Wine Packaging Market Size, Share, Trends and Forecast by Material Type, Packaging Type, and Region, 2025-2033

Wine Packaging Market Size and Share:

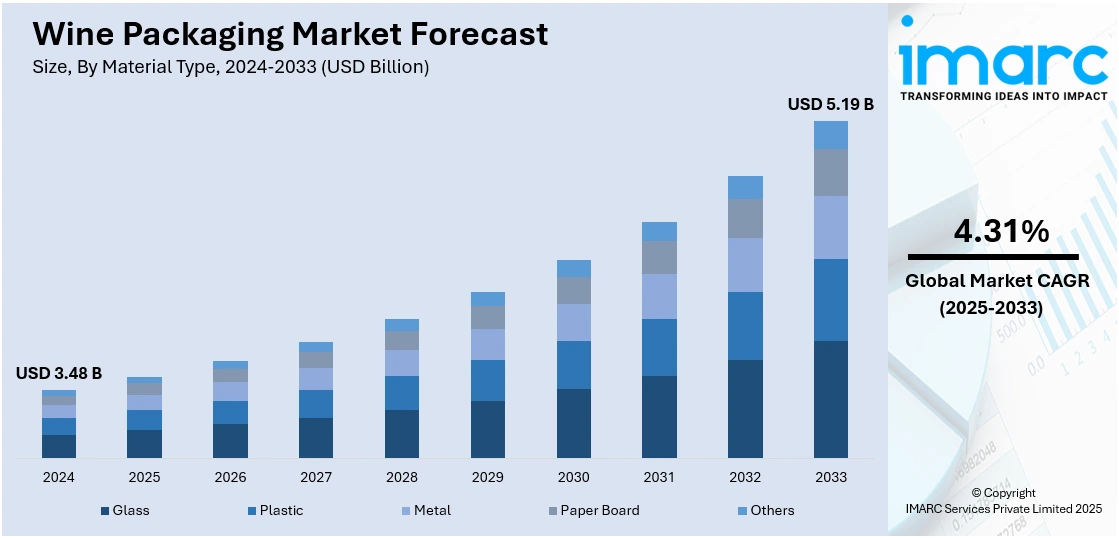

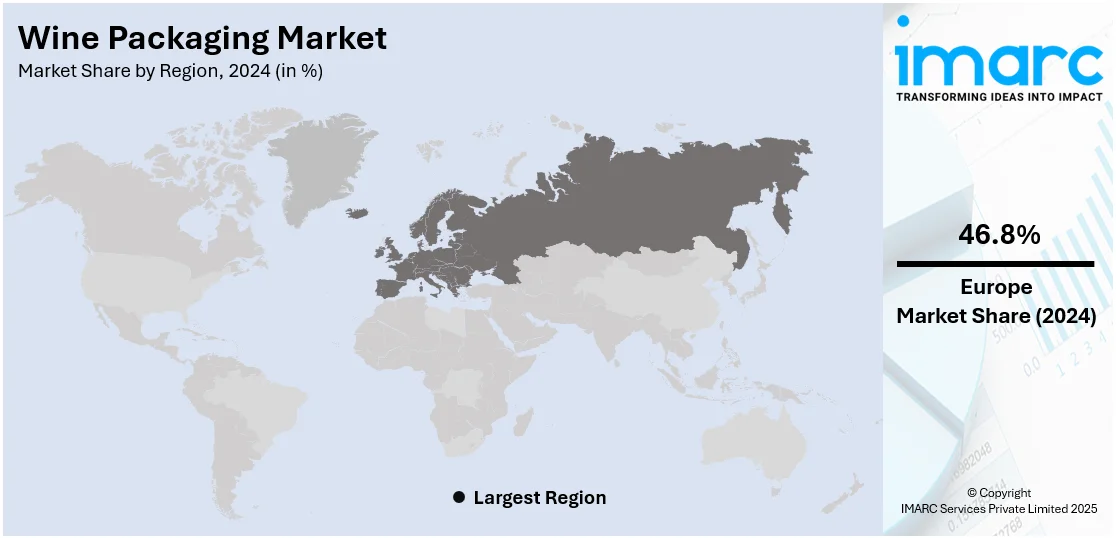

The global wine packaging market size was valued at USD 3.48 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.19 Billion by 2033, exhibiting a CAGR of 4.31% from 2025-2033. Europe currently dominates the market, holding a market share of 46.8% in 2024. The market is experiencing significant growth, driven by consumer demand for sustainable, innovative packaging solutions, and the adoption of eco-friendly materials, smart packaging, and premium designs. As wine consumption is rising, particularly among younger demographics, packaging formats like aluminum cans and bag-in-box are also gaining popularity. The increasing competition and technological advancements, are further influencing the wine packaging market share globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.48 Billion |

|

Market Forecast in 2033

|

USD 5.19 Billion |

| Market Growth Rate 2025-2033 | 4.31% |

Key drivers in the wine packaging market include growing consumer demand for premium and sustainable packaging options, with eco-friendly materials gaining popularity. For instance, in April 2025, Target announced the launch of America's first nationwide range of wines in eco-friendly paper bottles, The Collective Good. Available in 1,200 stores, the innovative Frugal Bottle uses 94% recycled paperboard, reducing carbon emissions by 84%. The initiative promotes sustainable practices while featuring high-quality wines from environmentally conscious vineyards worldwide. The rise in wine consumption across emerging markets and the increasing preference for attractive, innovative packaging designs also contribute to market growth. Furthermore, the adoption of smart packaging technologies, such as QR codes and NFC tags for enhanced consumer engagement, and advancements in packaging materials to preserve wine quality, are driving innovation in the market.

Key drivers in the United States wine packaging market include the growing demand for eco-friendly packaging, with consumers increasingly opting for sustainable materials like glass alternatives and biodegradable options. For instance, in September 2024, Albertsons Companies announced the launch of Bee Lightly, a new wine brand featuring 100% recycled PET flat-pack bottles, marking a first in the US market. The line includes a highly rated Chardonnay and Rosé, showcasing quality French wines while prioritizing sustainable packaging to reduce environmental impact and enhance transport efficiency. Innovations in packaging design, such as premium labels and personalized bottles, are also fueling market growth. Additionally, the rising popularity of wine among millennials and the trend toward convenient, single-serve packaging formats are driving demand. Advancements in packaging technology, including enhanced protection methods to preserve wine quality, further support the market’s expansion.

Wine Packaging Market Trends:

Rising Focus on Sustainability

The wine packaging market is increasingly driven by a demand for sustainable solutions, as consumers and brands prioritize eco-friendly options. Recyclable glass, aluminum, and biodegradable plastics are gaining popularity as alternatives to traditional packaging materials. For instance, in March 2024, Aldi announced the launch of the UK's first flat wine bottles made from 100% recycled PET, marking a milestone in sustainability. Available nationwide, the lightweight bottles are shatterproof and reduce lorry transport emissions by 30%. This initiative, in collaboration with Packamama, aligns with Aldi's commitment to eco-friendly packaging solutions. These sustainable options reduce environmental impact, aligning with the growing trend toward sustainability. Additionally, wineries are adopting packaging that emphasizes recyclability and reduced carbon footprints. The wine packaging market forecast indicates that this shift toward eco-friendly materials will continue to play a significant role in shaping market growth in the coming years.

Rising Demand Smart Packaging

Smart packaging is revolutionizing the wine packaging market by incorporating advanced technologies such as NFC (Near Field Communication), QR codes, and digital labeling. These innovations provide consumers with easy access to detailed product information, including origin, tasting notes, and pairing suggestions, enhancing the overall wine experience. Additionally, NFC and QR codes allow for real-time interaction with the brand, fostering stronger customer engagement. For instance, in May 2025, Identiv, ZATAP, and Genuine-Analytics announced their partnership to launch an NFC-based smart packaging solution for luxury wine, combating counterfeiting. The technology establishes a digital link between wine bottles and their contents, using IoT and blockchain for verification. As consumer demand for digital interaction rises, smart packaging is expected to become a standard in the industry. The wine packaging market outlook shows this trend continuing to expand in the coming years.

Growing Demand of Premium and Custom Designs

There is a growing preference for premium and custom-designed packaging in the wine industry, as brands seek to differentiate themselves in an increasingly competitive market. Unique, artistic packaging, such as intricate bottle shapes, high-quality labels, and custom finishes, appeals to premium wine consumers who value aesthetics and exclusivity. This trend not only enhances the perceived value of the product but also creates an emotional connection with the consumer. As wineries strive to make a statement with their offerings, the demand for premium packaging continues to rise, driving substantial growth in the wine packaging market. Wine packaging market growth is expected to reflect this shift in consumer preferences toward personalized and high-end designs.

Wine Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wine packaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type and packaging type.

Analysis by Material Type:

- Glass

- Plastic

- Metal

- Paper Board

- Others

Glass stand as the largest material type in 2024, holding around 67.8% of the market. Glass remains the largest material type in the wine packaging market due to its ability to preserve wine quality and enhance its aesthetic appeal. It is favored for its impermeability, which protects the wine from light and air, ensuring better preservation of taste and freshness. Additionally, glass packaging offers a premium, elegant look that aligns with consumer expectations for high-quality wines. Its recyclability also supports the growing demand for sustainable packaging, solidifying its position as the leading material in the wine packaging market. As a result, glass continues to dominate market share in wine packaging.

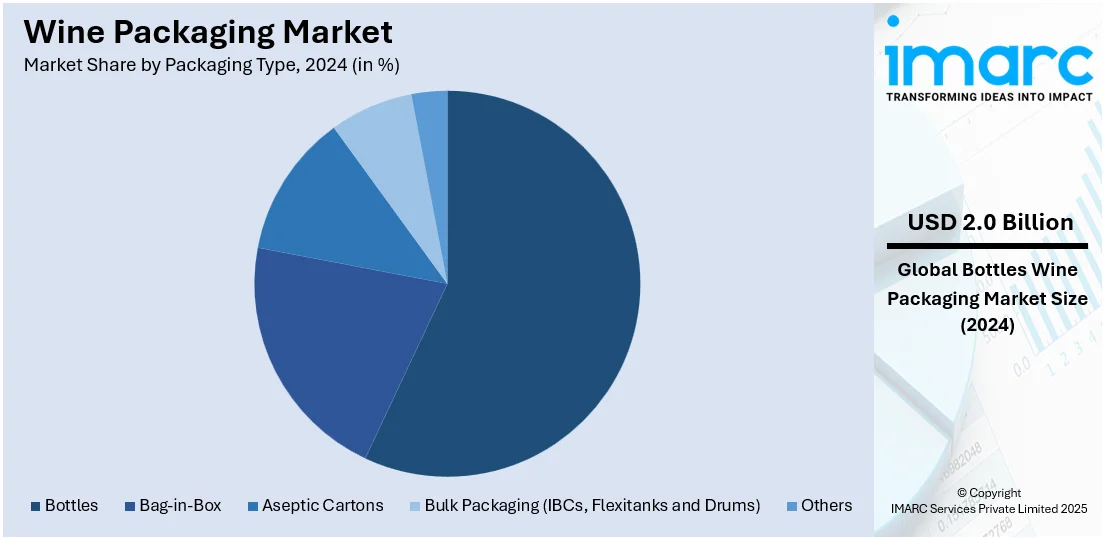

Analysis by Packaging Type:

- Bottles

- Bag-in-Box

- Aseptic Cartons

- Bulk Packaging (IBCs, Flexitanks and Drums)

- Others

Bottles lead the market with around 56.8% of market share in 2024. Bottles continue to lead the wine packaging market due to their long-standing tradition and functionality. Glass bottles, in particular, are preferred for their ability to preserve the wine’s quality by preventing exposure to air and light. They also provide an aesthetically pleasing and premium look, making them ideal for both everyday wines and high-end collections. The bottle shape, size, and labeling options offer versatility, catering to different consumer preferences. As a result, bottles dominate the market, maintaining their strong position in both traditional and premium wine packaging segments.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 46.8%. Europe accounts for the largest share of the wine packaging market, driven by its strong wine production heritage and high consumption rates. Countries like France, Italy, and Spain are key producers, where premium wines are highly valued, fostering demand for sophisticated and high-quality packaging. Additionally, European consumers increasingly prefer sustainable packaging, further propelling the market for eco-friendly materials such as recyclable glass and biodegradable plastics. The region's well-established wine industry, coupled with innovation in packaging designs, positions Europe as the dominant market for wine packaging, influencing global trends and market growth.

Key Regional Takeaways:

North America Wine Packaging Market Analysis

The North American wine packaging market is witnessing robust growth, driven by the region's strong wine consumption and a shift toward sustainable packaging solutions. Increasing consumer preference for premium and eco-conscious products is fueling demand for innovative packaging formats, such as lightweight glass bottles, cans, and bag-in-box packaging. As consumers focus on convenience and environmental impact, wine brands are investing in packaging that combines functionality with aesthetics. The growing popularity of wine among millennials, who prioritize portability and sustainability, further supports these trends. Additionally, the rise in direct-to-consumer sales and e-commerce is reshaping packaging requirements, with a greater emphasis on durable, protective packaging for shipping. With sustainability at the forefront of consumer decisions, North American wine packaging companies are aligning with green initiatives, offering recyclable and biodegradable options. This dynamic landscape continues to influence the market's evolution, driving adoption of diverse packaging innovations.

United States Wine Packaging Market Analysis

In 2024, the United States accounted for 90.00% of the wine packaging market in North America. The United States wine packaging market is experiencing increased momentum driven by growing wine consumption across various consumer segments. For instance, in 2023, the typical American drank an average of 4.7 Liters of wine, with total wine consumption reaching 18.5 billion Liters for the year. The increasing popularity of casual wine drinking, driven by changing social norms and varied product choices, has resulted in a higher demand for flexible, sustainable, and visually appealing packaging. As consumers explore new wine flavours and formats, packaging that enhances shelf appeal and preserves quality is gaining attention. Innovations in bag-in-box, aluminium cans, and lightweight glass bottles are responding to these preferences. Wine consumption is also being influenced by younger demographics, which favour portability and environmentally conscious solutions. As a result, wine packaging providers are investing in materials and formats that align with modern consumption habits. Growing wine consumption continues to shape wine packaging adoption trends across the country’s expanding market.

Asia Pacific Wine Packaging Market Analysis

Asia-Pacific wine packaging demand is strengthening with the expanding presence of wine companies in the region. For instance, in India, the annual wine consumption stands at approximately 400,000 cases, with around 85% comprising table wines and the rest being premium varieties. The market is seeing growth due to both emerging domestic producers and international brands enhancing their presence, which in turn fosters investment in unique and functional packaging solutions. As the number of wine companies increases, there is a competitive drive to establish strong brand identities, making packaging an essential marketing asset. Various elements such as labels, bottle shapes, closures, and design innovations are being utilized to appeal to a wide range of consumer segments. Additionally, the evolving regulatory and logistical frameworks in the region are pushing wine companies to adopt standardized, tamper-evident, and efficient packaging. The increasing number of wine companies also fosters localized bottling and filling operations, necessitating new packaging lines and technologies. Wine packaging is adapting rapidly in Asia-Pacific to meet the operational and marketing needs of a dynamic producer landscape.

Latin America Wine Packaging Market Analysis

Latin America is experiencing growing wine packaging adoption as wine export and import activities expand across the region. For instance, shipments of wine to Latin America in 2024 were up by 7.7%. The exports to the region totalled over USD 1.1 Billion in 2024. Trade liberalization, regional agreements, and diversified sourcing of wine products have heightened the need for efficient, compliant, and visually appealing packaging. Wine producers and distributors are optimizing packaging formats to meet the logistical requirements of cross-border movement and varied shelf environments. As wine export and import volumes rise, packaging plays a key role in brand differentiation and preservation during transit.

Middle East and Africa Wine Packaging Market Analysis

The adoption of wine packaging is increasing in the Middle East and Africa, fueled by a growing demand for premium wines in gourmet restaurants and luxury hotels. In 2020, the Department of Culture & Tourism reported that Abu Dhabi welcomed approximately 5.1 million hotel guests, achieving a 73% occupancy rate. Upscale hospitality venues are enhancing their wine offerings, which requires premium packaging that improves brand image and guest experience. As the appetite for exclusive wines rises, packaging options are focusing on luxury designs, durability, and visual appeal to fit high-end service environments. For example, MMI Dubai boasts the largest wine portfolio in the Gulf, featuring over 2,400 products, including 30 of the top 50 “World’s Most Admired Wine Brands.”

Competitive Landscape:

The market for wine packaging is very competitive, with many companies competing for market share by focusing on innovation, sustainability, and cost-effective solutions. Companies are focusing on offering a variety of packaging options, including glass bottles, aluminum cans, and eco-friendly alternatives like biodegradable plastics and lightweight packaging. Sustainability initiatives are driving the adoption of recyclable and renewable materials, while attractive designs and smart packaging technologies enhance consumer engagement. Competitive strategies also include the development of functional packaging formats that meet convenience and preservation requirements, along with customization options to differentiate brands. Market players are leveraging technology and regional expansion to capture diverse consumer segments.

The report provides a comprehensive analysis of the competitive landscape in the wine packaging market with detailed profiles of all major companies, including:

- Amcor Limited

- Ardagh Group

- Ball Corporation

- Encore Glass

- G3 Enterprises

- Guala Closures

- International Paper

- Maverick Enterprises Inc. (Sparflex SA)

- Owens-Illinois Group

- Scholle Ipn Corporation

Latest News and Developments:

- May 2025: Spanish wine brand Faustino launched its first bag-in-box Tempranillo in Tesco, targeting sustainable wine packaging. The new format aims to reduce waste while maintaining quality.

- April 2025: Frugalpac’s paper wine bottles, made from 94% recycled paperboard and a recyclable plastic pouch, went on sale at Target as part of an effort to cut nearly 87.8 tons of CO2e emissions. The lightweight Frugal Bottle, weighing just 83g, reportedly uses 77% less plastic than standard recycled plastic bottles and is 84% less carbon-intensive than traditional glass wine bottles.

- April 2025: TricorBraun WinePak launched EcoStep, a full-service wine packaging solution aimed at helping wineries meet sustainability goals. The initiative provides eco-conscious packaging options to simplify environmental impact reduction.

- March 2025: Aldi removed protective sleeves from its own-label corked wines, marking a first among UK supermarkets. The wine packaging change followed a successful 2024 trial and targeted 46 wine lines. This shift aims to cut 38 tons of annual packaging waste by eliminating plastic and aluminum sleeves.

- March 2025: Vinca launched 100% recycled aluminium wine bottles in the UK. The 750ml bottles feature two organic Sicilian wines: a crisp white Catarratto and a juicy red Syrah & Nero d’Avola. This eco-friendly packaging combines the convenience of cans with a premium wine experience.

Wine Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Glass, Plastic, Metal, Paper Board, Others |

| Packaging Types Covered | Bottles, Bag-in-Box, Aseptic Cartons, Bulk Packaging (IBCs, Flexitanks and Drums), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor Limited, Ardagh Group, Ball Corporation, Encore Glass, G3 Enterprises, Guala Closures, International Paper, Maverick Enterprises Inc. (Sparflex SA), Owens-Illinois Group and Scholle Ipn Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wine packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global wine packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wine packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wine packaging market was valued at USD 3.48 Billion in 2024.

The wine packaging market is projected to exhibit a CAGR of 4.31% during 2025-2033, reaching a value of USD 5.19 Billion by 2033.

Key factors driving the wine packaging market include rising demand for sustainable and eco-friendly packaging, innovations in packaging formats like cans and bag-in-box, consumer preference for premium and visually appealing designs, and the growing trend of wine consumption among younger demographics seeking convenience and portability.

Europe dominates the wine packaging market due to its strong wine production heritage, high demand for premium packaging, and growing consumer preference for sustainable solutions.

Some of the major players in the wine packaging market include Amcor Limited, Ardagh Group, Ball Corporation, Encore Glass, G3 Enterprises, Guala Closures, International Paper, Maverick Enterprises Inc. (Sparflex SA), Owens-Illinois Group and Scholle Ipn Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)