Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034

Women Apparel Market Size and Share:

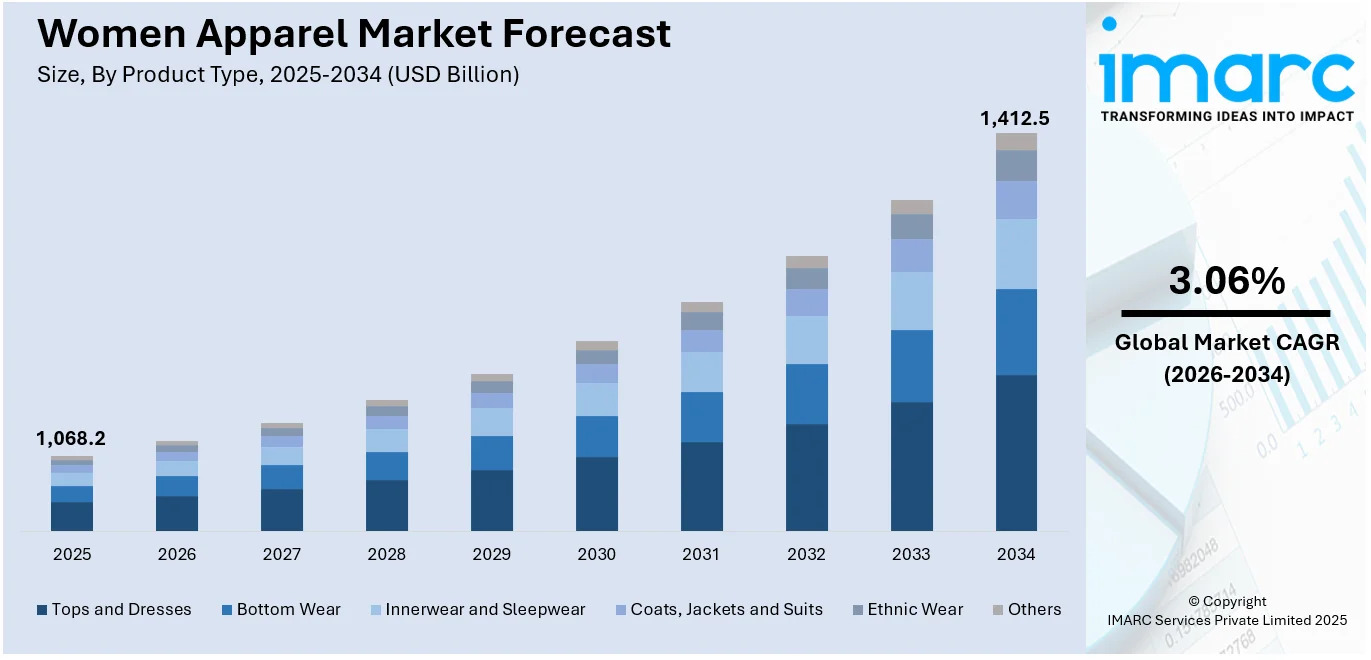

The global women apparel market size was valued at USD 1,068.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,412.5 Billion by 2034, exhibiting a CAGR of 3.06% during 2026-2034. Europe currently dominates the market, holding a significant market share of 39.8% in 2025. The market is fueled by growing disposable incomes, rapidly evolving fashion trends, and increasing online retail penetration. Greater social media influence and celebrity endorsements, rising demand for inclusive sizing and diverse fashion representation and growing working women population propels demand for flexible, fashionable apparel that can be worn both in and out of the workplace, while seasonal collections and continuous trend cycles also help maintain consumer interest which increases the women apparel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,068.2 Billion |

|

Market Forecast in 2034

|

USD 1,412.5 Billion |

| Market Growth Rate 2026-2034 | 3.06% |

The market driven by the increased disposable incomes, especially in developing markets, which have empowered women to make more expenditure on fashion. Changing fashion styles and the impact of social media sites and influencers have also propelled this shift and reduced product lifecycles. The growth in e-commerce and online shopping has democratized fashion, and technologies such as virtual try-ons make online shopping more engaging. Moreover, sustainability and responsible manufacturing processes are now driving purchasing behavior, with brands launching green alternatives. Inclusivity, such as expanded sizing and inclusive representation in marketing, is also becoming more important. The increasing number of working women has also raised demand for fashionable yet practical workwear. Regular product releases and continuous fashion changes also fuel consumer interest, further propelling women apparel market growth.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by innovation, consumer behavior, and operational changes in the industry. The US is a center for fast fashion and direct-to-consumer brands, having led the way through quick production cycles, as seen through the proliferation of trend-based low-cost labels. The nation's dominance in e-commerce and social commerce—especially through platforms such as TikTok Shop and Instagram—has transformed consumer engagement, allowing brands to connect with consumers in real-time and turn interest into sales. Furthermore, policy shifts including the examination of the de minimis import rule and the enactment of legislation such as the FABRIC Act are pressuring businesses to rethink global supply chains and adopt more ethical manufacturing practices. Increased consumer consciousness about sustainability, diversity, and labor practices also affects brand strategies and market behavior. As a trendsetter in both fashion innovation and retail, the US continues to disrupt established models and is a vital force in redefining the women's apparel market.

Women Apparel Market Trends:

Evolution of Fast Fashion

The fast fashion business has transformed women's clothing by providing the latest trending fashion staples at low costs. While fast fashion is expected to continue to grow 20% in the coming years, secondhand fashion is poised to grow 185%, according to World Economic Forum. Companies such as Shein and H&M have taken advantage of this strategy, bringing new collections quickly to address consumer needs. The streamlined supply chain, coupled with international sourcing, also makes fast fashion cost-effective to produce. Consequently, women are able to express their uniqueness and keep up with trends without the lengthy wait for conventional fashion cycles. Moreover, the fast-fashion business has fueled retail innovation, with companies constantly refreshing their collections and generating a sense of urgency for consumers, who are able to experience new, affordable products year-round. This strategy has transformed consumer expectations and transformed the way fashion is consumed and experienced globally.

E-Commerce and Shopping Experience

E-commerce has profoundly changed the women apparel market forecast for the coming years. According to the reports, the U.S. retail e-commerce market saw a 2.7% increase in sales for Q4 2024, reaching a total of USD 308.9 Billion, excluding seasonal variations and price changes. Internet platforms give customers the flexibility of shopping from home, with access to a wide range of products and easy price comparison. The use of technologies such as augmented reality (AR) and virtual try-ons further improves the experience of shopping online, enabling customers to see how clothes fit and look. Social commerce has only served to intensify this change, with Instagram and Facebook providing a platform to directly buy goods from social media. The impact is strongest in areas with deep mobile penetration, where consumers can seamlessly shop with their smartphones. Growth in e-commerce has also increased the presence of direct-to-consumer (D2C) brands, which use digital platforms to engage directly with consumers without involving conventional retail intermediaries. This transformation has given consumers more autonomy over their shopping experiences and pushed competition between brands to be more innovative and respond to changing demands.

Sustainability and Ethical Practices

As concern for the environment and social issues increases, there is a discernible change in consumer behaviors toward environmentally friendly and ethically manufactured women's clothing. Brands are already embracing sustainable materials, including organic cotton and recycled materials, and adopting transparent supply chains to ensure equitable labor practices. This is not simply a reaction to demand but an active measure to reduce the fashion sector's environmental impact. For example, in India, initiatives such as the Production-Linked Incentive (PLI) scheme by the government push manufacturers toward sustainable practices in line with global climate goals. Shoppers, particularly the younger generation, are increasingly more selective, and they prefer to support brands that have a responsibility towards sustainability and ethical manufacturing. This shift is challenging the old fast fashion formats, calling upon the industry to shift toward responsible and conscious consumption behaviors, which heavily influences the future women apparel market outlook.

Women Apparel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global women apparel market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, season, and distribution channel.

Analysis by Product Type:

- Tops and Dresses

- Bottom Wear

- Innerwear and Sleepwear

- Coats, Jackets and Suits

- Ethnic Wear

- Others

Tops and dresses stand as the largest component in 2025, holding around 32.3% of the market. Tops and dresses represent the largest segment due to the easy availability of a various designs in accordance with seasonal demand and requirements. Tops and dresses are the most popular women's clothing because they are versatile, fashionable, and can be worn on different occasions. Tops cover a variety of clothing, such as blouses, shirts, t-shirts, and sweaters, that can be worn on casual, formal, and business occasions. Dresses, in various styles like maxi, midi, and cocktail, provide outfits for occasions from everyday wear to special events. The popularity of this segment is propelled by trends such as fashion evolution, higher disposable incomes, and the expanding number of working women looking for fashionable yet practical clothing alternatives. Moreover, changing fashion trends are influencing the market positively.

Analysis by Season:

- Summer Wear

- Winter Wear

- All Season Wear

Winter wear leads the market share in 2025. Winter wear accounted for the largest market share as it is designed to keep the wearer warm and comfortable during the colder months. This segment encompasses coats, jackets, sweaters, and thermals for warmth and fashion. Fabric technology improvement and layering popularity also fuels sales and innovation. Style-conscious shoppers look for fashionable, practical winter clothes, which is also fueling high revenue in this category. Moreover, winter apparel enjoys the advantage of having higher prices and regular changes in materials and trends, which makes it an attractive category for brands to approach both mass and luxury market niches.

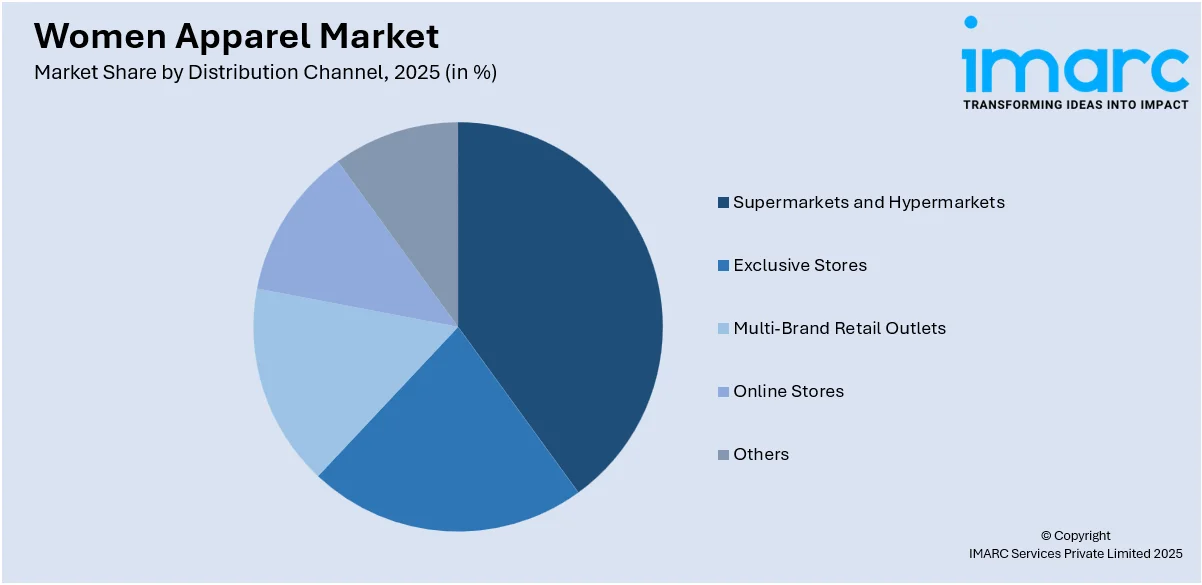

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with around 35.9% of market share in 2025. According to the report, supermarkets and hypermarkets lead the women's clothing market distribution channel segment by virtue of their extensive reach, affordability, and ease. These store formats provide a variety of clothing in one stop, appealing to price-conscious customers looking for quality and variety. Placing fashion products near necessary items increases impulse buying. The stores also have private label and established brand partnerships enabling them to sell trendy clothing at reasonable prices. Their capacity to serve urban and semi-urban customers, coupled with loyalty programs and regular discounts, enhances customer retention and induces high sales volume in the women's clothing category.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Europe accounted for the largest market share of over 39.8%. According to the report, Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others) was the largest market for women apparel. The increasing preference for trendy apparel among the masses represents another major factor favoring the market growth in Europe. Moreover, the rising adoption of online shopping portals and mobile apps due to ease, comfort, and convenience is contributing to the market growth in the region. Besides this, the growing female workforce participation is creating a positive outlook for the market.

Key Regional Takeaways:

United States Women Apparel Market Analysis

In 2024, the United States accounted for over 87.50% of the women apparel market in North America. The United States women's apparel market remains dynamic, shaped by evolving fashion trends, consumer preferences, and a heightened focus on inclusivity and diversity. Recent data from the U.S. Bureau of Economic Analysis shows that as of March 2025, disposable personal income increased by USD 191.6 Billion. At the same time, personal consumption expenditures grew by USD 87.8 Billion, highlighting the strong economic environment that is fueling consumer spending in the apparel sector. Demand for casualwear and athleisure continues to expand, driven by lifestyle shifts favoring comfort and versatility. The growing influence of social media platforms is accelerating fast-fashion trends, encouraging more frequent wardrobe updates among consumers. Eco-conscious buying behaviors are prompting brands to integrate sustainable fabrics and ethical production methods into their offerings. Personalization and customization services are increasingly popular, with consumers seeking unique clothing options tailored to their style and fit preferences. The rise of digital-native brands and direct-to-consumer channels is intensifying competition and reshaping retail landscapes. Technological integration, seasonless fashion, and premiumization trends are enhancing online shopping experiences, driving higher spending on long-lasting wardrobe staples.

Europe Women Apparel Market Analysis

The women’s apparel market in Europe is characterized by a strong consumer emphasis on craftsmanship, heritage designs, and quality fabrics. Shifts in demographics, with an increasingly diverse population, are fostering greater demand for culturally inclusive fashion. The growing popularity of rental and second-hand fashion models is altering traditional buying patterns and promoting circular economic practices. Eurostat states that, in February 2025, the seasonally adjusted retail trade volume increased by 2.3% in the Euro area and by 2.0% in the EU, as compared to February 2024. This highlights positive momentum in retail, including the women’s apparel segment. Consumers are increasingly drawn toward minimalist and timeless styles that emphasize functionality and longevity. Additionally, the influence of fashion weeks and designer collaborations across various segments is catalyzing innovation and cross-genre styles. A growing preference for artisanal, locally produced apparel, digital fashion experiences, and vintage styles is influencing consumer preferences, with sustainability and transparency being key purchasing drivers, especially among younger generations.

Asia Pacific Women Apparel Market Analysis

The Asia Pacific women’s apparel market is experiencing strong momentum due to rising urbanization, increasing disposable incomes, and changing lifestyle aspirations. A notable surge in demand for fusion fashion blending traditional and contemporary styles is shaping market trends. Youth-centric fashion, driven by pop culture and entertainment influences, is spurring rapid style adoption cycles. However, a growing concern linked to the region's fashion boom is the environmental impact. According to Net Zero India, India is expected to produce 7.7 million tons of textile waste in 2025, highlighting the need for sustainable production and consumption practices in the apparel industry. Growing mobile internet penetration is empowering e-commerce platforms, with mobile-first shopping becoming increasingly prevalent. Consumer interest in fashion subscription services and curated online boutiques is steadily increasing, offering personalized shopping experiences. The growing wellness focus is transforming activewear and athleisure into mainstream categories, with digital influencers and trendsetters significantly influencing purchase decisions and enhancing online brand visibility.

Latin America Women Apparel Market Analysis

The Latin America women apparel market is advancing steadily, fueled by cultural vibrancy and rising demand for bold, expressive fashion. Traditional craftsmanship integrated with modern silhouettes is gaining popularity, offering distinctive product appeal. With the implementation of Brazil’s National Circular Economy Strategy in June 2024, the country is positioned to lead the textile sector towards sustainable and low-carbon operations. Textile Insights highlights the importance of sustainability in the region, noting that innovative bio-based energy solutions, such as eucalyptus-derived biocarbon and second-generation ethanol, could reduce textile dyeing emissions by up to 50%. A youthful demographic is driving experimentation with bright colors, eclectic patterns, and versatile designs. The expansion of regional fashion events and local design talent is stimulating interest in homegrown brands. Additionally, the influence of music, dance, and artistic movements is permeating fashion sensibilities, encouraging dynamic styles that reflect individuality. Growing access to digital retail platforms is enabling wider product reach, enhancing consumer accessibility to diverse fashion ranges.

Middle East and Africa Women Apparel Market Analysis

The Middle East and Africa women’s apparel market is witnessing dynamic growth, driven by increasing fashion consciousness and significant investments in modern retail infrastructure. According to reports, fashion retail spending per capita in Saudi Arabia, at USD 800 annually, is expected to outpace disposable income growth (22% vs. 4% CAGR by 2028), aligning with GDP growth, which highlights the expanding potential in the region. The fusion of traditional motifs with contemporary cuts is appealing to a broad audience seeking cultural authenticity alongside modernity. Modest fashion trends are driving innovation in design, offering stylish yet culturally appropriate options. Luxury apparel demand is on the rise, fueled by a growing affluent consumer base. Social media influencers and localized fashion campaigns are crucial in shaping evolving fashion narratives and enhancing brand visibility.

Competitive Landscape:

Several leading companies in the women apparel market are undertaking a range of strategic efforts to drive growth and meet evolving consumer preferences. Major brands like Zara, H&M, Nike, and Levi’s are focusing on sustainability by integrating eco-friendly materials and adopting transparent supply chain practices. For instance, H&M’s Conscious Collection and Levi’s Water<Less® initiative highlight their commitment to ethical fashion. Digitalization is another prominent strategy, with businesses using AI and data analytics to offer customized shopping experiences, streamline inventory, and forecast fashion trends. Mobile apps and online platforms are being upgraded to provide frictionless shopping and virtual try-on capabilities, targeting tech-enabled consumers. Body positivity and inclusivity are also on the rise, with brands increasing their size ranges and showcasing diverse models in campaigns. Influencer and designer collaborations are now a prominent strategy to create hype and pull in the younger crowd. New brands are also leveraging social media and direct-to-consumer platforms to cannibalize traditional retail. Due to changing lifestyles, especially post-pandemic, comfort and athleisure clothing are the focus areas. Overall, innovation, sustainability, digital engagement, and inclusivity form the prime pillars propelling the women's clothing market onwards, with leading players responding quickly to stay competitive and relevant in an ever-changing environment.

The report provides a comprehensive analysis of the competitive landscape in the women apparel market with detailed profiles of all major companies, including:

- Adidas AG

- Burberry Group Plc

- Dolce & Gabbana

- Forever21

- Giorgio Armani S.p.A

- Industria de Diseño Textil, S.A.

- Kering

- L Brands Inc.

- LVMH

- PVH Corp.

- Prada S.p.A.

- Uniqlo Co. Ltd. (Fast Retailing Co. Ltd.)

Latest News and Developments:

- April 2025: The Kansas City Royals partnered with Wild Collective to launch a women’s clothing line, “Women of the K”. Royals players’ and coaches’ wives were involved in designing the collection, aiming to create stylish sports apparel for women.

- April 2025: Hicks Nurseries launched a new coastal-inspired collection called “Long Island Summer”, featuring women’s apparel, accessories, and home décor. The collection, designed to capture the essence of Long Island living, included easy-fit dresses, vacation-ready accessories, and summer décor items.

- March 2025: Apparel Group launched the women’s fashion brand BCBG in the GCC and Indian markets, opening its first mono-branded store at Bahrain’s Avenues Mall. The store offered a full lifestyle collection, with plans for six more locations by the end of 2025.

- February 2025: A’ja Wilson, a two-time WNBA champion and three-time MVP, launched her Nike signature shoe and apparel collection in Columbia, South Carolina. The predominantly pink line included the A’One sneaker and unique design elements.

- September 2024: Royal Enfield launched a new range of women’s riding gear and lifestyle apparel in India as part of its "She Rides Her Way" campaign. The collection included eco-friendly jackets, riding denims, helmets, boots, and gloves, designed for safety and style.

Women Apparel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tops and Dresses, Bottom Wear, Innerwear and Sleepwear, Coats, Jackets and Suits, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All Season Wear |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas AG, Burberry Group Plc, Dolce & Gabbana, Forever21, Giorgio Armani S.p.A., Industria de Diseño Textil S.A., Kering, L Brands Inc., LVMH, PVH Corp., Prada S.p.A. and Uniqlo Co. Ltd. (Fast Retailing Co. Ltd.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the women apparel market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global women apparel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the women apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The women apparel market was valued at USD 1,068.2 Billion in 2025.

The women apparel market is projected to exhibit a CAGR of 3.06% during 2026-2034, reaching a value of USD 1,412.5 Billion by 2034.

The women apparel market is driven by evolving fashion trends, rising disposable incomes, and increased online shopping. Social media influencers and celebrity endorsements boost brand visibility. Sustainability concerns and demand for inclusive sizing also shape consumer choices. Rapid urbanization and a growing working female population further fuel market expansion globally.

Europe currently dominates the women apparel market, driven by sustainability trends, digital transformation, and rising demand for inclusive fashion. E-commerce growth and virtual shopping tools enhance consumer engagement. Additionally, premiumization and eco-conscious buying behavior influence purchasing decisions, while a growing preference for ethical brands reshapes how fashion is produced and marketed.

Some of the major players in the women apparel market include Adidas AG, Burberry Group Plc, Dolce & Gabbana, Forever21, Giorgio Armani S.p.A., Industria de Diseño Textil S.A., Kering, L Brands Inc., LVMH, PVH Corp., Prada S.p.A. and Uniqlo Co. Ltd. (Fast Retailing Co. Ltd.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)