Vodka Market Size, Share, Trends and Forecast by Type, Quality, Distribution Channel, and Region, 2025-2033

Vodka Market Size and Share:

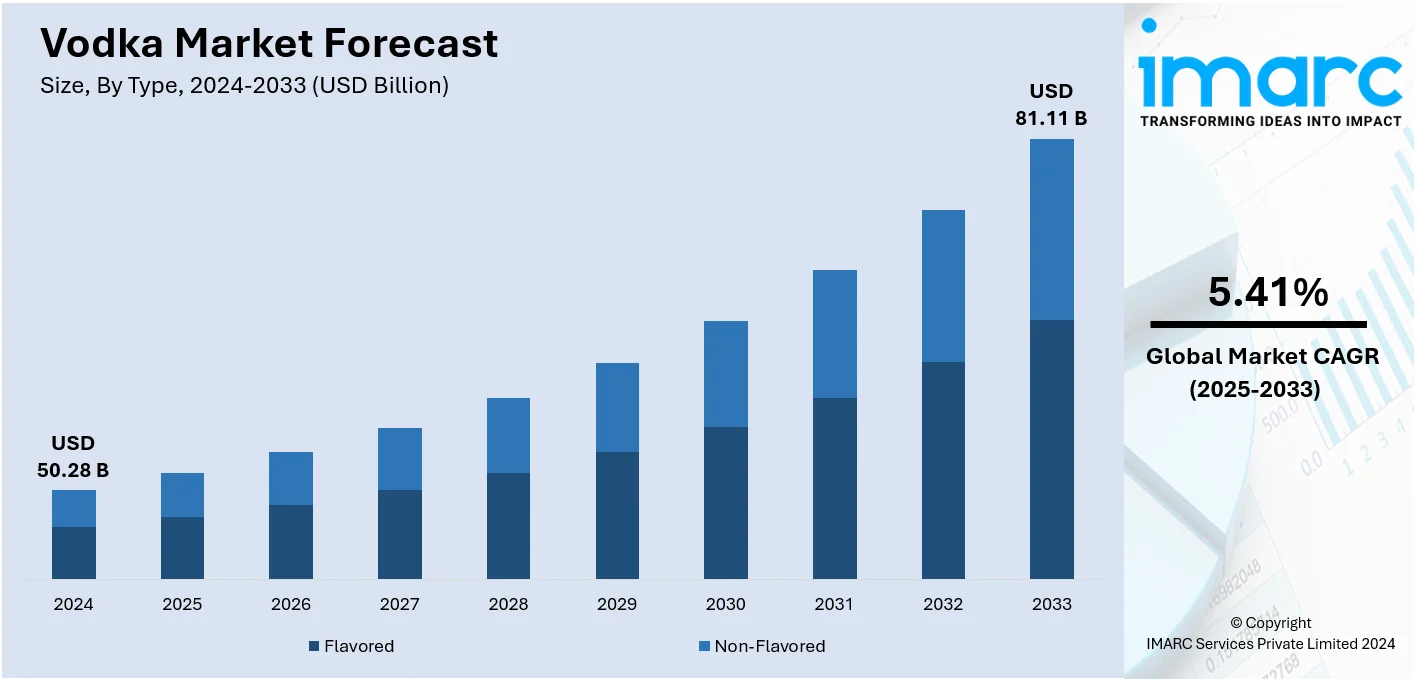

The global vodka market size was valued at USD 50.28 Billion in 2024. The market is projected to reach USD 81.11 Billion by 2033, exhibiting a CAGR of 5.41% from 2025-2033. North America currently dominates the market, due to increasing vodka consumption. The growing demand for premium vodka, combined with innovations in flavors, is positively influencing the market. Enthusiasts are seeking unique taste experiences, drawing interest in craft vodkas that emphasize authenticity and artisanal production. Producers are responding with creative new flavors, ranging from botanical infusions to exotic fruits, while maintaining the smoothness premium vodka is known for, which is fueling the vodka market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 50.28 Billion |

|

Market Forecast in 2033

|

USD 81.11 Billion |

| Market Growth Rate 2025-2033 | 5.41% |

High consumption is seen in countries such as Russia, Poland, and Ukraine, where vodka holds the highest place in their culture; hence, it commands the largest vodka market share in Europe. Trends of premiumization continue to push for growth, with customers who are increasingly looking towards better quality, craft, and flavor vodka products. E-commerce platforms are boosting accessibility, while younger demographics are exploring diverse vodka-based cocktails, enhancing demand. Environmental consciousness has encouraged manufacturers to follow sustainable practices for production, including eco-friendly packaging. Besides this, the expansion of vodka brands in emerging markets like Asia-Pacific is contributing to global growth, driven by evolving lifestyles and rising disposable incomes in urban areas.

The U.S. vodka market is one of the largest globally, driven by a robust cocktail culture and evolving consumer preferences. In 2023, vodka remained the top-selling spirit in the U.S., with 78.6 million 9-liter cases sold, despite a 1.5% sales decline from 2022. Premiumization is a key trend, with demand rising for high-quality and craft vodkas made with organic or locally sourced ingredients. Flavored vodkas continue to capture younger demographics seeking unique and versatile drink options. The growing popularity of ready-to-drink (RTD) cocktails also fuels vodka sales. Sustainability is gaining prominence, as brands adopt eco-friendly practices in production and packaging. Furthermore, innovative marketing campaigns and celebrity endorsements play a significant role in shaping consumer choices, bolstering the U.S. as a vital market for vodka.

Vodka Market Trends:

Increasing consumption of alcoholic beverages

The cocktail culture and mixology business has been very popular over the years, which increases demand for versatile spirits like vodka. As per a report, 2 Billion people consume alcohol worldwide. Consumers are trying to get creative in making their own cocktails and discovering vodka as a great base for multiple drinks. Increasing consumption of alcoholic beverages typically also tends to come in conjunction with a preference for higher-quality, premium products. This kind of trend encourages consumers to search through premium vodka brands that might differentiate themselves through unique flavors, exceptional craftsmanship, and production processes. In addition to the changing consumer preferences toward more craft and artisanal products, this encourages unique vodka offerings, thereby promoting innovation and supporting the vodka market growth.

Introduction of innovative product variants

Fruit-based vodka variants offer a wide range of flavors that can appeal to consumers looking for something different and unique, other than the unflavored vodka. With this in mind, fruit-based vodkas can be more extensive for mixologists and consumers to create innovative cocktails. Such variants can be used as a base for a wide range of creative and flavorful drinks. NIQ further states that 43% of people would prefer to have cocktails more in the early evening and not later in the night. In addition, specialty vodkas targeted at certain dietary needs such as gluten-free or organic vodkas, appeal to niche groups of consumers who want products that support their value system. This is also associated with how health-conscious consumer demand involves beverages perceived for their perceived wellness benefits through vodka infusion with natural elements such as botanicals, herbs, and fruits.

Rising product availability on online platforms

Online platforms provide consumers with access to a diverse range of vodka brands, flavors, and varieties that might not be available in local stores. This expanded reach allows consumers to explore a wider selection and discover new products, thereby improving the vodka market value. Moreover, online purchasing offers convenience and eliminates the need for consumers to visit physical stores. They can conveniently browse, compare, and order vodka from the comfort of their homes. IWSR data projects a 34% growth in alcohol e-commerce sales from 2021 to 2026, following 12% growth in 2019 and 43% in 2020. Besides, online platforms often feature consumer reviews and ratings, influencing purchasing decisions. Positive reviews and ratings can enhance a brand's reputation and encourage new customers to try their products, thus propelling the market growth.

Heightened need for effective branding and marketing

In the vodka industry, effective branding and marketing strategies have evolved to leverage innovative campaigns, celebrity collaborations, and the power of social media to engage consumers. Brands are increasingly utilizing unique and memorable campaigns that focus on lifestyle, quality, and experience, rather than just the product itself. According to the vodka market trends 2025, celebrity endorsements and collaborations are becoming a prominent strategy, with high-profile figures aligning themselves with big brands to enhance credibility and expand reach. These partnerships not only attract attention but also influence purchasing decisions, particularly among younger demographics. Social media platforms have amplified the impact of these campaigns, enabling brands to connect directly with consumers through interactive content, influencer partnerships, and user-generated material. By fostering community-driven engagement, vodka brands create authentic connections with their audience, leading to stronger brand loyalty and increased visibility. These strategies reflect the industry's shift toward a more personalized, digital-first approach that capitalizes on trends and consumer interests in real-time. In December 2024, Kylie Jenner launched canned vodka soda RTD Sprinter, which is manufactured with high-quality vodka, original fruit juices, and sparkling water.

Vodka Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vodka market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, quality and distribution channel.

Analysis by Type:

- Flavored

- Non-Flavored

Flavored stands as the largest component in 2024 driven by evolving consumer preferences for innovative and diverse taste profiles. Offering options like fruit, botanical, spice, and dessert-inspired flavors, flavored vodka appeals to younger demographics and experimental drinkers seeking unique mixology experiences. This category enhances the versatility of vodka in cocktails, making it a popular choice in the thriving bar and nightlife culture. The rise of RTD cocktails featuring flavored vodkas also supports its leading position. Also, brands are focusing on seasonal and limited-edition flavors to maintain consumer interest. This ongoing innovation, combined with effective marketing strategies, ensures flavored vodka remains the largest and fastest-growing segment within the global vodka market.

Analysis by Quality:

- Standard

- Premium

- Ultra-Premium

Ultra-premium leads the market driven by growing consumer demand for high-quality, luxury alcoholic beverages. This segment benefits from increasing interest in premium and craft products, with vodka drinkers seeking superior taste, unique distillation methods, and organic or locally sourced ingredients. Ultra-premium vodkas are often associated with exclusivity, craftsmanship, and luxury experiences, appealing to affluent consumers and connoisseurs who prioritize quality over price. Innovative packaging and branding, often coupled with celebrity endorsements, further enhance the appeal of ultra-premium products. As disposable incomes rise, particularly in North America and Europe, consumers are willing to invest in higher-priced vodka offerings. This trend reflects broader consumer shifts toward premiumization, positioning ultra-premium vodka as a dominant force in the global market.

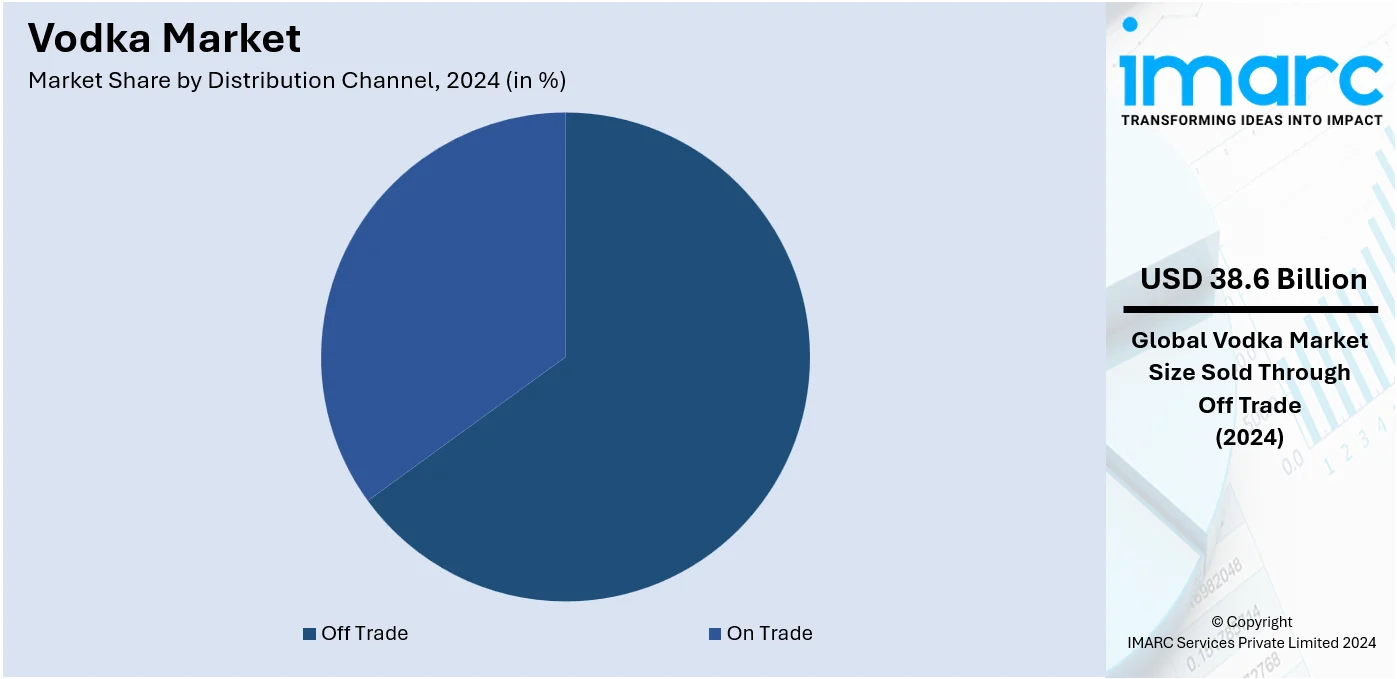

Analysis by Distribution Channel:

- Off Trade

- On Trade

In 2024, off trade accounts for the majority of the market driven by changing consumer buying habits and the convenience of at-home consumption. Supermarkets, hypermarkets, liquor stores, and e-commerce platforms play a pivotal role in this growth, offering a wide range of vodka options across price points. The increasing popularity of home-based entertainment, particularly post-pandemic, has fueled demand for premium and flavored vodkas for personal use and small gatherings. E-commerce has further strengthened the off-trade segment by providing easy access, competitive pricing, and home delivery options. According to the vodka market trends, promotions, discounts, and bundling deals in retail outlets are contributing to making off-trade the preferred purchasing channel for vodka enthusiasts worldwide.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share due to robust cocktail culture, high demand for premium and flavored vodkas, and the popularity of RTD alcoholic beverages. Consumers increasingly prefer innovative flavor profiles and craft options, driving growth within the segment. Additionally, premiumization trends have led to a surge in demand for high-quality, locally produced vodkas, particularly in the United States and Canada. The rise of e-commerce platforms has further expanded accessibility, enhancing sales across diverse consumer demographics. North America’s emphasis on sustainable and organic alcoholic beverages also aligns with evolving consumer preferences, solidifying its position as a key vodka market globally.

Key Regional Takeaways:

United States Vodka Market Analysis

The U.S. vodka market is benefiting from the rising demand for premium and craft spirits, particularly among younger consumers seeking high-quality and authentic experiences. As reported, millennials are now the second-largest generation in the U.S. electorate. The demographic shift is influencing the tastes of Generation Z and millennials, driving a preference for premium products. Vodka-based cocktails continue to dominate in bars and restaurants, contributing to the increasing consumption, as vodka remains a versatile base for various drinks. Moreover, growing health consciousness is driving demand for gluten-free, organic, and low-calorie variants of vodka. With increasing consumer interest in clean label, the emphasis of the brand has been on transparency and naturalness. The development of online shopping and direct-to-consumer sales platforms has allowed increased vodka sales, especially during the pandemic period. The increased consumption in homes due to growing popularity of home-based mixology and social gatherings further augments at-home consumption. Aside from this, craft distilleries and new-age flavored vodkas are bringing the market to a newer age of consumers. This will continue to be an increasingly large, diverse consumer base, high disposable income, and population of more than 331 million, which makes the United States the leading market for vodka brands domestically and internationally, with its competitive growth and innovation fueling.

Europe Vodka Market Analysis

Europe remains one of the largest markets for vodka, driven by its cultural significance and rich history, particularly in Eastern Europe and Russia, where vodka is a staple. According to WHO, about 470 Million people consumed alcohol in the region in 2019, with over 2 out of 3 adults having consumed alcohol. The growing trend toward premiumization is further contributing to the market's expansion, with consumers willing to pay a premium for high-quality, artisanal vodka brands. Increasing demand for low-calorie, organic, and clean-label vodka variants in the region, with an upward trend of health-consciousness, is another area that needs to be looked at. Vodka continues to be an important component in the most popular cocktails around the world, particularly in the UK and Germany, where cocktail culture continues to soar. The global travel retail market expansion has greatly aided the exports of European vodka, mainly due to increased demand in the realm of duty-free shopping. Moreover, craft distilleries and small-batch vodka producers in countries such as Poland, Sweden, and the Netherlands are emerging, adding diversity and innovation to the European vodka market, thus positioning it for sustained growth.

Asia Pacific Vodka Market Analysis

The vodka market in the Asia-Pacific region is growing due to factors such as increased urbanization, rising disposable incomes, and an increasing middle class. According to the World Bank, East Asia and the Pacific is the world's most rapidly urbanizing region, with an average annual urbanization rate of 3%. This urban growth, therefore, is driving premium alcoholic beverages, including vodka, demand among younger consumers who are influenced by Western culture and lifestyles. The increasing preference for flavored and premium vodka variants is also the reason for market expansion, as they seek more sophisticated and different products. Moreover, the growth of bars, clubs, and restaurants in main cities is further promoting vodka consumption in social settings. E-commerce and newer retail formats are improving the accessibility of markets, resulting in growth across the region. While cultural factors and government rules on alcohol consumption remain a challenge, the vodka market in APAC remains promising with growth, as consumer preference evolves.

Latin America Vodka Market Analysis

Latin American vodka market growth is stimulated by increasing urbanization and a growing tendency towards international spirits, with this group of consumers primarily including the younger, more urban-oriented population. Indeed, as reported, it is around 80% now, higher than most regions, which contributes to the higher demand for premium alcoholic beverages like vodka. Expanding middle classes combined with evolving cocktail cultures boost the vodka consumption levels in places such as restaurants and bars. The sales are enhanced with e-commerce coming along with new brand-flavored variants to provide a changed demand by a customer in vodka.

Middle East and Africa Vodka Market Analysis

Vodka has continued to grow in the Middle East and Africa with its growth attributed to growing Western lifestyles acceptance, which have been embraced in these areas, especially in nations such as the UAE and South Africa, where alcohol restrictions are not as strict. In fact, the MENA region already stands at 64% in urbanization, which contributes to the increased demand for vodka and other premium alcoholic drinks. Adding further fuels to this trend are an increasing expatriate population and the growth of night life and hospitality sectors of urban areas. However, cultural factors and regulatory challenges still influence market dynamics in certain regions.

Competitive Landscape:

Key players are driving the industry through aggressive marketing, product innovations, and premium offerings to capture greater vodka market share by brand. Established brands dominate with strong distribution networks, while emerging players contribute to diversity by offering craft and locally distilled options. The market is segmented by product types, including unflavored and flavored vodkas, catering to a wide range of consumer preferences. Increasing demand for sustainable production methods and organic ingredients has intensified competition, pushing brands to adopt eco-friendly practices. The growth of e-commerce as a key sales channel has further heightened competition, enabling smaller players to reach broader audiences. Overall, the market dynamics are shaped by product differentiation, regional preferences, and evolving consumer trends.

The report provides a comprehensive analysis of the competitive landscape in the vodka market with detailed profiles of all major companies, including:

- Anheuser-Busch InBev SA/NV

- Bacardi Limited

- Becle SAB de CV

- Brown–Forman Corporation

- Constellation Brands Inc.

- Davide Campari-Milano N.V. (Lagfin S.C.A.)

- Diageo plc

- Distell Group Limited

- Iceberg Vodka Corporation

- LVMH Moet Hennessy Louis Vuitton

- Pernod Ricard

- Russian Standard Vodka LLC

- Stoli Group S. à r.l.

- Suntory Holdings Limited

Latest News and Developments:

- June 2025: Absolut Vodka unveiled a new stage of its worldwide inventive and social campaign, ‘Born to Blend-World of Absolut Cocktails,’ spotlighting the dynamic cooperative energy between dance and cocktail culture. It would spread to more than 20 markets, including Germany, France, Poland, and international travel retail, after starting in the UK. In order to encourage viewers to experiment with Absolut cocktails at bars or at home, it would feature the hero movie, a remix song, and entertaining ‘How to Mix’ content.

- May 2025: ZigZag Vodka made its formal debut in the Indian spirits industry. The products would be offered at a few establishments and upscale bars in Delhi and Goa, with ambitions to shortly extend into Assam. The brand highlighted its distinct strategy of connecting with contemporary consumers and expressed its goal to become a major force in India's changing beverage sector.

- May 2025: Piccadily Agro Industries declared the release of a luxury vodka in small batches called Cashmir. With the pristine waters of the Kashmir Valley and carefully brewed from heritage organic Indian winter wheat, Cashmir paid homage to the land's everlasting mystique and poetic beauty.

- May 2025: Blisswater introduced Salty Nerd Vodka, a product that blended superior quality with eccentric personality. Made from high-quality grain and purified by charcoal filtering, Salty Nerd was a smooth, clean beverage that could be sipped straight or on the rocks.

- April 2025: Jatt Life, the premium UK vodka manufacturer, partnered with HS Oberoi Spirits to formally enter the Indian market. The brand, which was positioned in the premium market, would initially be offered in Delhi, Haryana, Chandigarh, Hyderabad, and Jalandhar.

Vodka Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flavored, Non-Flavored |

| Qualities Covered | Standard, Premium, Ultra-Premium |

| Distribution Channels Covered | Off Trade, On Trade |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anheuser-Busch InBev SA/NV, Bacardi Limited, Becle SAB de CV, Brown–Forman Corporation, Constellation Brands Inc., Davide Campari-Milano N.V. (Lagfin S.C.A.), Diageo plc, Distell Group Limited, Iceberg Vodka Corporation, LVMH Moet Hennessy Louis Vuitton, Pernod Ricard, Russian Standard Vodka LLC, Stoli Group S. à r.l., Suntory Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vodka market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global vodka market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vodka industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vodka market was valued at USD 50.28 Billion in 2024.

IMARC Group estimates the market to reach USD 81.11 Billion by 2033, exhibiting a CAGR of 5.41% from 2025-2033.

Rising demand for premium and flavored spirits is fueling innovation and product diversification. Besides this, the increasing popularity of cocktails, especially among the younger demographic, is boosting vodka consumption in bars, restaurants, and social events. Additionally, digital marketing, influencer promotions, and attractive packaging are enhancing brand visibility and appeal.

North America currently dominates the vodka market due to high consumer demand, a strong cocktail culture, and widespread availability of both domestic and international brands. The region is also experiencing growing interest in premium and flavored vodkas, supported by innovative marketing and distribution strategies. Additionally, the presence of major industry players and advanced retail infrastructure is stimulating the market growth.

Some of the major players in the global vodka market include Anheuser-Busch InBev SA/NV, Bacardi Limited, Becle SAB de CV, Brown–Forman Corporation, Constellation Brands Inc., Davide Campari-Milano N.V. (Lagfin S.C.A.), Diageo plc, Distell Group Limited, Iceberg Vodka Corporation, LVMH Moet Hennessy Louis Vuitton, Pernod Ricard, Russian Standard Vodka LLC, Stoli Group S. à r.l., Suntory Holdings Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)