Vietnam Motor Insurance Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, and Region, 2026-2034

Vietnam Motor Insurance Market Size and Share:

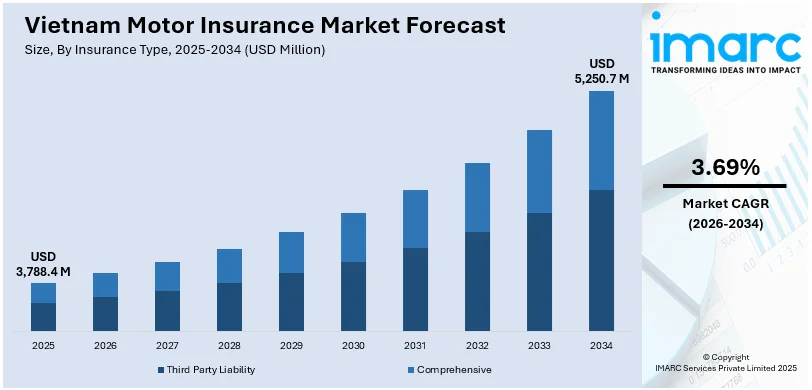

The Vietnam motor insurance market size was valued at USD 3,788.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 5,250.7 Million by 2034, exhibiting a CAGR of 3.69% from 2026-2034. Southern Vietnam currently dominates the market driven by the rising risk of road accidents and vehicle damage has heightened awareness of the need for insurance protection. Additionally, the growing use of commercial vehicles for inter-city transport and tourism increases demand for coverage. Expanding internet access and widespread smartphone usage have made it easier for consumers to research, purchase, and manage policies online. The introduction of usage-based insurance (UBI) offers personalized premiums, further attracting customers seeking cost-effective, tailored motor insurance solutions thus strengthening the Vietnam motor insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,788.4 Million |

| Market Forecast in 2034 | USD 5,250.7 Million |

| Market Growth Rate 2026-2034 | 3.69% |

Vietnam is experiencing a gradual increase in car ownership as more businesses and individuals invest in personal and business vehicles. Economic development, urban expansion, and better road networks have increased the availability of cars and motorbikes to the general public. With an increasing number of cars on the road, the need for motor insurance increases proportionally to cater to perils like accidents, theft, and damage. This growing car population gives insurers a steady stream of new business and policy renewals, and car growth is hence a major catalyst for the development of the motor insurance industry in both urban and rural locations.

To get more information on this market Request Sample

Increased adoption of technology in Vietnam's insurance industry is reshaping the motor insurance segment. Customers can purchase policies, lodge claims, and access customer service more conveniently through digital portals and mobile applications. Furthermore, telematics devices are gaining traction, enabling insurers to capture driving behavior and provide bespoke insurance products based on driving habits. This technology revolution not only improves customer experience but also facilitates insurers in better evaluation of risks and claims handling effectively. With deeper technology adoption, insurers can engage with more people, especially technology-embracing younger generations that prefer digital-first services.

Vietnam Motor Insurance Market Trends:

Shift Toward Digital & Telematics Solutions

The motor insurance industry in Vietnam is undergoing rapid digital transformation, driven by evolving customer expectations for convenience, speed, and transparency. Insurers are increasingly offering online policy purchases, digital claims processing, and mobile app services to meet these demands. Telematics technology, which tracks driving behavior to assess risk, is also emerging as a key innovation, allowing companies to offer personalized premiums based on individual driving habits. Although fewer than 5% of Southeast Asian insurers presently provide telematics-based solutions, almost 70% of customers say they would be interested in such individualized insurance options. This growing consumer demand highlights a major opportunity for insurers in Vietnam to differentiate themselves by adopting telematics and digital platforms. Overall, the shift towards digitalization and usage-based insurance reflects a broader trend of modernization and competitiveness in the market.

Growing Urbanization and Regulatory Influence

Urbanization is fundamentally transforming Vietnam's transport environment, particularly within cities where car ownership and road density are accelerating at a fast pace. As roads grow congested, the threat of accidents, theft, and damage to vehicles escalates, and people and companies seek motor insurance as a means of financial safety. Increased consciousness is also supplemented by regulation in the form of compulsory third-party liability insurance requirements for all car and motorcycle owners, as well as commercial fleets. Such policies guarantee extensive insurance coverage and aid to enhance market penetration throughout the nation. Furthermore, public campaigns encouraging road safety and safe driving practices are complementing the government's initiatives of decreasing accidents and traffic-related hazards. These together are propelling demand for basic and comprehensive motor insurance, thus urbanization and regulatory power becoming primary drivers for the industry.

Emergence of Electric Vehicle (EV) Insurance Products

With growing environmental awareness and government support for green mobility, EVs are becoming increasingly popular in Vietnam. About 15,700 EVs were sold in 2023, making up about 6% of all vehicle sales. The market is anticipated to expand at a compound annual growth rate of 17–18% until 2029–2032. This rapid adoption has prompted motor insurers to design specialized products tailored to the unique needs of EV owners. These policies cover specific risks such as battery damage, charging station incidents, and high-voltage system repairs, which are not typically included in conventional vehicle insurance. The rise of EV-focused insurance reflects both consumer interest in sustainable transport solutions and regulatory initiatives promoting eco-friendly vehicle use. This trend also presents opportunities for insurers to collaborate with automakers and offer innovative, customized insurance packages that meet the evolving demands of the EV market.

Vietnam Motor Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam motor insurance market, along with forecast at the regional, and country levels from 2026-2034. The market has been categorized based on insurance type and distribution channel.

Analysis by Insurance Type:

- Third Party Liability

- Comprehensive

Third-party liability insurance holds the majority share of 74.3% in Vietnam’s motor insurance market because it is mandatory by law for all vehicle owners. This regulatory requirement ensures that drivers are covered against legal and financial liabilities arising from injuries or damages caused to other people or their property. As a result, vehicle owners are compelled to purchase at least this basic level of coverage, making it the most common and widespread product. Additionally, many cost-conscious consumers, especially motorcycle owners and private vehicle users, opt only for third-party policies due to their affordability compared to comprehensive plans. The high number of two-wheelers and commercial vehicles on Vietnam’s roads further boosts the demand for this essential insurance type, sustaining its dominant position in the Vietnam motor insurance market outlook.

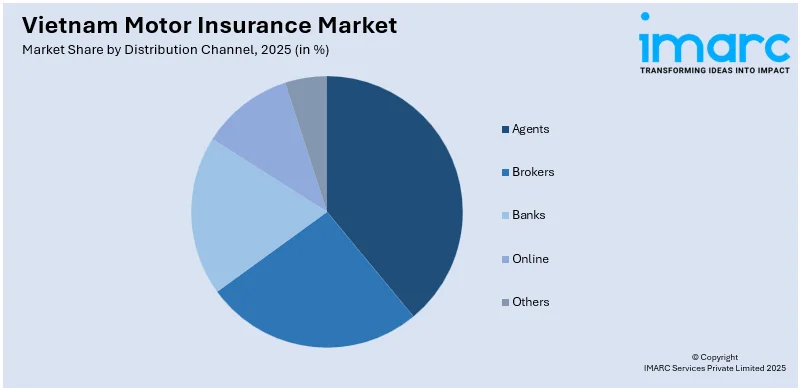

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Agents

- Brokers

- Banks

- Online

- Others

Agents play a dominant role in driving Vietnam’s motor insurance market growth due to their strong local presence, personal customer relationships, and ability to build trust among buyers. Many customers, especially in semi-urban and rural areas, prefer face-to-face interactions to understand policy terms, pricing, and benefits before purchasing. Agents also assist in claims processing, simplifying procedures for policyholders unfamiliar with digital tools. Their advisory role is critical in promoting add-on covers and comprehensive policies, beyond mandatory third-party liability insurance. Moreover, insurers heavily rely on agent networks to expand market reach, educate potential customers, and tap into growing demand from both individual vehicle owners and commercial fleet operators. This personalized service approach makes agents a key channel in the country’s insurance distribution landscape.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Based on the Vietnam motor insurance market forecast, Southern Vietnam remains the leading region due to its high population density, rapid urbanization, and strong economic activity. The region includes major urban centers and industrial hubs where personal and commercial vehicle ownership is significantly higher than in other parts of the country. As a result, the demand for both private and fleet motor insurance products is substantial. Additionally, the area has a well-developed road infrastructure supporting heavy traffic flow, which increases the risk of accidents and vehicle damage further driving the need for comprehensive insurance coverage. The presence of busy ports, logistics centers, and thriving tourism in Southern Vietnam also contributes to a higher reliance on transport vehicles, creating opportunities for insurers to offer specialized and diversified motor insurance solutions.

Competitive Landscape:

Urbanization is fundamentally transforming Vietnam's transport environment, particularly within cities where car ownership and road density are accelerating at a fast pace. As roads grow congested, the threat of accidents, theft, and damage to vehicles escalates, and people and companies seek motor insurance as a means of financial safety. Increased consciousness is also supplemented by regulation in the form of compulsory third-party liability insurance requirements for all car and motorcycle owners, as well as commercial fleets. Such policies guarantee extensive insurance coverage and aid to enhance market penetration throughout the nation. Furthermore, public campaigns encouraging road safety and safe driving practices are complementing the government's initiatives of decreasing accidents and traffic-related hazards. These together are propelling demand for basic and comprehensive motor insurance, thus urbanization and regulatory power becoming primary drivers for the industry.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam motor insurance market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Ford Vietnam launched "Ford Ensure" in partnership with four major insurers to offer a seamless, transparent vehicle insurance solution. The program provided instant policy issuance, fast claims, and guaranteed repairs at Ford-authorised dealerships using genuine parts, enhancing after-sales service quality and customer satisfaction across Vietnam.

- March 2025: Chubb acquired Liberty Mutual’s property and casualty business in Vietnam, including motor insurance operations. The deal transferred control of Liberty Mutual Insurance Vietnam to Chubb, expanding its presence in the country.

- March 2025: Geely Auto entered Vietnam with multiple vehicle models, including the all-electric EX5 and premium Monjaro SUV, supported by 15 dealerships. It partnered with Tasco Auto for a USD 168 Million assembly plant and offered comprehensive services, including insurance, aiming to provide customers with seamless ownership and after-sales experience.

Vietnam Motor Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment: ·

|

| Insurance Types Covered | Third Party Liability, Comprehensive |

| Distribution Channels Covered | Agents, Brokers, Banks, Online, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam motor insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam motor insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam motor insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Vietnam motor insurance market was valued at USD 3,788.4 Million in 2025.

The Vietnam motor insurance market is projected to exhibit a CAGR of 3.69% during 2026-2034, reaching a value of USD 5,250.7 Million by 2034.

Key drivers of Vietnam’s motor insurance market include rising vehicle usage and accident risk; mandatory third-party liability laws; expanding digital access and smartphone adoption enabling online policy purchases; growing commercial vehicle fleets for travel and logistics; and the emergence of usage-based insurance (UBI), offering tailored premiums and boosting customer appeal.

Southern Vietnam currently dominates the Vietnam motor insurance market due to its dense population, advanced urban infrastructure, and high vehicle ownership. The region’s bustling commercial activity, extensive transport networks, and thriving tourism drive substantial demand for both private and commercial vehicle coverage. Enhanced road risks and vehicle usage reinforce insurers’ focus there.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)