Global 3D Printing Market Expected to Reach USD 125.9 Billion by 2033, North America Led With 33.8% Market Share in 2024 - IMARC Group

Global 3D Printing Market Statistics, Outlook and Regional Analysis 2025-2033

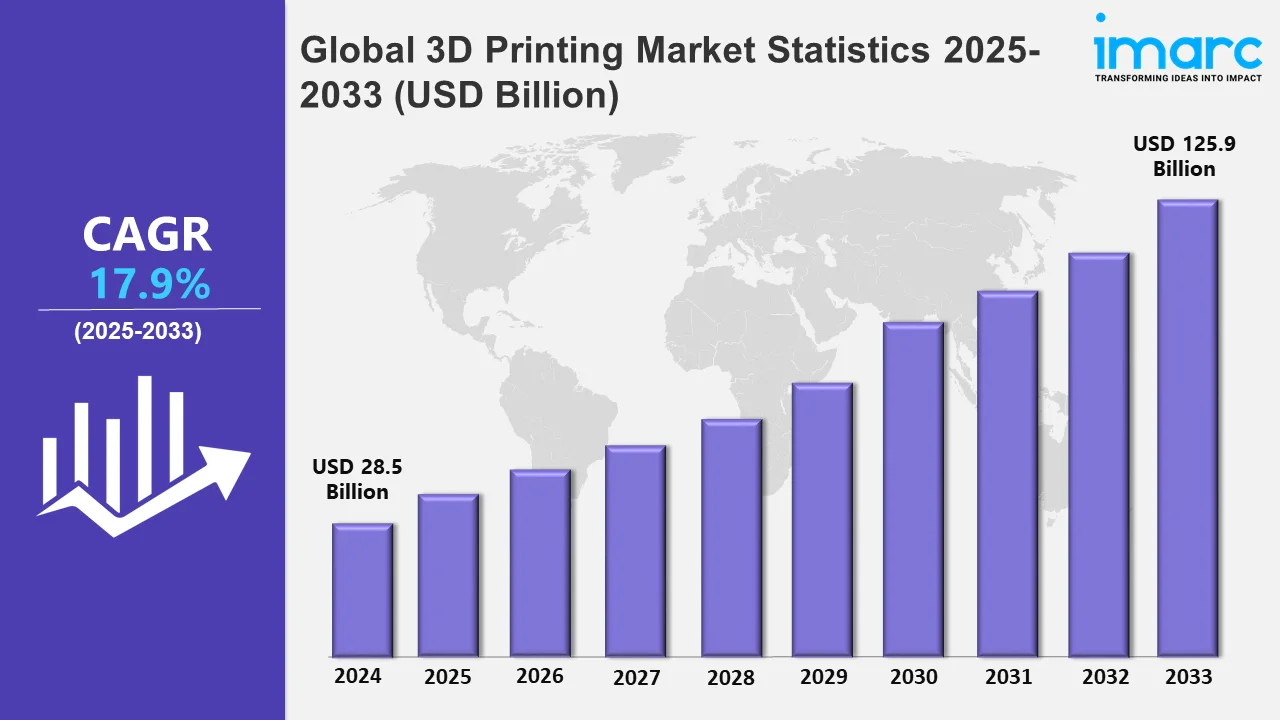

The global 3D Printing market size was valued at USD 28.5 Billion in 2024, and it is expected to reach USD 125.9 Billion by 2033, exhibiting a growth rate (CAGR) of 17.9% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing healthcare applications of 3D printing are impelling the market growth. 3D printing enables the production of customized prosthetics, implants, and surgical instruments tailored to specific patient requirements, thereby enhancing treatment outcomes. The use of 3D printed anatomical models enhances pre-surgical planning, helping healthcare professionals to practice complex procedures with precision. Additionally, improvements in bioprinting enhance the development of artificial organs and tissue engineering, addressing the high demand for organ transplants. 3D printing is also instrumental in producing cost-effective, personalized drug delivery systems and medical devices, reducing manufacturing lead times. It also has the ability to prototype and test new medical products efficiently. Healthcare settings employ modern 3D printing tools and machines to increase the patient’s comfort. In October 2024, Sparsh Hospitals, a premier healthcare facility, located in Bangalore, India, introduced its high-tech and modern on-site 3D printing lab. This facility will enhance surgical accuracy and minimize recovery periods and long-term medical expenses. It incorporates cutting-edge technologies, including tailored prosthetics creation and optimizing procedures to enhance healthcare affordability and efficiency for patients.

Technological advancements are enhancing the precision, efficiency, and scalability of 3D printing across industries. Innovations like faster printing speeds, multi-material printing, and enhanced software solutions have enabled smooth manufacturing processes. They have made 3D printing more accessible and practical for large-scale applications, reducing production time and costs. Additionally, AI-driven design optimization and the integration of cloud-based platforms streamline workflows and enhance the overall user experience. Advanced photopolymers, composites, and bio-compatible substances can be used to create complex, lightweight, and high-strength components with greater accuracy, attracting businesses that seek sustainable and efficient solutions. Major companies work on developing and incorporating advanced 3D printing solutions into manufacturing operations. In October 2024, HENNgineered, a leading expert in manufacturing technologies and 3D materials, announced the expansion of its machine fleet with the acquisition of the Axtra3D Lumia X1 3D printer. This modern tool provides printing speeds that are up to 20 times faster than conventional SLA techniques, enabling the company to decrease lead times and provide faster turnarounds for prototypes and small batch productions. It will also assimilate the printer's ‘Hybrid PhotoSynthesis (HPS) technology’ into its production capabilities.

Global 3D Printing Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the report, North America accounts for the largest market share driven by its advanced manufacturing infrastructure, increasing research and development (R&D) investments, and the rising number of key industry players.

North America 3D Printing Market Trends:

North America is enjoying the leading position in the market due to its advanced technological infrastructure and strong adoption across industries like automotive, aerospace, and healthcare. The United States, a key market player, invests heavily in research and development (R&D) efforts, promoting innovation in 3D printing technologies. Major companies create various 3D printing solutions in response to customization needs. Apart from this, there is a high demand for rapid prototyping and custom products. Big companies in the US team up with government bodies to develop aircraft 3D components. In September 2024, Ursa Major Technologies, a prominent rocket engine manufacturing company based in Colorado, revealed its participation in the US Department of Defense (DOD) initiative to produce solid rocket motors through 3D printing in the United States. The US Navy and the Office of Strategic Capital (OSC) will fund USD 12.5 Million in this project to expand the manufacturing of these rocket motors. This investment will support the development of Ursa Major's 3D printing-based Lynx SRM manufacturing method.

Asia-Pacific 3D Printing Market Trends:

The Asia-Pacific region accounts for a sizeable portion of the 3D printing industry owing to the increasing need for personalized items with detailed imaging and product innovations. Nations, such as China, Japan, and India invest in 3D printing technologies to cater to different needs. China, being a manufacturing hub, utilizes 3D printing techniques like stereolithography that adopts ultraviolet (UV) lasers for mass production. In addition, educational institutions and small-to-medium enterprises in this area adopt 3D printing technologies.

Europe 3D Printing Market Trends:

The market for 3D printing is expanding gradually in Europe, which can be attributed to the rising reliance on additive manufacturing technologies. The region benefits from a strong industrial base, particularly in automotive, aerospace, and healthcare, which need 3D printing tools. In Germany, the UK, and France, modern printing items are being adopted for prototyping, tool production, and creating customized parts. Additionally, Europe's emphasis on sustainability and innovation in manufacturing processes encourages the usage of 3D printing.

Latin America 3D Printing Market Trends:

On account of the growing adoption of additive manufacturing technologies, Latin America is experiencing 3D printing market expansion. In nations like Brazil, manufacturers use 3D printing for prototyping, product design, and production. This area is well-known for the high number of government initiatives that promote 3D printing in local businesses and universities. Moreover, people prefer customized products and cost-effective modern printing solutions.

Middle East and Africa 3D Printing Market Trends:

The market for 3D printing in the Middle East and Africa region is distinguished by the rising investments in additive manufacturing. The region is noted for its high focus on industries like construction, aerospace, healthcare, and automotive, using 3D printing to improve efficiency and reduce costs. The UAE, in particular, has set ambitious objectives, by promoting research and innovation through government-backed initiatives.

Top Companies Leading in the 3D Printing Industry

Some of the leading 3D printing market companies include 3D Systems Inc., Beijing Tiertime Technology Corporation Limited, EOS GmbH, The ExOne Company (Desktop Metal Inc.), General Electric Company, Hewlett Packard Enterprise Company, Materialise NV, Optomec Inc., Proto Labs Inc., Renishaw Plc, SLM Solutions Group AG, Stratasys Limited, Ultimaker B.V., Voxeljet AG and XYZprinting Inc., among many others. In September 2024, Proto Labs Inc., a leading digital manufacturing resource company, broadened its 3D printing options category and launched an advanced photopolymers technology- Axtra3D Hybrid PhotoSynthesis (HPS). It provides highly consistent and intricately detailed 3D printed components at higher speeds. It also employs a precise laser and digital light processing (DLP) system to concurrently capture images of internal and external component structures.

Global 3D Printing Market Segmentation Coverage

- On the basis of the technology, the market has been categorized into stereolithography, fused deposition modeling, selective laser sintering, electron beam melting, digital light processing, and others. Stereolithography is a very important method for making prototypes that are highly detailed and precise. It is a technique that involves UV lasers as the solidifying agents to produce photopolymer resin laterally. Alternatively, fused deposition modeling presses out heated thermoplastic material to construct objects precisely. Selective laser sintering employs a laser to bond powdered plastic and ceramic substances into solid forms, ensuring high strength and precision. Conversely, electron beam melting is adopted to form complicated geometry patterns with metals. Digital light processing enables faster print times and is beneficial for high-resolution prints.

- Based on the process, the market has been classified into binder jetting, directed energy deposition, material extrusion, material jetting, powder bed fusion, sheet lamination, and vat photopolymerization, amongst which binder jetting dominates the market. It is economical, adaptable, and able to manufacture components with high precision. The method employs powdered substances like metals, ceramics, and polymers, which are combined with the help of a liquid binder. It is utilized for the production of large and complex parts in less time since it does not require a complex support structure.

- On the basis of the material, the market has been divided into photopolymers, plastics, metals and ceramics, and others. Among these, photopolymers account for the majority of the market share due to their versatility and ability to create highly detailed and precise parts. By including resin-based printing technologies, these materials create detailed and smooth parts that are useful to the automotive sector. They cure quickly when exposed to light and enable faster printing speeds and more intricate designs. They also come in various types, such as flexible, rigid, or biocompatible resins, to meet different needs of people.

- Based on the offering, the market has been segregated into printer, material, software, and service amongst which, printer exhibits a clear dominance because it is essential for the entire additive manufacturing process. It is widely adopted, as it changes digital designs into tangible objects, utilizing various materials like plastics, metals, and composites. Advanced 3D printers are installed more, as they provide features like faster printing speeds, improved resolution, and multi-material printing, which enhance printing operations.

- On the basis of the application, the market has been categorized into prototyping, tooling, and functional part manufacturing, wherein prototyping holds the biggest market share. It facilitates companies to quickly create and test new product designs before full-scale production. This method shortens development time, lowers expenses, and decreases the possibility of design mistakes. Major industries can also create functional and complex 3D models that represent real-life conditions. Prototyping is used for its ability to support innovations and improve product designs.

- Based on the end user, the market has been segregated into consumer products, machinery, healthcare, aerospace, automobile, and others. Amongst these, consumer products exhibit a clear dominance. They provide tailored and as-needed production solutions. 3D printing enables companies to manufacture customized products, such as shoes, jewelry, glasses, and home furnishings and hence allows them to come up with unique designs that suit different choices. Additionally, it offers lower production costs and faster delivery times for these items, which appeals to small firms and large corporations alike.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 125.9 Billion |

| Market Growth Rate 2025-2033 | 17.9% |

| Units | Billion USD |

| Segment Coverage | Technology, Process, Material, Offering, Application, End-User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | 3D Systems Inc., Beijing Tiertime Technology Corporation Limited, EOS GmbH, The ExOne Company (Desktop Metal Inc.), General Electric Company, Hewlett Packard Enterprise Company, Materialise NV, Optomec Inc., Proto Labs Inc., Renishaw Plc, SLM Solutions Group AG, Stratasys Limited, Ultimaker B.V., Voxeljet AG and XYZprinting Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on 3D Printing Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)