Vietnam Telecom Market Size, Share, Trends and Forecast by Services, Application, and Region, 2026-2034

Vietnam Telecom Market Size and Share:

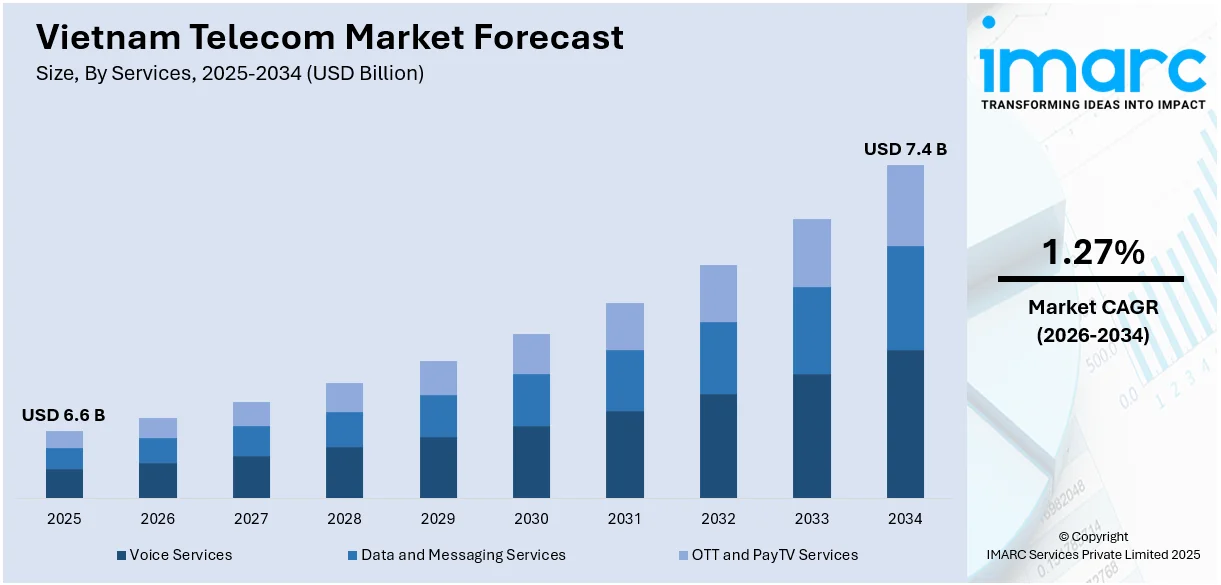

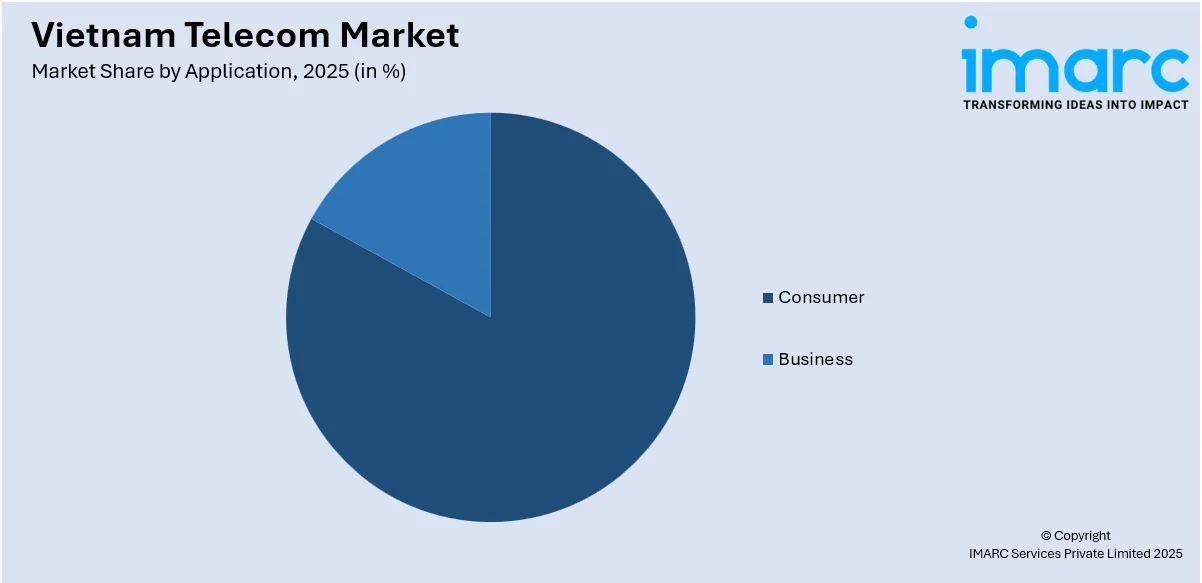

The Vietnam telecom market size was valued at USD 6.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 7.4 Billion by 2034, exhibiting a CAGR of 1.27% during 2026-2034. Southern Vietnam currently dominates the market, holding a significant market share of over 35.3% in 2025. The telecom market was led by data and messaging services in 2025, which made up 57.6% of the total share. Additionally, the consumer segment held the largest share of the telecom market in 2025 at 83.8%. The market is growing steadily, supported by rising mobile and internet usage, developing 5G infrastructure, and demand for digital services. Infrastructure expansion, wider smartphone adoption, and competitive service offerings are helping shape consumer behavior and provider strategies across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.6 Billion |

| Market Forecast in 2034 | USD 7.4 Billion |

| Market Growth Rate 2026-2034 | 1.27% |

The telecom market Vietnam continues to shift toward data-centric services, with mobile internet and broadband usage rising across regions. Increased access to smartphones and affordable data plans has encouraged more users to move online, making mobile data the preferred mode of connectivity. The shift away from voice-based services toward data-led usage is creating space for telecom providers to rollout more digital services, from streaming to app-based communications. In the lower part of the country, especially in expanding urban areas, there's a notable investment in 4G and pilot 5G deployments to meet the rising demand. Vietnam 5G rollout 2025 is a key focus, with major operators aiming for significant coverage expansion this year. Telecom players are also working on improving service quality and reach, ensuring stable connections even in semi-urban and rural pockets. In addition, broader access to digital payment systems and online platforms is driving internet engagement.

To get more information on this market Request Sample

The rise in digital service consumption and rural network expansion is shaping the telecom industry in Vietnam. As more consumers adopt streaming platforms, social media, and mobile apps, data demand continues to climb. This shift is encouraging telecom providers to invest in network capacity and broaden digital offerings beyond traditional voice and messaging. In mid-sized towns and peripheral zones, efforts are being made to improve coverage through public-private partnerships and government-led connectivity goals. These lower-tier areas are gradually gaining access to mobile broadband and fiber internet, helping reduce the digital gap. At the same time, telecom companies are introducing localized packages and multilingual support to serve these expanding user bases better. Increased interest in remote work, e-learning, and mobile-based financial tools has also raised the importance of reliable connections in underserved regions.

Vietnam Telecom Market Trends:

Improvement in Network Technologies

On August 22, 2022, MobiFone launched Ericsson's Spectrum Sharing technology and initiated carrier aggregation between its existing 1800MHz and 2600MHz bands, marking the first pilot of high-speed 5G services in Hue, Vietnam. Alongside this, MobiFone introduced new offerings designed to showcase the potential of 5G, including cloud gaming, 8K video streaming, virtual reality (VR), and extended reality (XR) applications. The 5G trial, supported by Ericsson's advanced technologies, expanded coverage by nearly 30% and enhanced network capacity, resulting in improved user experiences. Advancements in network technology, particularly the transition to 5G, are accelerating growth in Vietnam's telecom sector. Compared to earlier generations, 5G delivers significantly faster data rates and higher bandwidth, making it especially suitable for data-intensive activities like video streaming and online gaming. These improvements are enhancing user satisfaction and encouraging broader adoption across different segments of the population. Moreover, the adoption of Open Radio Access Network (ORAN) for 5G deployments is gaining traction, promising more flexible, cost-effective, and open network architectures. ORAN 5G allows for greater vendor diversity and innovation, fostering a more competitive ecosystem for network equipment and software.

Accelerated Digital Connectivity in Vietnam

Vietnam's communication sector is experiencing significant expansion, largely propelled by ambitious government programs centered on digitalizing public administration and fostering advanced urban development. These initiatives are generating substantial demand for robust network infrastructure, including accelerated 5G deployment and widespread fiber optic expansion. This strategic embrace of digital transformation by authorities is creating fertile ground for innovation and investment, ensuring continued vitality and advancement within the nation's digital landscape. For example, in April 2025, Vietnam has approved a pilot program for satellite internet Vietnam, specifically allowing Starlink, a SpaceX subsidiary, to provide services until 2031. This move aims to expand connectivity, particularly in remote and underserved areas, complementing existing fiber optic and 5G/4G networks. The pilot, capped at 600,000 subscribers, signifies Vietnam's openness to foreign investment in its evolving telecom market and its commitment to bridging the digital divide.

Surging Broadband Demand Driven by Smartphones

According to Vietnam Briefing, the country recorded 71 Million mobile broadband subscribers and nearly 19 Million fixed broadband subscribers in 2021, reflecting year-on-year growth of 4% and 14.6%, respectively. The widespread adoption of smartphones is a key factor fueling increased broadband demand and mobile data revenue in Vietnam. Affordable devices have expanded internet access significantly, especially for rural and low-income users. As smartphone ownership rises, so does the engagement with diverse online activities like browsing, media streaming, social networking, and mobile payments. This multifunctionality makes daily routines more efficient, driving higher consumption of telecom services. The growing user base, empowered by accessible and versatile smartphones, is boosting Vietnam's overall telecom market performance and broadband usage.

Integration of Advanced Technologies for Enhanced Services

The Vietnam telecom market forecast indicates a strong trajectory of growth, significantly propelled by the integration of advanced technologies. Artificial Intelligence (AI) and the Internet of Things (IoT) are playing a critical role in revolutionizing telecom services and operations across Vietnam. Artificial Intelligence (AI) is being deeply embedded within telecom networks to achieve various strategic objectives. AI capabilities are being utilized to optimize network performance, automate customer service interactions, and detect and prevent fraudulent activities. On August 1, 2022, Comviva announced a partnership with Vietnamobile to improve AI-driven customer interaction. Through this collaboration, Vietnamobile is using Comviva's MobiLytix platform to deliver real-time, personalized communication at scale. These developments reflect the growing emphasis on tech-driven service delivery, which is expected to strengthen Vietnam's telecom ecosystem in the years ahead. Additionally, LoRaWAN IoT, as a low-power, wide-area networking protocol, can be integrated within the broader Internet of Things (IoT) landscape, enabling a range of applications from smart agriculture to smart city initiatives in Vietnam, particularly in areas where traditional broadband infrastructure might be less developed.

Vietnam Telecom Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam telecom market, along with forecasts at the regional level from 2026-2034. The market has been categorized based on services and application.

Analysis by Services:

- Voice Services

- Wired

- Wireless

- Data and Messaging Services

- OTT and PayTV Services

In 2025, the data and messaging services led the telecom market, holding 57.6% of the market share, driven by the rapid increase in mobile internet usage and widespread adoption of smartphones across urban and rural areas, primarily driving this dominance. Consumers are shifting toward digital communication platforms, reducing reliance on traditional voice services. The rollout of affordable 4G and expanding 5G trials further fueled demand for high-speed connectivity. Additionally, the growing popularity of social media, mobile banking, online gaming, and video streaming significantly contributed to higher data consumption. Telecom providers have responded by introducing competitive data packages and bundled service plans, intensifying competition and innovation within the segment while reinforcing the central role of data services in Vietnam’s telecom landscape.

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Consumer

- Business

In 2025, the consumer segment led the telecom market, holding 83.8% of the market share, fueled by rising mobile penetration and increasing digital engagement among the population. A growing youth demographic, greater access to low-cost smartphones, and the expansion of mobile broadband coverage have collectively boosted demand for telecom services among individuals. Lifestyle changes such as increased remote working, online education, and entertainment streaming have also amplified individual data usage. Telecom operators have focused on tailored prepaid and postpaid plans, offering flexible options that meet diverse consumer needs. Loyalty programs, bundled services, and promotions have further strengthened consumer uptake. This strong consumer base continues to be the primary driver of revenue generation and service innovation, prompting providers to prioritize user experience, reliability, and affordability in their offerings.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2025, the Southern Vietnam region led the telecom market, holding 35.3% of the market share, driven by its economic vitality and dense urban population. Cities such as Ho Chi Minh City have seen robust infrastructure development, high smartphone penetration, and strong demand for advanced digital services. The region benefits from a thriving commercial sector, tech-savvy residents, and a growing number of businesses relying on telecom solutions for operations and connectivity. Telecom providers have concentrated their investments here, rolling out faster networks and pilot 5G projects to cater to evolving user demands. Educational institutions, tech hubs, and a dynamic startup ecosystem have also spurred data consumption. This regional growth highlights the importance of tailored telecom strategies that address both residential and commercial needs in high-growth zones like Southern Vietnam.

Competitive Landscape:

The competitive landscape of the market is shaped by aggressive pricing, expanding service portfolios, and network quality enhancements. Operators are focusing on upgrading infrastructure, expanding fiber and 5G coverage, and offering bundled services to retain and grow their user base. High demand for data-driven services has pushed providers to innovate with flexible plans and digital platforms. Urban regions see intense rivalry due to higher customer density, while rural expansion is gaining traction through government-backed initiatives. Strategic partnerships, customer engagement efforts, and technology investments continue to drive competition and market positioning.

Latest News and Developments:

- March 2025: MobiFone launched 5G services, becoming Vietnam’s third operator to do so. Initially available in urban centers, it offers speeds up to 1.5 Gbps. The service supports industries like healthcare and smart cities, contributing to the government’s goal of 50% 5G adoption by 2029.

- October 2024: VNPT Group launched Vietnam’s first XGS-PON WiFi 7 service using Qualcomm’s 10G Fiber technology. This next-generation internet solution offers high-speed, low-latency connectivity. The initiative strengthens VNPT’s technological leadership in the Asia-Pacific region and enhances domestic equipment manufacturing capabilities.

- October 2024: Viettel launched Vietnam’s first commercial 5G standalone (SA) network, offering speeds up to 1 Gbps. With coverage across 63 provinces, it provides flexible service packages for postpaid, prepaid, and industrial users.

- October 2024: Singapore's M1 acquired a 70% stake in Vietnam’s ADG for SGD 37.8 Million, expanding its telecom presence. M1 will leverage ADG’s IT expertise and partnerships to enhance enterprise solutions. The deal supports M1’s regional growth and complements Keppel Ltd.'s connectivity services.

- April 2024: Viettel Group launched the 30MW Hoa Lac Data Center, Vietnam's largest and first to commit to 30% renewable energy use. This advanced facility, designed for AI development with double the average capacity and robust security, significantly boosts Vietnam's telecom infrastructure. It adds to Viettel's existing 14 data centers, totaling 87MW power capacity, underscoring their commitment to national digital transformation.

Vietnam Telecom Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Applications Covered | Consumer, Business |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam telecom market from 2020-2034.

- The Vietnam telecom market research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam telecom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telecom market in Vietnam was valued at USD 6.6 Billion in 2025.

The telecom market is projected to exhibit a CAGR of 1.27% during 2026-2034, reaching a value of USD 7.4 Billion by 2034.

Key factors driving the telecom market include growing mobile and internet penetration, rising demand for data services, 5G deployment, digital transformation across industries, government initiatives, increasing smartphone adoption, and expanding rural connectivity and infrastructure investments by major telecom players.

In 2025, Southern Vietnam dominated the Vietnam telecom market with a market share of 35.3%, with growth driven by urban expansion, rising mobile subscriptions, 5G infrastructure development, and increasing demand for high-speed internet and digital services.

5G rollout in Vietnam is boosting network speeds, expanding coverage nationwide, and sparking use cases in healthcare, smart cities, industry automation, and e-commerce. Government incentives and operator investment aim for full 5G coverage by 2025, driving economic growth and digital transformation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)