Vietnam Plywood Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2025-2033

Vietnam Plywood Market Overview:

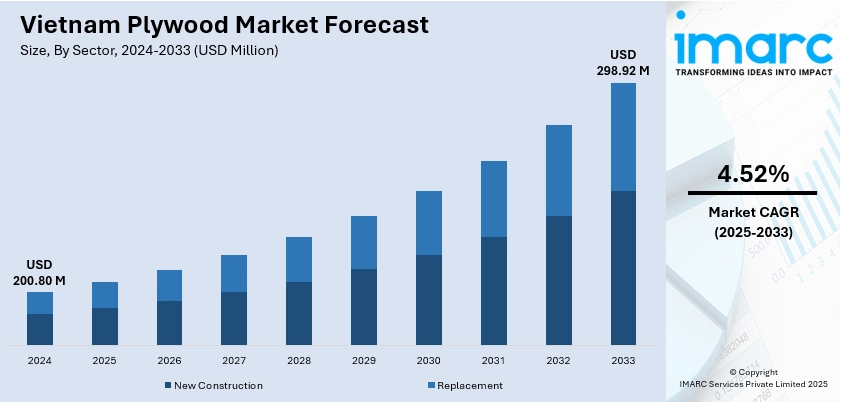

The Vietnam plywood market size reached USD 200.80 Million in 2024. The market is projected to reach USD 298.92 Million by 2033, exhibiting a growth rate (CAGR) of 4.52% during 2025-2033. Rising export-oriented production is driving the demand for large-scale, efficient, and high-quality plywood manufacturing. As the government is spending resources on roads, bridges, airports, industrial parks, schools, and hospitals, there is a growing need for construction materials like plywood that are strong, lightweight, and easy to handle. This is fueling the Vietnam plywood market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 200.80 Million |

| Market Forecast in 2033 | USD 298.92 Million |

| Market Growth Rate 2025-2033 | 4.52% |

Vietnam Plywood Market Trends:

Increasing export-oriented production

Rising export-oriented production is positively influencing the market. Based on Volza's Vietnam Export data, Vietnam shipped 1,890,872 consignments of plywood from November 2023 to October 2024 (TTM). Vietnam is focusing heavily on producing plywood for international markets, such as the United States, Japan, South Korea, and the EU. As global buyers are looking for reliable and affordable plywood suppliers, Vietnam’s competitive pricing, skilled labor, and steady raw material supply are making it an attractive option. Manufacturers are investing in better machinery, technology, and quality control to meet strict export standards, which improves the overall capacity and quality of the plywood industry. Export-oriented production also encourages the use of certified and eco-friendly wood, as international markets often require sustainability standards. The steady flow of foreign orders gives local producers financial stability. It is also creating jobs and strengthening Vietnam’s reputation as a major plywood supplier. The emphasis on exports is leading to specialization in different grades and types of plywood, such as moisture-resistant and marine plywood, tailored to customer needs. As international demand is growing, factories are scaling up and innovating to stay competitive. This export-based approach is supporting the continuous modernization of the industry.

To get more information on this market, Request Sample

Growing infrastructure development

Rising infrastructure development is impelling the Vietnam plywood market growth. As the government is investing in roads, bridges, airports, industrial parks, schools, and hospitals, there is an increasing need for construction materials like plywood that are strong, lightweight, and easy to handle. Plywood is commonly used for formwork in concrete casting, temporary structures, scaffolding platforms, wall paneling, and flooring. Its cost-effectiveness and reusability make it ideal for large-scale infrastructure projects. As Vietnam continues to urbanize and expand its transport and utility networks, construction activity is rising sharply, boosting plywood utilization. The rapid growth of industrial zones and public infrastructure is also attracting more private investment, further catalyzing the demand. Additionally, plywood manufacturers are benefiting from bulk orders and long-term contracts, encouraging them to broaden production capacity and improve item quality. Infrastructure development also improves logistics and transportation, helping plywood factories distribute their products more efficiently across the country. Overall, Vietnam’s burgeoning construction sector is driving continuous demand for plywood and strengthening the entire wood processing industry. As per industry reports, the Vietnam construction industry is projected to grow by 6% in 2025.

Vietnam Plywood Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and sector.

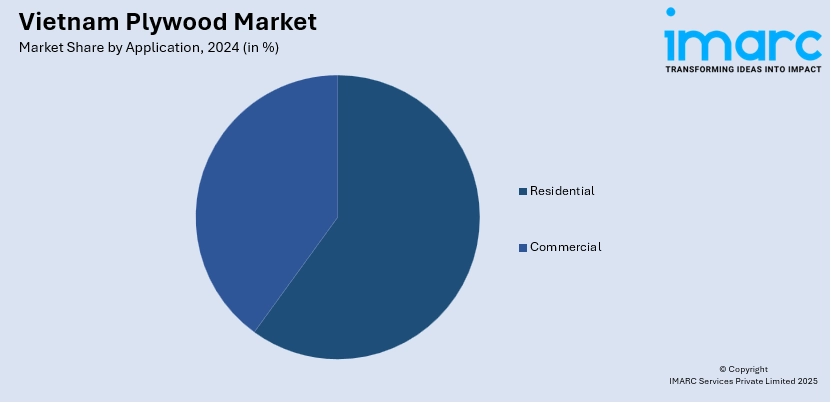

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Sector Insights:

- New Construction

- Replacement

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes new construction and replacement.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Plywood Market News:

- In March 2025, Hoa Phat invested in high-quality flooring plywood manufacturing, broadening its product line. Plywood for flooring would be a new product range within the Hoa Phat Group's ecosystem. In line with its long-term strategy, the firm aimed to dedicate 20% of its plywood production to the container segment, reserving 80% for high-end plywood items to cater to both local and international market needs. The Group aspired to rank among the Top 3 flooring producers in Vietnam by 2030.

- In March 2025, the Trade Remedies Authority of Vietnam advised companies to persist in observing the export and import of plywood products to avert illegal transhipment and false representation of Vietnamese origin. The DOC permitted qualified Vietnamese exporters to engage in a self-certification process to be relieved from the trade measures.

Vietnam Plywood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam plywood market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam plywood market on the basis of application?

- What is the breakup of the Vietnam plywood market on the basis of sector?

- What is the breakup of the Vietnam plywood market on the basis of region?

- What are the various stages in the value chain of the Vietnam plywood market?

- What are the key driving factors and challenges in the Vietnam plywood market?

- What is the structure of the Vietnam plywood market and who are the key players?

- What is the degree of competition in the Vietnam plywood market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam plywood market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam plywood market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam plywood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)