Virtual Tour Software Market Size, Share, Trends and Forecast by Deployment, End-User, and Region, 2025-2033

Virtual Tour Software Market Size and Share:

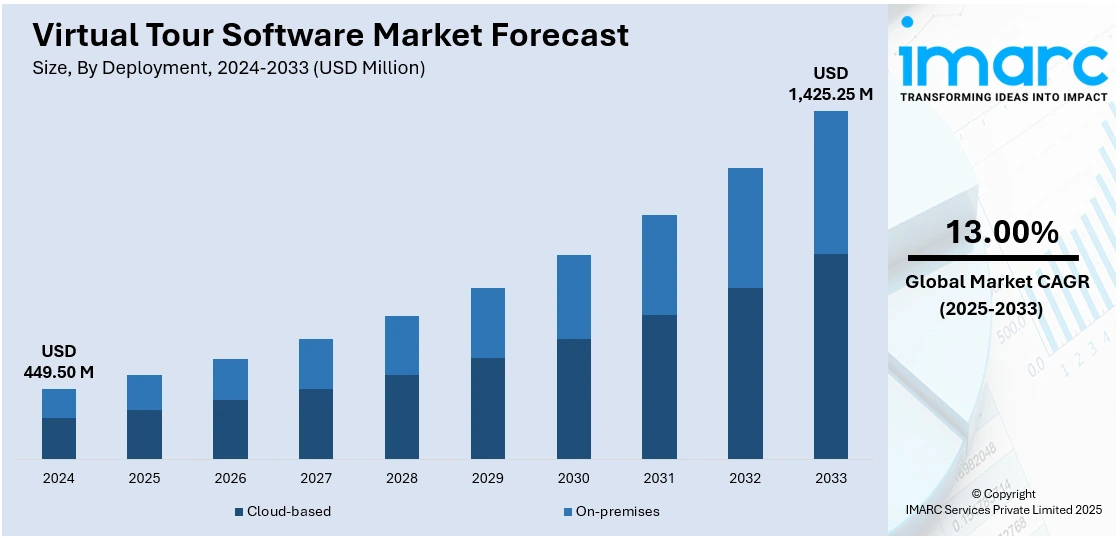

The global virtual tour software market size was valued at USD 449.50 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,425.25 Million by 2033, exhibiting a CAGR of 13.00% from 2025-2033. North America currently dominates the market, holding a market share of 35.00% in 2024. The market is witnessing significant growth, driven by demand from real estate, tourism, education, and retail sectors for immersive, remote viewing solutions. Advancements in VR, 360-degree imaging, and mobile optimization, integration of cloud-based platforms and AI and businesses increasingly adopting these tools for marketing and customer interaction are further contributing to the growing virtual tour software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 449.50 Million |

|

Market Forecast in 2033

|

USD 1,425.25 Million |

| Market Growth Rate 2025-2033 | 13.00% |

The virtual tour software market is experiencing significant growth mainly driven by the rising adoption of digital tools in real estate, hospitality, and education sectors to enhance customer engagement and remote visualization. Rising demand for immersive experiences, integration of VR/AR technologies and increasing internet penetration support market growth. Businesses are leveraging virtual tours for marketing and operational efficiency while advancements in 360-degree imaging and cloud-based platforms are improving accessibility and scalability, fueling widespread adoption across industries seeking interactive and cost-effective visualization solutions. For instance, in January 2025, the Virtual Tour Experts launched a personalized virtual tour of the University of Cambridge, utilizing 360° video, AI, and 3D mapping. Designed for prospective students and alumni, the immersive platform includes interactive features and accessibility options receiving positive feedback with an average rating of 4.51 out of 5 from initial users. These factors are driving the virtual tour software market growth across the world.

Key drivers in the United States virtual tour software market include the increasing reliance on digital experiences in real estate, hospitality, and education sectors. High smartphone penetration and widespread use of high-speed internet enable smooth delivery of immersive virtual tours. The demand for remote property viewings, virtual campus visits, and interactive hotel previews is rising. Additionally, tech-savvy consumers and the availability of advanced VR and 360-degree imaging tools support market expansion, as businesses seek more engaging and contactless customer engagement methods. Leading companies are increasingly adopting virtual tour tools to offer tailored experiences and boost customer engagement. For instance, in November 2024, Mack Trucks announced the launch of the Mack Live Tour, an innovative virtual experience allowing truck buyers to explore models from home. Prospective customers receive personalized, interactive tours led by product specialists, ensuring convenience and tailored information. The program is available for qualified buyers in the U.S. and Canada.

Virtual Tour Software Market Trends:

AI-Driven Automation Enhancing Virtual Tour Efficiency

AI-driven automation is transforming virtual tour software by streamlining content creation and improving user engagement. AI tools can automatically generate virtual tours from images or videos, reducing manual effort and production time. Personalization features adapt tour content based on user behavior, delivering more relevant experiences. Additionally, AI improves navigation by enabling voice commands, smart tagging, and interactive guidance. For instance, in October 2024, CubiCasa launched CubiCasa Tour, an AI tool that creates interactive virtual home tours in minutes. Designed for listing agents, it simplifies the process using a smartphone scan and photos, eliminating the need for costly equipment, thus enhancing property listings affordably and efficiently. These capabilities increase scalability and appeal, making virtual tours more efficient and accessible for businesses across diverse industries.

Rising Adoption in Non-Traditional Sectors

According to virtual tour software market forecast, adoption is rising beyond real estate and tourism, with sectors like education, manufacturing, and healthcare leveraging the technology. Educational institutions use virtual tours for campus navigation and remote learning. For instance, in January 2025, Eastern New Mexico University launched an upgraded virtual campus tour in collaboration with YouVisit. The interactive tour features 360-degree views, new stops including the Roosevelt Science Center, and testimonials from current students, enhancing access to campus for prospective students worldwide. In manufacturing, they support equipment training and facility walkthroughs. Healthcare providers use them for patient orientation and medical training. These applications enhance accessibility, reduce costs, and improve engagement, fueling broader market demand across previously untapped industries.

Mobile-First Optimization Driving User Engagement

With user behavior increasingly centered around smartphones and tablets, virtual tour software providers are prioritizing mobile-first design. Responsive interfaces, lightweight file formats, and app-based experiences are being developed to ensure seamless performance on mobile devices. This shift enhances user accessibility, allowing customers to view properties, products, or campuses on-the-go without compromising quality. Mobile compatibility also supports broader reach in marketing campaigns and improves conversion rates. As mobile traffic continues to surpass desktop usage, this trend is expected to significantly influence the virtual tour software market outlook.

Virtual Tour Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global virtual tour software market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on deployment and end user.

Analysis by Deployment:

- Cloud-based

- On-premises

Cloud-based stand as the largest deployment in 2024, holding around 65.6% of the market. Cloud-based deployment dominates the virtual tour software market due to its scalability, ease of access, and cost-effectiveness. Users can create, store, and share immersive tours without heavy IT infrastructure, making it ideal for businesses of all sizes. Real-time updates, cross-device compatibility, and remote collaboration further enhance its appeal. The growing preference for remote work and digital-first customer engagement has accelerated cloud adoption, especially in sectors like real estate, education, and tourism where seamless, high-quality virtual experiences are essential.

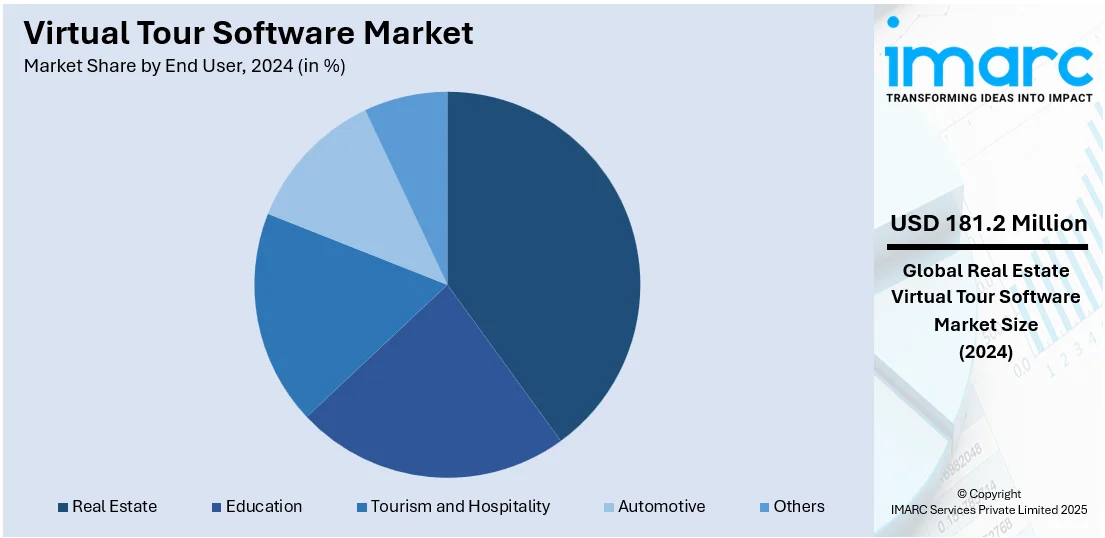

Analysis by End User:

- Real Estate

- Education

- Tourism and Hospitality

- Automotive

- Others

Real estate leads the market with around 40.3% of market share in 2024. The real estate sector leads the virtual tour software market, driven by rising demand for remote property viewing and enhanced buyer engagement. Virtual tours enable prospective buyers and renters to view properties from any location, saving time and facilitating quicker decision-making. Agents use interactive 3D walkthroughs to showcase listings more effectively, improving lead conversion. With growing reliance on digital marketing and increasing competition, real estate professionals are investing in virtual tour tools to differentiate listings and offer a more immersive, accessible experience.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.00%. North America holds the largest share in the virtual tour software market, supported by advanced digital infrastructure, widespread internet access, and high adoption of immersive technologies. The region's strong real estate, hospitality, and education sectors actively use virtual tour solutions to enhance customer engagement. Growing demand for remote services, coupled with increased investment in AR/VR platforms, has accelerated market growth. Additionally, the presence of key software providers and early tech adoption among consumers contribute to North America's leading position in this space.

Key Regional Takeaways:

United States Virtual Tour Software Market Analysis

In 2024, United States accounted for 89.30% of virtual tour software market in North America. United States is experiencing increased virtual tour software adoption due to growing cloud adoption across sectors. According to reports, 98% of U.S. organizations have adopted cloud technology for business operations. The scalability, data security, and seamless integration capabilities of cloud platforms are enabling businesses to deploy virtual tours with minimal infrastructure. Real estate, tourism, and education sectors are leveraging cloud-based virtual tour software to deliver interactive experiences. As more enterprises migrate to cloud ecosystems, the reliance on virtual tour software as a customer engagement tool strengthens. Enhanced accessibility and cost-efficiency are further encouraging adoption, especially among small and mid-sized organizations. With cloud adoption gaining traction, virtual tour software is becoming integral to digital strategies, aligning with demands for real-time interaction, virtual demonstrations, and immersive content delivery. This momentum is expected to continue as organizations increasingly prioritize flexibility and remote accessibility in service delivery.

Asia Pacific Virtual Tour Software Market Analysis

Asia-Pacific is witnessing growing virtual tour software adoption due to rising urbanization and digitization efforts across industries. For instance, the Indian government announced an extension of the current Digital India initiative, with a budget allocation of INR149 billion (approximately USD 1.79 billion) allocated over five years, spanning from 2021-22 to 2025-26. As cities expand and infrastructures modernize, the need for digital tools that support the visualization of physical spaces intensifies. Urban development projects, smart city initiatives, and digital transformation campaigns are fuelling demand for virtual solutions. Virtual tour software serves as a vital enabler in showcasing new developments, educational institutions, and cultural heritage sites. Increased smartphone penetration and high-speed internet access further support software deployment. Government-backed digitization initiatives are encouraging industries to integrate virtual tools into operations. With urbanization accelerating and digital experiences becoming a consumer expectation, virtual tour software adoption continues to gain momentum. Businesses and organizations are turning to this technology to present dynamic, immersive content in ways that resonate with increasingly tech-savvy populations.

Europe Virtual Tour Software Market Analysis

Europe is embracing virtual tour software adoption in response to the growing trend of remote work, learning, and socializing. According to reports, the percentage of EU employees working from home rose from 5% in 2019 to 12.3% in 2020. As hybrid lifestyles become mainstream, individuals and organizations seek digital tools that replicate physical interactions. Virtual tour software offers immersive engagement, making it ideal for remote training, virtual office walkthroughs, and online cultural events. Educational institutions and businesses are investing in these solutions to maintain interactivity and continuity. The shift toward flexible, digital-first operations is driving interest in tools that support visual storytelling and collaboration. Social and professional environments are increasingly dependent on technology that allows for spatial context and real-time navigation. This trend is reinforcing the integration of virtual tour platforms across industries. The continued evolution of remote practices ensures sustained growth in software adoption across European markets.

Latin America Virtual Tour Software Market Analysis

Latin America is experiencing a rise in virtual tour software adoption due to growing rapid urbanization and growing internet penetration. According to reports, over the past ten years, internet access in Latin America increased from 43% to 78%, with countries like Chile reaching as high as 90%, outpacing China's internet penetration. This growth has been fueled by the inclusion of middle and lower-income populations. Expanding urban centers increase the need for innovative visualization tools in sectors such as real estate and education. Simultaneously, improved connectivity across the region allows broader access to virtual experiences. These combined forces create a conducive environment for integrating virtual tour solutions, making them accessible and valuable for a diverse audience in Latin America.

Middle East and Africa Virtual Tour Software Market Analysis

In the Middle East and Africa, the demand for virtual tour software is fuelled by the growing number of construction projects and the increasing use of 3D modelling in real estate. According to reports, Saudi Arabia's construction industry is thriving, with more than 5,200 projects in progress, totaling USD 819 billion in value. Virtual tours of real estate properties and large-scale infrastructure developments are becoming essential tools for showcasing projects in a realistic, interactive way. As the construction sector embraces digital transformation, including the use of 3D modelling, virtual tour software offers a compelling way to present and market physical spaces to remote clients and stakeholders.

Competitive Landscape:

The virtual tour software market is highly competitive, with numerous players offering differentiated solutions across various industries. Leading companies focus on enhancing user experience through advanced features like 360-degree imaging, VR integration, and interactive navigation. Cloud-based platforms, mobile compatibility, and customization tools are key areas of innovation. Firms are also investing in AI-driven analytics to provide user insights and improve content effectiveness. Strategic partnerships, acquisitions, and product upgrades are common as companies aim to expand their reach and capabilities. Competition intensifies as demand rises across real estate, education, tourism, and automotive sectors, driving continuous innovation and market diversification.

The report provides a comprehensive analysis of the competitive landscape in the virtual tour software market with detailed profiles of all major companies, including:

- 3DVista Stitcher

- CloudPano

- Concept3D Inc.

- Easypano Holdings Inc.

- Eyespy360

- iStaging Corp.

- Klapty, Kuula LLC

- Matterport Inc.

- My360, RTV Inc.

- SeekBeak

Latest News and Developments:

- March 2025: Powata launched a virtual tour service for the Singapore real estate market, offering real estate agents a powerful tool to create interactive 3D property tours. The service aimed to meet the demand for remote property viewing, enhancing the property exploration experience for both agents and potential buyers.

- March 2025: ThingLink launched an AI-assisted creation flow that enabled educators and L&D professionals to generate virtual tours and immersive learning materials in minutes. This new feature empowered users to create interactive, high-quality content without needing advanced design skills.

- February 2025: Kuula users enhanced their virtual tours by adding videos through hotspots and interactive cards, using platforms like YouTube and Vimeo. This integration provided dynamic content, boosting viewer engagement and offering additional context to scenes.

- January 2025: Air India highlighted its premium cabin offerings and in-flight services at the Outbound Travel Mart, providing a virtual reality experience of its A350 aircraft. Guests could explore business class suites equipped with full-flat beds and roomy economy seats.

Virtual Tour Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployments Covered | Cloud-based, On-premises |

| End Users Covered | Real Estate, Education, Tourism and Hospitality, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3DVista Stitcher, CloudPano, Concept3D Inc., Easypano Holdings Inc., Eyespy360, iStaging Corp., Klapty, Kuula LLC, Matterport Inc., My360, RTV Inc., SeekBeak, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the virtual tour software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global virtual tour software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the virtual tour software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The virtual tour software market was valued at USD 449.50 Million in 2024.

The virtual tour software market is projected to reach USD 1,425.25 Million by 2033, exhibiting a CAGR of 13.00% from 2025-2033.

Key factors driving the virtual tour software market include rising demand for remote viewing in real estate and tourism, increasing use of immersive technologies like VR and 360-degree imaging, widespread internet access, and the shift toward digital-first marketing strategies to enhance customer engagement across multiple sectors.

North America currently dominates the virtual tour software market, driven by strong digital infrastructure, high adoption of immersive tech, and demand across real estate and education sectors.

Some of the major players in the virtual tour software market include 3DVista Stitcher, CloudPano, Concept3D Inc., Easypano?Holdings Inc., Eyespy360, iStaging Corp., Klapty, Kuula LLC, Matterport Inc., My360, RTV Inc., SeekBeak, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)