Waterless Cosmetics Market Size, Share, Trends and Forecast by Product, Nature, Gender, Distribution Channel, and Region 2025-2033

Waterless Cosmetics Market Size and Trends:

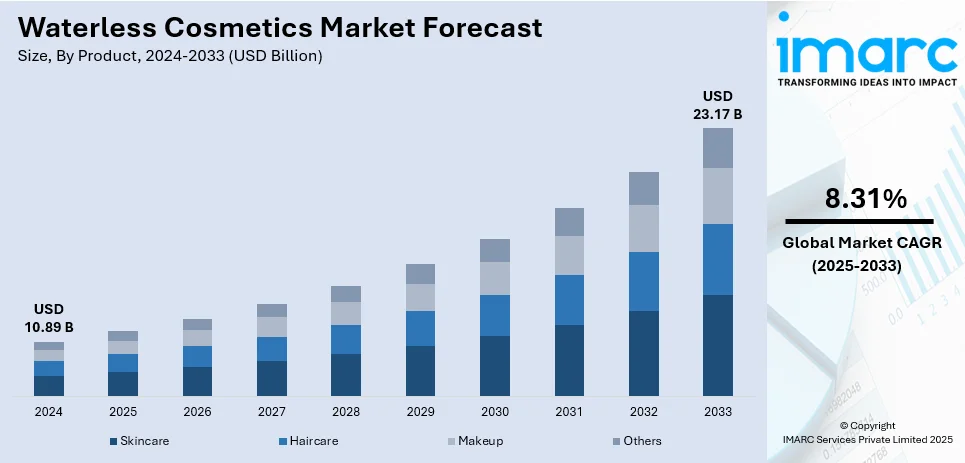

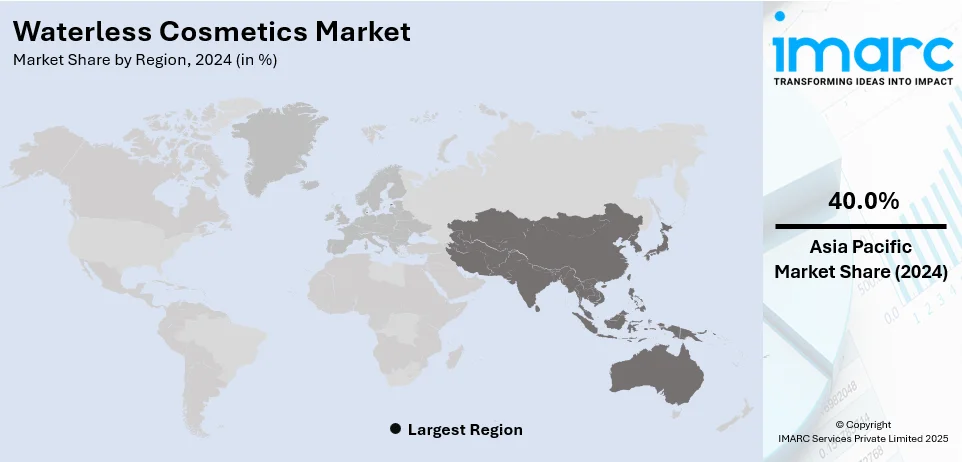

The global waterless cosmetics market size was valued at USD 10.89 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 23.17 Billion by 2033, exhibiting a CAGR of 8.31% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 40.0% in 2024. The waterless cosmetics market share is rising due to the increasing customer demand for eco-friendly products, reduced environmental impact, improved product concentration, personal wellness trends, and sustainability concerns, along with advantages like longer shelf life and reduced packaging waste.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.89 Billion |

|

Market Forecast in 2033

|

USD 23.17 Billion |

| Market Growth Rate (2025-2033) | 8.31% |

The waterless cosmetics market growth is attributed to the increasing awareness about consumers toward sustainability and environmental issues. With the beauty industry shifting toward more environmentally friendly solutions, waterless cosmetics are an emerging innovation in this direction. Traditional cosmetics have water as the primary ingredient, which contributes to excess water usage and packaging waste. On the other hand, waterless formulations remove the use of water. Hence, active ingredients are more concentrated, thus achieving stronger and better results using fewer amounts. This trend fits into the direction of consumers looking for cleaner, more environmentally friendly beauty products that are effective and sustainable. Demand for eco-conscious ingredients and biodegradable formulations has further increased the trend of waterless beauty products. Natural and sustainable ingredients, which are the new buzzwords for consumers, can add value to the appeal of the market. The fact that waterless products are travel-friendly and longer-lasting due to their compact and concentrated nature gives added value to consumers. In the future, the waterless cosmetics market will continue to grow rapidly as new waterless solutions are developed and innovated, such as self-preserving skincare and biodegradable cleansing products.

The United States emerged as a key market for waterless cosmetics, driven by increasing consumer demand for eco-friendly, sustainable beauty solutions. As awareness about environmental issues rises, consumers are gravitating toward products that reduce water usage and packaging waste. Waterless cosmetics offer concentrated formulas, which improve efficacy and reduce the need for preservatives, making them highly appealing to eco-conscious buyers. A key driver for the market expansion is the increased demand for clean, natural ingredients by consumers looking for products without toxic chemicals and artificial additives. Leading beauty brands in the United States are also moving to satisfy the demand through the development of new waterless formulations, including self-preserving skincare and waterless shampoos, to boost the market profile. Furthermore, U.S. consumers increasingly prioritize sustainability. Many consumers will pay a premium for products that are aligned with their environmental values.

Waterless Cosmetics Market Trends:

Growing attention to water efficiency

This industry is witnessing a growing focus on reducing water consumption, driven by increasing environmental concerns and a need for sustainable resource usage. The consumers and beauty brands that are adopting this trend and investing in waterless formulations to lower their ecological footprint. Companies such as Syensqo have invested USD 2.1 Million in Bioeutectics, a provider of natural, high-performance solvents for cosmetics. The investment supports the development of waterless products, which eliminate water as a key ingredient, hence reducing the manufacturing and product use impact. One of the milestones in this trend was when Cryosmetics released 100% natural, waterless skincare products that utilize self-preserving ingredients, focusing on microbiome health, in September 2024. These innovations represent great progress toward creating sustainable, waterless cosmetics with better product stability, not reliant on synthetic preservatives. This shift toward waterless products by the industry is a response to environmental pressures and a step toward improving product efficiency and consumer satisfaction. As this trend continues to grow, the waterless cosmetics market share is expected to see significant revenue expansion, as eco-conscious consumers increasingly prefer products that are both effective and sustainable.

Rising use of sustainable ingredients

The demand for sustainable ingredients in the beauty industry is growing at an incredible pace due to consumers being more environmentally aware and requiring cleaner, safer products. Brands focus on biodegradable, chemical-free, and eco-friendly components that meet consumers' increasing interest in clean beauty products. Chemical Abstracts Service states that more than 40% of consumers prefer purchasing personal care and beauty products with a natural ingredient nowadays, which can be labeled as the most significant trend in terms of consumer expectations toward sustainability and ethics. Most companies develop sustainable ingredients to increase their use of these aspects in waterless cosmetics. For example, Clariant just launched GlucoTain GEM, which it made especially to address formulators' needs for waterless, solid personal care formulations, in April 2024. This ingredient enhances the performance of products while contributing to environmental objectives, like reducing water consumption. The integration of such biodegradable and sulfate-free ingredients into waterless products meets the needs of an eco-conscious consumer and aids in reducing the overall water usage in formulations. Hence, the growing importance of sustainability has become a main impetus in expanding the waterless cosmetics market demand, mainly driven by a culture of responsible consumerism of waste minimization and eco-responsibility among consumers.

Rising demand for concentrated formula

With the increasingly discerning consumers in terms of value and efficiency of products, the demand for concentrated formulas in waterless cosmetics has skyrocketed. Waterless formulations are usually more concentrated. They give the consumer a product that will provide higher potency in smaller quantities, thus longer-lasting and travel-friendly. This trend for concentrated products reflects a wider trend for better value and effective results in beauty solutions. For example, Vantage's JEESPERSE NoLo range won the C&T Allē Award in March 2024. This innovation is interesting as it is an example where the formulation does not require water to activate, due to which there is less wastage and more product efficiency. Similarly, Tangle Teezer's buyout by French company Bic in 2023 for €200 Million highlights how there is a huge demand for sustainable beauty solutions that transcend just skincare and haircare. Through such acquisitions and innovations, companies support waterless, eco-friendly beauty products that appear both effective and sustainable. This waterless cosmetics market trend of concentrated formulas is propelling the market, as consumers have been looking for convenience, portability, and higher performance in their beauty routines.

Waterless Cosmetics Market Dynamics:

Compact, Long-Lasting Formulas Drive Demand

Waterless cosmetics are becoming popular because they are concentrated, portable, and last longer. Since these products have no water, only a small amount is needed for effective results, making them cost-efficient. Their compact packaging makes them easy to carry, appealing to people with busy lifestyles. Consumers prefer beauty products that are convenient without compromising performance, increasing the demand for waterless skincare.

Online Shopping Boosts Market Growth

E-commerce and direct-to-consumer (DTC) sales are creating big opportunities for waterless cosmetics. According to the International Trade Administration, most people worldwide started their online product searches on e-commerce marketplaces in 2023. Online platforms help brands reach global customers without relying on physical stores, reducing costs and increasing profits. Customers can compare products, read reviews, and make informed choices, making niche products like waterless cosmetics more accessible. As online shopping expands, waterless beauty brands can reach more consumers.

Waterless Cosmetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global waterless cosmetics market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, nature, gender, and distribution channel.

Analysis by Product:

- Skincare

- Haircare

- Makeup

- Others

Skincare represents the largest market with a share of 53.2%. Skincare products have been steadily growing with increased consumer awareness about skin health and wellness. Multi-functional skincare items, including moisturizers, serums, and anti-aging products, contribute to their increasing demand. Waterless formulations within the skincare category improve product concentration, thus reducing the requirement for preservatives and unnecessary packaging. As customers move with the times in concern about environmental issues and increased demand for sustainable, eco-friendly alternatives, especially in this case for skincare, this category is gaining ground. Innovations and developments in skincare technology, such as sensitive skin formulations, along with the natural ingredients ride waves to the increase of this segment. The versatility of skin care products in tackling various skin concerns such as dryness, wrinkles, and acne makes them the central focus of waterless beauty brands, leading to their domination in the market.

Analysis by Nature:

- Synthetic

- Organic

Synthetic holds the leading position with a share of 55.4% as they seem stable, have a longer shelf life, and show consistent results. In addition, these are less subject to microbial contamination, so they are naturally favored for waterless formulations. The mass appeal of synthetic products, often priced more competitively than organic or natural alternatives, also contributes to their widespread adoption. In addition, the extensive range of available synthetic ingredients allows the creation of high-performing formulations, catering to various skincare concerns, from acne to aging. Since waterless cosmetics are designed to have concentrated formulas, synthetic ingredients fit well with these product needs as they can be more easily engineered and standardized. While organic and natural products are gaining popularity due to consumer demand for clean beauty, the superior functionality, cost-effectiveness, and long shelf life of synthetic products keep them as the dominant player in the waterless cosmetics market.

Analysis by Gender:

- Men

- Women

Women lead with a share of 79.8%, due to higher consumption of cosmetics and personal care products. Women's grooming and beauty routines are more elaborate, and hence, they have a greater preference for skincare and cosmetic products. This includes a shift toward waterless beauty formulations that offer convenience, sustainability, and effectiveness. The demand for gender-specific products, such as skincare and makeup targeted specifically at women, remains strong, while the gender-neutral approach for unisex products is also gaining momentum. As women lead the beauty and wellness industry, the growth of clean beauty products reflects their desire for eco-friendly, cruelty-free, and sustainable products. The critical aspect that maintains this market segment's leadership position is the greater interest by women in skincare, cosmetics, and other beauty products. Product innovations in the women's beauty segment further strengthen its dominant position.

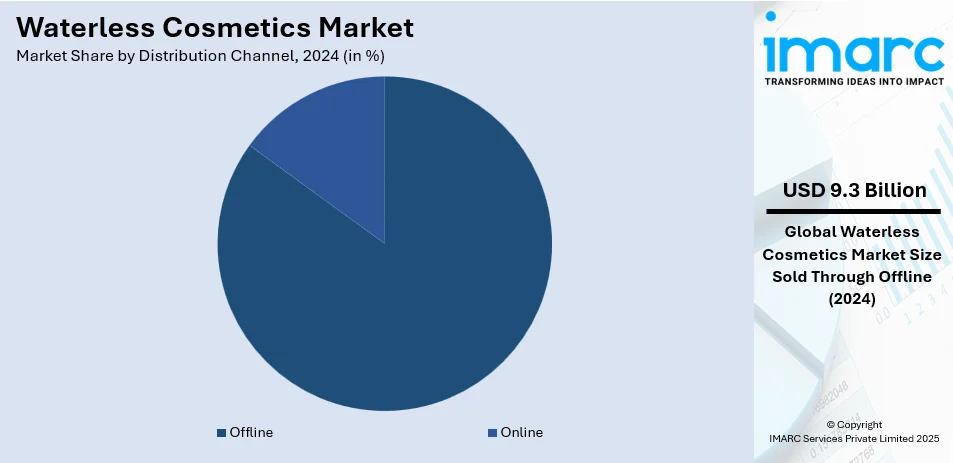

Analysis by Distribution Channel:

- Online

- Offline

Offline channels dominate the market with a share of 85.0%. Offline retail is the most preferred way of buying cosmetics, mainly because of the feel of testing products in-store before buying. Consumers prefer to visit beauty stores, drugstores, and department stores for personal care products, especially skincare and cosmetics, as they want to assess the texture, smell, and effectiveness of waterless formulations. Further, offline channels give consumers a sense of guidance from in-store specialists, hence, a more customized shopping experience. Even though the growth rate for online shopping is on the increase, considering the recent worldwide switch to e-commerce, the majority of the waterless cosmetics market retail is offline. Many brands have been extending their brick-and-mortar store footprint to tap the large portion of consumers who prefer shopping in physical stores. Such an advanced level of in-store product awareness, the ability to test products before making a purchase, and instant product availability ensure that offline channels will continue to remain the most sought-after distribution platform for waterless beauty products.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific accounts for the largest market share of 40.0%, driven by the rising middle-class population, greater disposable income, and increasing demand for personal care products. Consumers in Asia-Pacific are becoming more conscious of their health, wellness, and environmental impact, leading to higher adoption rates of sustainable, waterless beauty products. Other countries, such as China, Japan, and South Korea, have been leading the way in skincare and cosmetic innovation for decades, setting the trend for the wider market. The increasing demand for premium, eco-friendly, and multi-functional beauty products also adds to the region's dominance. Asia-Pacific is also leading in terms of product diversity, offering a wide range of beauty and skincare items that align with local preferences for natural ingredients and advanced skincare solutions. As the waterless beauty solutions market continues to grow, Asia-Pacific remains the largest and most significant market for these products.

The demand for waterless cosmetics in North America is rising, driven by the increasing desire for eco-friendly and sustainable beauty products. The clean beauty solutions of U.S. consumers increasingly reflect their environmental values, making the adoption of waterless formulations highly rapid. Increasing awareness about water conservation and the need for more concentrated and long-lasting products are also driving factors for market growth. International players like major beauty brands are innovating and launching waterless product lines, thus improving the access and attraction of such eco-friendly solutions in the region.

Waterless cosmetics have a vast market in Europe, as consumers prefer natural, sustainable, and cruelty-free beauty products. The clean beauty trend is also on the rise in Europe, along with environmental concerns, that's fueling demand for waterless cosmetics. Customers demand that the companies' products contribute to reduced waste from packaging and water use; hence, manufacturers are making more waterless products. Regulation policies in Europe on sustainability support also drive innovations in this field, with a focus on bio-renewable content and sustainable processes of producing goods.

Waterless cosmetics Latin America market has had a constant rise as people now become sensitive toward sustainability and other green aspects of life. One of the key drivers for waterless products' demand has been the growing popularity of the market in favor of natural and organic beauty solutions and growing awareness about water scarcity in the region. Consumers in Latin America have been embracing waterless formulations, such as efficiency, portability, and reduced environmental impact. Regional players now innovate to serve local preferences as the market for waterless cosmetics expands, introducing new products with ingredients native to the region.

Waterless cosmetics are gradually gaining acceptance in the Middle East and Africa, mainly due to increasing awareness about sustainable beauty practices and environmental challenges in the region. Consumers are likely to prefer beauty products with a minimum use of water, especially where water is scarce. The young tech-savvy population in this region, fond of new trends in beauty and cosmetics, fuels the demand for waterless formulation. Besides that, luxury high-performance beauty and cosmetics in the MEA sector are in high demand. There is pressure by brands to market waterless products, concentrated and active cosmetic solutions.

Key Regional Takeaways:

United States Waterless Cosmetics Market Analysis

In 2024, United States held a market share of 80.0% for waterless cosmetics, driven by the intensified investment in the cosmetics market. In fact, in 2021, it reported a record-breaking scenario with 388 deals and a whopping venture capital of USD 3.3 Billion. This is a sign of improved consumer interest in more innovative formulations that reduce water consumption to meet sustainability goals. Products such as concentrated facial serums, solid cleansers, and powder-based skincare items are gaining traction, attracting investment into their production and distribution. This shift is supported by rising awareness about water conservation and the need for sustainable consumption, which has encouraged manufacturers to allocate resources toward research and development of waterless options. Additionally, the growing demand for premium beauty solutions has bolstered the expansion of high-end waterless offerings. Advanced packaging that preserves efficacy and continues to offer environmental benefits has further pushed the adoption. Therefore, improved consumer education and increased promotional campaigns also significantly contribute to inviting people to bring waterless options into their daily lives.

Europe Waterless Cosmetics Market Analysis

As per the waterless cosmetics market forecast, its adoption is driven by the increasing demand for green products, which is a result of increased environmental awareness. The European Commission's eco-innovation index rose by 27.5% between 2014 and 2024, primarily due to an increase in resource efficiency. Solid lotions, dry shampoos, and powder-based cosmetics are now the new trends for consumers as they save water while reducing packaging waste. Such strict regulations in place to ensure environmental sustainability compel brands to innovate their product offerings. The lightweight nature of waterless products also helps reduce transportation-related emissions, making them another step closer to sustainability. With greater education about environmental impacts, there is now more appreciation for the long-term benefits of such solutions. Social media campaigns and influencer endorsements have amplified awareness, encouraging individuals to incorporate eco-conscious choices into their routines. Moreover, the trend toward minimalist beauty routines complements the use of concentrated, waterless options, reinforcing their appeal. It has, in turn, entrenched itself as one of the most appreciated products that offer high performance while having minimal environmental impact.

Asia Pacific Waterless Cosmetics Market Analysis

Waterless cosmetics are gaining momentum as skincare and haircare demand rises with a preference for multifunctional products. Arata, a hair care brand, raises USD 4 Million in Series A funding led by Unilever Ventures, along with participation from L'Oréal's Bold and Skywalker Family Office. The funds will support R&D, marketing, and talent acquisition, boosting the brand's growth in hair and scalp solutions. Waterless formulations like solid shampoos, balm cleansers, and powder masks are increasingly sought after for their versatility and portability. Hydration and nourishment products will be preferred by customers seeking longevity without the addition of preservatives, so these will gain preference. The continued growth in urbanization and the middle class has gone hand in hand with increased spending on innovative cosmetics for different types of skin and hair needs. This trend has prompted brands to extend their range of products and create a variety of offerings with natural and chemical-free compositions. Consumer demand for sustainable, environmentally friendly beauty products also resonates with the advantages of waterless products. The use of local ingredients and region-specific formulations enhances the appeal by demonstrating flexibility to accommodate diverse preferences and climatic conditions across the region.

Latin America Waterless Cosmetics Market Analysis

The growth of waterless cosmetics was on account of rising discretionary incomes and thus the imperative to hunt for premium and state-of-the-art beauty products. For instance, between 2021 and 2040, Latin America's overall disposable income is expected to increase by about 60% in real terms. With greater purchasing power, individuals are opting for concentrated beauty balms, solid cleansers, and powdered formulations that provide enhanced convenience and functionality. These products cater to evolving beauty preferences, emphasizing long-lasting benefits and high efficacy. Increased purchasing power has also spurred the rise of boutique beauty stores and niche shops selling various waterless cosmetic products. The trend reflects a shift toward distinctive, high-value solutions that support contemporary lifestyles.

Middle East and Africa Waterless Cosmetics Market Analysis

As per the waterless cosmetics outlook, this increase in the adoption of waterless cosmetics is also correlated with the growing number of online distribution channels through which the product reaches more consumers. As stated by the International Trade Administration, the UAE leads in eCommerce in GCC countries, where the market experienced a growth of 53% in 2020 and set a record in eCommerce sales worth USD 3.9 Billion, accounting for 10% of total retail sales. Detailed product descriptions, tutorials, and reviews on digital platforms make the purchase process easier and alleviate consumer anxiety about unknown formulations. Online offers and discounts alone create further interest in waterless solutions such as powdered foundations, balm cleansers, and solid moisturizers. Social media is very important in the spread of information, where influencers and targeted marketing campaigns are utilized to highlight the benefits of products.

Competitive Landscape:

Market players in the waterless cosmetics industry are driving innovation through strategic investments, product development, and collaboration. Many of the brands focus on creating waterless formulations aligned with the growing consumer demand for sustainability and clean beauty. For example, Syensqo has invested millions in finding natural, high-performance solvents, while others, such as Cryosmetics, have 100% natural, waterless skincare products, that focus on microbiome health and self-preserving ingredients. This shift has made the industry realize the significance of eco-friendly, sustainable manufacturing processes. Additionally, major players are exploring new ingredients, such as Clariant’s introduction of GlucoTain GEM, a sustainable ingredient designed for waterless personal care products, further aligning with the demand for biodegradable and chemical-free components. The trend toward concentrated formulas also continues to gain traction, with waterless products offering more potent, longer-lasting solutions in smaller, travel-friendly sizes. Strategic acquisitions, such as Tangle Teezer by Bic, follow the trend of increasing attention to the enhancement of the offer of waterless products. These efforts are creating a favorable waterless cosmetics market outlook.

The report provides a comprehensive analysis of the competitive landscape in the waterless cosmetics market with detailed profiles of all major companies, including:

- Carter + Jane

- Clensta

- Ktein Biotech Private Limited

- Loli Beauty Pbc Inc.

- L'Oréal S.A.

- Pinch of Colour

- Taiki USA

Latest News and Developments:

- September 2024: Cryosmetics introduced waterless skincare products that are 100% natural and prioritize the health of the microbiota. The self-preserving formulations don't require the addition of preservatives. Formulations support the sustainability of saving water. These are examples of the growing attention to eco-friendly, functional cosmetics.

- April 2024: Clariant launched GlucoTain GEM, a green ingredient that allows waterless personal care. It enables biodegradable, sulfate-free cleansing solutions in solid formulations and was said to reduce water dependency and increase eco-friendly product offerings. It has been reported to highlight the importance of environmental responsibility within the cosmetics industry.

- March 2024: Vantage won the C&T Allē Award for JEESPERSE NoLo, a family of self-emulsifying bases. These products focus on the waterless hair care trend as easy and environmentally friendly. Formulations are improved for stability and effectiveness without the need for water. This achievement shows the innovation of eco-friendly hair care.

- March 2024: Mono Skincare: Revolutionizing the beauty industry by introducing the world's first waterless extemporaneous dermo-cosmetics. This new line is all about a completely water-free skincare routine, with the aim of sustainability and less water consumption. The products are designed for daily use, which aligns with modern eco-conscious beauty trends.

- January 2024: L'Oréal's CEO said the company is acquiring water-saving startup Gjosa, a move that cements the commitment of the French cosmetics giant to sustainability. It integrates Gjosa's innovative water-efficient technology into L'Oréal's products and services, aiming to reduce environmental impact while enhancing user experience.

Waterless Cosmetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Skincare, Haircare, Makeup, Others |

| Natures Covered | Synthetic, Organic |

| Genders Covered | Men, Women |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Carter + Jane, Clensta, Ktein Biotech Private Limited, Loli Beauty Pbc Inc., L'Oréal S.A., Pinch of Colour, Taiki USA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the waterless cosmetics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global waterless cosmetics market.

- The study maps the leading, and the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the waterless cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The waterless cosmetics market was valued at USD 10.89 Billion in 2024.

The waterless cosmetics market is projected to exhibit a CAGR of 8.31% during 2025-2033, reaching a value of USD 23.17 Billion by 2033.

The waterless cosmetics market is driven by increasing customer demand for eco-friendly products, reduced environmental impact, improved product concentration, personal wellness trends, and sustainability concerns, along with advantages like longer shelf life and reduced packaging waste.

Asia Pacific currently dominates the market driven by the rising middle-class population, greater disposable income, and increasing demand for personal care products.

Some of the major players in the waterless cosmetics market include Carter + Jane, Clensta, Ktein Biotech Private Limited, Loli Beauty Pbc Inc., L'Oréal S.A., Pinch of Colour, Taiki USA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)