Vietnam Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Vietnam Vegan Cosmetics Market Overview:

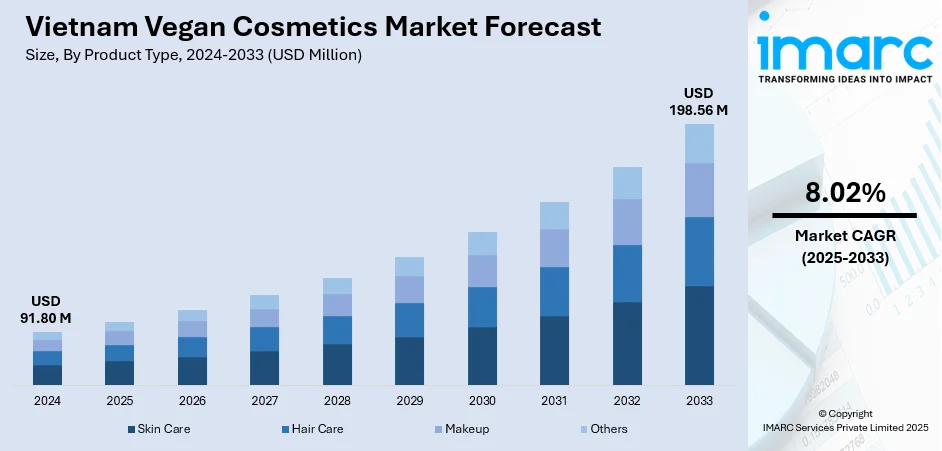

The Vietnam vegan cosmetics market size reached USD 91.80 Million in 2024. Looking forward, the market is expected to reach USD 198.56 Million by 2033, exhibiting a growth rate (CAGR) of 8.02% during 2025-2033. The market is fueled by increasing concern over animal welfare, green living, and the wellness of plant-based skin care. Social media influencers and celebrities are propagating vegan beauty movements, while Gen Z consumers are driving demand for transparency and clean-label products. Classic herbal knowledge is being reengineered by local companies to produce distinctive, culturally appropriate products, which further contributes to the growing Vietnam vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 91.80 Million |

| Market Forecast in 2033 | USD 198.56 Million |

| Market Growth Rate 2025-2033 | 8.02% |

Vietnam Vegan Cosmetics Market Trends:

Increasing Conscious Consumerism and Cultural Transformation

Vietnam's vegan cosmetics industry is booming in the backdrop of a larger cultural transformation fueled by growing environmental consciousness and conscious consumerism. As urban middle-class consumers grow more conscious about living sustainably and animal rights, they are increasingly turning away from animal-tested products, products containing animal-derived substances, or those with unsustainable packaging. This change is most apparent in urban areas like Ho Chi Minh City and Hanoi, where plant-based lifestyles have become increasingly popular. As per the Global Viewer consumer database maintained by INTAGE, 51% of Vietnamese women from Generation Z thoroughly investigate the ingredients and impacts of cosmetics prior to buying them. This represents the top outcome in Southeast Asia. shops and beauty parlors widely showcase cruelty-free beauty products, and social media stars promote awareness by supporting local vegan beauty companies. These influencers do not just endorse single products, as they also teach people how to read ingredient labels in Vietnamese, noting the use of animal-derived ingredients such as collagen and beeswax. This localized strategy helps to establish credibility with Vietnamese-speaking consumers, and brands are adapting by translating labels and promotional materials into Vietnamese.

To get more information on this market, Request Sample

Domestic Brand Innovation and Cultural Heritage

One of the significant trends in Vietnam's vegan beauty market is the way local brands are combining vegan innovation with traditional Vietnamese ingredients and skincare routines. Borrowing from a rich tradition of employing botanicals—like turmeric, green tea, kaffir lime, and rice bran—startups have created face masks, cleansers, and moisturizers that are cruelty-free and vegan-certified. Such companies invest into R&D to establish that plant extracts can deliver effective results similar to chemical-based solutions. They also promote such natural ingredients in their branding, linking contemporary commercialization with a proud heritage. Moreover, they also tap into national pride and consumer aspirations for authenticity. Some companies further subsidize rural farmers and cooperatives through sourcing arrangements that guarantee organic farming practices. This ensures supply traceability in the chain—essential for vegan certification—but also benefits rural livelihoods. The complementarity of heritage-based formulations, responsible sourcing, and consumer empowerment further contributes to the Vietnam vegan cosmetics market growth.

Retail Channels and Regulatory Landscape

Distribution strategies in the Vietnamese vegan cosmetics market are changing rapidly to keep up with consumer demand and regulatory trends. Earlier dominated by online stores and specialty organic shops, the niche has now entered mainstream drugstores and supermarket chains in big city centers. Vegan skincare and cosmetics are now available at top pharmacy chains in District 1 of Ho Chi Minh City or upmarket supermarkets in Da Nang, reflecting increasing availability. Meanwhile, in e-commerce, mainstream local sites like Shopee Vietnam and Lazada Vietnam feature frequent promotions and live-selling reviews conducted by influencers speaking Vietnamese in favor of cruelty-free products. In terms of regulation, the government has recently enforced stricter ingredient listing and product registration, with stricter labeling requirements that favor vegan brands. These encompass more precise denotation of preservatives, natural versus synthetic ingredients, and animal testing information, which provides a competitive advantage to vegan businesses that voluntarily follow open practices from the outset. This consumer protection climate facilitates greater ease for ethical brands to distinguish themselves, assuaging Vietnamese consumers regarding product safety. Consequently, the intersection of improved distribution infrastructure and facilitative regulation is generating fertile ground for long-term growth for Vietnam's vegan cosmetic industry.

Vietnam Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

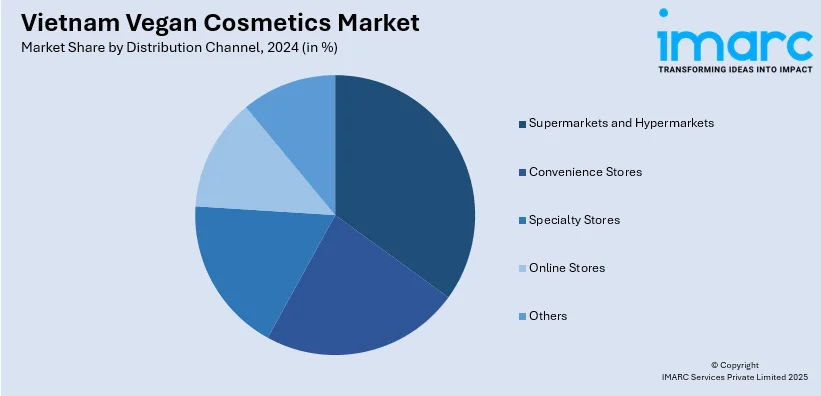

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Vegan Cosmetics Market News:

- In April 2025, Sol by Melia Phu Quoc announced the launch of the "Endless Summer" campaign, a special gift experience for resort guests for the next holiday season, in partnership with Cocoon Vietnam, a well-known vegan skincare brand in Vietnam.

Vietnam Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam vegan cosmetics market on the basis of product type?

- What is the breakup of the Vietnam vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Vietnam vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Vietnam vegan cosmetics market?

- What are the key driving factors and challenges in the Vietnam vegan cosmetics market?

- What is the structure of the Vietnam vegan cosmetics market and who are the key players?

- What is the degree of competition in the Vietnam vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)