Water Purifier Market Report by Technology Type (Gravity Purifiers, RO Purifiers, UV Purifiers, Sediment Filter, Water Softener, and Others), Distribution Channel (Retail Stores, Direct sales, Online), End-User (Industrial, Commercial, Household), and Region 2026-2034

Water Purifier Market Size:

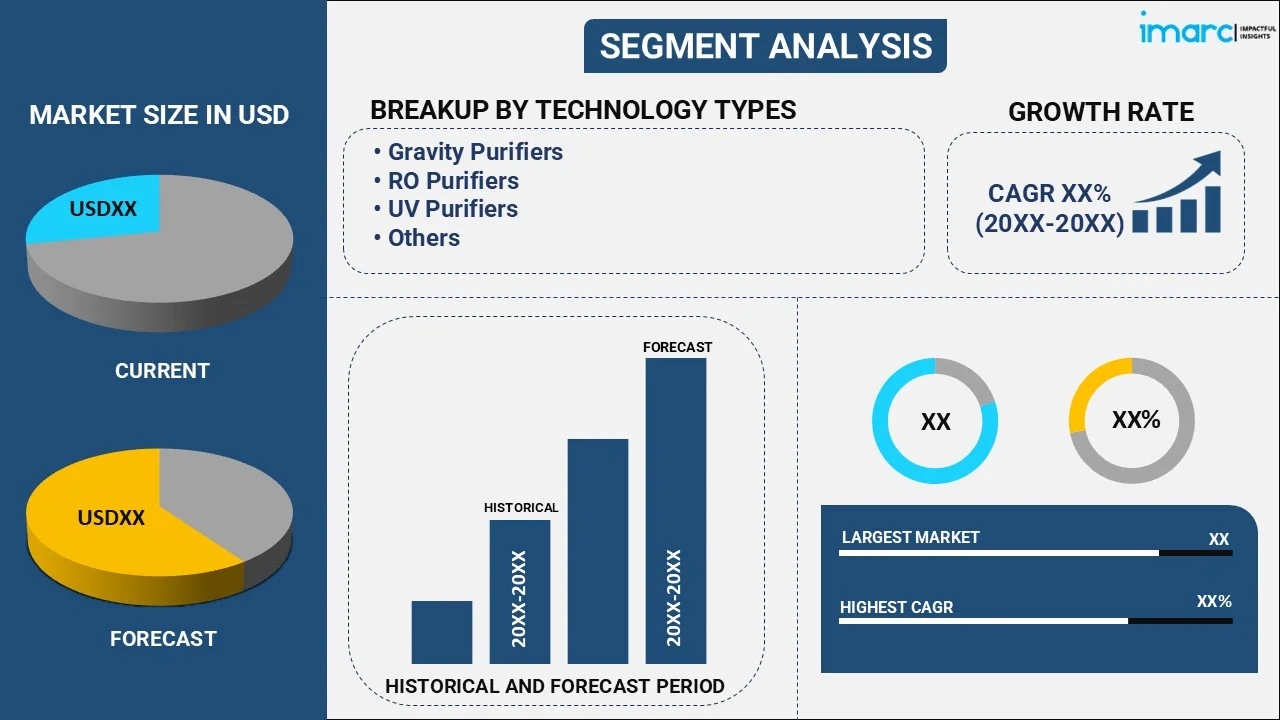

The global water purifier market size reached USD 64.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 134.2 Billion by 2034, exhibiting a growth rate (CAGR) of 8.16% during 2026-2034. Asia Pacific leads the market owing to the growing awareness about water quality, increasing demand for clean drinking water, and a strong focus on health and environmental sustainability. The market is experiencing strong growth driven by increasing awareness of water quality, rapid urbanization and improving infrastructure in emerging economies, escalating need for eco-friendly and sustainable water purification technologies, and heightening focus on health and wellness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 64.9 Billion |

|

Market Forecast in 2034

|

USD 134.2 Billion |

| Market Growth Rate 2026-2034 | 8.16% |

Elevated industrial operations, agricultural runoff, and urban growth are resulting in higher levels of water pollution. With the decline in water quality, consumers are searching for trustworthy purification systems to guarantee clean and safe drinking water, increasing the need for sophisticated filtration solutions. Additionally, the growing awareness about waterborne illnesses and the harmful effects of drinking untreated water is encouraging individuals to purchase water purifiers. People are placing more emphasis on their health, choosing purified water to minimize the chances of sickness and uphold their overall wellness. Besides this, advancements in filtration technology, including reverse osmosis and ultraviolet (UV) filtration, are greatly enhancing the efficiency and cost-effectiveness of water purifiers. These improvements are improving the efficiency and accessibility of water purifiers, resulting in their increased use in both developed and developing areas.

To get more information on this market Request Sample

Water Purifier Market Trends:

Environmental Concerns and Sustainability

The adoption of water purifiers is being influenced by environmental sustainability, as consumers are becoming more conscious about the effects of plastic waste on the environment. Numerous individuals are transitioning from bottled water to home purification systems in order to lessen their environmental impact and help decrease plastic waste. Innovations in water purification technology are aiding in tackling these issues, as producers create energy-efficient and water-conserving designs that reduce ecological effects. In 2025, Glacier Fresh launched a range of sustainable water filtration solutions, featuring eco-friendly reverse osmosis systems and outdoor filters, in partnership with international organizations such as Polarhub. Items such as the U03 reverse osmosis system, aimed at delivering purer water and reducing waste, are addressing the rising need for eco-friendly options. With environmental responsibility increasingly influencing consumer buying choices, the demand for efficient, eco-conscious water purifiers is growing.

Corporate and Institutional Adoption

Alongside residential needs, commercial and institutional sectors are increasingly adopting water purifiers to meet the requirements of staff, clients, and students. Businesses, educational bodies, healthcare organizations, and numerous public entities recognize the importance of providing access to safe and clean water as part of their corporate social responsibility (CSR) initiatives and improve employee well-being. In the corporate area, water purification systems are essential for ensuring the well-being and safety of workers, particularly in industries such as hospitality, manufacturing, and healthcare. The deployment of water purifiers in major organizations and commercial establishments is driven by the need to comply with local laws concerning water quality and workplace health standards. With a focus on the welfare of their stakeholders, organizations and companies are increasingly requiring comprehensive water purification systems, expanding the market past residential applications.

Increasing Water Contamination

The rising level of water pollution globally are a major factor driving the need for water purifiers. Different contaminants, such as industrial byproducts, chemicals, and pathogens, threaten water quality, rendering it unsafe for drinking. With rapid urbanization and increasing agricultural runoff, numerous areas encounter a growing challenge in providing safe drinking water. This situation emphasizes the necessity for sophisticated purification systems that can eliminate impurities and supply clean water. In reaction to these challenges, both individuals and industries are progressively investing in water purification technologies that provide dependable and efficient solutions. The demand for clean water, driven by environmental damage and health issues, is bolstering the market growth. The rising awareness about the negative impacts of drinking untreated water is driving the need for systems that ensure the elimination of harmful contaminants, making water purifiers vital for both homes and businesses.

Water Purifier Market Growth Drivers:

Integration of Smart Technology and Advanced Features

With consumers becoming more tech-savvy, the need for purifiers providing greater convenience, efficiency, and performance is increasing. Smart water purifiers that come with functionalities like real-time monitoring of water quality, tracking of filter lifespan, and app integration are gaining popularity. These advancements not only improve user experience but also offer increased control and personalization of water purification methods. For instance, in 2025, Xiaomi released the Mi Water Purifier S1, equipped with a smart touch faucet for hands-free water dispensing, ultraviolet (UV)-LED sterilization, and a multi-stage filtration system. The purifier features intelligent functions such as real-time TDS monitoring and filter life tracking through the Mi Home app, demonstrating how these advanced attributes address consumer demands for convenience and refined health solutions.

Government Regulations and Initiatives

Governing bodies around the world are significantly contributing to the growth of the water purifier market by implementing more stringent regulations on water quality. Regulations requiring water quality standards in both public and private systems are encouraging industries and consumers toward the use of water filtration solutions. Moreover, various governments are offering incentives for individuals and companies to invest in water purification systems as part of efforts to protect health and the environment. Campaigns to raise public awareness, along with stringent regulations on water pollutants, are driving the need for efficient filtration systems. In addition, governing authorities are progressively investing in water purification initiatives, particularly in developing areas, where water pollution continues to be a major issue. These initiatives foster a favorable market outlook, motivating local and global entities to invest in the research, development, and distribution of cutting-edge purification technologies to comply with regulatory requirements and safeguard public health.

Strategic Partnerships and Brand Collaborations

Strategic collaborations and partnerships among established brands are allowing businesses to merge their knowledge, assets, and market access to provide innovative products that satisfy the growing consumer need for dependable water purification options. By utilizing one another’s advantages, brands can incorporate advanced technologies and innovations, guaranteeing improved product efficiency, consumer confidence, and market reach. Collaborations with internationally renowned brands enhance visibility and credibility, drawing a wider user base in both advanced and developing markets. In line with this trend, in 2024, Kent RO Systems partnered with BLACK+DECKER to introduce two innovative water purifiers, Crest RO and Zenith RO, in India. This collaboration, merging Kent’s purification knowledge with BLACK+DECKER’s worldwide standing in home solutions, aimed to offer safe, quality drinking water for Indian families, highlighting how brand partnerships can address both local and global requirements in the water purification industry.

Water Purifier Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, and regional levels for 2026-2034. Our report has categorized the market based on technology type, distribution channel, and end-user.

Breakup by Technology Type:

To get detailed segment analysis of this market Request Sample

- Gravity Purifiers

- RO Purifiers

- UV Purifiers

- Sediment Filter

- Water Softener

- Others

RO purifiers account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technology type. This includes gravity purifiers, RO purifiers, UV purifiers, sediment filter, water softener, and others. According to the report, RO purifiers represented the largest segment.

Reverse Osmosis (RO) purifiers dominate the market due to their exceptional filtration capabilities. They use a semi-permeable membrane to remove a wide range of contaminants, including heavy metals, dissolved solids, and microorganisms. RO purifiers produce high-quality drinking water but may generate wastewater during the purification process.

Gravity purifiers are simple and cost-effective devices that use the force of gravity to filter out contaminants. They are ideal for areas with limited access to electricity and rely on gravity to push water through filtration media. While they provide basic purification, they may not remove all types of contaminants, making them suitable for relatively clean water sources or as a secondary purification method.

UV purifiers employ ultraviolet light to disinfect water by inactivating microorganisms like bacteria and viruses. They are effective in killing pathogens but may not remove other impurities like dissolved solids. UV purifiers are often used in conjunction with other filtration methods for comprehensive purification.

Sediment filters primarily target physical impurities like sand, silt, and rust particles. They are typically used as pre-filters to protect other purification components in a water purifier system. Sediment filters ensure that the water entering the purifier is free from large debris that could clog or damage the main filtration stages.

Water softeners focus on reducing the hardness of water by removing minerals like calcium and magnesium ions. While they enhance water quality for household purposes, they may not address microbial or chemical contaminants. Water softeners are commonly used alongside other purification technologies in regions with hard water issues.

Breakup by Distribution Channel:

- Retail Stores

- Direct sales

- Online

Retail stores hold the largest share in the industry

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail stores, direct sales, and others. According to the report, retail stores accounted for the largest market share.

Retail stores are traditional and prominent distribution channels for water purifiers. They offer customers the advantage of physical interaction with products, allowing consumers to assess quality and features firsthand. Knowledgeable sales staff can provide guidance, which is especially valuable for complex or premium water purifiers. Retail stores cater to immediate purchase needs and provide post-sale services such as installation and maintenance. Their wide presence ensures accessibility to consumers across urban and rural areas, making them a preferred choice, particularly in regions where in-person shopping is the norm.

Direct sales involve manufacturers or authorized dealers selling water purifiers directly to consumers. This distribution channel allows for personalized demonstrations and product explanations, building trust and ensuring consumers make informed choices. Direct sales may also offer flexible payment options. However, it can be associated with higher product costs due to commissions and operational expenses.

Online distribution has witnessed significant growth in the water purifier market, offering consumers convenience and a vast product range. E-commerce platforms provide detailed product descriptions, customer reviews, and competitive pricing. Online sales cater to a tech-savvy customer base seeking easy access to a variety of water purifiers and the convenience of doorstep delivery. Online channels are especially favored by urban consumers with busy lifestyles and a preference for digital shopping experiences.

Breakup by End User:

- Industrial

- Commercial

- Household

Household represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes industrial, commercial, and household. According to the report, household represented the largest segment.

The household sector dominates the water purifier market due to its vast consumer base seeking safe and clean drinking water. Health-conscious individuals and families invest in water purifiers to ensure their tap water meets safety standards. Household water purifiers vary in size and complexity, catering to diverse consumer needs. The convenience of at-home water purification, coupled with increasing awareness of water-related health concerns, makes households the primary driving force behind the market's growth.

The industrial sector represents a significant end user of water purifiers, mainly for processes requiring high-quality water, such as manufacturing, food and beverage production, and pharmaceuticals. Industrial water purification systems ensure consistent water quality and prevent equipment damage. While this sector fuels the demand for large-scale purification solutions, it accounts for a substantial portion of the market. However, it is outpaced by the household sector, as industrial demand is limited to specific industries with stringent water quality requirements.

The commercial sector includes businesses like restaurants, hotels, and offices that rely on water purifiers to meet their daily water needs. Commercial water purifiers enhance the taste and quality of drinking water for customers and employees. They are often more robust than household units but cater to a smaller market share compared to households, as businesses typically purchase fewer units and prioritize cost-effective solutions.

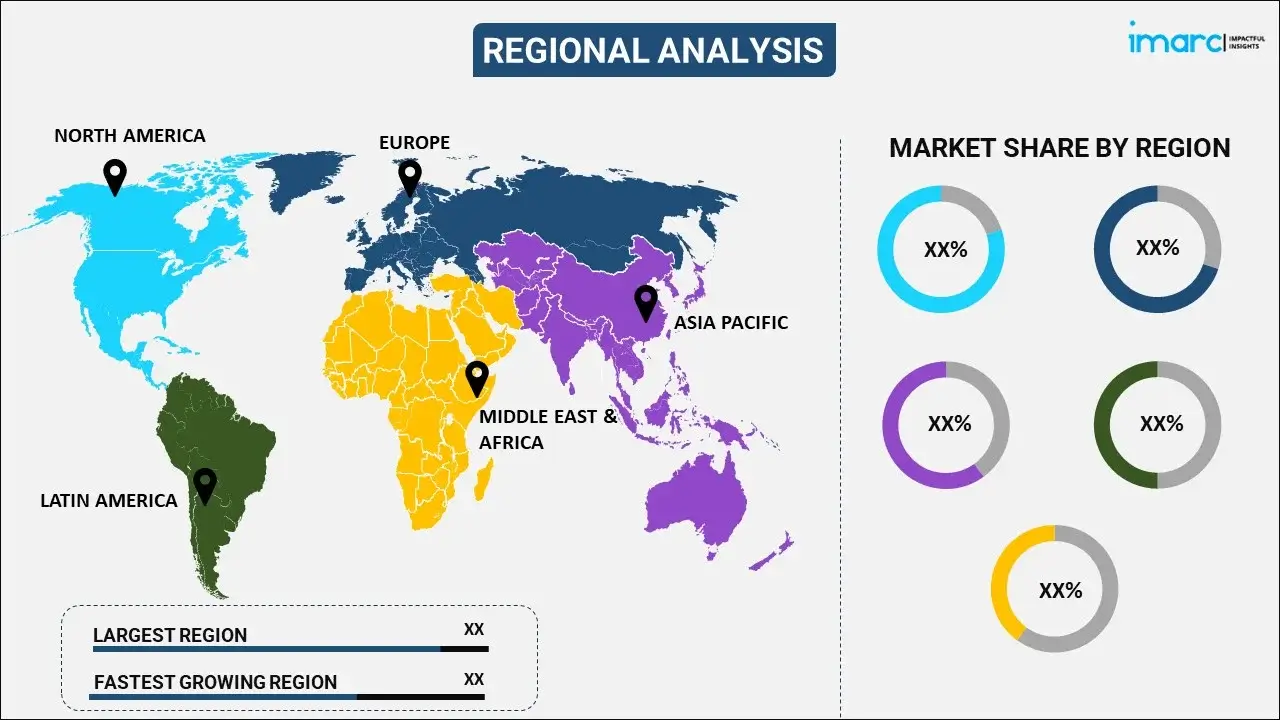

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

Asia Pacific leads the market, accounting for the largest water purifier market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia Pacific, Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific held the biggest market share due to its large population, rapid urbanization, and increasing awareness of water quality issues. Access to safe drinking water is a priority in the region, fueling substantial demand for a wide range of water purifiers. Urban growth, industrialization, and water contamination concerns contribute to the region's market dominance. The availability of various water purifier types and the expansion of distribution networks ensure Asia Pacific's leading position.

Europe drives the water purifier market through its stringent water quality standards and health-conscious consumer base. Consumers prioritize clean and safe drinking water, spurring demand for advanced purification technologies. The region's focus on sustainability aligns with eco-friendly purification methods, thus fostering innovation. High urbanization rates and developed infrastructure enhance market accessibility. Despite its strong position, Europe is outpaced by the Asia Pacific region.

North America contributes significantly to the water purifier market, driven by concerns about water contaminants and health consciousness. Consumers seek water purification solutions to ensure the quality of their tap water. The region's preference for advanced technologies, such as RO and UV purifiers, fuels market growth. Established distribution channels and online sales further drive accessibility to water purifiers. North America remains a substantial market, although it falls behind the Asia Pacific.

The Middle East and Africa drive the water purifier market with a growing population, improving living standards, and a focus on health and hygiene. Concerns about water quality in certain areas lead to a demand for water purifiers, particularly in urban centers. The region's unique water challenges, such as desalination needs, contribute to specialized purification solutions. While the market in this region is growing, it is smaller compared to Asia Pacific.

Latin America plays a role in the water purifier market, primarily due to water quality issues in some areas and an emerging awareness of health-consciousness. Consumers seek purification solutions to address contaminants in their tap water. However, the market's size in Latin America is comparatively smaller than in regions like Asia Pacific and North America, as it is still evolving and has room for further growth.

Leading Key Players in the Water Purifier Industry:

Key players in the water purifier market are actively engaged in several strategic initiatives to maintain their competitive edge. They are heavily investing in research and development (R&D) to develop advanced and innovative purification technologies that provide more efficient and sustainable solutions. Many industry leaders are focusing on expanding their product portfolios to cater to diverse consumer needs, including compact and cost-effective purifiers for smaller households and portable units for outdoor use. Marketing efforts also play a pivotal role, with an emphasis on highlighting the health benefits of purified water and the environmental advantages of eco-friendly purification methods. Furthermore, partnerships and collaborations with distribution channels are being forged to enhance market reach and accessibility, ensuring that these leading water purifier companies remain at the forefront of providing clean and safe drinking water solutions to consumers worldwide.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- 3M Company

- A. O. Smith Corporation

- BRITA India Water Solutions Pvt. Ltd.

- Coway Co., Ltd.

- Eureka Forbes

- Kent RO Systems Ltd.

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Livpure Smart

- Panasonic Corporation

- Whirlpool Of India

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- August 2025: Samsung launched the Bespoke AI Water Purifier Countertop in South Korea, priced at approximately $1,000 (₩1.45 million). It features AI-powered control via SmartThings and Bixby, a 4-stage NSF-certified filter system, and can remove 82 types of harmful substances. It also supports voice commands for specific tasks like setting water quantity for ramen.

- August 2025: Acer Malaysia launched the Acerpure AQUA WP5 Hot & Cold RO Water Purifier for RM2,299 (limited-time offer). The compact, plug-and-play system offers precise control over temperature and volume, featuring a 5-in-1 RO filter with double UVC sterilization. It’s available on Shopee and Lazada, with a complimentary RM100 eWallet credit and a free filter replacement.

- July 2025: Eureka Forbes launched a new range of Aquaguard water purifiers featuring Longlife Nanopore Filter technology with a 2-year filter life, reducing maintenance and cost for Indian households. The purifiers are designed for affordability, convenience, and consistent water quality. A TVC campaign highlights the health and economic benefits of this innovation.

- June 2025: ANGEL held its Indonesia Strategic Launch in Jakarta, marking its entry into the Indonesian market. The company unveiled advanced water purification technologies and announced partnerships with local businesses like TOMORO COFFEE to provide safer, smarter water solutions. ANGEL also revealed its service network across 40 cities in Indonesia, aimed at meeting the nation's growing demand for water purification.

- April 2025: KENT RO Systems launched the 'KENT Sapphire' RO water purifier, featuring multi-stage purification with RO+UF+UV+Alkaline+TDS Control. It enhances water pH up to 9.5 for better immunity and includes UV LED in the storage tank for added safety.

- January 2025: VIOMI unveiled two advanced water purifiers at CES 2025: the Vortex 8 and Kunlun. The Vortex 8 offers 0.0001-micron RO filtration, a 3:1 wastewater ratio, and a 4-year filter life, while the Kunlun enriches water with six minerals, featuring a 1200G flow rate and a 7-layer filtration system. Both products emphasize sustainability and health-conscious hydration.

- June 28, 2022: Pentair PLC announced the acquisition of the Manitowoc Ice from Welbilt, Inc. his acquisition aligns with Pentair's goal of bolstering its commercial water solutions business. Manitowoc Ice is known for its expertise in manufacturing commercial ice machines, a complementary addition to Pentair's portfolio of water-related products and solutions. This move allows Pentair to diversify its offerings further, serving a broader customer base in the commercial sector and strengthening its position as a comprehensive provider of water-related solutions for businesses and industries.

- May 16, 2022: Eureka Forbes, renowned for its Aquaguard brand, launched new marketing campaign featuring the popular actor Madhuri Dixit. The campaign, titled "Pani mein Zinc aisa kahaan hota hai… jahaan Aquaguard hota hai," underscores the brand's commitment to providing safe and zinc-enriched drinking water. This strategic move highlights the importance of zinc in water purification, positioning Aquaguard as a trusted solution. The campaign was orchestrated by Taproot Dentsu India Communications and is set to be disseminated across various media channels and platforms, further strengthening Aquaguard's presence in the water purifier market.

- January 25, 2022: Whirlpool Of India announced the relocation of its Global Technology & Engineering Center (GTEC) of its Global Product Organization to a new facility in Pune (India) in order to innovate new technology in its products. This strategic move underscores the company’s commitment to innovation and the development of cutting-edge technology in its products. GTEC holds significant importance as one of Whirlpool's primary R&D institutes on a global scale, playing a pivotal role in the company's worldwide product development efforts.

Water Purifier Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Types Covered | Gravity Purifiers, RO Purifiers, UV Purifiers, Sediment Filter, Water Softener, Others |

| Distribution Channels Covered | Retail Stores, Direct sales, Online |

| End Users Covered | Industrial, Commercial, Household |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | 3M Company, A. O. Smith Corporation, BRITA India Water Solutions Pvt. Ltd., Coway Co., Ltd., Eureka Forbes, Kent RO Systems Ltd., Koninklijke Philips N.V., LG Electronics Inc., Livpure Smart, Panasonic Corporation, Whirlpool Of India, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the water purifier market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global water purifier market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the water purifier industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global water purifier market reached a value of USD 64.9 Billion in 2025.

According to the estimates by IMARC Group, the global water purifier market is expected to exhibit a CAGR of 8.16% during 2026-2034.

The market experienced a negative impact on account of the sudden outbreak of the COVID-19 pandemic, as the stringent lockdown regulations across several nations resulted in temporary shutdown of manufacturing facilities, insufficient raw materials, and disrupted supply chains for water purifiers.

Growing water pollution levels, coupled with the increasing prevalence of water-borne diseases is augmenting the demand for water purifier across the globe.

Several water purifier manufacturers are introducing advanced water purification technologies, including activated carbon filtration and reverse osmosis.

On the basis of the technology type, the market has been bifurcated into gravity purifiers, RO purifiers, UV purifiers, sediment filters, water softeners, and others. In this segment, RO purifiers account for the largest market share.

On the basis of the distribution channel, the market has been bifurcated into retail stores, direct sales, and online, where retail stores hold the largest market share.

On the basis of the end user, the market has been bifurcated into industrial sector, commercial sector, and household sector. In this segment, the household sector accounts for the largest market share.

Region-wise, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where Asia Pacific dominates the global market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)