Size and Share:

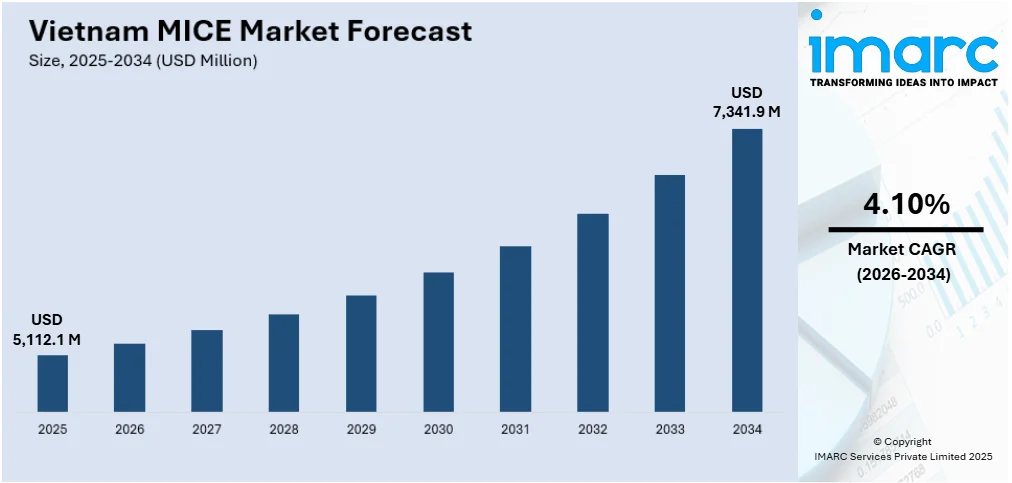

The Vietnam MICE market size was valued at USD 5,112.1 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 7,341.9 Million by 2034, exhibiting a CAGR of 4.10% during 2026-2034. The market is growing rapidly, driven by strong economic expansion, government support, and increasing foreign investment. The country's strategic location, affordable costs, and world-class hospitality infrastructure make it an attractive destination for business events. With improved air connectivity and aggressive marketing, Vietnam is solidifying its position as a leading MICE hub. Rising demand for corporate travel, incentive programs, and hybrid conferences is further expanding the Vietnam MICE market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5,112.1 Million |

| Market Forecast in 2034 | USD 7,341.9 Million |

| Market Growth Rate (2026-2034) | 4.10% |

That thriving real estate industry is driven by the nation's record-breaking economic growth and growing levels of foreign investments. With Vietnam emerging as a top business hub in Southeast Asia, the demand for high-quality MICE facilities and services has rapidly picked up speed. The government's friendly policies, ranging from visa exemption to upgrading infrastructure, somehow fill in the gaps in the growing industry. Vietnam's distinct cultural heritage, beautiful natural scenery, and comparatively low costs have placed Vietnam in the crosshairs of an international event magnet. The arrival of integrated resorts and luxury hotels that boast world-class convention centers has further placed Vietnam in the competition space to capture the regional MICE market. Vietnam is targeting 22 to 23 million foreign visitors by 2025 and will become one of Southeast Asia's top tourism spots, with a focus on MICE events. In 2024, the country received 17.5 million tourists, which surpassed Singapore and fell just behind Thailand and Malaysia. Improvements in infrastructure, the availability of longer visa stays, and the hosting of major international events are fueling this tourism growth, with the MICE segment increasingly contributing to it.

To get more information on this market Request Sample

In addition, the growing focus on corporate travel and networking events, particularly in industries, such as technology, finance, and manufacturing, is propelling the Vietnam MICE market growth. Corporations increasingly employ MICE events to motivate employees, strengthen connections, and feature innovations. Vietnam is set to gain from its geopolitical location and increased air connectivity as demand for hybrid and large-scale face-to-face events picks up following post-pandemic recuperation. Governmental authorities at the local level are promoting MICE tourism aggressively through collaborative work with global event organizers and targeted promotion campaigns. Vietnam's MICE tourism sector is on the rise, as seen from the attendance of 500 businesses at the Hanoi MICE Expo 2024 and the visit of over 4,500 Indian travelers in August. The country's major cities, including Hanoi, Da Nang, and Ho Chi Minh City, are attracting foreign MICE groups, while the Vietnam Tourism Association is concentrating on enhancing service quality and promoting sustainability for the industry. The country aims to become a 'green destination' in order to host high-ranking international events. Furthermore, the country's reputation for hospitality and culinary excellence enhances its appeal, ensuring a steady influx of business travelers and event participants seeking unique experiences.

Vietnam MICE Market Trends:

Government Investment in Infrastructure

Through government support and investments in infrastructure growth, Vietnam's MICE industry is on an unprecedented upward trajectory. In 2025, the federal government laid out to spend USD 36 Billion on infrastructure, an increment of nearly 40% from past years. This budget adjustment increased the goal to 7% from 6% of the nation's GDP. These massive investments have established the infrastructure to sustain the largest world-class convention complexes, hotels and transportation systems on a par with the finest global standards. The new venues are drawing international-level event organizers, placing Vietnam as the top destination for large-scale MICE events. By focusing on the development of physical and digital infrastructure, the country has created an environment to excel in catering to the demands of foreign corporations and visitors attending MICE events.

Vietnam’s Rich Cultural Heritage

Vietnam’s wealth of historical and cultural assets is a major factor driving the MICE market. As of mid-2024, Vietnam boasts over 40,000 historical sites, including eight UNESCO World Heritage Sites, 130 special national monuments, and 10,000 provincial sites. The country also has approximately 70,000 cultural elements, with 15 recognized on UNESCO’s intangible heritage lists. These cultural treasures provide unique and attractive settings for conferences, conventions, and exhibitions. The mix of ancient landmarks and natural beauty appeals to both international organizers and attendees, making Vietnam a compelling choice for those seeking an inspiring venue. The rich cultural backdrop enhances the event experience and adds value to business tourism in the country. Therefore, this further is creating a positive Vietnam MICE market outlook.

Economic Growth and Middle-Class Expansion

Vietnam's strong economic growth is significantly impacting the MICE market's development, especially due to the increasing middle class. In 2023, only 13% of the population was classified as middle class, but projections from the Ministry of Labour, Invalids and Social Affairs indicate that this figure will rise to 26% by 2026. This demographic transition is driving a rise in demand for corporate meetings, incentive travel, and team-building events. As disposable incomes rise, the swiftly growing middle class has emerged as a crucial consumer segment for MICE services in a remarkably short period. Event organizers are modifying their offerings to meet the requirements of this burgeoning market. These enhanced packages attract a more diverse audience that is in search of unique and unforgettable experiences.

Vietnam MICE Industry Segmentation:

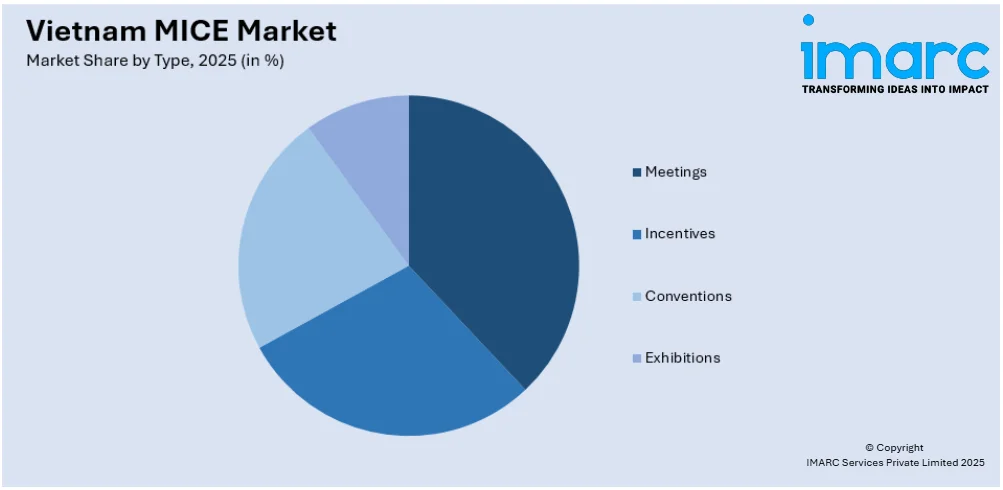

IMARC Group provides an analysis of the key trends in each segment of the Vietnam MICE market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type.

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- Meetings

- Incentives

- Conventions

- Exhibitions

The meetings segment currently dominates the market in 2025. Businesses are increasingly turning to Vietnam due to its world-class meeting facilities, value-for-money pricing, and as a natural hub in Southeast Asia. Development is further enhanced by government support, including extended and simplified visa policies and the rejuvenation of infrastructure. In addition, with the post-pandemic trend of hybrid and virtual meetings opening up new possibilities that enable individuals to attend both physically and virtually has significantly provided a boost to the Vietnam MICE market demand in this segment. With escalating demand from finance, technology, and healthcare sectors, Vietnam is rapidly emerging as a destination of choice for corporate/association meetings.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam, with the capital city of Hanoi, is a significant region with its political hub and exquisite cultural heritage. The region possesses first-class meeting venues, such as the National Convention Center and the Hanoi International Exhibition Center, which are ideal for large meetings and government conferences. Northern Vietnam gets a good share of corporate events from sectors such as finance, technology, and manufacturing, all aided by robust infrastructure and great international air connectivity through Hanoi’s Noi Bai Airport. National policies to encourage MICE tourism and ongoing growth of hotel investments complete the positioning of this compact, small country as a first-rate destination for large, high-profile meetings and conventions.

Embodied by Hue and Da Nang, central Vietnam has emerged as a thrilling MICE destination, where heavenly beaches and state-of-the-art infrastructure coexist. With enhanced infrastructure such as expressways and Da Nang International Airport, accessibility is convenient and simple in this area. The region is attractive to corporate retreats, health-focused incentives, and global conventions, particularly in the travel and hospitality sectors. With affordable, naturally stunning, and growing in luxury hotels, Central Vietnam is a strong competitive option for traditional MICE destinations, with excellent potential for future business and leisure-driven events growth.

Southern Vietnam, led by Ho Chi Minh City, is quickly emerging as the nation's most dynamic MICE market, driven by its economic isolation and cosmopolitan charm. The area's top venues, such as the SECC and the new Gem Center, draw international trade shows, high-tech industry conferences, and corporate events. Due to being located next to emerging business centers, including Dong Nai and Binh Duong, a great number of industrial and commerce-related events prefer this region. Southern Vietnam's blend of city sophistication with a relaxed, tropical lifestyle ensures Southern Vietnam's status as Vietnam's preferred MICE destination for both inbound and outbound events.

Competitive Landscape:

Vietnam's competitive MICE market is intensifying as industry players scale up their operations to capture the thriving demand. Numerous key players are implementing technology solutions to support hybrid events while making strategic alliances with overseas event organizers and airlines to enhance accessibility. Destination management companies are designing distinct, rewarding experiences by adding business programming with cultural and recreational activities. The cost of visibility-intensive marketing campaigns that reach regional and overseas corporate customers has elevated visibility exponentially. Competitive pricing models supplemented by value-added services have been a key driver of difference. According to the Vietnam MICE market forecast, green initiatives have rapidly become a top priority as venues adopt more sustainable practices to appeal to an increasing number of environmentally aware clients. As Vietnam's MICE market continues to evolve, the convergence of innovations, strategic collaboration, and sustainability is shaping a dynamic landscape poised for long-term growth and global competitiveness.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam MICE market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: Ho Chi Minh City expanded its MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism, aiming to strengthen its position as a leading business travel hub. Efforts include infrastructure improvements, customized incentive programs, and cultural experiences, aiming for 8.5 million visitors, while gaining international recognition for its MICE offerings.

- February 2025: Red Dot Representations partnered with Vietnam’s Thang Long Tours to promote culturally immersive travel experiences for Indian and global tourists. The collaboration aims to position Vietnam as a top destination for leisure and MICE travel, offering personalized itineraries that highlight the country’s authentic heritage and natural beauty.

- October 2024: Vietourist partnered with Appier to enhance customer engagement using AI tools AIQUA and BotBonnie. The collaboration led to a 171% lead increase and augmented MICE service promotion through personalized campaigns. Vietourist aims to further scale its MICE offerings and customer experience with continued AI integration.

- May 2024: Da Nang launched a new MICE tourism campaign after attracting 45,344 visitors in 2023. The city plans to support large delegations with event planning incentives, enhance international outreach, and promote itself at global fairs, aiming to strengthen its role as a leading MICE destination in Southeast Asia.

Vietnam MICE Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Meetings, Incentives, Conventions, Exhibitions |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam MICE market from 2020-2034.

- The Vietnam MICE market research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam MICE industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Vietnam MICE market was valued at USD 5,112.1 Million in 2025.

The growth of the Vietnam MICE market is driven by strong economic expansion, government support, increasing foreign investment, affordable costs, strategic location, world-class hospitality infrastructure, improved air connectivity, and rising demand for corporate travel, incentive programs, and hybrid conferences.

The Vietnam MICE market is projected to exhibit a CAGR of 4.10% during 2026-2034, reaching a value of USD 7,341.9 Million by 2034.

Meetings hold the largest share in the Vietnam MICE type market due to their consistent demand from corporate sectors, government organizations, and international businesses. The rise in business expansions, conferences, and professional gatherings has significantly driven the dominance of the meetings segment. Additionally, improved infrastructure and supportive government policies further support this growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)