Vitamins Market Size, Share, Trends and Forecast by Type, Source, Application, and Region 2026-2034

Vitamins Market Size and Share:

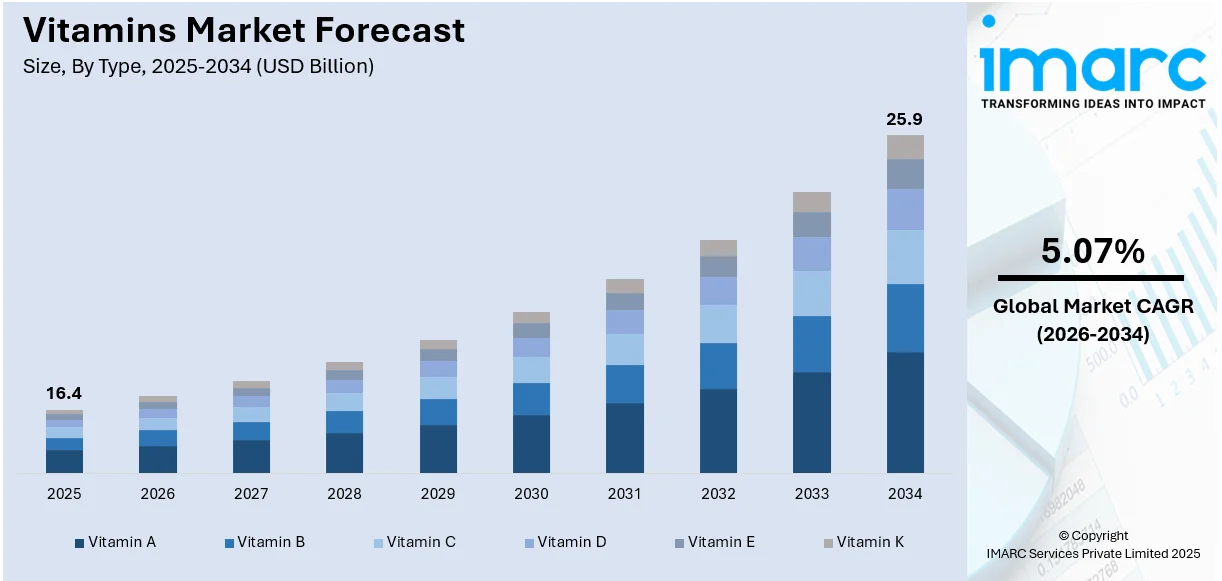

The global vitamins market size was valued at USD 16.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 25.9 Billion by 2034, exhibiting a CAGR of 5.07% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 41.7% in 2025. The increasing health and wellness awareness, growing geriatric population, rising incidence of vitamin deficiencies, and rapid technological advancements in product development are driving the market across Asia Pacific.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 16.4 Billion |

| Market Forecast in 2034 | USD 25.9 Billion |

| Market Growth Rate (2026-2034) | 5.07% |

The global vitamins market is currently flourishing, propelled by growing health awareness among consumers and a rise in emphasis on preventive healthcare. As individuals strive to boost their overall health, the need for dietary supplements and enriched foods has increased. The growing geriatric populations in developed countries are also driving market expansion, since older adults frequently need extra nutrients to stay healthy. Furthermore, the increasing inclination toward personalized nutrition, driven by technological advancements and consumer demand for customized health solutions, is broadening market possibilities. Rising urbanization and shifts in lifestyle have also caused a greater occurrence of nutrient deficiencies. As per Worldometers, 57.5% of the entire world population resides in urban regions in 2024. In addition to this, advancements in the manufacturing and distribution of vitamin supplements are crucial for market growth.

To get more information on this market Request Sample

The United States has emerged as a key regional market for vitamins. The United States vitamins market is driven by the growing health consciousness among consumers, leading to higher demand for dietary supplements and functional foods. The increasing geriatric population requires more vitamins to manage age-related health concerns, further boosting market growth. As per the National Council on Aging, by 2040, adults over the age of 65 are projected to constitute 22% of the total population in the United States. Increased focus on preventive healthcare and wellness, alongside rising awareness of nutrition’s role in disease prevention, further fuels demand for vitamins. The popularity of fitness and sports nutrition also contributes to market expansion, as athletes seek supplements to enhance performance. Moreover, the growing trend of personalized nutrition, along with advancements in supplement delivery formats, continues to shape the United States vitamins market.

Vitamins Market Trends:

Increasing awareness about health and wellness

One of the most significant factors propelling the market growth is that consumers are becoming more aware about their health and wellbeing. According to McKinsey, overall, about 50% of US consumers now reported wellness as a top priority in their everyday lives, thus significantly higher than 42% in 2020. It represents an evolving trend of greater concern over consumers' health and wellness. This is attributed to a number of factors, including expanded media coverage of health-related issues, improvements in medical research, and easier access to information. The digital lifestyle provides consumers with instant access to information, enabling them to educate themselves on the benefits of vitamins and nutritional supplements. At the beginning of 2024, there were 331.1 million internet users in the United States. Internet penetration was 97.1%. In addition, the total number of cellular mobile connections in the country stood at 396.0 Million at the start of 2024. As a result, the significance of social media, health blogs, and online forums as information sources has also increased in relation to accepting experiences and knowledge on the benefits of vitamins.

Growing prevalence of lifestyle-related diseases

The need for vitamins has increased due to a rise in lifestyle-related disorders. These include diabetes, obesity, and cardiovascular problems. According to CDC data, 41.9% of individuals in the United States are obese. Also, according to NIH, approximately 20.6% of American adolescents between the ages of 12 and 19 are obese, and this proportion is rising. Additionally, around 60 million adults in the European region who are 25 years of age and older have diabetes. Due to this, individuals are now taking a more proactive approach to maintaining their health and using vitamins as a preventative step. Consequently, the industry has grown tremendously due to the move away from reactive therapy and toward preventative healthcare.

Rising geriatric population

Requirements and trends in dietary demands change along with age, and individual aspects of certain vitamins and minerals begin to gain importance. For example, higher doses of calcium, magnesium, and vitamins B12 and D are required by geriatric persons in order to maintain bone health, sustain cognitive function, and secure against chronic illnesses. According to the World Population Prospects 2022, the global population aged 65 and above is rising faster than younger age groups, set to grow from 10% in 2022 to 16% by 2050. Due to a number of variables, including reduced consumption of food, impaired absorption capacities, and long-term medical disorders that impair nutrient metabolism, this population segment is more vulnerable to deficiencies. According to the Survey on Health, Ageing, and Retirement in Europe (SHARE), the EU population aged 65 and older recorded an average of having two or more chronic illnesses in 2020. This brings about increased demands for vitamins among these groups to bridge these nutritional gaps and encourage healthy aging.

Vitamins Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, source, and application.

Analysis by Type:

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Vitamin E

- Vitamin K

Vitamin B stands as the largest component in 2025, holding around 25.0% of the market. This vitamin segment dominated the market due to its importance in most body functions, which range from energy production to cognitive function and metabolic processes. Widespread use of these vitamins for the treatment of stress, improving moods, prevention of heart conditions, and avoidance of deficiency-related diseases, including neurological disorders, supports market growth. Added factors to the growth of Vitamin B market are growing knowledge of the benefits of vitamin B and the rising incidence of vitamin deficiencies on account of poor diets and particular disease conditions.

Analysis by Source:

- Natural

- Synthetic

Natural leads the market worldwide in 2025. According to the vitamin market forecast and outlook, natural vitamins are leading the market share as they are extracted from whole food sources such as fruits, vegetables, and herbs. They provide an attractive alternative for health-conscious consumers seeking products with minimal processing and no artificial additives. Consumer awareness about clean-label products has further catalyzed its growth. Besides this, natural vitamins also confer better bioavailability and are more potent in efficacy compared to other conventional alternatives. As the need for organic vitamin is growing rapidly, the vitamin market revenue is increasing, driven by adoption among individuals focusing upon organic agriculture as well as environmentally sustainable practices.

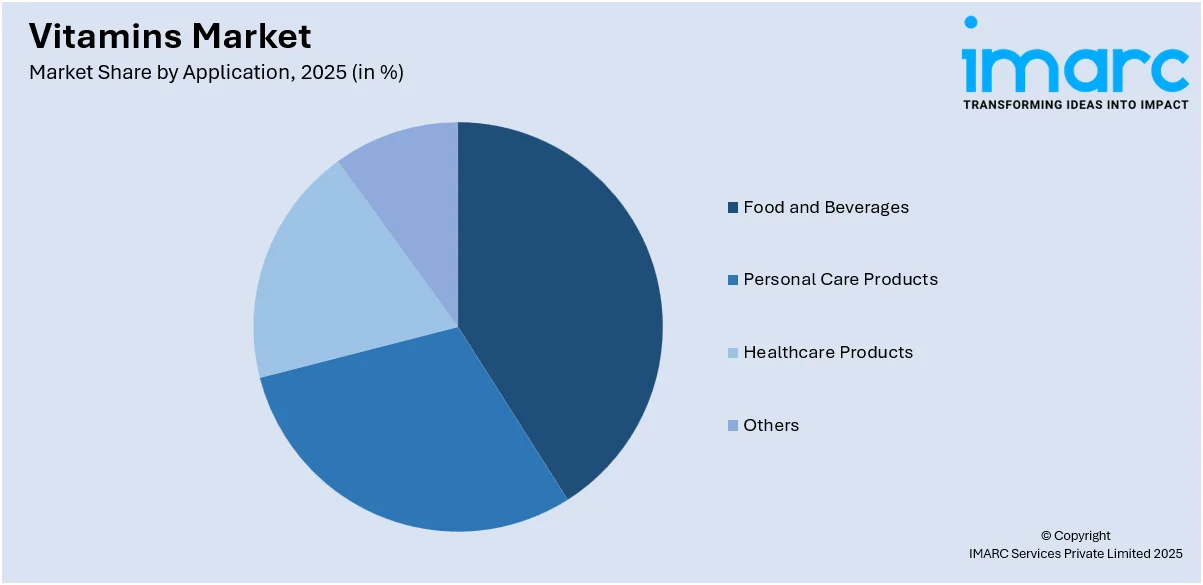

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Personal Care Products

- Food and Beverages

- Healthcare Products

- Others

Food and beverages lead the market with around 35.0% of market share in 2025. This segment is driven by the increasing trend of fortifying everyday food items with essential vitamins. It caters to a broad consumer base that is seeking convenient ways to meet their nutritional requirements through their regular diet. The fortification of staple foods such as dairy products, cereals, juices, and snacks with vitamins such as A, D, and B-complex ensures that consumers can effortlessly enhance their nutrient intake.

The healthcare products segment includes the extensive use of vitamins in dietary supplements and pharmaceutical formulations to address a wide range of health issues. Moreover, their critical role in preventing and managing conditions, such as vitamin deficiencies and chronic diseases, and supporting the immune system is supporting the market growth. Besides this, the increasing prevalence of lifestyle-related health problems such as obesity, cardiovascular diseases (CVDs), and diabetes is boosting the vitamin market share by fueling the demand for vitamin supplements as preventive and therapeutic measures.

The personal care products segment includes vitamins in skincare, haircare, and cosmetic products. Vitamins such as A, C, and E are highly valued for their antioxidant properties and their role in promoting healthy skin, hair, and nails. Moreover, the increasing consumer awareness about the benefits of vitamins in enhancing the efficacy of personal care products is favoring the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 41.7%. According to the vitamin market report and overview, the Asia Pacific region holds the largest share of the market, driven by a combination of rapid economic growth, increasing health consciousness, and a large population. Moreover, the growing middle-class population, boosting the focus on preventive healthcare and wellness, is catalyzing the market growth. Additionally, the prevalence of vitamin deficiencies among individuals, prompting government initiatives and public health campaigns to promote the consumption of these products, is boosting the market growth. Apart from this, the region's robust pharmaceutical and nutraceutical industries, combined with advancements in manufacturing technologies that make these products more accessible and affordable, are enhancing the demand for vitamins.

Key Regional Takeaways:

United States Vitamins Market Analysis

Several factors are driving the vitamins market in the United States. These are mostly characterized by an increasing health consciousness and the trend toward preventive health care. According to greatgreenwall.org, about 59 million Americans use some type of vitamins or supplements regularly, indicating that vitamins play a pretty significant role in consumer health regimens. As people become increasingly aware of their eating habits and the necessity of nutritional supplementations, there is a need for products that promote overall wellness. This trend is becoming more significant as the population ages, particularly with the elderly seeking specific vitamins for health issues such as bone density, immunity, and cognitive function. Expanding fitness and wellness culture that finds strong support from direct consumers and also by healthcare professionals supports demand for supplements. Ease of access by means of direct-to-consumers sales, particularly online platforms, have expanded to offer a much wider choice of vitamins across markets, supporting growth. The Covid-19 pandemic has also contributed to emphasizing immunity and individual care, elevating demand for vitamin supplementations. The growth in the market is further enhanced by innovations within product formulations, including plant-based ingredients and personalized regimens.

Asia Pacific Vitamins Market Analysis

Currently, the Asia-Pacific area exhibits rapid growth in the vitamin markets driven by rising disposable income and increasing health and wellness consciousness. In countries such as China, India, and many across Southeast Asia, the emerging middle classes are driving this demand for dietary supplements. For instance, according to People Research on India's Consumer Economy in India, middle-class people constitute only 31% of Indian citizens, which is expected to rise up to 40% in the year 2031. In a similar manner, Japan, South Korea, and many other countries are seeing an increase in their aging population who demand vitamins against age-related health issues. The market is also influenced by the shift toward preventive healthcare and the popularity of natural and plant-based ingredients. In the markets of China and India, vitamins are finding their way to consumers through rising urbanization and penetration of e-commerce. Increasing governmental efforts to enhance the public health and nutrition of people in this region are further fueling market growth.

Europe Vitamins Market Analysis

The main growth driver for the European vitamins market is the growing demand for customized nutrition. This factor has gained support from increased health and wellness consciousness. European Union statistics indicate that in 2023, 35.0% of people in the EU had a long-standing (chronic) health problem. It means that there is a great need for vitamins and supplements in order to be healthy and also track chronic conditions. Consumers in Europe are becoming more aware of the long-term health benefits of vitamins. This is particularly evident in the context of aging populations and the growing incidence of chronic diseases. There has been a turn toward natural, organic supplementation, driven by clean label drives and sustainability. Regulations also support the use of vitamins as dietary supplements, ensuring product safety and efficacy. There is also growing adoption of vitamins among millennials and Generation Z due to increased visibility of self-care and preventive health trends. Rising availability of vitamins through online retail channels and the growth of digital health tools continue to fuel market growth. With its sound healthcare infrastructure, Europe remains an excellent market to support vitamins and dietary supplements.

Latin America Vitamins Market Analysis

In Latin America, the vitamins market is driven by increasing consumer awareness regarding the benefits of vitamins for overall health and wellness. There is growing interest in preventive healthcare, particularly in countries like Brazil and Mexico, where rising healthcare costs are prompting consumers to turn to dietary supplements. According to the new United Nations report, Regional Overview of Food Security and Nutrition 2023, 6.5% of the population in Latin America and the Caribbean suffers from hunger, totaling 43.2 Million people. This highlights the need for vitamins to address nutritional gaps and improve overall health. Additionally, the expanding middle class and improved access to modern retail channels, including e-commerce, are fueling market growth. According to Payments and Commerce Market Intelligence (PCMI), e-commerce transaction volume in Latin America is expected to reach USD 923 Billion by 2026, further enhancing market accessibility. The demand for natural and organic vitamins is also rising, reflecting broader global trends.

Middle East and Africa Vitamins Market Analysis

The vitamins market in the Middle East and Africa is driven by a combination of factors, including an increasing focus on health and wellness, rising disposable incomes, and growing urbanization. The region is seeing a shift towards healthier lifestyles, with consumers becoming more aware of the benefits of vitamins for boosting immunity and overall health. Notably, 1 in 6 adults in the region has diabetes, totaling 73 million people, the highest proportion among all IDF regions, as stated by IDF Diabetes Atlas. This growing prevalence of chronic diseases is encouraging the use of vitamins as part of preventive healthcare. The demand for natural and organic products is also on the rise, particularly among the younger, health-conscious population. Moreover, the expanding availability of vitamins through modern retail channels and e-commerce platforms is enhancing market access.

Competitive Landscape:

Key players in the global vitamins market are actively driving growth through product innovation, strategic partnerships, and expanding distribution channels. Companies are investing in research and development (R&D) to create new, more effective vitamin formulations, including personalized and bioavailable supplements tailored to specific health needs. Strategic acquisitions and partnerships with health and wellness brands are also allowing companies to broaden their product portfolios and reach new customer segments. Additionally, leading players are focusing on sustainability by adopting eco-friendly packaging and sourcing raw materials responsibly, catering to the growing consumer demand for sustainable products. Digital transformation, including e-commerce platforms and direct-to-consumer sales models, has expanded accessibility to vitamins worldwide. Furthermore, key companies are promoting awareness through educational campaigns about the importance of vitamins in maintaining health, which enhances consumer trust and drives market demand.

The report provides a comprehensive analysis of the competitive landscape in the vitamins market with detailed profiles of all major companies, including:

- BASF SE

- Bluestar Adisseo (China National Bluestar (Group) Co. Ltd.)

- Farbest-Tallman Foods Corporation

- Glanbia Plc

- Jubilant Bhartia Group

- Koninklijke DSM N.V.

- Stern-Wywiol Gruppe GmbH & Co. KG

- Vertellus

- Vitablend Nederland B.V.

- Zagro (Industria de Diseño Textil S.A.)

- Zhejiang Garden Biopharmaceutical Co. Ltd.

Latest News and Developments:

- March 2024: Procter & Gamble Health Ltd, a subsidiary of the global consumer goods company Procter & Gamble, plans to expand its range of vitamins, minerals, and supplements (VMS), with a focus on neurotrophic vitamins, as part of its five-year strategy. Currently, 90% of the company's portfolio consists of VMS products, with the nasal decongestant Nasivion making up the remaining share.

- January 2024: Tata 1mg, in collaboration with UK-based healthcare R&D company Vitonnix, is expanding its footprint in India's growing nutraceutical market with plans to introduce additional products beyond the initial five offerings. In the first phase, the partnership launched five sublingual sprays catering to daily vitamin and supplement needs, including Vitamin D, Melatonin, Biotin, Veg Omega, and Multivitamin.

- December 2023: Centrum, a multivitamin brand from Haleon (formerly GlaxoSmithKline Consumer Healthcare), has expanded its portfolio with the introduction of Multivitamin and Protein Powders alongside its existing range of tablets and gummies. Addressing nutritional gaps prevalent among Indians, these new offerings are tailored for men, women, and children. The variants for men and women provide 24 essential vitamins and minerals, combined with plant protein for overall well-being, while the children’s variant includes 24 vitamins, minerals, probiotics, and a blend of plant and milk-based protein.

- September 2023: BASF calculated the Product Carbon Footprints (PCFs) for vitamins, carotenoids, beverage processing polymers, feed enzymes and feed performance ingredients for the human and animal nutrition markets. The BASF methodology for calculating PCFs is certified by TÜV Rheinland according to the internationally recognized standard, ISO 14067:2018. The benchmarking shows that the PCF for specific BASF vitamin A and E products is significantly better which is at least 20 % than the global market average PCF of the corresponding third-party products. BASF’s benchmark assessments have been conducted according to ISO 14044, ISO 14067, and GHG protocol standard.

- February 2023: DSM-Firmenich (Koninklijke DSM N.V merged with Firmenich), confirmed that the company is resuming Rovimix Vitamin A production in Sisseln, Switzerland. In November 2022, the firm announced a temporary halt to Vitamin A production at the site. Restarting production will allow DSM-Firmenich to serve its customers with animal nutrition premix solutions ahead of the shutdown for lifetime extension work planned for the Vitamin A line in 2023.

Vitamins Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, Vitamin K |

| Sources Covered | Natural, Synthetic |

| Applications Covered | Personal Care Products, Food and Beverages, Healthcare Products, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Bluestar Adisseo (China National Bluestar (Group) Co. Ltd.), Farbest-Tallman Foods Corporation, Glanbia Plc, Jubilant Bhartia Group, Koninklijke DSM N.V., Stern-Wywiol Gruppe GmbH & Co. KG, Vertellus, Vitablend Nederland B.V., Zagro (Industria de Diseño Textil S.A.), Zhejiang Garden Biopharmaceutical Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vitamins market from 2020-2034.

- The vitamins market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vitamins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Vitamins are organic compounds essential for various bodily functions, including growth, metabolism, and immune support. They are required in small amounts and must be obtained through diet or supplements since the body cannot produce them. Vitamins play crucial roles in maintaining overall health and preventing deficiencies that can lead to various diseases.

The Vitamins market was valued at USD 16.4 Billion in 2025.

IMARC estimates the global vitamins market to exhibit a CAGR of 5.07% during 2026-2034.

The growing health consciousness and wellness trends worldwide, increasing demand for personalized nutrition, rising geriatric population and related health concerns, advancements in product innovation and supplement formats, and expanding distribution through e-commerce platforms are driving the global vitamins market.

According to the report, vitamin B represented the largest segment by type due to its essential role in energy production, metabolism, and overall health.

Natural leads the market by source due to the growing consumer preference for plant-based, chemical-free products that are perceived as healthier.

According to the report, food and beverages represented the largest segment by application due to its consistent demand, broad consumer base, and critical role in daily consumption and global trade.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Vitamins market include BASF SE, Bluestar Adisseo (China National Bluestar (Group) Co. Ltd.), Farbest-Tallman Foods Corporation, Glanbia Plc, Jubilant Bhartia Group, Koninklijke DSM N.V., Stern-Wywiol Gruppe GmbH & Co. KG, Vertellus, Vitablend Nederland B.V., Zagro (Industria de Diseño Textil S.A.), Zhejiang Garden Biopharmaceutical Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)