Vietnam Online Food Delivery Market Size, Share, Trends and Forecast by Order Method, Cuisine, and Region, 2025-2033

Vietnam Online Food Delivery Market Size and Share:

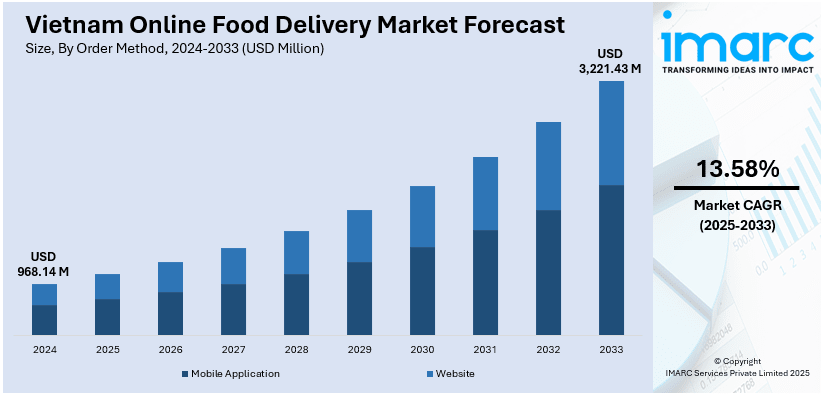

The Vietnam online food delivery market size was valued at USD 968.14 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,221.43 Million by 2033, exhibiting a CAGR of 13.58% from 2025-2033. Southern Vietnam currently dominates the market, holding a significant market share of over 52.3% in 2024. The market is witnessing significant growth, driven by changing consumer habits, urbanization, and increased use of mobile apps. Moreover, rising demand for convenience, digital payment adoption, and wider internet access are boosting service usage across both major and smaller cities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 968.14 Million |

|

Market Forecast in 2033

|

USD 3,221.43 Million |

| Market Growth Rate 2025-2033 | 13.58% |

One of the key drivers of the Vietnam online food delivery market is the rising adoption of smartphones and internet connectivity, particularly among younger, urban populations. According to the data published by ITA, Mexico's digital economy, with over 97 million internet users (81% of the population), is projected to reach $63 billion in e-commerce by 2025. Key government initiatives include the National Digital Strategy and the establishment of the Digital Transformation Agency, while the fintech sector boasts over 500 startups as of 2023.This digital shift has made food delivery platforms more accessible and convenient, allowing consumers to order meals with ease. Additionally, the growing demand for quick and contactless services, especially after the COVID-19 pandemic, has further accelerated the use of online food delivery apps. The convenience factor continues to reshape dining habits across major cities in Vietnam.

Another significant driver is the evolving lifestyle of Vietnamese consumers, with busy work schedules and a preference for ready-to-eat meals fueling demand. The rise of dual-income households and a growing middle class are contributing to higher disposable incomes, encouraging more frequent use of food delivery services. Furthermore, increased investments in logistics, improved delivery infrastructure, and strategic partnerships with restaurants are enhancing customer experience and efficiency, pushing the market toward sustained growth.

Vietnam Online Food Delivery Market Trends:

Strategic partnerships and collaborations

Strategic partnerships between online food delivery platforms and popular local restaurants contribute significantly to market growth. Collaborations enhance the variety of cuisines available, attract a broader customer base, and streamline logistics. By joining forces, these entities create synergies that benefit both the platforms and the restaurants, fostering a competitive edge in the market. Moreover, these partnerships often involve joint marketing efforts, co-branded promotions, and shared technology resources. This collaborative approach not only enriches the customer experience with diverse dining options but also optimizes operational efficiency for both platforms and restaurants. According to industry reports, Vietnamese consumers spent USD 1.4 Billion on online food delivery platforms such as Grab, ShopeeFood, Baemin, and GoJek. The mutual support in marketing and logistics results in a win-win scenario, solidifying the market presence of online food delivery platforms while boosting the visibility and reach of local eateries. This interconnected ecosystem strengthens customer loyalty, as users appreciate the seamless integration of their favorite restaurants into the online delivery landscape.

Customer loyalty programs and discounts

Online food delivery platforms often employ customer loyalty programs, discounts, and promotional offers to retain existing customers and attract new ones. These initiatives create a sense of value for users, encouraging repeat business and expanding the customer base. As consumers seek cost-effective dining options, loyalty programs and discounts play a pivotal role in influencing their choices. Furthermore, these customer loyalty programs contribute to building a strong relationship between users and online food delivery platforms. The reward systems, which may include points, exclusive deals, or freebies, incentivize continued patronage. The growing popularity of these programs is evident in Vietnam, where the Vietnam Food and Beverage Market Report 2024, developed from research across 4,005 restaurants/cafes and 4,453 diners nationwide, highlights the effectiveness of loyalty programs and discounts in influencing consumer behavior. Discounts offered during promotional periods or on specific orders serve as powerful enticements, making online food delivery more appealing than traditional dining options. This strategic use of incentives fosters customer retention and also cultivates a positive brand image, positioning these platforms as value-driven and customer-centric entities in the competitive online food delivery market.

Rising integration of cloud kitchens

The integration of cloud kitchens or virtual kitchens is a driving force providing a favorable Vietnam online food delivery market outlook. These kitchens operate solely for fulfilling online orders, eliminating the need for a physical dining space. This model reduces overhead costs for restaurants and allows them to cater exclusively to the growing demand for online deliveries. The increased prevalence of cloud kitchens enhances the efficiency and scalability of online food delivery services. Moreover, the integration of cloud kitchens revolutionizes the culinary landscape by enabling greater agility and innovation. With a focus on digital orders, restaurants can experiment with diverse menus, respond quickly to changing consumer preferences, and optimize their operations for maximum efficiency. The absence of physical dining spaces streamlines costs, enabling these establishments to offer competitive pricing. This innovative model aligns with the modern consumer's demand for convenience, speed, and variety, further propelling the online food delivery market's growth. The strategic adoption of cloud kitchens not only benefits restaurants but also enhances the overall flexibility and adaptability of the online food delivery ecosystem.

Vietnam Online Food Delivery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam online food delivery market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on order method and cuisine.

Analysis by Order Method:

- Mobile Application

- Website

As per the Vietnam online food delivery market forecast, mobile application stands as the largest order method in 2024, holding around 74.7% of the market. Mobile applications dominate the Vietnam online food delivery market due to their convenience, user-friendly interfaces, and seamless ordering experience. Platforms like GrabFood, ShopeeFood, and Baemin offer fast access, real-time tracking, secure payment options, and personalized promotions, making them the go-to choice for consumers. With rising smartphone usage and internet penetration, mobile apps have become the primary channel for food orders. Frequent updates, intuitive designs, and exclusive app-based discounts further strengthen their position as the leading segment in the market.

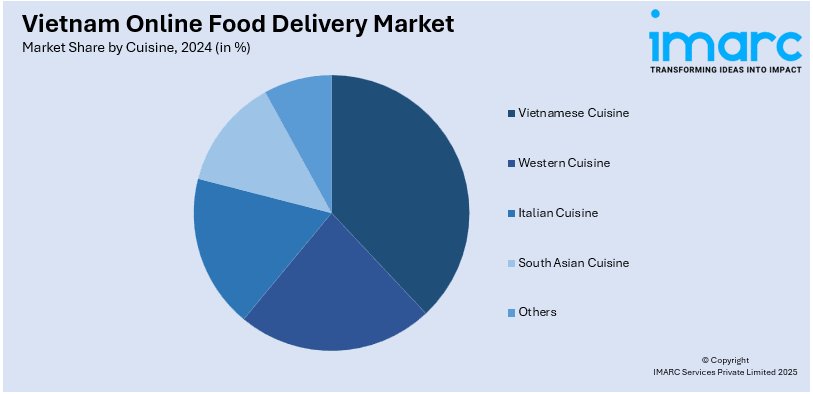

Analysis by Cuisine:

- Vietnamese Cuisine

- Western Cuisine

- Italian Cuisine

- South Asian Cuisine

- Others

Vietnamese cuisine leads the market with around 46.8% of Vietnam online food delivery market share in 2024. Vietnamese cuisine leads the online food delivery market in Vietnam, driven by strong local preference and cultural attachment to traditional dishes. Favorites like pho, banh mi, bun cha, and com tam are widely available on major platforms and enjoy consistent demand across all age groups. These meals are not only affordable and flavorful but also cater to daily consumption needs, making them a staple in online orders. The familiarity, accessibility, and quick preparation time of Vietnamese dishes contribute to their dominance.

Regional Analysis:

- Southern Vietnam

- Northern Vietnam

- Central Vietnam

In 2024, Southern Vietnam accounted for the largest market share of over 52.3%. Southern Vietnam accounted for the largest share in the country’s online food delivery market, led by urban centers like Ho Chi Minh City. The region’s high population density, fast-paced lifestyle, and widespread smartphone and internet usage have accelerated the adoption of delivery apps. A strong presence of working professionals and students fuels demand for convenient meal solutions. Moreover, the region has a dense network of restaurants, cloud kitchens, and delivery partners, enabling faster fulfillment and broader cuisine options, further boosting order volumes.

Competitive Landscape:

The Vietnam online food delivery market is characterized by intense competition, driven by rapid urbanization, growing smartphone penetration, and increasing consumer preference for convenience. Companies are striving to enhance user experience through faster delivery times, intuitive app interfaces, and varied payment options. Aggressive promotional strategies, including discounts and loyalty programs, are commonly employed to attract and retain customers. Moreover, partnerships with local restaurants and cloud kitchens are expanding service reach and menu offerings. As competition intensifies, businesses are investing in technology and logistics to differentiate themselves and scale operations efficiently. This competitive push continues to shape and expand overall Vietnam online food delivery market demand.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam online food delivery market with detailed profiles of all major companies, including:

- Vietnammm.com (Takeaway.Com N.V.)

- Foody.vn

- Now.vn

- Eat.vn

- Grab Food

Latest News and Developments:

- January 2024: Be Group, a Vietnamese multi-service application company, is expanding its operations and market share in Vietnam. It has secured funding to rival Grab Holdings, the market leader, and has grown to 40 cities and provinces since 2018. Be Group aims to reach 20 million users and $200 million in annual revenue by 2026.

- September 2024: Gojek exited Vietnam's food delivery market in 2024 due to unsustainable heavy discounts and fierce competition, particularly from Grab. The company struggled to gain significant market share despite offering a range of services like ride-hailing and parcel delivery.

Vietnam Online Food Delivery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Order Methods Covered | Mobile Application, Website |

| Cuisines Covered | Vietnamese Cuisine, Western Cuisine, Italian Cuisine, South Asian Cuisine, Others |

| Regions Covered | Southern Vietnam, Northern Vietnam, Central Vietnam |

| Companies Covered | Vietnammm.com (Takeaway.Com N.V.), Foody.vn, Now.vn, Eat.vn, Grab food, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam online food delivery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam online food delivery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam online food delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Vietnam online food delivery market was valued at USD 968.14 Million in 2024.

The growth of Vietnam’s online food delivery market is driven by increasing smartphone usage, rising internet penetration, changing consumer lifestyles, and growing demand for convenience. Urbanization, busy work schedules, and improved delivery logistics also contribute significantly to market expansion.

IMARC estimates the Vietnam online food delivery market to reach USD 3221.43 Million by 2033, exhibiting a CAGR of 13.58% from 2025-2033.

Southern Vietnam currently dominates the online food delivery market due to its dense urban population, particularly in cities like Ho Chi Minh City. High digital adoption, busy lifestyles, and strong demand for convenience contribute significantly to the region's market leadership.

Some of the major key players include, Vietnammm.com (Takeaway.Com N.V.), Eat.vn, Foody.vn, Now.vn, Grab Food, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)