Virtual Reality Market Size, Share, Trends and Forecast by Device Type, Technology, Component, Application, and Region, 2025-2033

Virtual Reality Market Size, Industry Share & Growth Insights:

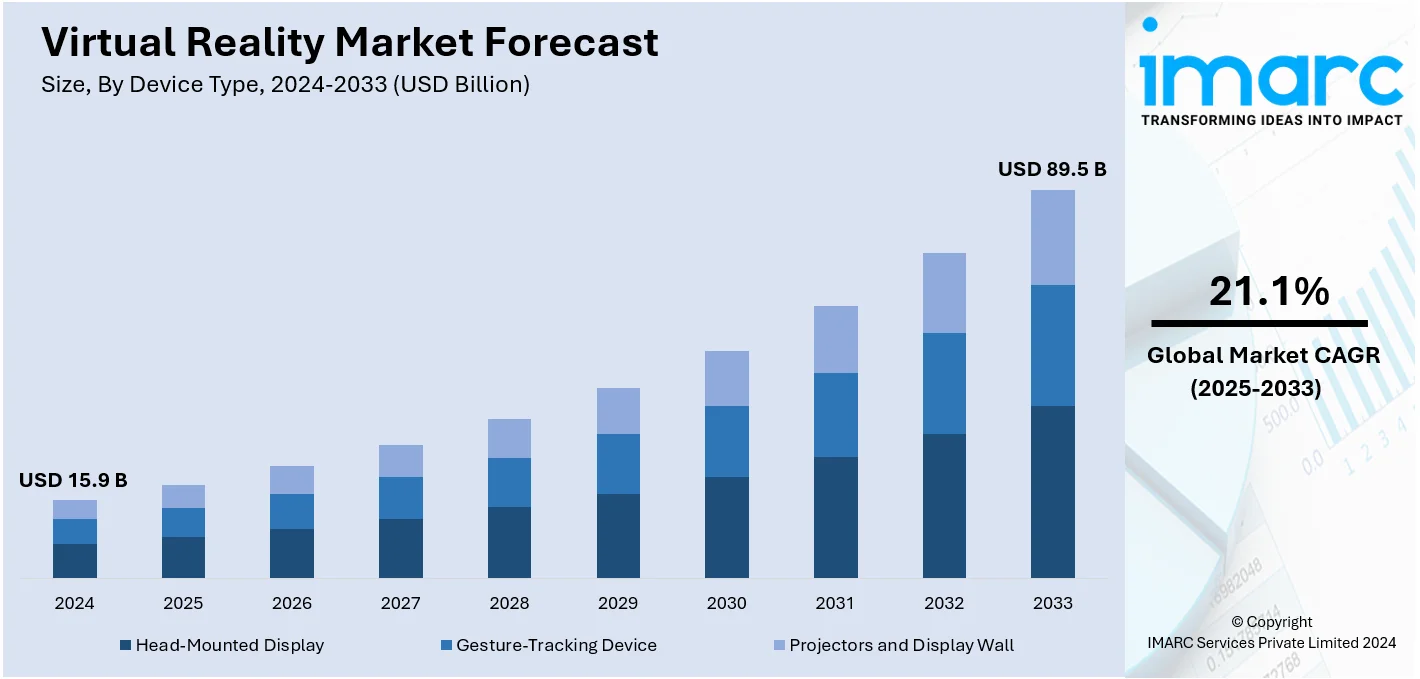

The global virtual reality market size was valued at USD 15.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 89.5 Billion by 2033, exhibiting a CAGR of 21.1% from 2025-2033. North America currently dominates the market. The growing innovations in surgical training, pain management, and mental health therapy, rising focus on efficient training, simulation, and design by enterprises, and increasing demand for immersive gaming and entertainment experiences are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.9 Billion |

| Market Forecast in 2033 | USD 89.5 Billion |

| Market Growth Rate 2025-2033 | 21.1% |

The global virtual reality (VR) market is experiencing rapid growth due to advancements in technology, increasing demand for immersive experiences, and a broad range of applications across various industries. The rise of gaming, entertainment, and e-commerce, along with innovations in hardware such as more affordable and powerful headsets, is a key factor. Additionally, VR's expanding role in sectors like healthcare, education, manufacturing, and real estate has boosted its adoption. The need for remote collaboration and training, accelerated by the COVID-19 pandemic, has further accelerated interest. Furthermore, the quality and accessibility of VR experiences are being improved by advancements in 5G networks and artificial intelligence. As consumer awareness and market acceptance rise, the potential for VR applications continues to expand, driving continued market growth.

The market growth for virtual reality (VR) in the United States is propelled by rising investment in VR infrastructure, growing demand for immersive experiences across various sectors, and technological advancements. The gaming industry, the largest adopter of VR technology, continues to expand rapidly, with VR gaming revenue expected to reach $1.9 billion by 2024, according to Statista. Furthermore, the healthcare industry is using VR for pain treatment, therapy, and medical training, which is substantially accelerating the market expansion. The U.S. is also seeing a rise in VR's use in education, corporate training, and real estate. The development of 5G networks and more affordable VR hardware is improving accessibility and enhancing user experiences. A notable example is Meta's (formerly Facebook) investment in the Metaverse, a key driver of VR adoption.

Virtual Reality Market Trends:

Immersive Gaming and Entertainment Experiences

Gamers are looking for more immersive and realistic settings, which is encouraging the adoption of VR as it provides an unparalleled level of engagement. Big gaming companies are incorporating VR technology into their platforms, appealing to both casual and dedicated gamers. Beyond gaming, entertainment sectors, such as live sports, concerts, and movies, are also benefiting from the ability of VR to simulate real-world experiences. People are becoming more tech-savvy and looking for high-quality immersive content, which is driving the demand for VR solutions. In 2024, Rezzil revealed the upcoming release of 'Premier League Player,' a Premier League VR game officially licensed for Meta Quest devices only. In addition, in 2024, iQIYI revealed intentions to introduce VR location-based entertainment in key Chinese cities in the upcoming summer, with plans for global expansion to Dubai and Bangkok. The project uses immersive technology to create engaging in-person experiences with popular IPs, like a new VR theater inspired by Love Between Fairy and Devil.

Healthcare and Therapeutic Applications

The healthcare industry is utilizing VR for applications, such as surgical training, pain management, and mental health therapy. VR provides a secure and regulated space for medical practitioners to simulate surgeries and procedures without endangering patients. In the field of mental health, VR is employed for exposure therapy to help individuals with conditions like anxiety and phobias by recreating difficult scenarios in a controlled environment. Furthermore, VR is being used in physical therapy and rehabilitation to provide patients with a fun and interactive method for completing therapeutic exercises. The increasing utilization of VR in the healthcare sector is bolstering the market growth. In 2024, Wundrsight, a startup focused on digital therapeutics, secured USD 400,000 in funding from Inflection Point Ventures to grow its VR-based mental health offerings throughout India. The money will help establish collaborations with medical centers and speed up the progress of new treatments for disorders, including anxiety and autism.

Enterprise Applications and Training

Enterprises in various sectors are incorporating VR for purposes like training, simulation, and design. Healthcare, construction, automotive, and aviation sectors are using VR for affordable and secure training settings. Surgeons can practice procedures, architects can visualize designs, and engineers can simulate machinery performance, all within a virtual space. This enhances productivity and reduces the risk associated with real-world training. Businesses are acknowledging the effectiveness and abilities of VR, which is driving the need for these technologies. Businesses are also utilizing VR for remote teamwork and virtual offices, further supporting the market growth. In 2023, Sandals Corporate University introduced its virtual and augmented reality (XR) Platform in partnership with EON Reality, bringing advanced AI and VR technology to hospitality education. The program aimed to transform employee training by offering immersive, interactive experiences for staff members.

Virtual Reality Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global virtual reality market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on device type, technology, component, and application.

Analysis by Device Type:

- Head-Mounted Display

- Gesture-Tracking Device

- Projectors and Display Wall

Head-mounted display (HMD) holds the largest share in the market because of its widespread use across various industries, including gaming, entertainment, healthcare, and education. HMDs offer immersive experiences by providing users with a first-person perspective, making them highly popular for both individuals and enterprise applications. The popularity of this segment is because of continuous advancements in display resolution, comfort, and wireless capabilities, enhancing user experience. The virtual reality market outlook remains promising owing to advancements in immersive technologies, including HMD.

Analysis by Technology:

- Semi and Fully Immersive

- Non-Immersive

Semi and fully immersive leads the market, driven by its ability to offer highly engaging and interactive experiences across various applications. Semi and fully immersive VR technologies create realistic simulations by integrating advanced hardware such as HMDs, motion sensors, and surround audio systems, providing users with a deeper sense of presence. This segment is particularly popular in industries like gaming, healthcare, and education, where immersive environments enhance training, simulations, and entertainment. The demand for more realistic and immersive VR experiences, coupled with advancements in motion tracking and graphical processing, is bolstering the virtual reality market growth.

Analysis by Component:

- Hardware

- Software

Hardware represents the largest segment because of the critical role it plays in delivering immersive experiences. This segment includes essential components like HMDs, sensors, processors, and motion controllers, which are fundamental to creating and enhancing VR environments. Continuous innovations in VR hardware, such as improved resolution, better field-of-view, and advanced motion tracking, are making these devices more accessible and appealing to both individuals and enterprises. The growing demand for high-performance hardware in gaming, healthcare, and enterprise applications is offering a favorable virtual reality industry outlook.

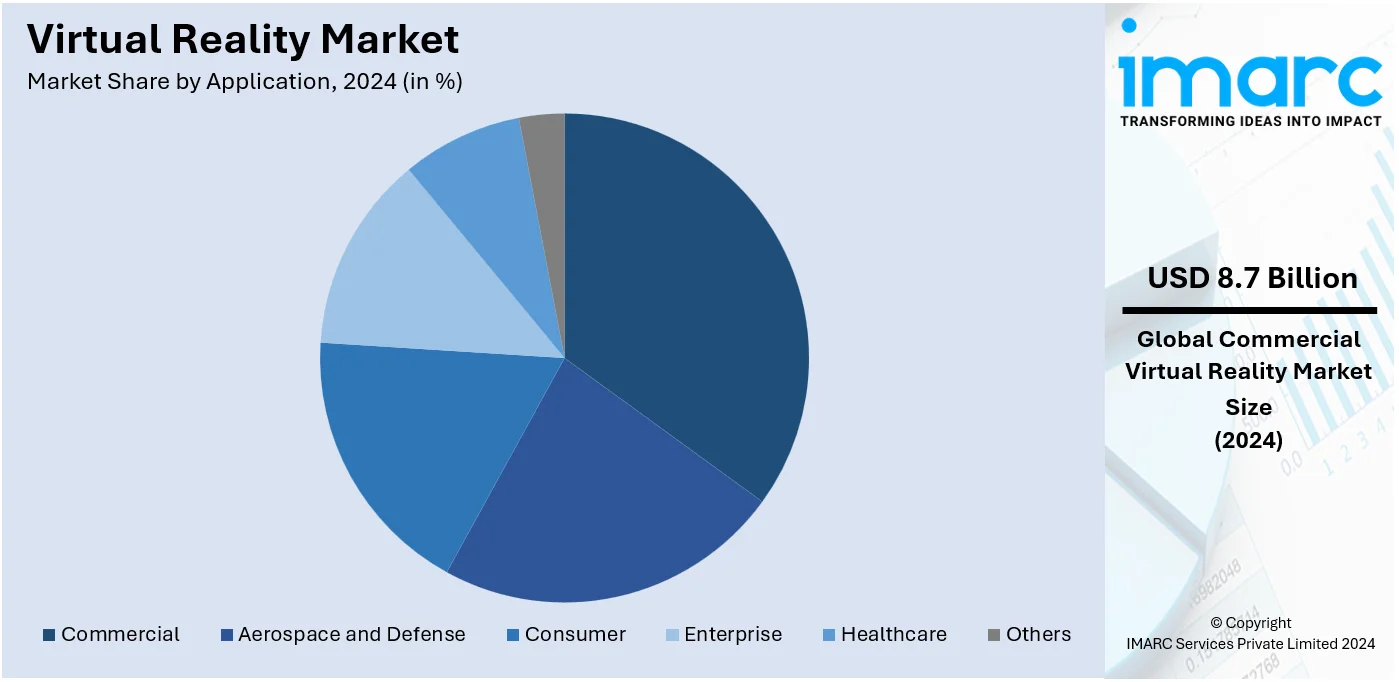

Analysis by Application:

- Aerospace and Defense

- Consumer

- Commercial

- Enterprise

- Healthcare

- Others

Commercial holds the biggest market share owing to its expanding use across industries like retail, real estate, and entertainment. In retail, VR enables virtual shopping experiences and product visualization, allowing buyers to engage with products in immersive environments. Real estate firms utilize VR for virtual property tours, providing potential buyers and renters the ability to explore spaces remotely. In the entertainment sector, VR is transforming the way users experience concerts, movies, and interactive events, creating new avenues for content usage. This increasing commercial adoption is driving the virtual reality market dynamics as businesses leverage VR to enhance customer engagement and operational efficiency. In 2023, Alo Yoga introduced a VR shopping experience in collaboration with Obsess, which enabled buyers to explore products and content using the Meta Quest 2 VR headset. The virtual store offered interactive shopping experiences, workout videos, and a seamless checkout process.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37%. North America leads the market, driven by strong technological infrastructure, high user adoption rates, and rising investments from major tech companies. The region is home to key players, which are continuously pushing the boundaries of VR technology through innovation in hardware and software. Virtual reality market insight indicates that North America's leadership is further solidified by increasing research efforts and user demand for advanced immersive technologies. In 2023, the Federal Communications Commission (FCC) of the United States granted Apple, Meta, and Google permission to use the 6GHz spectrum for low-power mobile VR and AR devices, offering improved connectivity without relying on strong wireless fidelity (Wi-Fi) signals. Meta and Google emphasized that this would enhance features for AR glasses and smartphone linkages. This development was expected to drive innovation in wireless VR and AR technologies.

Key Regional Takeaways:

United States Virtual Reality Market Analysis

The U.S. virtual reality market is growing rapidly as technological innovations and government investment stimulate the sector. The U.S. Bureau of Economic Analysis reported the contribution of the VR industry to the economy in the sum of more than USD 5 Billion in 2023. The U.S. Department of Defense, DoD, has actively taken part in the VR adoption process for military uses. In October 2023, the DoD granted USD 1.5 Million to the University of Arizona College of Medicine – Tucson to develop a portable VR device for rapid traumatic brain injury field conditions assessment. In further news, in September 2023, the DoD granted USD 5.7 Million to Indiana University's Center on Representative Government to create "Democracy Quest," an interactive learning tool in VR to aid in civics education enhancement. The DoD continues to invest in VR and AR solutions to enhance military training, focusing on developing sophisticated systems that simulate complex battle scenarios. The market is expanding because of rising consumer spending on VR gear and software.

Europe Virtual Reality Market Analysis

The virtual reality market across the European region is thriving as a result of European Union investment in virtual and augmented reality technologies. Within 2023, the European Commission committed EUR 1.5 Million (USD 1.59 Million) as a source to develop VR as well as AR technologies across different industries to increase innovative thinking in the respective marketplaces, as per an industry report. Some VR-related projects the EU is funding are augmented reality eyewear intended to be wearable throughout the day, as well as a toolset for human-machine interactions with XR as a base. Another initiative includes large language model-based systems for XR and is to create personalized experiences. Applications of XR bringing art and culture to the people in places where such exposures would otherwise not be accessible, combined with efforts that are assisting in shaping the European Metaverse. These investments reflect the growing use of XR technologies across industries such as manufacturing, construction, cultural heritage, tourism, education, healthcare, and advertising, positioning Europe as a significant player in the global XR market.

Asia Pacific Virtual Reality Market Analysis

The Asia Pacific VR market is seeing a growth phase because of Japan's leading AR/VR technology. According to industry reports, the nation, famous for creating hardware and software of games, is further broadening its application in fields of medicine, tourism, retail, and manufacturing. Growth is boosted by government support and 5G adoption. Japan's AR/VR market stood at about USD 3.42 Billion (JPY 370 Billion) in 2023, and the estimated compound annual growth rate is 21.5% from 2018 to 2023. The largest sector is the consumer one, with a projected 2023 spend of about USD 1.16 billion (130 billion JPY). The applications in retail include the use of VR/AR for virtual shopping, while in the healthcare sector, HoloEyes offer a 3D anatomical visualization to be used for surgery. The industrial sector, including the manufacturing and automotive industries, is also embracing VR/AR to enhance processes as Honda is working on VR in-car entertainment systems.

Latin America Virtual Reality Market Analysis

The Latin America region is presently witnessing a rise in VR markets, headed by the country of Brazil, promoting technological innovation to drive changes. In the year 2023 alone, approximately BRL 1.2 Billion (USD 237.6 Million) were received from the government through its National Fund for Scientific and Technological Development (FNDCT). This funds various scientific and technology initiatives - including VR technologies-to advance such technological infrastructure in related sectors: education, health, industrial manufacturing, or entertainment. Brazil's involvement in the international collaborative networks, for example, Eureka, has made it a robust entity that will guarantee international funding and partnerships in all VR-related projects. It is making strategic plays into digital transformation and innovation and opening doors for industries to embrace VR in greater extents. As a result, Brazil is set to become one of the most important regional players in the VR market, as significant investments will fuel technological progress and further expand applications in both public and private sectors.

Middle East and Africa Virtual Reality Market Analysis

In the MEA region, adoption in virtual reality is at the forefront due to the policies and investments by governments toward immersive technologies. For example, the UAE National Strategy for Artificial Intelligence 2031 provides for a global AI hub by 2031 based on specific sectors, particularly healthcare, tourism, and logistics. As part of this plan, the UAE government has been investing in advanced technologies such as VR to revolutionize public services and further enrich citizen experiences. It seeks to create AED 335 Billion (USD 91.21 Billion) in economic growth and develop VR solutions in important sectors such as medical diagnostics, tourism experiences, and educational applications. In addition, its commitment to building a solid data infrastructure and fostering worldwide collaborations will further fuel the innovation of VR across this region. As such, the MEA region is expected to become one of the region's largest players in the global VR market, especially with investments in research and talent development and infrastructure development to support the adoption of VR technologies.

Leading Virtual Reality Companies:

Leading companies in the market are focusing on improving hardware components of VR, such as head-mounted displays, controllers, and tracking systems. Companies are collaborating with content creators, software developers, entertainment firms, educational institutions, and studios to produce high-quality and engaging VR experiences. The growing virtual reality demand is encouraging leading companies to innovate and expand VR applications across different sectors. In 2024, HTC VIVE and Epic Games revealed a $3.5 million funding for Wevr, a VR studio popular for immersive projects, such as TheBlu and partnerships with well-known brands. This investment supports HTC's objective to develop the XR ecosystem and enhance immersive experiences.

The report provides a comprehensive analysis of the competitive landscape in the virtual reality market with detailed profiles of all major companies, including:

- CyberGlove Systems Inc.

- Eon Reality Inc.

- Google LLC (Alphabet Inc.)

- HTC Corporation

- Microsoft Corporation

- Oculus VR LLC (Facebook Inc.)

- Samsung Electronics Co. Ltd.

- Sixense Enterprises Inc.

- Sony Corporation

- StarVR Corp (Acer Inc.)

- Ultraleap Ltd.

- Unity Software Inc.

Latest News and Developments:

- December 2024: Perfect Corp. acquired Wannaby Inc., a digital immersive experiences expert. Through this acquisition, Perfect Corp. can improve its digital products and market presence by extending its virtual try-on technology into luxury fashion categories including clothing, shoes, and bags.

- December 2024: Generative 3D AI firm Backflip said it closed a USD 30 Million co-led funding round by NEA and Andreessen Horowitz. It is set to disrupt the design and manufacturing sector through AI for converting text and images into physical objects. This tech combines 3D simulation and physics-based engineering to create products quickly.

- September 2024: HTC has unveiled the Vive Focus Vision, which is the next-gen successor to the Vive Focus 3. The upgraded product has a Qualcomm Snapdragon XR2 chip, 2448 x 2448 pixels per eye, a field of view of 120-degree, dual 16MP cameras with color passthrough, and automatic lens adjustment. It offers 128GB storage and expandable storage up to 2TB.

- May 2024: Sony and Siemens unveiled a new VR headset for industrial use expected for release in December 2024, with a specific emphasis on engineering and product design. Incorporated into the Siemens' NX platform, the headset strives to enhance productivity and allow for instant design modifications.

- January 2024: Qualcomm unveiled the Snapdragon XR2+ Gen 2 chip, especially made for VR and AR products, with Google and Samsung planning to integrate the technology. Qualcomm's goal is to improve immersive experiences and stimulate growth in the VR/AR industry through innovation.

Virtual Reality Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Head-Mounted Display, Gesture-Tracking Device, Projectors and Display Wall |

| Technologies Covered | Semi and Fully Immersive, Non-Immersive |

| Components Covered | Hardware, Software |

| Applications Covered | Aerospace and Defense, Consumer, Commercial, Enterprise, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Products and Chemicals Inc., American Roller Company LLC, Durum Verschleißschutz GmbH, Lincotek Rubbiano S.p.A, Metallizing Equipment Co. Pvt. Ltd., Montreal Carbide Co. Ltd., Powder Alloy Corporation, Praxair Surface Technologies Inc. (Linde plc), Progressive Surface Inc., Wall Colmonoy Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the virtual reality market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global virtual reality market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the virtual reality industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Virtual reality (VR) is an immersive technology that replicates a user’s physical presence in a digital or virtual world. Using specialized hardware such as headsets and controllers, VR creates interactive experiences that allow users to engage with 3D spaces in real-time, often used in gaming, training, education, and therapy.

The global virtual reality market was valued at USD 15.9 Billion in 2024.

IMARC estimates the global virtual reality market to exhibit a CAGR of 21.1% during 2025-2033.

Key factors driving the market include innovations in healthcare applications like surgical training and pain management, the demand for immersive gaming and entertainment, and the growing focus on efficient training and simulations across industries such as aerospace, defense, and commercial sectors.

In 2024, head-mounted displays (HMDs) represented the largest segment by device type, driven by their widespread use in gaming, entertainment, healthcare, and education.

Semi and fully immersive technologies lead the market by technology owing to their ability to create highly engaging and realistic experiences, particularly in gaming, healthcare, and education.

Hardware is the leading segment by component, driven by continuous innovations in VR devices like HMDs, sensors, and motion controllers, enhancing user experiences across industries.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global virtual reality market include CyberGlove Systems Inc., Eon Reality Inc., Google LLC (Alphabet Inc.), HTC Corporation, Microsoft Corporation, Oculus VR LLC (Facebook Inc.), Samsung Electronics Co. Ltd., Sixense Enterprises Inc., Sony Corporation, StarVR Corp (Acer Inc.), Ultraleap Ltd., Unity Software Inc. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)