Vietnam Release Liners Market Size, Share, Trends and Forecast by Material Type, Substrate Type, Labelling Technology, Application, and Region, 2025-2033

Vietnam Release Liners Market Size and Share:

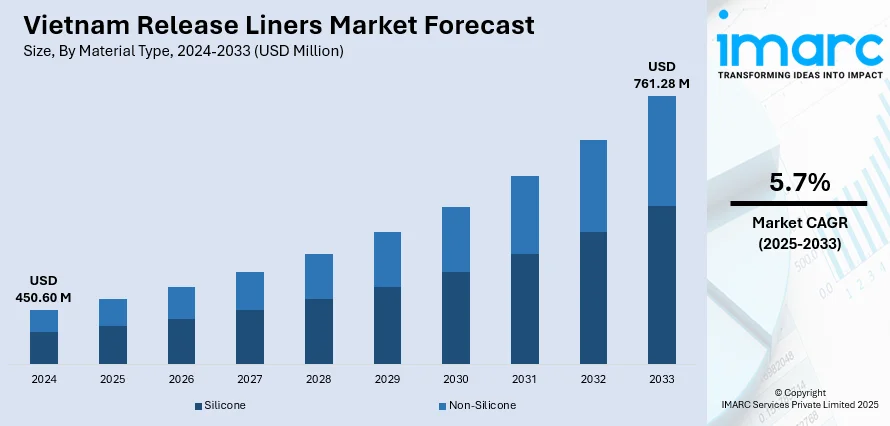

The Vietnam release liners market size was valued at USD 450.60 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 761.28 Million by 2033, exhibiting a CAGR of 5.7% during 2025-2033. Southern Vietnam dominated the market, holding a significant market share of 40% in 2024. The increasing need for effective packaging that is customized to meet specific product requirements is one of the key factors contributing to the Vietnam release liners market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 450.60 Million |

|

Market Forecast in 2033

|

USD 761.28 Million |

| Market Growth Rate 2025-2033 | 5.7% |

The market is growing due to rising demand from the packaging, electronics, automotive, and hygiene product sectors. As e-commerce expands, more pressure-sensitive labels are needed, increasing the use of release liners. The country’s growing manufacturing base, especially in electronics and automotive, further boosts demand. Industrial development zones and foreign direct investment have led to more domestic production of adhesives and labels, supporting liner use. Additionally, increased hygiene awareness after the pandemic has raised the consumption of sanitary products, which also require release liners. Regulatory pressure on waste and sustainability is prompting shifts toward recyclable and reusable liners, opening opportunities for innovation. Local manufacturers are also improving quality and capacity to meet both domestic and export needs, positioning Vietnam as a growing hub in the regional release liner supply chain, thereby further driving the Vietnam release liners market growth.

To get more information on this market, Request Sample

The growing demand for sustainable materials is influencing the Vietnam release liners market. New innovations, like release liners made from recycled and unbleached fibers, are being introduced to reduce environmental impact. This shift toward eco-friendly solutions is enhancing circularity and meeting the evolving needs of industries seeking greener alternatives. For instance, in June 2023, Finnish manufacturing company Ahlstrom, which also operates in Vietnam, introduced two new sustainable release liners for pressure-sensitive adhesive (PSA) tapes, expanding its Acti-V Industrial product line. These liners are designed to enhance circularity and reduce environmental impact by incorporating recycled and unbleached fibers.

Vietnam Release Liners Market Trends:

Industrial Growth Boosting Demand for Release Liners

Vietnam's industrial sector is experiencing steady growth, with the Index of Industrial Production (IIP) showing positive momentum. The month-on-month increase in industrial production signals a robust manufacturing environment, particularly in packaging, automotive, and electronics. As industries expand, there is a rising need for high-quality release liners used in adhesive products, labels, and other manufacturing applications. The demand for efficient production processes and durable materials, such as silicone, paper-based, and pressure-sensitive liners, is accelerating. This growth in industrial output is expected to further drive the Vietnam release liners market, as manufacturers seek innovative solutions to support their expanding operations and enhance product quality. The ongoing industrial boom offers promising opportunities for the release liners sector. For example, the World Bank Group reported that as of November 2024, the Index of Industrial Production (IIP) in Vietnam registered a 1.6% month-on-month growth, improving from 1.1% in October.

Growth in the Contact Adhesive Sector Driving Release Liner Demand

The growth of the contact adhesive market in Vietnam is driving increased demand for release liners. As the use of contact adhesives expands across industries like automotive, construction, and packaging, the need for efficient liner solutions becomes more crucial. Release liners play a key role in ensuring smooth application and handling of adhesives, providing necessary support for adhesive products. With continuous industrial advancements, manufacturers are seeking high-quality liners that offer durability, resistance, and precision. As demand for contact adhesives rises, the market for release liners will continue to grow, supporting the broader adhesive industry by providing essential solutions for diverse applications. The ongoing expansion of the contact adhesive market strengthens the overall need for compatible and reliable release liner options, positively influencing the Vietnam release liners market outlook. According to IMARC Group, the Vietnam contact adhesive market, which is closely linked with the use of release liners, is projected to grow at a CAGR of 4.23% during 2025–2033, reinforcing the sustained demand for compatible liner solutions.

Packaging Industry Driving Release Liner Market Growth

A key factor fueling this momentum is Vietnam's dynamic packaging and processing industry, which is growing at a rate of 10–15% annually, according to Paper Vietnam. Based on the Vietnam release liners market forecast, as Vietnam's industrial environment evolves, the regional market is positioned for further development, keeping up with the country's growing need for adhesive-based goods across various industries throughout the forecast period. This growth in the packaging sector is directly driving the need for release liners, which are essential for smooth and efficient adhesive applications in packaging, labeling, and manufacturing. As businesses invest more in advanced packaging technologies and sustainable solutions, the demand for specialized release liners, including eco-friendly options, continues to rise. Additionally, the surge in consumer goods and e-commerce packaging further strengthens the market for release liners, ensuring sustained growth for this sector in Vietnam.

Vietnam Release Liners Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam release liners market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on material type, substrate type, labelling technology, and application.

Analysis by Material Type:

- Silicone

- Non-Silicone

Silicone stood as the largest material type in 2024, holding around 70.6% of the market due to the growing demand for high-performance, durable materials in various industries such as automotive, electronics, and packaging. Silicone-coated release liners are popular for their superior resistance to high temperatures, chemical exposure, and ease of use in manufacturing processes. As industries in Vietnam expand and modernize, particularly in packaging and medical devices, the demand for silicone-coated liners is increasing. They offer precise release properties, ensuring smooth production flows and reducing product defects. Additionally, silicone release liners are preferred for applications requiring high-quality adhesive performance, making them highly valued in Vietnam’s growing market. With more manufacturers recognizing the benefits of silicone in enhancing product efficiency and quality, the silicone segment continues to be a significant driver, fueling the market’s expansion.

Analysis by Substrate Type:

- Paper-Based

- Glassine/Calendered Kraft Paper

- Polyolefin Coated Paper

- Clay Coated Paper

- Others

- Film-Based

- Polyvinyl Chloride

- Polypropylene

- Polyethylene

- Polyethylene Terephthalate

- Polystyrene

Paper-based led the market with around 59.8% of market share in 2024, owing to its cost-effectiveness, versatility, and eco-friendly appeal. Paper release liners are commonly used in various applications, including adhesives, labels, and medical products, thanks to their excellent printability and ease of handling. In Vietnam, industries such as packaging, labels, and textiles are expanding, increasing the demand for paper-based release liners. They offer a sustainable alternative to plastic-based liners, aligning with growing environmental concerns and the trend toward more sustainable packaging solutions. Paper-based liners also provide good barrier properties and are easily recyclable, making them attractive to businesses looking to reduce their carbon footprint. As Vietnam’s industrial and packaging sectors continue to grow, the demand for paper-based release liners will rise, positioning this segment as a key driver of the market.

Analysis by Labelling Technology:

- Pressure-Sensitive

- Glue-Applied

- Sleeving

- Stretch Sleeve

- In-Mold

- Others

Pressure-sensitive led the market with around 65.4% of market share in 2024 because of its widespread use in industries requiring high-performance adhesives. Pressure-sensitive release liners are crucial for products like tapes, labels, medical patches, and graphic films, as they provide reliable adhesion without needing heat or solvent activation. In Vietnam, the demand for pressure-sensitive products is rising across sectors such as packaging, automotive, and electronics, as businesses seek cost-effective, efficient, and versatile solutions. These release liners offer benefits like easy application, precision, and durability, making them ideal for a variety of consumer and industrial goods. As industries in Vietnam continue to expand, the need for pressure-sensitive liners grows, driven by their ability to enhance production processes and product quality. This demand for high-performance adhesive solutions fuels the growth of the pressure-sensitive segment in Vietnam's release liners market.

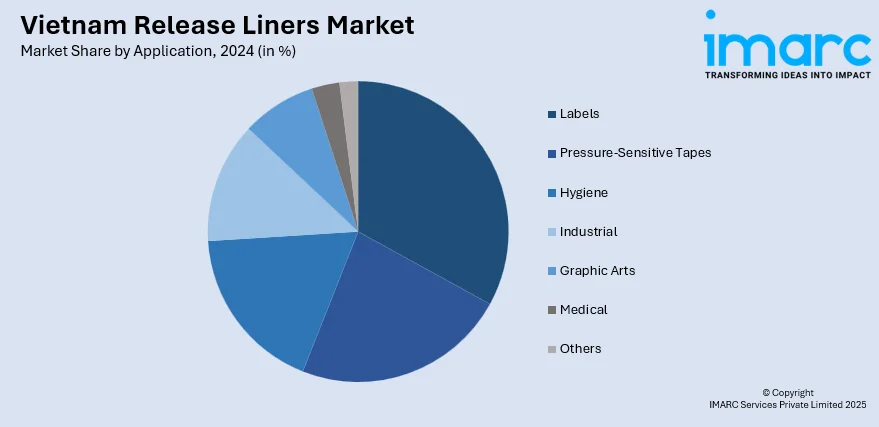

Analysis by Application:

- Labels

- Pressure-Sensitive Tapes

- Hygiene

- Industrial

- Graphic Arts

- Medical

- Others

Labels led the market with around 50.9% of market share in 2024 due to the rapid growth of the packaging and retail sectors. Labels are essential for branding, product identification, and compliance in various industries, including food and beverage, pharmaceuticals, and consumer goods. As the demand for packaged goods increases in Vietnam, the need for efficient, high-quality label production rises. Release liners are crucial in the manufacturing of labels, providing a smooth, adhesive-friendly surface that ensures easy handling and application. With the rise of e-commerce and retail growth in Vietnam, the label market continues to expand, boosting the demand for release liners. Additionally, consumers’ growing preference for visually appealing and durable packaging further fuels this segment. The label sector’s growth is thus a significant driver of the release liners market in Vietnam, contributing to its overall expansion.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2024, Southern Vietnam accounted for the largest market share of over 40% due to its well-established industrial infrastructure and dense concentration of manufacturing facilities. Key provinces like Ho Chi Minh City, Binh Duong, and Dong Nai are home to many factories producing electronics, automotive components, labels, and packaging materials, all of which use release liners. The region benefits from strong logistics networks, including access to major ports like Cat Lai and Cai Mep-Thi Vai, making it easier to import raw materials and export finished goods. Foreign direct investment is also heavily focused in the south, bringing advanced production technologies and increasing output. Additionally, the region’s proximity to large consumer bases and industrial parks helps drive steady demand. These combined factors give Southern Vietnam a clear advantage in leading the national release liners market.

Competitive Landscape:

The Vietnam release liners market is witnessing steady activity, supported by industrial growth and rising demand across key sectors. Among recent developments, collaborations, partnerships, and joint ventures are the most common. These help local firms access technology and scale production to meet growing needs. Government support in the form of industrial zone expansion and manufacturing incentives is also shaping the market. Product innovation is ongoing, but usually tied to foreign partnerships rather than standalone domestic breakthroughs. Funding rounds and large-scale product launches are less frequent compared to strategic alliances and supply chain integrations. Overall, the market is developing steadily, with collaboration and partnership-driven models as the dominant current approach.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam release liners market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Oslo-based Elkem, which also has an office in Vietnam, launched Silcolease Re Poly 11362 and 368, its first recycled silicone-based release liner products, developed via patented depolymerization technology. These solvent-free products offer identical performance to virgin silicones and a 70% lower carbon footprint, aligning with the growing demand for sustainable solutions and ensuring seamless integration into high-speed coating processes.

Vietnam Release Liners Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Silicone, Non-silicone |

| Substrate Types Covered |

|

| Labelling Technologies Covered | Pressure-Sensitive, Glue-Applied, Sleeving, Stretch Sleeve, In-Mold, Others |

| Applications Covered | Labels, Pressure-Sensitive Tapes, Hygiene, Industrial, Graphic Arts, Medical, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam release liners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam release liners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam release liners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The release liners market in Vietnam was valued at USD 450.60 Million in 2024.

The Vietnam release liners market is projected to exhibit a CAGR of 5.7% during 2025-2033, reaching a value of USD 761.28 Million by 2033.

Growth in Vietnam’s packaging, electronics, and automotive industries is driving demand for release liners. Rising e-commerce, increased hygiene product use, and expanding label manufacturing also contribute. Foreign investment and industrial development zones support production growth. Environmental regulations are pushing innovation in recyclable and reusable liner materials, adding momentum to market expansion.

Southern Vietnam accounted for the largest share, holding around 40% of the market in 2024 due to its concentration of industrial zones, strong manufacturing base, better infrastructure, and proximity to ports, supporting higher production and export activities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)