Vietnam Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

Vietnam Vegetable Oil Market Overview:

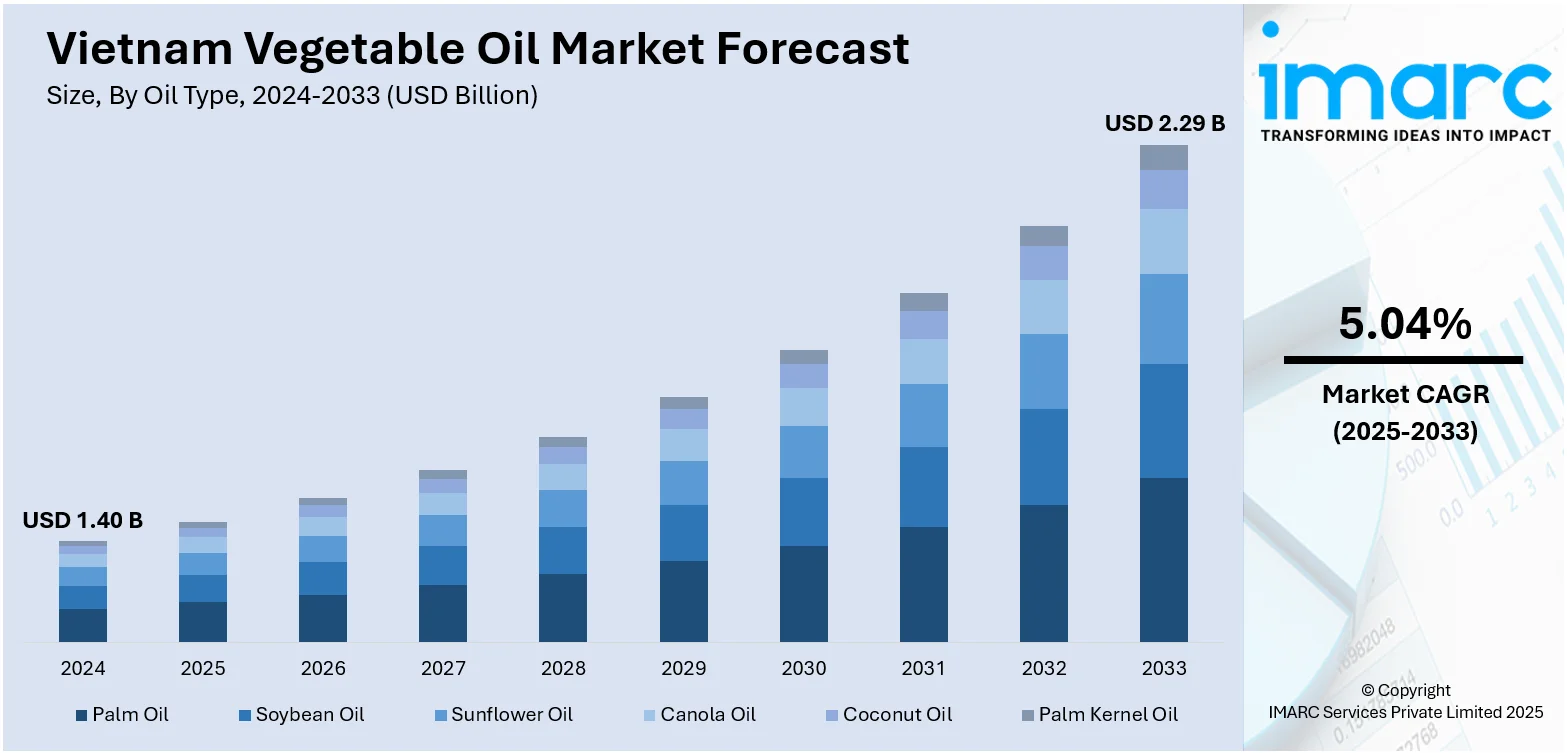

The Vietnam vegetable oil market size reached USD 1.40 Billion in 2024. Looking forward, the market is projected to reach USD 2.29 Billion by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033. The market is driven by widespread culinary use across households, restaurants, and food processors, rooted in traditional cooking habits and urban dietary shifts. Strategic refining capacity expansion and efficient crude oil import systems are optimizing domestic supply. Additionally, industrial demand from animal feed, cosmetics, and emerging biofuel applications is further augmenting the Vietnam vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.40 Billion |

| Market Forecast in 2033 | USD 2.29 Billion |

| Market Growth Rate 2025-2033 | 5.04% |

Vietnam Vegetable Oil Market Trends:

Dietary Preferences and Expansion of Packaged Food Sector

Vietnam’s traditional cuisine, centered on fried foods, stir-fries, and processed noodles, relies heavily on vegetable oil, creating a large and stable base of household and foodservice demand. The expansion of urban middle-class households and their shift toward packaged, ready-to-eat, and street food has driven increased usage of oils such as palm, soybean, and sunflower. Domestic brands are responding with blended and fortified oils that meet both price sensitivity and nutritional expectations. As cooking behavior in cities changes to favor convenience and speed, oil formats like pouches, sprays, and single-serve sachets have gained market share. The rise of local fast-food chains and regional QSR (quick-service restaurant) operators has further intensified institutional demand for frying oils that retain consistency and safety under high-temperature use. In rural areas, traditional cooking continues to rely on bulk palm oil due to its cost advantage, reinforcing a dual-structure consumption pattern. These patterns of consistent volume demand across income brackets and geographies ensure steady growth. The expansion of food processing, hospitality, and urban home cooking all play a role in sustaining Vietnam vegetable oil market growth, making edible oil a critical staple in the country’s evolving food economy.

To get more information on this market, Request Sample

Import Dependency and Strategic Refining Capacity Expansion

Vietnam imports a significant portion of its vegetable oil, particularly crude palm and soybean oils, from Indonesia, Malaysia, and Argentina. These imports are refined and packaged by domestic companies, which are now investing in refining upgrades and port-adjacent processing zones to reduce supply chain inefficiencies. Key players such as Calofic and Tuong An Vegetable Oil have expanded crushing and refining capacity near ports like Cai Mep-Thi Vai and Hai Phong. This infrastructure focus ensures rapid raw material turnaround and lowers costs linked to global price fluctuations. Vietnam’s strategic location also enables it to re-export refined oils to neighboring Cambodia, Laos, and parts of southern China. At the policy level, the government has supported value-added investment in oil refining and logistics hubs through targeted incentives and public–private partnerships. Furthermore, blending mandates, storage standards, and traceability guidelines are encouraging quality consistency across domestic production. As global commodity prices remain volatile, Vietnam’s ability to secure and refine large volumes of crude oil efficiently remains a vital economic lever. This import–refine–redistribute model not only satisfies local demand but positions Vietnam as a regional refining and re-export center.

Industrial Use in Animal Feed, Cosmetics, and Biofuels

Vegetable oil in Vietnam is not confined to culinary use; it also plays an essential role in feed formulation, personal care manufacturing, and nascent biofuel sectors. Oilcakes and byproducts from soybean and palm oil processing are widely used in poultry, aquaculture, and livestock feed, sectors that are rapidly industrializing in Vietnam. The demand for protein-rich feed inputs has driven cross-sector synergy between oil processors and feed producers. In the cosmetics and personal care industry, vegetable oils such as coconut and rice bran serve as base ingredients for soaps, lotions, and organic beauty products, aligning with the country’s growing natural cosmetics segment. Meanwhile, environmental targets and energy diversification policies have led to small-scale biodiesel pilot projects using used cooking oil (UCO) and palm oil derivatives. While biofuel demand remains limited, infrastructure and regulatory groundwork are being laid to encourage future uptake. This diversification into non-edible applications strengthens the vegetable oil sector’s resilience against food price cycles and broadens its industrial importance. The multi-industry demand from feed, beauty, and energy sectors adds layered momentum to the broader market’s evolution.

Vietnam Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

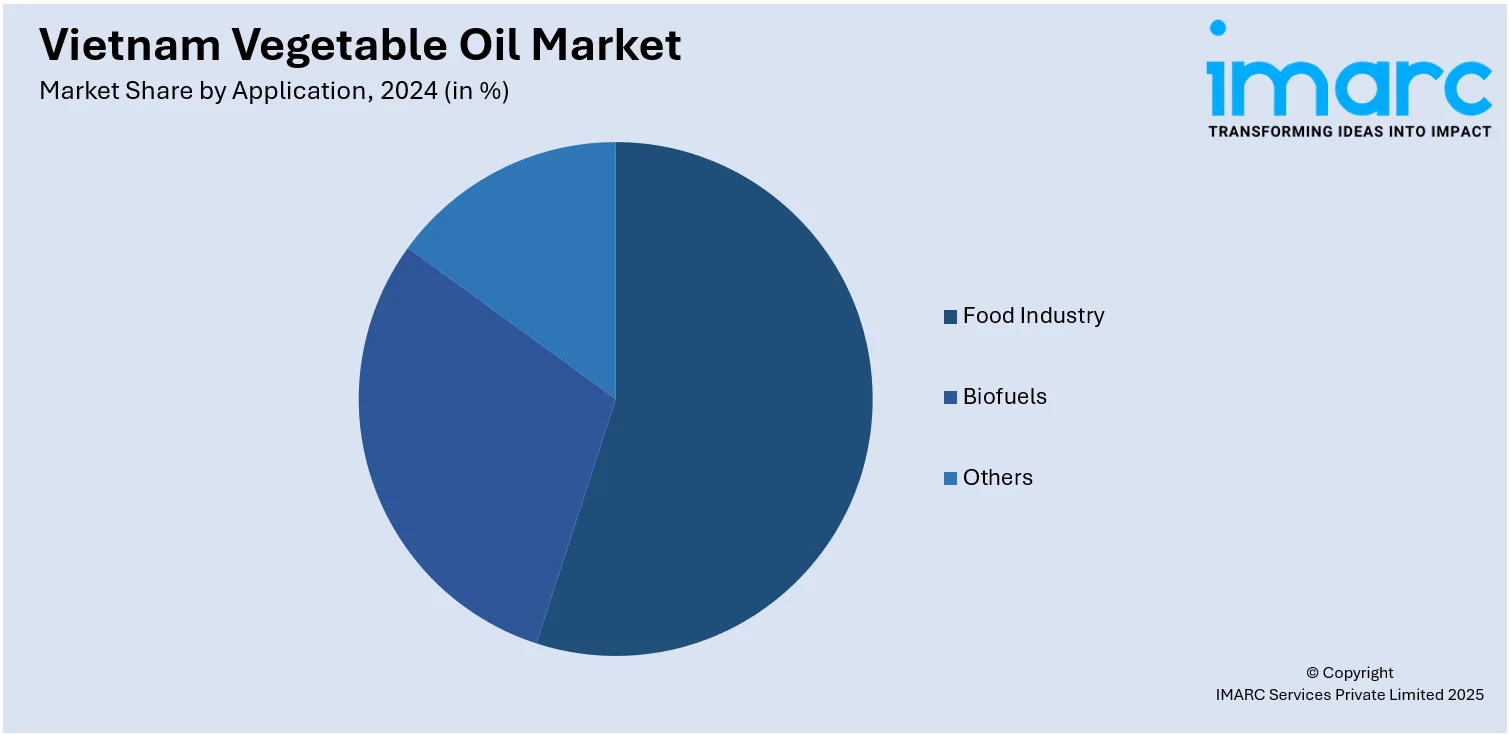

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam vegetable oil market on the basis of oil type?

- What is the breakup of the Vietnam vegetable oil market on the basis of application?

- What is the breakup of the Vietnam vegetable oil market on the basis of region?

- What are the various stages in the value chain of the Vietnam vegetable oil market?

- What are the key driving factors and challenges in the Vietnam vegetable oil market?

- What is the structure of the Vietnam vegetable oil market and who are the key players?

- What is the degree of competition in the Vietnam vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)