Wallpaper Market Size, Share, Trends and Forecast by Wallpaper Type, Distribution Channel, End User, and Region, 2026-2034

Wallpaper Market Size and Trends:

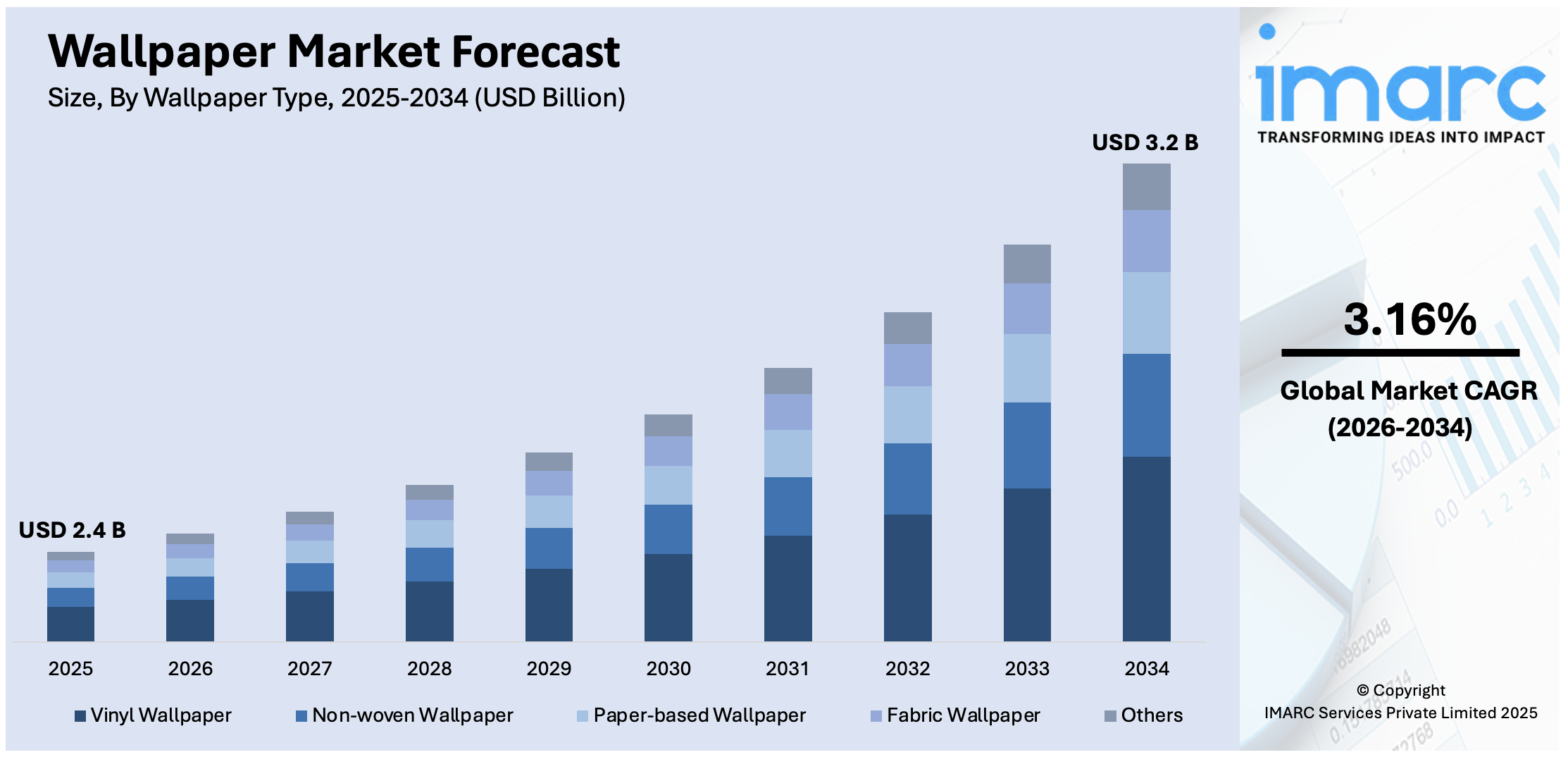

The global wallpaper market size was valued at USD 2.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3.2 Billion by 2034, exhibiting a CAGR of 3.16% from 2026-2034. North America currently dominates the market, holding a market share of over 36.3% in 2025. The increasing awareness of design trends, the rising product demand in home staging to enhance the appeal of real estate properties, and the development of innovative features are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.4 Billion |

| Market Forecast in 2034 | USD 3.2 Billion |

| Market Growth Rate (2026-2034) | 3.16% |

The wallpaper market is fueled by increasing demand for personalized, aesthetically appealing interiors and advancements in digital printing technology, enabling intricate and customizable designs. Urbanization and rising disposable incomes have driven interest in premium home décor products. For instance, on July 15, 2024, Xeikon partnered with Kernow Coatings to introduce KernowJet Interiors substrates like Bright Gold and Smooth Pearl, offering luxurious finishes, high print quality, and design flexibility for residential, commercial, and hospitality markets. In addition to this, eco-friendly and durable wallpaper materials attract environmentally conscious consumers, while the hospitality sector’s focus on unique ambiances augments growth. Easy installation and removal render wallpapers ideal for temporary spaces, and expanding e-commerce platforms enhance accessibility, driving further adoption across various applications.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by emerging trends in home renovation and personalization, with consumers increasingly seeking unique, aesthetically appealing designs. Social media's influence amplified demand for premium wallpapers, while technological advancements like eco-friendly materials and fire-retardant properties address sustainability and safety concerns. For example, Anstey Wallpaper, on February 11, 2024, announced its goal to achieve net carbon zero by 2030, focusing on sustainable practices with water-based inks and eco-friendly substrates. Their advanced digital and conventional printing technologies deliver luxury wallpapers for restoration and iconic spaces worldwide. Multifunctional wallpapers, offering acoustic insulation and moisture resistance, are expanding applications in residential and commercial spaces. Online distribution networks enhance accessibility, supporting growth across diverse consumer demographics.

Wallpaper Market Trends:

Increasing Demand from the Commercial Sector

The product demand from the commercial sector is favourably impacting the market. Various establishments, including offices, hotels, restaurants, retail stores, and entertainment venues, have recognized the importance of wallpapers in creating visually captivating and immersive environments for their customers and employees. Office buildings and other commercial projects are becoming more common. Despite low economic forecasts, the new supply of these offices is expected to augment construction and decoration activities in important markets, such as Germany and the UK, where demand for spaces larger than 5,000 square meters is at a 19-year high in 2024, as per the industry reports. In the corporate world, offices and workspaces are increasingly embracing wallpapers to enhance the ambiance and reflect their brand identity. Wallpaper designs can incorporate company logos, colors, and themes, creating a cohesive and professional atmosphere that aligns with the organization's image. In the hospitality industry, hotels and restaurants utilize wallpapers to establish a unique and memorable aesthetic. From luxurious and elegant designs to bold and vibrant patterns, wallpapers help create visually striking interiors that leave lasting impressions. Retail stores also leverage wallpapers to enhance the shopping experience. By integrating captivating designs and themes, wallpapers can evoke specific moods, reinforce branding, and entice customers to explore the store further. The commercial sector's demand for wallpapers is driven by the desire to differentiate businesses and create inviting spaces that resonate with customers.

Growing Real Estate Industry

The growing real estate industry is offering numerous opportunities for the market. As the real estate sector expands, both in residential and commercial segments, there is an increasing demand for interior decoration solutions to enhance the appeal of properties. This rapid expansion can be seen very well in developing countries like India Brazil etc. For instance, according to a survey by the Confederation of Real Estate Developers' Association of India (CREDAI), the real estate sector in India is projected to achieve a market size of USD 1.3 trillion by 2034, and USD 5.17 trillion by 2047. According to a statement released by the body, the residential and commercial divisions of the Indian real estate industry account for 80% and 20% of the market's present size, which is INR 24 lakh crore (about USD 300 Billion).

Wallpaper has emerged as a popular choice among homeowners, real estate developers, and interior designers. In the residential sector, new construction projects and housing developments create opportunities for wallpaper installation. Homebuyers often seek properties with aesthetically pleasing interiors, and wallpapers offer a versatile and visually striking option to fulfil this demand. Additionally, the resale market benefits from wallpapers in home staging, as they can transform a space and make it more attractive to potential buyers. In the commercial sector, the growing real estate industry drives the adoption of wallpapers in various establishments. Offices, hotels, restaurants, retail stores, and other commercial spaces utilize wallpapers to create inviting and visually appealing environments for customers and employees. The expansion of the real estate industry, combined with the desire to enhance property value and create appealing spaces, contributes to the increasing demand for wallpapers. Manufacturers and designers can leverage this trend by collaborating with real estate developers, interior designers, and staging companies to offer tailored wallpaper solutions that meet the specific needs of the industry.

Introduction of Innovative Features

The introduction of innovative features is catalyzing the market. Manufacturers have introduced a range of cutting-edge technologies and functionalities that go beyond purely decorative purposes. These innovative features have captured the attention of consumers seeking more than just visually appealing wallpapers. For instance, wallpapers with soundproofing properties have gained popularity, especially in urban areas where noise pollution is a concern. These wallpapers help create a quieter and more peaceful living or working environment. According to World Bank data, currently, approximately 56% of the global population, 4.4 billion people – reside in urban areas. This pattern is anticipated to persist, as the urban populace is projected to more than double by 2050, when approximately 7 out of 10 individuals will reside in urban areas. Thermal insulation is another innovative feature that appeals to energy-conscious consumers. Wallpaper with insulating properties can help regulate temperature, reducing the need for excessive heating or cooling and contributing to energy efficiency. Furthermore, wallpapers with antimicrobial properties have gained traction due to the increased focus on hygiene and cleanliness. These wallpapers inhibit the growth of bacteria and other microbes, making them ideal for healthcare facilities, hospitality spaces, and households. By incorporating these innovative features into wallpapers, manufacturers not only cater to specific consumer needs but also provide added value and differentiation in the market. As consumers become more aware of these features and their benefits, the demand for wallpapers with innovative functionalities is expected to continue driving market growth.

Wallpaper Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wallpaper market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on wallpaper type, distribution channel and end user.

Analysis by Wallpaper Type:

- Vinyl Wallpaper

- Non-woven Wallpaper

- Paper-based Wallpaper

- Fabric Wallpaper

- Others

Vinyl wallpaper leads the market with around 36.9% of market share in 2025. Vinyl wallpaper offers a range of advantages that have contributed to its market dominance. These wallpapers are known for their durability and resilience, making them suitable for high-traffic areas such as commercial spaces and households with children or pets. Their ability to withstand wear and tear, moisture, and stains makes them a practical choice for residential and commercial applications. Furthermore, vinyl wallpapers offer a wide range of design options, including various patterns, textures, and colors, providing consumers with ample choices to suit their preferences and interior styles. The versatility of vinyl wallpapers allows them to mimic other materials such as wood, stone, or fabric, offering cost-effective alternatives without compromising on aesthetic appeal. They are also comparatively simple to install and sustain. Their moisture-resistant properties suit humid environments like bathrooms and kitchens, where moisture and splashes are common.

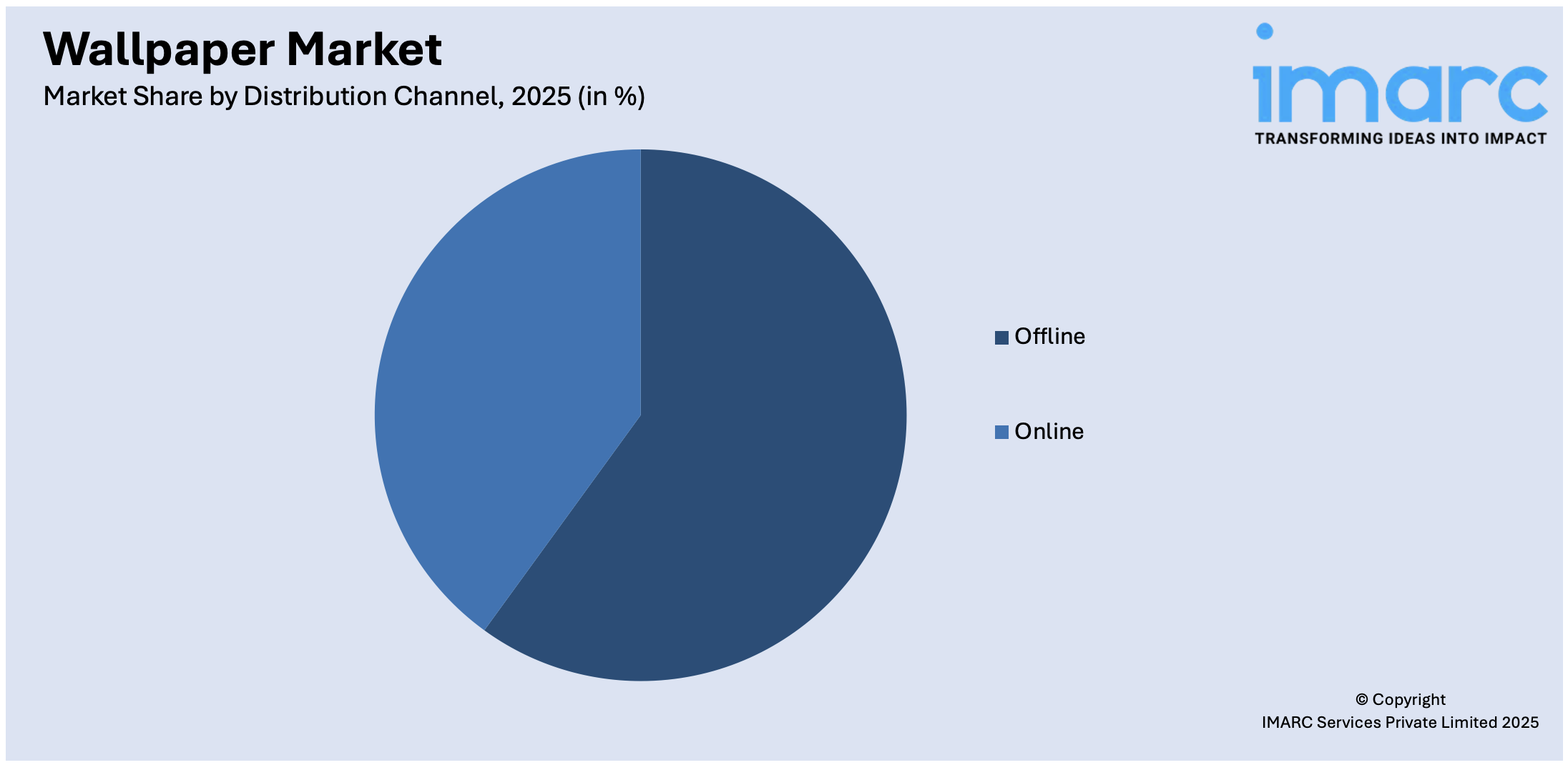

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads the market with around 55.9% of market share in 2025. Traditional brick-and-mortar retail channels, including home improvement stores, specialty wallpaper shops, and interior design showrooms, have been the primary drivers of this segment's dominance. Offline channels offer several advantages that contribute to their market share. One key advantage is the tactile experience they provide to customers. In physical stores, shoppers can touch and feel the texture, quality, and weight of wallpaper samples, allowing them to render informed decisions about their purchase. Additionally, interacting with knowledgeable staff members who can provide guidance and recommendations further enhances the shopping experience. Offline channels also facilitate immediate access to a wide range of wallpaper options. Customers can browse through numerous designs, patterns, and colors in person, allowing them to visualize how the wallpapers will look in their space. While online sales have been growing, the offline segment continues to thrive due to the personalized service and customer engagement it offers. Moreover, some consumers prefer to see the actual product before making a purchase, especially regarding decor elements like wallpaper.

Analysis by End User:

- Residential

- Commercial

Commercial users lead the market with around 54.0% of market share in 2025. Commercial spaces utilize wallpapers for multiple reasons. Wallpapers contribute to the overall ambiance and aesthetic appeal of these establishments. They help create visually captivating and immersive environments that enhance the customer experience and leave a lasting impression. For example, hotels and restaurants often use wallpapers to create unique themes and atmospheres that align with their brand identity. Wallpapers in commercial spaces serve as a branding tool. They can incorporate company logos, colors, and visual elements that reinforce the brand image and create a cohesive look throughout the establishment. Moreover, wallpapers in the commercial segment can offer functional benefits. They can be designed with soundproofing, thermal insulation, or antimicrobial properties to cater to specific needs in different commercial environments. As businesses increasingly prioritize creating visually appealing and memorable spaces, the demand for wallpapers in the commercial segment is expected to grow. Manufacturers and designers are actively developing innovative and customized wallpaper solutions to meet the specific requirements of this market segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 36.3%. A strong emphasis on interior design and home improvement in the North American culture has resulted in a significant demand for wallpapers. Homeowners and businesses prioritize creating visually appealing and personalized spaces, leading to higher adoption of wallpapers. North America benefits from a well-developed retail infrastructure, including home improvement stores, specialty wallpaper shops, and online platforms. These distribution channels provide easy access to a wide range of options for consumers, contributing to market growth. Moreover, the region's flourishing construction industry, with numerous residential and commercial projects, presents opportunities for wallpaper installations. New constructions, renovations, and remodeling activities in North America create a demand for interior decoration, including wallpapers. Additionally, the presence of influential interior design trends and a strong social media culture in North America drives the popularity of wallpapers.

Key Regional Takeaways:

United States Wallpaper Market Analysis

In 2024, the United States represents 84.70% of the North America wallpaper market. The growing trends in interior designing and house remodelling are contributing to the wallpaper market of the United States. At present, wallpapers were a vital part of the U.S. home remodelling market for 2023, especially for Gen Z and millennial buyers. Similarly, according to various studies conducted recently, on average, the homeowner spent an estimated amount of around USD 8,484 in 2022 pertaining to various home renovation improvements surrounding their living spaces in the United States. This translates to a national average of USD 567 Billion for house repairs and renovations in that year, up 15% from 2021, according to CBS News. Demand is fuelled by the trend towards eco-friendly, personalized, and peel-and-stick wallpapers since these products are convenient. Sales of peel-and-stick wallpaper alone increased on a year-over-year basis. Another emerging sector are the commercial applications, such as hotels, offices, and retail outlets. Companies are increasingly using the customized wallpaper designs to enhance beauty in the places. The market has seen smart wallpapers having conductive materials or screens made of LED. Moreover, with the advancement in the digital printing, superior flexible designs that appeal to consumer preferences are achieved. The increased demand for wallpapers manufactured from recycled paper and non-toxic inks arises from the LEED requirements on sustainable materials set by the U.S. Green Building Council.

Europe Wallpaper Market Analysis

Wallpaper demand in Europe market is based on people's long-time preference for sophisticated interior designs and lifestyle sensitivity to environmental conservation, leading to expansion in the market. In 2023, Germany, the UK, and France are at the head of the pack. The findings of a conference held in Milan in early December 2024 point to a decline in construction activity in the 19 Euroconstruct countries by 2.4% in 2024 before picking up by an estimated 0.6% in the following year. Total construction output is estimated to grow by 3.5% in Eastern Europe and by 0.4% in Western Europe in 2025. Textured and patterned wallpapers are in good demand given the fashion for Scandinavian and retro styles. European manufacturers are focusing on wallpapers made from biodegradable and VOC-free material, and sustainability is a great motivator. Strict environmental standards of the European Union as well as consumer demand for environmental-friendly products fuel innovation in this industry. Increased consumer adoption is also increased by the rise in the popularity of digital wallpapers with printable designs, which allow homeowners to design custom interiors. Wallpaper is becoming increasingly used in commercial settings such as restaurants and boutique hotels to provide specific aesthetics. The wallpaper market is further expected to grow due to continued investment in new construction and renovation projects, especially in Eastern Europe.

Asia Pacific Wallpaper Market Analysis

The wallpaper industry in Asia-Pacific is growing at the fastest rate attributed to factors such as urbanization, greater disposable income, and a boom in residential construction. According to an industrial report, the construction market in the region, which created an estimated USD 4.36 Trillion in 2022 accounting for 45% of the global construction market, is growing rapidly, with China and India at the helm. High-end wallpaper demand in China increased sharply, showing that high-end buyers are increasingly interested in luxury interior design. Water-resistant and washable wallpapers are examples of technological innovation that meets practical needs in humid conditions, making them popular in Southeast Asia. Localized designs are made possible by digital printing technology appealing to cultural tastes around the world. The commercial sector, including retail and hospitality industries, also demands wallpaper as companies look to enhance their aesthetics. The area is anticipated to expand at a faster rate due to increasing adoption rates and ongoing urban infrastructure projects.

Latin America Wallpaper Market Analysis

Urbanization and rising middle-class expenditure on house renovation are driving the wallpaper business in Latin America. The desire for affordable, peel-and-stick wallpaper options that appeal to both homeowners and renters is driving the region's market. The construction sector in the region is also growing rapidly due to various initiatives by the government as well as private players. For example, Vollert's revolutionary housing design for Brazil's middle class, which constitutes 30% of the population, has the potential to greatly grow the nation's building industry by meeting the urgent demand for reasonably priced homes. This project aims to speed up the construction process using the latest available precast concrete technology which can reduce building time by as much as 50% more than that of the regular techniques. Wallpaper is rapidly becoming popular in both residential and commercial interior designs. With countries like Brazil and Mexico driving growth, this type of interior design is expanding across the globe. Growing environmental consciousness is leading to an increased utilization of sustainable materials. In addition, it is also driven by state-backed housing projects that cater to the demand for affordable wallpaper.

Middle East and Africa Wallpaper Market Analysis

The wallpaper industry in Middle East and Africa is thus affected by luxury construction and emphasis on interior design. Due to government plans and grand megaprojects, the construction sector in Middle East and Africa is likely to gain significant momentum. For example, from 2025 to 2028, Saudi Arabia intends to invest more than USD 175 Billion a year in industrial and megaprojects, such as the revolutionary Neom and Red Sea projects. To meet the growing demand for residential real estate, the National Housing Company in Saudi Arabia also announced projects totalling USD 17.3 Billion. Wallpapers with moisture- and heat-resistant qualities are especially well-liked given the harsh weather. Sales are also influenced by cultural preferences for elaborate and colourful decorations. High-end wallpapers have become increasingly used in commercials, such as in exclusive hotels, to enhance indoor decoration.

Competitive Landscape:

Top companies are bolstering the market growth and maintaining their competitive edge by focusing on innovation, distribution reach, and strategic marketing efforts. These companies invest in research and development (R&D) to create unique, high-quality wallpaper designs catering to changing consumer preferences. They continuously introduce new collections with diverse patterns, colors, and textures to attract a wide range of customers. Furthermore, these companies have established strong offline and online distribution networks, ensuring their products are widely available to consumers. They collaborate with retailers, home improvement stores, and e-commerce platforms to reach a broader customer base. Marketing plays a crucial role in their success as well. These companies employ effective branding strategies, engage with influencers, and leverage social media platforms, trade shows and exhibitions to showcase their products and build relationships with industry professionals.

The report provides a comprehensive analysis of the competitive landscape in the wallpaper market with detailed profiles of all major companies, including:

- A.S. Création Tapeten AG

- All 4 Walls Wallpaper

- Asian Paints Ltd.

- Brewster Home Fashions

- Erismann & Cie. GmbH

- F. Schumacher & Co.

- Grandeco Wallfashion Group Belgium NV

- Gratex Industries Ltd.,

- Laura Ashley Holdings plc

- Marburger Tapetenfabrik

- Osborne & Little

- Sangetsu Corporation

- York Wallcoverings Inc.

Latest News and Developments:

- February 2024: Asian Paints released its color, wallpaper, and design forecast for 2024, providing information on new trends that will influence interior design. An increasing inclination for comfort, sustainability, and biophilic designs that link interior spaces to nature is reflected in the company's emphasis on a shift towards warm, earthy hues and natural textures.

- June 2021: Grandeco Wallfashion Group of Belgium announced that it has acquired the whole share capital of Holden Decor Limited, one of the top wallcovering firms in the United Kingdom, from D&V Holden Limited.

- 2020: All 4 Walls Wallpaper collaborated with HGTV Home, a well-known home improvement and design network, to launch an exclusive wallpaper collection.

- 2020: Asian Paints launched their "Nilaya" wallpaper collection, which showcased a wide range of designs and textures suitable for various interior styles.

- 2019: A.S. Création partnered with the renowned fashion brand Esprit to launch a new wallpaper collection inspired by Esprit's lifestyle and fashion trends.

Wallpaper Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Wallpaper Types Covered | Vinyl Wallpaper, Non-woven Wallpaper, Paper-based Wallpaper, Fabric Wallpaper, Others |

| Distribution Channels Covered | Online, Offline |

| End-Users Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A.S. Création Tapeten AG, All 4 Walls Wallpaper, Asian Paints Ltd., Brewster Home Fashions, Erismann & Cie. GmbH, F. Schumacher & Co., Grandeco Wallfashion Group Belgium NV, Gratex Industries Ltd., Laura Ashley Holdings plc, Marburger Tapetenfabrik, Osborne & Little, Sangetsu Corporation,York Wallcoverings Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wallpaper market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global wallpaper market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wallpaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Wallpaper refers to a decorative material used to enhance interior walls, offering aesthetic appeal and functional benefits. Available in various designs, colors, and textures, it transforms spaces by adding personality and style. Wallpaper is a versatile alternative to paint, often used in residential, commercial, and hospitality settings for visual impact.

The wallpaper market was valued at USD 2.4 Billion in 2025.

IMARC estimates the global wallpaper market to exhibit a CAGR of 3.16% during 2026-2034.

The market is primarily driven by increasing consumer demand for personalized interiors, advancements in digital printing, eco-friendly materials, multifunctional designs, and the growing real estate and commercial sectors requiring aesthetically appealing and sustainable decoration solutions.

In 2025, vinyl wallpaper represented the largest segment by wallpaper type, driven by its durability, moisture resistance, and versatile design options.

Offline leads the market by distribution channel attributed to tactile experiences, immediate availability, and personalized customer service in physical stores.

Commercial is the leading segment by end user, driven by the need to create unique, brand-aligned, and functional environments.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global wallpaper market include A.S. Création Tapeten AG, All 4 Walls Wallpaper, Asian Paints Ltd., Brewster Home Fashions, Erismann & Cie. GmbH, F. Schumacher & Co., Grandeco Wallfashion Group Belgium NV, Gratex Industries Ltd., Laura Ashley Holdings plc, Marburger Tapetenfabrik, Osborne & Little, Sangetsu Corporation, and York Wallcoverings Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)