White Box Server Market Report by Form Factor (Rack & Tower Servers, Blade Servers, Density-Optimized Servers), Business Type (Data Centers, Enterprises), Processor Type (X86 Server, Non-X86 Server), Operating System (Linux Operating System, and Others), Component (Motherboard, Processor, Memory, Hard Drive, Server Case/Chassis, Network Adapter, and Others), and Region 2025-2033

White Box Market Size & Share:

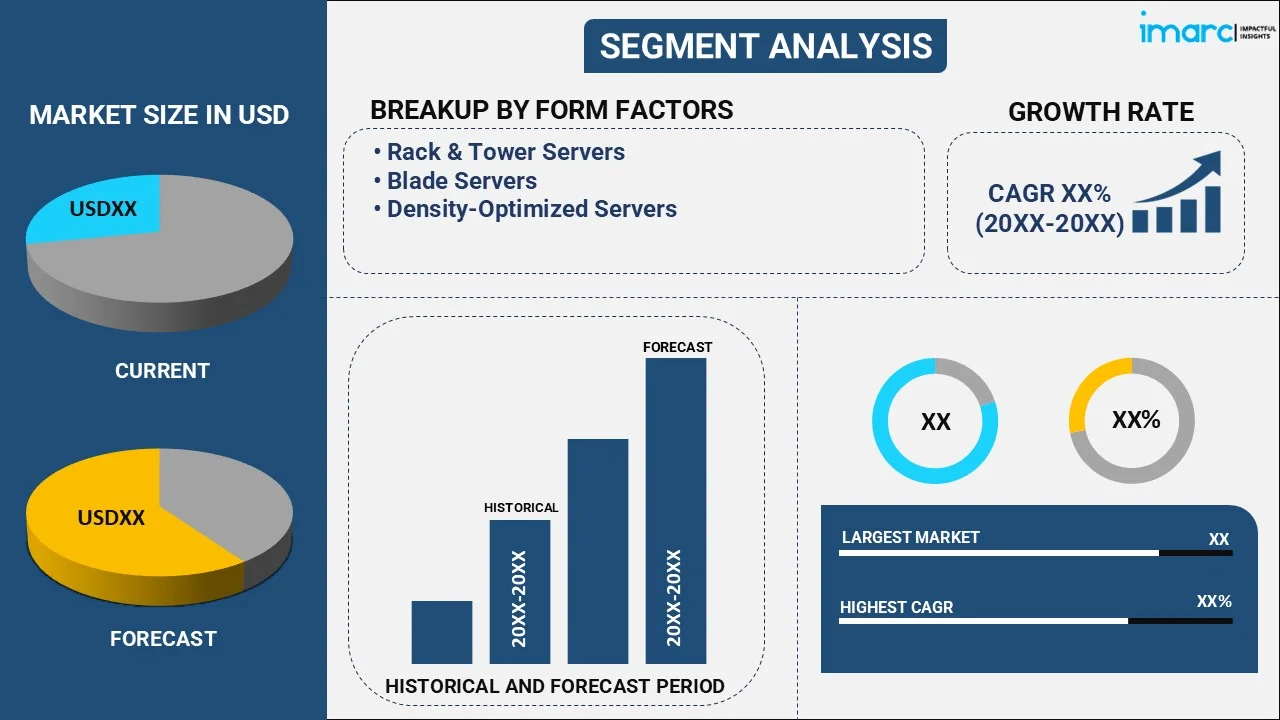

The global white-box server market size reached USD 17.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 67.7 Billion by 2033, exhibiting a growth rate (CAGR) of 15.43% during 2025-2033. At present, North America holds the largest white box market share owing to robust technological infrastructure and presence of significant hyperscale data centers including Google, Microsoft Azure, and Amazon Web Services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.0 Billion |

|

Market Forecast in 2033

|

USD 67.7 Billion |

| Market Growth Rate 2025-2033 | 15.43% |

A white box server refers to a data center server that is built by Original Design Manufacturers (ODM) by using Commercial-Off-The-Shelf (COTS) components. It is primarily used by data center professionals who require extensive customizability in the product. Depending upon the components, a white box server can efficiently perform various memory and network connectivity functions. They can also run virtualization software as well as premium operating systems such as Windows Server and Red Hat Enterprise Linux (RHEL) and provide High Availability (HA) and failover protection.

The cost-effectiveness and high degree of customizability of white-box servers are the key factors driving the white box server market growth. Along with this, the rising trend of digitalization and increasing use of cloud services and big data analytics is also contributing significantly to the product demand. There is a growing demand for low-costs servers, enhanced uptime and flexibility in the hardware designs, owing to which, consumers are increasingly opting for ODM services to build their networking equipment and software solutions. Additionally, data analytics and cloud adoption with increased server applications for processing workloads through cross-platform support are also augmenting the growth of the global white box server market

White Box Server Market Trends:

Technological Advancements for Developing Energy-efficient solutions

White box server manufacturers are developing economical and energy-efficient servers for offering improved storage to meet the users’ requirements. Moreover, various technological advancements, such as the construction of energy-efficient green data centers for controlling carbon emissions and electricity consumption, is also creating a positive outlook for the market. Furthermore, the rising adoption of open platforms and an overall increase in the demand for micro-servers across the globe is driving the white box server industry growth. Increasing popularity of edge computing is also creating growth opportunities for market participants. As numerous devices connect to the IoT and generate enormous amounts of data, there is a growing need for decentralized computing power in close proximity to the data source. White box servers offer the required storage and processing power capabilities while maintaining the scalability and cost-effectiveness.

Increasing Adoption of Hyper-converged Infrastructure

While white box server prices have decreased, the overall performance of the infrastructure have improved significantly. The uptrend toward hyper-converged infrastructure (HCI) is further supporting cost-effectiveness and strengthening the demand mix for white box servers. HCI integrates computing, networking, and storage into a unified system, which simplifies data center management and helps reduce costs. White box servers are compatible with HCI installation and offer flexibility with different software-defined solutions. This enables businesses to develop scalable and robust infrastructures that adapt conveniently with changing technological needs.

Growth in Implementation of Arm-Based White Box Servers

The proliferating adoption of Arm-based white box servers is revolutionizing the market dynamics. Over the recent years, Arm-based architecture has gained immense traction owing to their cost-effectiveness and energy efficiency. Arm-based servers are well-suited for edge computing, cloud computing, and data center applications where performance and power consumption are critical parameters. As white box server companies develop more robust software ecosystems and processors, the implementation of Arm-based servers is projected to further expand and boost the white box server market size.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global white-box server market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on form factor, business type, processor type, operating system and component.

Breakup by Form Factor:

- Rack & Tower Servers

- Blade Servers

- Density-Optimized Servers

Breakup by Business Type:

- Data Centers

- Enterprises

Breakup by Processor Type:

- X86 Server

- Non-X86 Server

Breakup by Operating System:

- Linux Operating System

- Others

Breakup by Component:

- Motherboard

- Processor

- Memory

- Hard Drive

- Server Case/Chassis

- Network Adapter

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the market has also been examined with some of the key players being Celestica Inc., Compal Inc., Hon Hai Precision Industry Company Ltd., Hyve Solutions Corporations, Inventec Corporation, MiTAC Holdings Corporation, Pegatron Corporation, Penguin Computing, Quanta Computer Incorporated, Equus Computer Systems, Super Micro Computer, Inc., Wistron Corporation and ZT Systems. Collectively these players hold the majority of the white box server market share.

White Box Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Form Factor, Business Type, Processor Type, Operating System, Component, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Celestica Inc., Compal Inc., Hon Hai Precision Industry Company Ltd., Hyve Solutions Corporations, Inventec Corporation, MiTAC Holdings Corporation, Pegatron Corporation, Penguin Computing, Quanta Computer Incorporated, Equus Computer Systems, Super Micro Computer, Inc., Wistron Corporation and ZT Systems |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The global white-box server market was valued at USD 17.0 Billion in 2024.

We expect the global white-box server market to exhibit a CAGR of 15.43% during 2025-2033.

The emerging trend of digitalization, along with the introduction of technological advancements, such as the construction of energy-efficient green data centers, for controlling carbon emissions and electricity consumption, is primarily driving the global white-box server market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing application of white-box servers by several organizations, as it can efficiently perform numerous memory and network connectivity functions, during the remote working scenario.

Based on the form factor, the global white-box server market can be segmented into rack & tower servers, blade servers, and density-optimized servers. Currently, rack & tower servers hold the majority of the total market share.

Based on the business type, the global white-box server market has been divided into data centers and enterprises, where data centers currently exhibit a clear dominance in the market.

Based on the processor type, the global white-box server market can be categorized into X86 server and non-X86 server. Currently, X86 server accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global white-box server market include Celestica Inc., Compal Inc., Hon Hai Precision Industry Company Ltd., Hyve Solutions Corporations, Inventec Corporation, MiTAC Holdings Corporation, Pegatron Corporation, Penguin Computing, Quanta Computer Incorporated, Equus Computer Systems, Super Micro Computer, Inc., Wistron Corporation, and ZT Systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)