Wall Covering Market Size, Share, Trends and Forecast by Product Type, Printing Type, Application, End User, and Region, 2025-2033

Wall Covering Market Size and Share:

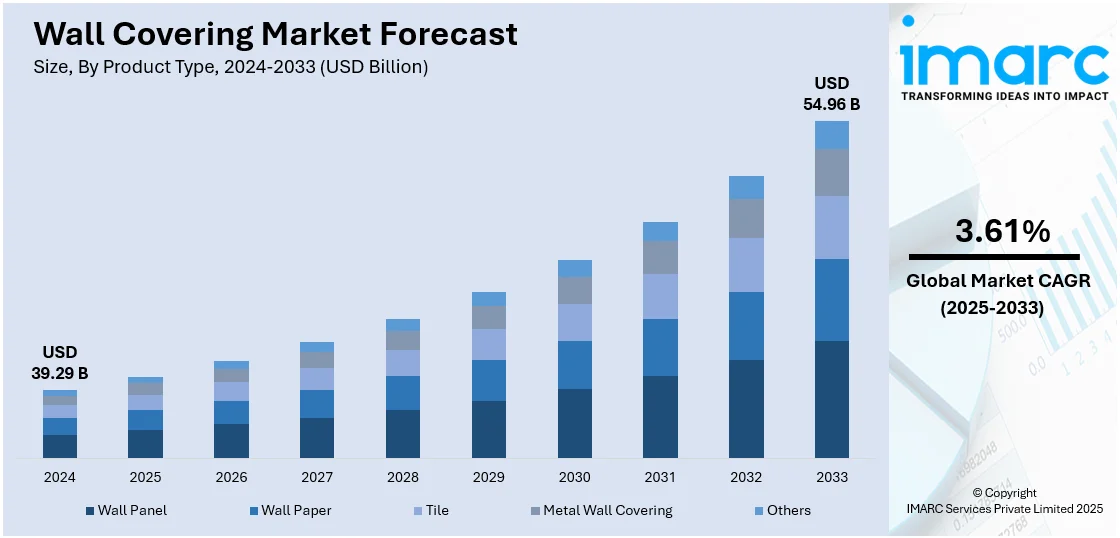

The global wall covering market size was valued at USD 39.29 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 54.96 Billion by 2033, exhibiting a CAGR of 3.61% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 40.4% in 2024. The increasing focus on maintaining the aesthetic appeal of households is impelling the growth of the market. Moreover, the rise in technological advancements for introducing products that are efficient, strong, and easy to maintain is contributing to the market growth. Apart from this, intensive urbanization and the huge development in construction in emerging economies are expanding the wall covering market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 39.29 Billion |

|

Market Forecast in 2033

|

USD 54.96 Billion |

| Market Growth Rate 2025-2033 | 3.61% |

The global market for wall coverings is growing rapidly with changing end user behavior, technology upgrades, and growing investments in interior decoration. One of the most prominent trends is the growing demand for environment-friendly and sustainable wall coverings, including those produced from recycled material and low-volatile organic compounds (VOC) products, keeping pace with world environmental issues and green building codes. Furthermore, digital printing technology is transforming the market through the ability to create high-quality, personalized designs that address personal tastes. This technology is driving the demand from residential and commercial markets, especially among millennials and urban residents looking for personalized interior spaces.

To get more information on this market, Request Sample

The United States market for wall coverings is experiencing growth, driven by evolving tastes, technological improvement in materials, and high investments in exquisite interior design. Moreover, the increased popularity of peel-and-stick wall coverings, which are easy to apply and remove, are gaining popularity among homeowners and renters who are interested in do-it-yourself (DIY) trends. Technology innovation is the other key driver, especially in digital printing, where customized and high-resolution walls can be manufactured effortlessly. This is expanding the design potential for homes and offices alike. The increased popularity of home remodeling, which is driven by aging housing inventory and more remote working, also contributes to the market growth. In 2025, leading luxury wood paneling solutions pioneer, Wood Panel Wall USA presented its newest line of modern wood panel designs. In keeping with the interior design trends of 2025, this new collection has been carefully designed to satisfy the changing tastes of architects, designers, and homeowners looking to enhance interior spaces.

Wall Covering Market Trends:

Aesthetic appeal and customization options

The popularity of different wall coverings and options in terms of aesthetic appeal and customization has a huge impact on preferences, which, in turn, impels the market growth. Moreover, individuals are attracted to wall coverings, which feature an array of motifs, colors, and textures that they can use to show their style and update their space with the latest fashion as well. Personalization is becoming an essential element, and these manufacturers are encouraging to offer customized solutions that satisfy personal preferences. According to an industry report, 71% of buyers expect companies to provide personalized customer interactions. In addition to improving the ambiance of the internal spaces, banners and wallpapers are another tool for expressive and unique environmental storytelling, and consequently, they are become an important tool in interior design practices. This transformation is contributing to the wall covering market growth and leads to the rise of wall covering market value.

Rapid advancements in material technology

The wall covering industry is investing in technological advancements to introduce products that are efficient, strong, and easy to maintain. Innovations such as vinyl wall coverings, non-woven fabrics, and fiberglass are resulting in the development of coverings that can deal with wear and tear, moisture, and mold growth. Such technical developments are broadening the range of their application areas, meaning that wall coverings can operate in different environments, from heavy-duty commercial areas to areas with humidity, such as bathrooms and kitchens, thereby leading to an increase in the wall covering demand.

Escalating demand for eco-friendly and sustainable products

The growing consumer consciousness towards the sustainability is offering a favorable wall covering market outlook. An industry report revealed a growing interest in eco-friendly products, with global online searches for sustainable goods increasing by 71% in just five years. Furthermore, 72% of consumers report purchasing more green products now compared to five years ago. Customers nowadays prefer products that are environment friendly, non-toxic, manufactured through sustainable processes, and recyclable. This change is encouraging producers to switch to eco-friendly, recyclable wallpapers, organic fabrics, and natural fibers, standards, rules, regulations, and green buildings, which consider environmental conservation and healthier indoor air quality through the implementation of eco-friendly materials.

Urbanization and construction activities

Intensive urbanization and the huge development in construction in emerging economies are the main factors fueling the wall covering market outlook. In urbanization process, the demand for residential and commercial buildings constantly rises, and thus, the need for interior decoration items including wall coverings increases. Cultural norms and aspirations of modernization shift, wherein leisure activities move towards wellness based on contemporary, refined, and visually appealing designs. It is another major factor that affects the market segment of wall structures since they render an environment that is new and presents a new character to a place. This includes all types of wall coverings and their dynamics, which will be an important part of a wall covering market overview. According to the world bank report, the expansion of urban land consumption outpaces population growth by as much as 50%, which is expected to add 1.2 million km² of new urban built-up area to the world by 2030.

Wall Covering Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wall covering market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, printing type, application, and end user.

Analysis by Product Type:

- Wall Panel

- Wall Paper

- Vinyl Wallpaper

- Non-woven Wallpaper

- Paper-based Wallpaper

- Fabric Wallpaper

- Others

- Tile

- Metal Wall Covering

- Others

The tile segment dominates the market as it offers durability and low maintenance compared to the other surface coverings that they had in their residential and commercial spaces. Tiles provide the most desired versatility in aesthetics as options include ceramic and porcelain to natural stone and glass to please all design preferences, be it in terms of aesthetics or functionality. Besides, the segment's growth is also underpinned by technological advancements that led to the development of slip-resistant, scratch-proof, and digitally printed tiles, which contribute positively to the wall-covering industry’s revenue. Tiles offer vast design flexibility with a wide range of colors, textures, shapes, and patterns. They can enhance the visual appeal of interiors and exteriors, supporting various architectural and decor styles, from modern minimalism to classic elegance.

Analysis by Printing Type:

- Digital

- Traditional

Traditional stands as the largest component in 2024, holding 70.5% of the market. The market segment for the traditional wall covering is driven by a rising trend for tangible, personal touch products among the masses. Traditional methods offer a sense of authenticity and trust to them as compared to digital alternatives. Industries such as manufacturing, agriculture, and health care tend to adhere to traditional techniques as they are effective, hard to change and in some cases are required by the government. In areas where digital infrastructures are limited, conventional methods remain dominant as they are highly reliable and also easily accessible. Such in-depth wall covering market analysis is a base for the study of factors that shape behavior of consumers and market influencers.

Analysis by Application:

- New Construction

- Renovation

New construction leads the market with 61.4% of market share in 2024. The construction area encompasses a major part of the wall-covering market research report and is strongly driven by the increasing population and urbanization in emerging economies, which result in a greater demand for housing and commercial units. This demand is also driven by the growing economies of the emerging cities, which serve as a driver for the construction industry with a rise in power and individual incomes, respectively. Government initiatives leading to infrastructure development, such as housing and urban projects, are a key aspect of the growth of this sector. Sustainable and green building norms are increasingly influencing new constructions due to environmental problems and regulations. Advancements in construction technologies, materials, and progressive designs that are in line with energy efficiency and sustainability standards are bolstering market growth.

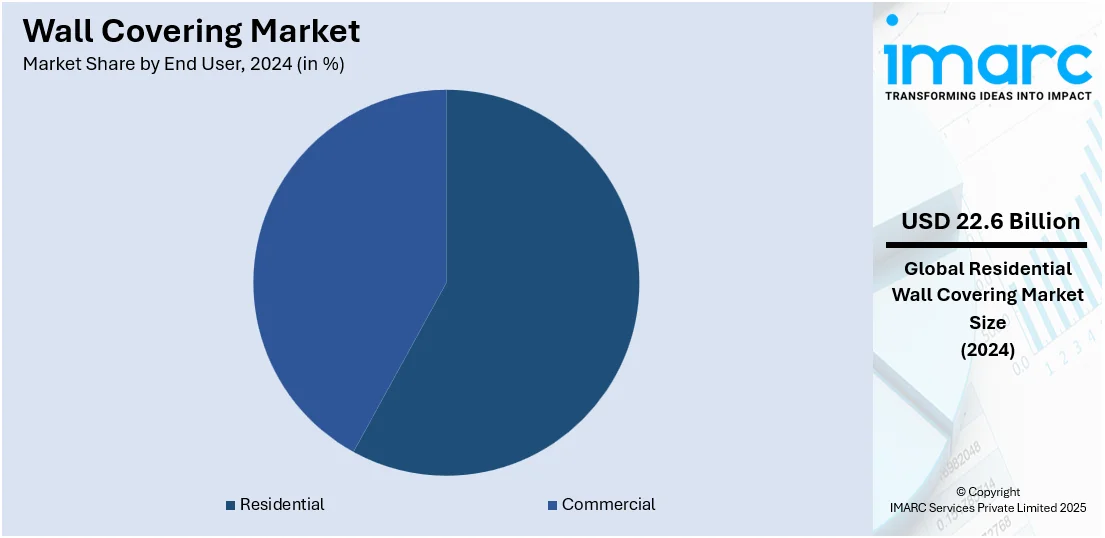

Analysis by End User:

- Commercial

- Residential

Residential electronics leads the market with 57.4% of market share in 2024. The residential segment is a major contributor to improving the market dynamics. The increasing need for individualization and comfort in home environments is encouraging homeowners to show their personalities and unique styles in the wall coverings they choose. The interest in home improvement and renovation is intensifying as people focus on making their living spaces more attractive and functional. The abundance of materials, textures, and designs allows for extensive customization of interiors. Furthermore, the rise of eco- and health-conscious living contributes to the growing popularity of wall coverings that are manufactured from nature-safe or non-toxic, environmentally appropriate materials. The sustainable home decor trend is also reflected in the wall covering market statistics.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 40.4%. It is mainly driven by heightened innovations in interior designing, a fast-growing real estate sector, and increasing middle-class affluence that create both the need for modern living standards and upgrading and the means to afford it. The region boasts a strong production base, offering a wide variety of wall covering products at affordable prices. Moreover, the regional cultural emphasis on bright and stylish interiors and the fast-growing demand for innovative and eco-friendly materials play a significant role in market dynamics, appealing to the younger generation of homeowners looking to create their unique, comfortable, and stylish living spaces. As the wall covering market statistics and forecasts shows, Asia Pacific remains one of the most successful and prospective players in the global landscape.

Key Regional Takeaways:

United States Wall Covering Market Analysis

The United States holds 87.30% share in North America. The United States market is primarily driven by increasing demand for home renovations and remodeling, particularly among millennials and Gen Z homeowners. In line with this, the rising urbanization and real estate development are fueling the need for innovative and functional wall coverings. The increasing consumer preference for sustainable and eco-friendly products, promoting the use of materials made from recycled or natural sources, is propelling the market growth. An industry report revealed that consumer demand for sustainable products remains high, with nearly 50% of Americans stating they purchased an environmentally friendly product in April 2025. Similarly, continual technological advancements in digital printing are enabling more customizable designs, enhancing the market appeal. The growing focus on aesthetic personalization, especially through social media trends, is driving market expansion. Furthermore, ongoing DIY culture and the rise of online home improvement platforms are expanding the consumer base in the market. Additionally, continuous innovations in wall covering functionality, such as soundproofing and moisture resistance, are supporting market demand. Moreover, strategic collaborations are also improving product innovation and market penetration.

Europe Wall Covering Market Analysis

The European market is experiencing growth due to rising demand for premium and luxury interior finishes in both residential and commercial spaces. In accordance with this, the increasing preference for personalized home décor and modern minimalist designs is driving the market development. Similarly, the rise of smart home technologies is also fostering the market expansion, with wall coverings offering integrated functionalities like smart lighting. The Smart Homes and Home Automation Report 2024 stated that by the end of 2023, there were 218.2 million smart home systems in use across the EU27+3 countries. Of these, 28.9 million were multifunction systems, and 189.3 million were point solutions. This represents 27.8% of households in Europe, or about 65.5 million smart homes. Furthermore, the growth of the hospitality industry, particularly boutique hotels, is strengthening the market demand for aesthetic wall coverings. The heightened focus on indoor air quality, fueling the shift towards breathable and non-toxic materials, is stimulating the market appeal. Additionally, emerging design trends in commercial spaces such as offices and retail stores are accelerating market growth. Apart from this, ongoing innovations in product development are enhancing the versatility and functionality of wall coverings, creating lucrative market opportunities.

Asia Pacific Wall Covering Market Analysis

The market in Asia Pacific is majorly propelled by rapid urbanization and the growing construction sector in emerging economies such as China and India. According to industry reports, India is poised to become the third-largest construction market globally, following China and the US. The industry is expected to reach USD 1.4 Trillion by 2025. Similarly, the increasing adoption of modern interior design concepts, including open-plan living spaces, is encouraging the higher uptake of versatile and aesthetically appealing wall coverings. The rising disposable incomes and a growing middle class are promoting investment in premium and decorative wall finishes, fostering market growth. The expanding hospitality and commercial real estate sectors are contributing to the demand for high-end wall coverings in hotels, offices, and retail spaces. Furthermore, the ongoing innovations in digital printing technologies, providing consumers with more design flexibility, are enhancing market accessibility. Moreover, the rise of DIY home improvement trends is also providing an impetus to the market.

Latin America Wall Covering Market Analysis

The market in Latin America for wall covering is significantly guided by the region's increasing demand for affordable yet stylish home improvements, particularly in urban areas. Furthermore, the emerging trend of sustainable and eco-friendly materials in both residential and commercial spaces is strengthening the market demand. The US Green Building Council (USGBC) declared that, in 2024, Brazil ranked 9th globally with 125 LEED-certified projects covering over 2 million square meters. Additionally, the rise in middle-class disposable income, enabling consumers to invest in decorative wall solutions, is bolstering market growth. Apart from this, ongoing innovations in wall-covering technologies, such as self-cleaning surfaces, are attracting consumers seeking low-maintenance and durable products.

Middle East and Africa Wall Covering Market Analysis

The market in the Middle East and Africa is significantly influenced by the rapid urbanization and real estate growth in key regions like the UAE and Saudi Arabia. In addition to this, the rise in luxury commercial and hospitality projects is further fueling market adoption. The Q2 2024 Middle East Hotel Construction Pipeline Trend Report showed 607 hotel construction projects with 147,088 rooms in the region. Furthermore, growing awareness of sustainable building practices is promoting the use of eco-friendly wall coverings. The increasing focus on energy-efficient buildings, encouraging the adoption of materials with thermal insulation, is expanding the market scope. Moreover, the ongoing cultural shift towards modern interior designs and rising disposable incomes are contributing to market expansion.

Competitive Landscape:

Leading players are actively involved in various strategic initiatives to solidify their position in the market and respond to changing consumer interest. They are investing considerably in research and development (R&D) to launch innovative, sustainable, and high-quality products in this growing demand space. By broadening their product spread through creative agreements with artists, innovators, and technologists, they are producing and marketing unique and custom solutions for distinct customer groups. Characteristics in the wall covering market segmentation have aided them in gaining a competitive edge. They employ cutting-edge manufacturing technology as well as digital printing and augmented reality (AR) to provide engaging customer experiences. As per the wall covering market forecast, partnerships made by key players with others through collaborations and acquisitions are expected to increase their geographical scope, bolster distribution, and penetrate new business areas.

The report provides a comprehensive analysis of the competitive landscape in the wall covering market with detailed profiles of all major companies, including:

- A.S. Création Tapeten AG

- Ahlstrom

- Architonic

- Asian Paints Limited

- Brewster

- F. Schumacher & Co.

- Grandeco Wallfashion Group Belgium NV

- J. Josephson, Inc.

- Osborne & Little

- Saint-Gobain

- Sanderson Design Group

- York Wallcoverings

Latest News and Developments:

- April 2025: UltraTech Cement's Board approved the acquisition of 100% equity in Wonder WallCare for INR 235 crore. This acquisition grants UltraTech access to a putty manufacturing plant in Rajsamand, Rajasthan, enhancing its production capacity for wall putty and value-added products in the competitive market.

- March 2025: Antica Ceramica launched its Stone Wall Panels collection, offering four designs: Abstract Elegance, Dynamic Waves, Textured Floral Masterpiece, and Thikri Work Panel. These sophisticated panels blend heritage craftsmanship with modern aesthetics, providing versatile, customizable wall coverings for luxurious interiors.

- February 2025: Wallkalakar launched its Pichwai Wallpapers Collection, inspired by the intricate Pichwai paintings of Nathdwara, Rajasthan. The collection features designs like Shrinathji with Gopis and Majestic Mahal Reverie, blending traditional motifs with contemporary aesthetics. These luxury wallpapers offer cultural elegance and spiritual serenity, available for customization.

- January 2025: Wood Panel Wall USA launched a new collection of premium wood panels crafted from sustainable materials like natural oak, MDF veneer, and WPC. These versatile panels offer stylish, functional wall and ceiling solutions, combining modern wall covering designs with sound absorption and eco-friendly craftsmanship for residential and commercial spaces.

- November 2024: VOX India expanded its product range with three versatile wall and ceiling panels, including Infratop Four Lamella SV26, Fronto SV24, and Welo SV22. These panels offer stylish, durable, and low-maintenance solutions for both residential and commercial spaces, catering to the demand for modern, sustainable architectural materials.

Wall Covering Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Printing Types Covered | Digital, Traditional |

| Applications Covered | New Construction, Renovation |

| End Users Covered | Commercial, Residential |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A.S. Création Tapeten AG, Ahlstrom, Architonic, Asian Paints Limited, Brewster, F. Schumacher & Co., Grandeco Wallfashion Group Belgium NV, J. Josephson, Inc., Osborne & Little, Saint-Gobain, Sanderson Design Group, York Wallcoverings, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wall covering market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global wall covering market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wall covering industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wall covering market was valued at USD 39.29 Billion in 2024.

The wall covering market is projected to exhibit a CAGR of 3.61% during 2025-2033, reaching a value of USD 54.96 Billion by 2033.

The market is driven by increasing consumer demand for sustainable, eco-friendly products, technological advancements in printing and material innovations, urbanization, and growing construction activities, particularly in emerging economies. The rising trend for personalized and customizable designs further boosts market growth.

Asia Pacific currently dominates the wall covering market, accounting for a share of 40.4% in 2024, driven by rapid urbanization, increased construction activity, and high demand for innovative, eco-friendly materials.

Some of the major players in the wall covering market include A.S. Création Tapeten AG, Ahlstrom, Architonic, Asian Paints Limited, Brewster, F. Schumacher & Co., Grandeco Wallfashion Group Belgium NV, J. Josephson, Inc., Osborne & Little, Saint-Gobain, Sanderson Design Group, York Wallcoverings, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)