Vietnam Tablet Market Report by Product, Operating System, Screen Size, End User, Distribution Channel, and Region, 2026-2034

Vietnam Tablet Market Overview:

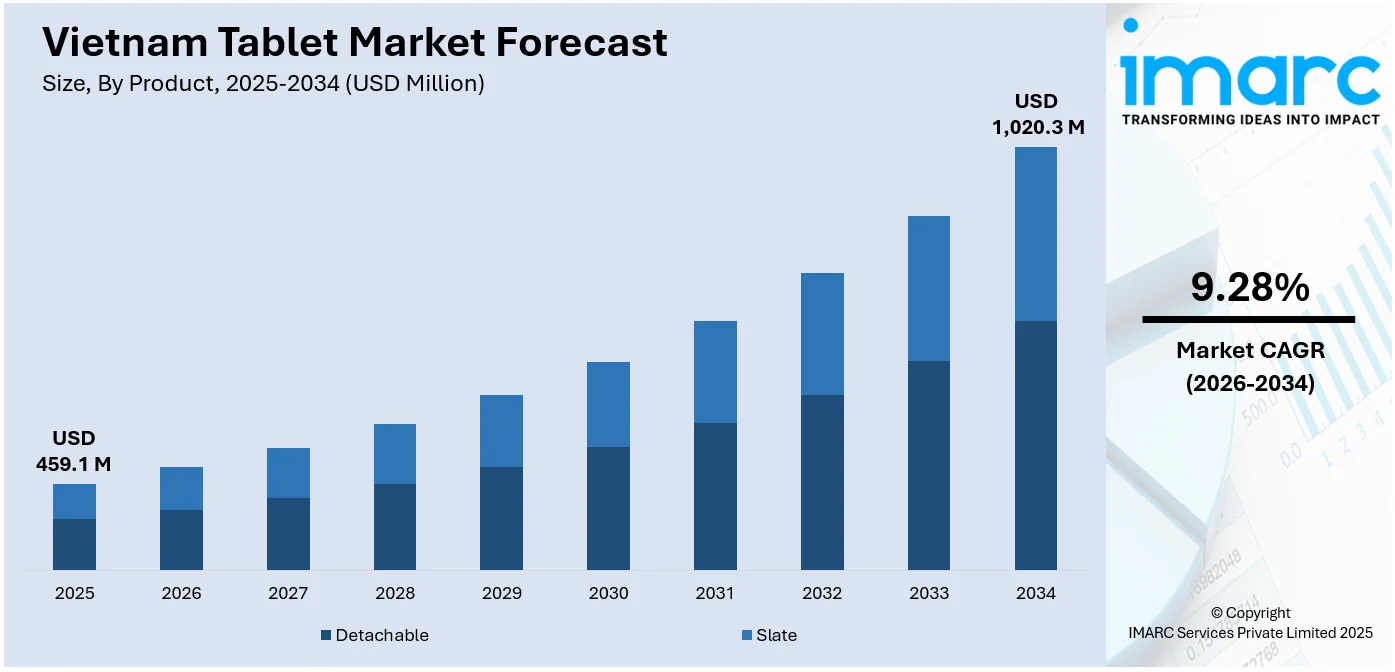

The Vietnam tablet market size was valued at USD 459.1 Million in 2025. The market is projected to reach USD 1,020.3 Million by 2034, exhibiting a CAGR of 9.28% from 2026-2034. The market is driven by digital consumption in retail, hospitality, education, healthcare, and e-commerce industries. Tablets are being used more and more for point-of-sale terminals, learning environments, telemedicine consultations, and internet shopping because they are portable, have intuitive user interfaces, and deliver impressive performance. Digital education programs sponsored by governments and increasing preference for mobile productivity tools are also driving demand. As Vietnam progresses on its path of digital transformation, all these factors combined contribute to the growth of the Vietnam tablet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 459.1 Million |

|

Market Forecast in 2034

|

USD 1,020.3 Million |

| Market Growth Rate 2026-2034 | 9.28% |

The tablet market in Vietnam is largely fueled by Vietnam's growing investment in digital transformation, especially in education and public administration. As the government promotes the use of digital technologies in schools, tablets are being used to enable engaging learning, particularly in rural and remote communities. The inclusion of tablets in national education schemes facilitates enhanced student interest, access to online curricula, and customized learning experiences. Moreover, digital governance changes are introducing mobile devices into regular routine work, improving public service provision. This development also gains strength from increasing internet penetration and widespread use of cloud platforms, which encourage mobile and tablet adoption. With continued modernization of its digital infrastructure in Vietnam, demand for tablets as affordable, mobile computing solutions is likely to grow, thus supporting Vietnam tablet market growth. According to the reports, in October 2024, BYD widened its Vietnam operations to fix the Apple tablets, further establishing Vietnam as an important nexus in the world tablet supply chain and production ecosystem.

To get more information on this market Request Sample

One of the main drivers of tablet use in Vietnam is accelerating consumer demand for thin, multi-purpose electronic products that bring the mobility of smartphones and functionality of laptops. As per the sources, in October 2024, Vietnam's Xelex Group introduced its Latimer laptop-tablet to the U.S., demonstrating Vietnam's increasing capacity for technology and its widening presence in sophisticated global tablet markets. Moreover, with changing lifestyle trends, particularly among young professionals, students, and city families, tablets are being used more for purposes like browsing, entertainment, remote working, and e-learning. Their compatibility with productivity tools, portability, and long battery lives make them the perfect travel companions for today's digital consumers. The growth of the gig economy and flexible work schedule is also driving tablet purchases higher, as consumers look for budget-friendly and efficient substitutes for conventional computing devices. In addition, the Vietnam tablet market outlook has shown a steady demand for screen-based entertainment such as video streaming and mobile gaming, which tablets address well. Such changing consumer behavior, backed by an expanding middle class and increased digital literacy, continues to drive tablet demand in both urban and semi-urban areas.

Vietnam Tablet Market Trends:

Emergence of Tablets in Retail, Hospitality, and Professional Segments

The tablet market in Vietnam is registering robust growth owing to the rising demand in the retail as well as hospitality segments. Companies in these sectors are leveraging tablets for diverse purposes, such as point-of-sale (POS) payments, electronic order management, and instant customer service improvement. Their portability and small size make them ideal for an environment that focuses on space efficiency and rapid interaction. In the hospitality industry, tablets allow waiters to manage orders more efficiently and enhance the speed of service, consequently enhancing overall customer satisfaction. In addition, healthcare professionals, salespeople, and field services representatives increasingly use tablets for purposes including inventory management, document processing, virtual meetings, and mobile presentations. The devices enable effortless communication and productivity regardless of location. With Vietnam's business environment adopting digital transformation, tablets have emerged as essential tools for driving efficiency, minimizing operational expenses, and enhancing customer interaction. Their flexibility in multiple business applications makes them central elements of enterprise digital infrastructure.

Increasing Role of Tablets in Vietnam's Educational Revolution

Vietnam's education industry is experiencing a significant digital revolution, and tablets are a strong driving force behind learning. Students and educators are both using tablets in their day-to-day activities for accessing digital textbooks, interactive education apps, and virtual classrooms. These technologies improve both distant learning and in-school teaching through the delivery of flexible, interactive, and personalized content. In 2024, Vietnam saw more than 204 million minutes spent on digital learning, as well as the opening of over 2 million new learner accounts. Reflecting a nationwide shift transition toward tech-enabled education. The trend has been further promoted by the government through online education programs, incorporating tablets in curricula of public and private schools. Nine in every ten Vietnamese schools are now online, supporting the 100% school connectivity target in Vietnam, as reported by the United Nations Development Coordination Office. Tablets have become necessary educational tools to ensure inclusive learning experiences across the country.

Tablet Integration into E-Commerce and Healthcare Services

Vietnam’s tablet market is expanding rapidly due to increasing adoption in e-commerce and healthcare. In e-commerce, tablets are favored for their larger screens and better navigation interfaces compared to smartphones, offering a seamless and visually rich shopping experience. People utilize tablets for product browsing, price comparison, and buying, particularly as Vietnam's e-commerce industry is expected to grow to USD 15.3 billion by 2025. This growth is fueling demand for compact but effective digital devices. At the same time, the health industry is adopting tablets due to their convenience in clinical settings. Medical staff use them to view electronic health records, provide telehealth consultations, and record real-time patient information at the bedside. Their portability, battery life, and simplicity play a significant role in optimizing operations in hospitals and clinics. As both industries continue to rapidly digitize, the functionality and ease of use of tablets are solidifying their role as vital tools for delivery of services and customer interaction.

Vietnam Tablet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam tablet market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, operating system, screen size, end user, and distribution channel.

Analysis by Product:

- Detachable

- Slate

Slate tablets were the uncontested leaders in the Vietnamese tablet market in 2025, holding an 85.4% market share. Their compactness, affordability, and versatility across all industries make them the choice of both consumers and professionals. With growing demand in the education, retail, and healthcare industries, slate tablets continue to satisfy mobility and performance needs without the complexity or extra weight of detachable accessories. Their simplicity increases ease of use, particularly in learning environments where ease of access and sturdiness are essential. Additionally, as companies incorporate improved processors, longer battery life, and intuitive interfaces, slate tablets appeal to a broader customer base comprising students, field workers, and mainstream users. The rise in the availability of slate tablets in entry-level and premium segments enables broad market coverage across income segments. Their cost-effectiveness and utility make slate tablets the top form factor in Vietnam tablet market trends.

Analysis by Operating System:

- Android

- iOS

- Windows

Android tablets dominated the Vietnam tablet market at 59.7% share in 2025, thanks to their open-source versatility, widespread brand involvement, and affordability. Offering several device choices from low-end to premium models, Android tablets appeal to varying user needs in education, enterprise, and entertainment applications. The flexibility of the Android operating system enables localized content and applications, in line with Vietnam's digital transformation endeavors. The presence of Android tablets in numerous screen sizes and capabilities also contributes to their prevalence in government and private digital projects. Regular system updates and integration with Google services easily contribute to their use in productivity and learning. In addition, the affordability of Android renders it the system of choice for mass purchase by institutions and schools. With app developers still streamlining apps for Android tablets, and distributors opening up wider channels for distribution, the operating system's grip on the Vietnamese market is likely to be stable and strong.

Analysis by Screen Size:

- 8’

- 8’’ and Above

8-inch and larger tablets held a significant 72.2% market share in Vietnam during 2025, reflecting the high demand for larger screens that enhance user experience and functionality. Such tablets provide better viewing experiences, making them suitable for media watching, online courses, remote meetings, and work activities. The ample screen real estate supports multitasking and seamless app navigation, particularly in business applications like healthcare and education. Larger tablets are also popular in retail settings where they are utilized for order taking, customer service, and point-of-sale applications. Increased digital educational programs, viewing of online content, and cloud services further accelerate this segment's growth. Enhanced battery life and high-resolution screens in this size range increase user satisfaction. As Vietnamese buyers more and more look for interactive and multifunctional gadgets for personal and business use, tablets in the 8-inch and larger category continue to dominate the Vietnam tablet market forecast with high and stable demand.

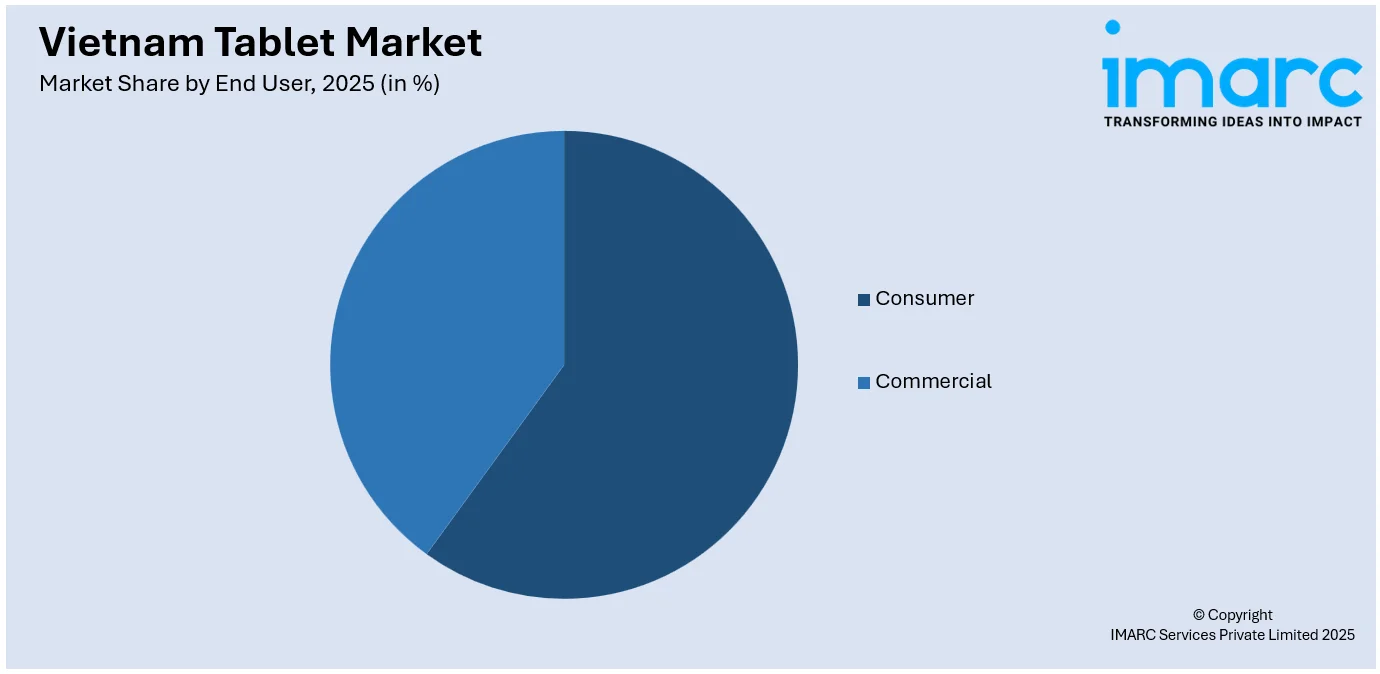

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Consumer

- Commercial

Consumers accounted for the biggest end-user group in Vietnam's tablet market in 2025, with an 80.8% share of overall demand. Tablets are used extensively by homes for learning, leisure, and communication. As internet penetration, digital literacy, and affordability rise, Vietnamese consumers have increasingly resorted to tablets as a multi-purpose substitute for laptops and smartphones. The pandemic-induced shift to online education and remote work has entrenched the use of tablets in daily habits, from educational lessons to video calls. Families are embracing tablets for kid-friendly apps, streaming, and simple productivity. Moreover, their convenience and user-friendly interfaces attract a wide age range, ranging from students to elderly consumers. The growth in e-commerce, online banking, and telemedicine has also spurred greater consumer dependence on tablets. Further digitization of government services and education reform by the government is likely to sustain high consumer adoption, cementing their leadership in Vietnam's expanding tablet landscape.

Analysis by Distribution Channel:

- Online

- Offline

Online channels contributed 58.7% to the distribution of Vietnam's tablet market in 2025, indicating a significant change in buying behavior by consumers. Online marketplaces, brand sites, and third-party websites have evolved into the most convenient source for purchasing tablets based on their affordability, competitive prices, and extensive availability of products. As access to the internet expands to urban and rural communities, online stores provide shoppers with convenient access to a multitude of brands, models, and configurations. The option to compare features, read reviews, and take advantage of seasonal discounts further increases online shopping. This trend is specially strong among young, technologically savvy consumers who prefer shopping digitally. Apart from this, integration with online payment systems and improved logistics infrastructure has dramatically improved the overall shopping experience. With increasing brands making investments in online presence and post-sales service, the digital platforms can be expected to further solidify their stake, playing a major role in the dynamic growth of the Vietnam tablet market.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Southern Vietnam is a key area within the tablet market of the country on account of its high density population, economic vitality, and fast-evolving urbanization. The region, which has key cities such as Ho Chi Minh City, enjoys strong infrastructure, high internet penetration, and a digitally savvy consumer base. Tablets are also widely being picked up in this region for academic, retail, and professional applications, with schools, startups, and businesses adopting digital solutions. The high number of shopping malls and retail chains present in the region also makes access to latest tablet models easy, both offline and online. In addition, digitally driven government-backed projects and smart city projects in the south are stimulating wider adoption of tablets in public services and education. Southern Vietnam remains a trendsetter when it comes to the adoption of digital technologies and an important growth region for manufacturers and distributors looking to extend their presence in the country's competitive and dynamic tablet market.

Competitive Landscape:

The tablet market in Vietnam is marked by intense competition among many international and local players providing a wide variety of devices across various price categories. The companies compete based on performance, design, screen size, battery life, and operating systems to address changing consumers' and professionals' needs. Strong demand from the education, healthcare, retail, and e-commerce industries has prompted manufacturers to bring user-focused features like stylus support, tough build, and state-of-the-art connectivity options. An influx of affordable tablets has increased access, especially among the education and public sectors. At the same time, high-end devices with improved screen quality, processing, and multitasking features appeal to enterprise and tech-savvy consumers. Distribution channels via e-commerce websites, electronics stores, and authorized brand outlets have also grown market reach. With digitalization gaining pace in Vietnam, businesses are adding more products to offerings and pursuing localized strategies in order to resonate with a broad population, enhancing competition in the Vietnam tablet market.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam tablet market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: OPPO prepared to launch the OPPO Pad SE globally, starting with markets like Vietnam and Singapore. The tablet features a MediaTek MT6789 chipset, a 10.95-inch display, 4GB RAM, and 128GB storage. With both cellular and Wi-Fi variants certified, it targeted mid-range users seeking affordable yet capable tablet options.

- February 2025: Samsung prepared to launch the Galaxy Tab S10 FE and S10 FE+ in 2025, with the S10 FE+ receiving KRRA certification in South Korea. Manufactured in Vietnam, the tablets featured Exynos 1580 chips, up to 12GB RAM, 256GB storage, Android 15, and a 12MP front camera, signaling strong mid-range potential.

- January 2025: Lenovo launched its budget Tab in Vietnam with a 4G variant featuring a 10.1-inch LCD display, Helio G85 processor, 4GB RAM, up to 128GB storage, Android 14, and Dolby Atmos speakers. Priced from USD 159, it offers a 5,100mAh battery, fast charging, IP52 rating, and basic cameras for everyday use.

Vietnam Tablet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Detachable, Slate |

| Operating Systems Covered | Android, iOS, Windows |

| Screen Sizes Covered | 8’, 8” and Above |

| End Users Covered | Consumer, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam tablet market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam tablet market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tablet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tablet market in the Vietnam was valued at USD 459.1 Million in 2025.

The Vietnam tablet market is projected to exhibit a CAGR of 9.28% during 2026-2034, reaching a value of USD 1,020.3 Million by 2034.

The market is fueled by growing digital uptake in education, retail, and healthcare segments, as well as rising demand for convenient, multi-purpose devices. Digital learning programs supported by the government and expansion of e-commerce and online services also contribute to market growth. Tablets provide flexibility, convenience, and improved user experience, making them perfect for e-learning, mobile productivity, and interactive consumer engagement across various user segments in Vietnam.

The slate tablet market segment holds the highest percentage of the Vietnamese tablet market at 85.4%. This is due to its classy design, easy-to-use interface, and low price. Its functionality in a range of consumer, educational, and business uses makes it the most sought-after device among users, supporting its dominant position in the overall tablet market space.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)