Agricultural Adjuvant Market Size, Share, Trends and Forecast by Type, Crop Type, Application, and Region, 2025-2033

Agricultural Adjuvant Market Size and Share:

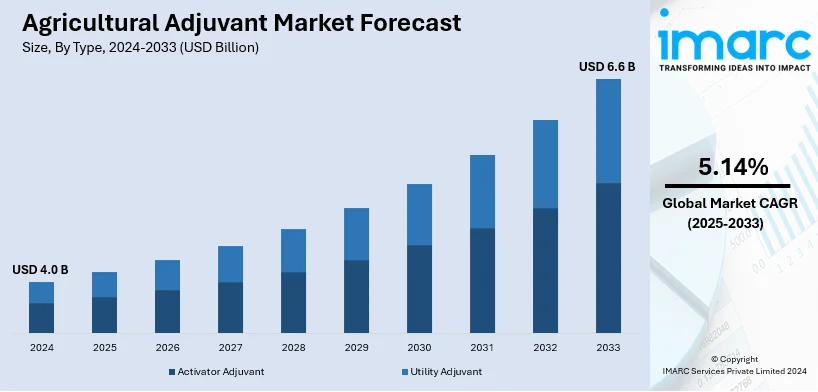

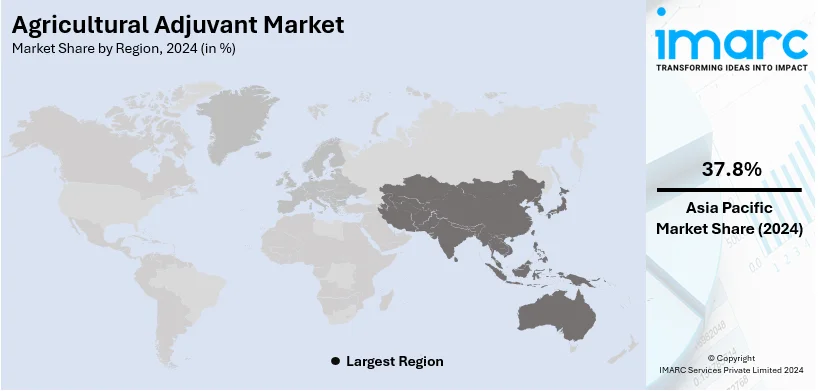

The global agricultural adjuvant market size was valued at USD 4.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.6 Billion by 2033, exhibiting a CAGR of 5.14% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 37.8% in 2024. At present, Asia Pacific exhibits the highest market demand, driven by extensive agricultural activities and advancements in crop protection and management solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.0 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Market Growth Rate (2025-2033) | 5.14% |

The global agricultural adjuvant market is driven by an increasing demand for sustainable agriculture practices that can maximize the yield and quality of the crops. Rising food demand across the globe due to a soaring population has made farmers adopt innovative crop protection solutions, mainly adjuvants for pesticides, herbicides, and fungicides. According to the IMARC Group, the global herbicides market has reached USD 34.2 Billion in 2024. Other growing pressure factors, such as a rise in pests and diseases, as well as an inability to predict climatic behavior, point more toward the need for robust crop protection products. There also seems to be a greater encouragement in the direction of precision agriculture and IPM systems in adjuvants used, optimizing chemical applications and also resulting in environmental friendliness. Developments in bio-based formulation will increase environmental support and drive the demand forward, enhancing market growth.

The United States has become an important regional market for agricultural adjuvants. The market is propelled by the growing requirement to improve the efficiency and efficacy of agrochemicals to satisfy the demand for high-quality agricultural products. Increasing occurrence of resistant pests, weeds, and diseases has resulted in a boost in the utilization of adjuvants to enhance the effectiveness of herbicides, pesticides, and fungicides. Adjuvants that enhance chemical application efficiency, minimize waste, and possess low environmental effects have further driven the need for sustainable agriculture and precision farming methods. Additionally, governmental backing for sustainable farming methods and the implementation of integrated pest management techniques have significantly contributed to the market growth.

Agricultural Adjuvant Market Trends:

Increasing shift toward sustainable agriculture

The increasing shift toward sustainable agriculture is significantly contributing to the market. With the growing emphasis on environment-friendly and socially responsible farming practices, farmers are seeking adjuvants that align with sustainable agricultural principles. Adjuvants that facilitate reduced chemical usage, minimize environmental impact, and improve resource efficiency are in high demand. These adjuvants support the goals of sustainable agriculture by optimizing the effectiveness of agrochemical applications, reducing runoff and environmental contamination, and improving targeted pest and weed control. A McKinsey survey of 500 U.S. farmers in 2023 revealed 90% awareness of sustainable practices, yet holistic adoption remains limited. Agricultural adjuvants, supported by initiatives like the USDA's USD 7 Billion conservation budget, present an efficient pathway to boost sustainability and decarbonize agriculture, addressing the sector's 25% share of global emissions. Furthermore, adopting sustainable farming practices, such as organic farming and integrated pest management, requires effective adjuvants compatible with these systems. Adjuvants formulated specifically for organic farming or those that enable reduced chemical inputs drive market growth. As the agricultural industry continues to prioritize sustainability, the demand for adjuvants that contribute to sustainable farming practices will continue to rise, thus stimulating the agricultural adjuvant market growth.

Rising investments in agricultural research and development (R&D)

The increasing investments in agricultural R&D are positively influencing the market. These investments are resulting in the development of innovative adjuvant formulations with improved functionalities and performance. New adjuvants are being developed through intensive R&D, which provide better compatibility, stability, and efficiency in agrochemical applications. Advanced formulations are addressing the challenges of farmers, such as pesticide resistance and reduced chemical inputs. Department of Agriculture, Fisheries and Forestry shows that increasing investments in agricultural R&D in Australia amount to USD 2.98 Billion in 2023-24 at an annual growth rate of 6.85% by the private sector, which majorly drives innovations in agricultural adjuvants, enhancing crop protection and productivity while reducing environmental impacts. Other investments in agricultural R&D contributed to the development of adjuvants that are aligned with emerging trends, such as precision agriculture and sustainable farming practices. The developments offered by these adjuvants promote optimizations in effectiveness in agrochemical applications, reducing the negative impacts on the environment and promoting resource efficiency. Investments in agricultural R&D continue to increase; developments in innovative adjuvant solutions will accelerate market growth, ensuring that farmers have access to the latest agricultural technology.

Rapid adoption of precision agriculture techniques

The rapid adoption of precision farming techniques is increasing the scale of the agricultural adjuvant market. Precision agriculture uses advanced technologies such as GPS, sensors, and drones to enable location-specific farming and tailored crop management. For instance, in May 2022, the Government of Canada announced an investment of CAD 4,41,917.5 to develop a single system for precise fruit tree cultivation. Adjuvants play an important role in precision agriculture, as they make the usage of agrochemicals more effective and efficient. They aid in the exact delivery and targeted application of pesticides, herbicides, and fertilizers, making their application effective and minimizing wastage. Further, precision agriculture enables farmers to maximize their usage of resources, lower input costs, and reduce negative impacts on the environment. High-performance adjuvants that enhance precision agriculture techniques, such as increasing spray coverage, reducing drift, and enhancing adhesion, are in high demand. The growth of precision agriculture is likely to increase the demand for adjuvants that help apply agrochemicals accurately and effectively, which will further expand the market. These additives improve crop productivity, optimize resource utilization, and encourage sustainable agricultural practices in the context of precision farming.

Agricultural Adjuvant Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agricultural adjuvant market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on type, crop type, and application.

Analysis by Type:

- Activator Adjuvant

- Utility Adjuvant

Activator adjuvant stand as the largest component with 70.5% of the market share in 2024. They are uniquely created to boost the effectiveness of pesticides and herbicides by enhancing their spreadability, coverage, and absorption. They are extensively utilized to guarantee effective crop protection and weed management. They lower the surface tension of spray solutions, enhancing wetting and spreading on the target plant surface. This allows for better pesticide infiltration, resulting in greater effectiveness in managing pests and diseases. Additionally, farmers and agricultural experts acknowledge the role of activator adjuvants in enhancing the efficacy of agrochemical uses. These adjuvants aid in enhancing overall crop management, which includes improved surface coverage on plants, better absorption of active compounds, and heightened specificity for targets. Given the significant role, activator adjuvants play in modern agricultural practices, their dominance in the market is driving the overall growth of the adjuvant agriculture sector. As the demand for effective crop protection solutions continues to rise, activator adjuvants will remain essential components, supporting sustainable and efficient farming systems.

Analysis by Crop Type:

- Cereals & Oilseeds

- Fruits & Vegetables

- Others

Cereals and oilseeds dominate the market with 37.8% of the market share in 2024. Cereals and oilseeds represent a significant segment of the agriculture industry, with high demand for effective crop protection and nutrient management solutions. Adjuvants tailored for cereals and oilseeds help optimize pesticide applications, improve coverage, and enhance absorption, thereby driving market growth in this segment. Furthermore, fruits and vegetables are another important crop category that requires specialized adjuvants. These crops often face unique challenges, such as delicate plant structures, disease susceptibility, and strict residue regulations. Adjuvants formulated for fruits and vegetables aid in precise and effective pest control, disease management, and residue reduction, thus fueling market growth in this segment.

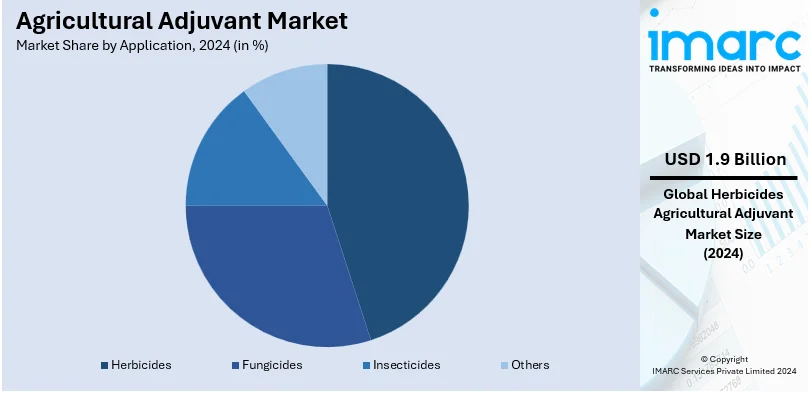

Analysis by Application:

- Herbicides

- Fungicides

- Insecticides

- Others

Herbicides lead the market with 48.7% of the market share in 2024. Herbicides are commonly utilized to guarantee effective crop defense and weed management. Adjuvants aid in boosting the effectiveness of herbicides by enhancing their distribution, coverage, and uptake. They lower the surface tension of spray solutions, facilitating improved wetting and spreading on the surface of the target plant. As worries about weed control rise and the necessity for efficient remedies becomes evident, the need for adjuvants in the herbicide sector keeps expanding. Adjuvants enhance the effectiveness and efficiency of herbicides, resulting in improved weed management and minimizing the risk of crop yield reductions. Herbicides constitute the major segment in the agriculture adjuvant market, and the sustained need for adjuvants in herbicide use drives the overall expansion of the market. Adjuvants allow farmers to obtain enhanced weed management results, resulting in higher crop yields and greater productivity in agriculture.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest agricultural adjuvant market share of 37.8%. Asia Pacific is a key region for the agriculture industry, with high crop diversification in the region. The vast and broad farming operations in the area encompass cereals, oilseeds, fruits, vegetables, and other crops that require crop protection and management solutions, including adjuvants. Additionally, the rates of population growth and eating patterns are shifting quickly in the Asia Pacific region, consequently leading to a rise in food demand. This has led to a demand for greater agricultural productivity and efficiency, as well as a rise in the use of adjuvants to enhance crop yields and guard against pests and diseases. Growing awareness of agricultural sustainability and minimizing environmental impact in the Asia Pacific has boosted the need for adjuvants to aid eco-friendly farming methods. There is a strong need in the area for adjuvants that improve the effectiveness of agrochemicals while minimizing their environmental impact. A robust manufacturing foundation for agrochemicals enhances the availability and accessibility of adjuvants, thereby driving market expansion.

Key Regional Takeaways:

United States Agricultural Adjuvant Market Analysis

In 2024, the United States accounts for over 78.80% of the agricultural adjuvant market in North America. The United States is one of the ideal places where the development of agricultural technology could take place because of its powerful infrastructure, facilities for research, and climatic zones. The position that America takes at the global level makes agribusiness innovation in its area. Such areas, with widespread agricultural land like Iowa, Illinois, and Nebraska, offer perfect spaces to have advanced agricultural lands where the current advanced practices of farming could thrive well. The U.S. has a robust support structure: federal incentives and land-grant universities driving research in sustainable practices. For example, USDA's 2023 Pesticide Data Program showed that more than 99% of the 9,832 food samples tested in the U.S. had pesticide residues below EPA safety benchmarks. That is the safe regulatory environment. This advantage supports the adoption of agricultural adjuvants, enhancing pesticide efficacy while maintaining consumer and environmental safety. Moreover, the widespread application of precision agriculture technologies improves resource utilization and efficiency while reducing costs, thus making the U.S. an excellent location for deploying state-of-the-art agricultural aids. For example, the implementation of new technologies in large-scale farms in the Midwest has yielded significant improvements in crop productivity. The country's commitment to sustainable agriculture and water resource management further strengthens its case as a location for deploying solutions responsive to modern agricultural challenges.

Asia Pacific Agricultural Adjuvant Market Analysis

The Asia-Pacific area is notable as a prime center for progress in agricultural innovations, fueled by its varied climate, wide-ranging farming methods, and swift technological integration. Nations such as India, China, and Australia demonstrate the benefits of this area through extensive farming activities and growing recognition of sustainable agricultural methods. As per FAO, India is home to 15% of the global livestock population, requiring enhanced forage crop yields to satisfy increasing needs for milk and meat, forecasted at 400 Million Tons and 14 Million Tons by 2050. With pesticide application at merely 0.6 kg/ha relative to global standards, there exists considerable potential for agricultural adjuvants to sustainably boost forage production. The area gains from an increasing need for enhanced crop yields, bolstered by government programs encouraging precision farming and sustainable agricultural practices. For example, Australia’s leading agrochemical studies and China’s emphasis on biotechnology integration highlight innovation designed for local agricultural issues. Moreover, a large and active rural labor force, along with increasing investments in agri-tech startups, bolsters Asia-Pacific's role as a leader in agricultural innovation. These developments, combined with targeted market expansion, position Asia-Pacific as a key participant in the worldwide initiative for efficient, sustainable, and adaptable farming methods.

Europe Agricultural Adjuvant Market Analysis

Europe offers a strategic advantage for adopting advanced agricultural solutions due to its progressive regulatory framework, strong emphasis on sustainable farming, and access to cutting-edge research facilities. Countries like Germany, France, and the Netherlands are at the forefront of agricultural advancements, focusing on improving crop yields and reducing environmental impacts. The European Union's Common Agricultural Policy (CAP) provides funding and guidance for innovation, promoting precision farming and environmentally friendly practices. For instance, European countries such as France, Spain, and Italy demonstrate significant pesticide use per hectare, averaging 3.6 to 6.1 kg, highlighting the region's reliance on crop protection. This provides a robust market opportunity for agricultural adjuvants to enhance pesticide efficacy and promote sustainable farming practices. Additionally, Europe's diverse climatic zones enable testing and optimizing agricultural products for a wide range of conditions, from the Mediterranean climate in Spain to the temperate zones in Northern Europe. Strong collaborations between academic institutions, research organizations, and private companies drive innovation, as seen in initiatives like Horizon Europe. These factors, coupled with high consumer demand for sustainable and high-quality produce, position Europe as a leading region for integrating advanced agricultural technologies and solutions into modern farming practices.

Latin America Agricultural Adjuvant Market Analysis

Latin America holds a strategic position for agricultural advancements due to its diverse climates, extensive arable land, and strong export-oriented farming practices. Countries like Brazil and Argentina lead in crop production, benefiting from advanced agrochemical technologies that optimize yields. Favorable government policies supporting sustainable agriculture and increasing investments in modern farming techniques further enhance the region's potential. Latin America's robust agricultural export market, particularly in soybeans, sugarcane, and coffee, drives the demand for innovative solutions to improve productivity and environmental sustainability. For example, precision farming in Brazil and integrated pest management in Argentina showcase the region's proactive approach to modern agriculture.

Middle East and Africa Agricultural Adjuvant Market Analysis

The Middle East and Africa region offers a strategic advantage for agricultural advancements due to its diverse climatic conditions and growing focus on sustainable farming practices. Countries like South Africa and Egypt are expanding their agricultural outputs with innovative solutions to combat drought and pest infestations. For instance, in 2022, Saudi Arabia achieved a 124% self-sufficiency ratio in dates and 118% in dairy products. The adoption of agricultural adjuvants can further enhance crop yields and quality, contributing to increased self-sufficiency and reduced reliance on imports. The region's vast arid and semi-arid lands, coupled with increasing government initiatives to enhance crop yield, make it ideal for advanced agricultural technologies. For instance, Kenya's thriving horticulture and Morocco's progressive agronomic practices underscore the region's potential. Additionally, access to emerging markets and expanding infrastructure supports the integration of novel farming techniques across the region.

Competitive Landscape:

The leading players in the agricultural adjuvant market are focusing on strategic moves to strengthen their market position and meet the increasing demand for effective crop protection solutions. Major companies such as BASF SE, Bayer CropScience, Corteva Agriscience, and Syngenta are investing heavily in R&D to produce innovative adjuvant formulations that enhance pesticide efficacy, minimize environmental impact, and maximize crop yields. They are engaging in partnerships and collaborations to expand their product portfolio and increase market reach. Major players are also engaging in the development of biodegradable, eco-friendly adjuvants to meet sustainability goals and strict regulations. Increasing consumer demand for eco-friendly products is boosting this trend. Capacity expansions, M&A activity have also become common as companies seek to extend and strengthen their distribution chains.

The report provides a comprehensive analysis of the competitive landscape in the agricultural adjuvant market with detailed profiles of all major companies, including

- Akzo Nobel N.V.

- Croda International PLC

- Corteva Agriscience

- Evonik Industries Ag

- Solvay SA

- Huntsman International LLC.

- Nufarm Limited

- Helena Agri-Enterprises, LLC

- Wilbur-Ellis Holdings, Inc.

- Brandt Consolidated, Inc.

Latest News and Developments:

- May 2024: BASF introduced the Agnique BioHance adjuvant line to boost the performance of biological pesticides. These adjuvants enhance adhesion and spreading, improving pesticide efficacy. Trial results demonstrated effectiveness against key plant pathogens. Targeted diseases include downy mildew, powdery mildew, and late blight. This launch highlights BASF's focus on innovative agricultural solutions.

- January 2024: GreenLight Biosciences achieved U.S. EPA registration for its Calantha bioinsecticide. This product targets the damaging Colorado potato beetle, addressing a significant agricultural challenge. Calantha offers an eco-friendly alternative to chemical insecticides. Its development reflects GreenLight's commitment to sustainable farming solutions. The approval marks a milestone in bioinsecticide innovation.

- January 2024: Kwale County Governor Fatuma Achani launched the distribution of subsidized agricultural inputs to local farmers in preparation for the upcoming long rainy season. The initiative provides certified seeds, fertilizers, spray agricultural adjuvants, and agricultural tools to enhance productivity and food security. This program aims to support smallholder farmers, improve yields, and reduce poverty in rural areas.

- July 2023: BPCL launched MAK ADJOL Banana, a new adjuvant designed to enhance the effectiveness of fungicides used in banana cultivation in Tamil Nadu. Developed in collaboration with the National Research Centre for Banana (NRCB), this product improves fungicide penetration, spreading, and reduces evaporation. It is biodegradable, eco-friendly, and safe for use, addressing issues like leaf-spot disease in banana farming.

Agricultural Adjuvant Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Activator adjuvant, Utility adjuvant |

| Crop Types Covered | Cereals & Oilseeds, Fruits & Vegetables, Others |

| Applications Covered | Herbicides, Fungicides, Insecticides, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Akzo Nobel N.V., Croda International PLC, Corteva Agriscience, Evonik Industries Ag, Solvay SA, Huntsman International LLC, Nufarm Limited, Helena Agri-Enterprises, LLC, Wilbur-Ellis Holdings, Inc., and Brandt Consolidated, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agricultural adjuvant market from 2019-2033.

- The agricultural adjuvant market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agricultural adjuvant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Agricultural adjuvant is a substance added to agrochemicals, such as herbicides, pesticides, or fertilizers, to enhance their effectiveness. Adjuvants improve properties like spray coverage, adhesion, and absorption, making the chemicals more efficient, reducing waste, and increasing crop protection or yield in various agricultural applications.

The agricultural adjuvant market was valued at USD 4.0 Billion in 2024.

IMARC estimates the global agricultural adjuvant market to exhibit a CAGR of 5.14% during 2025-2033.

The global agricultural adjuvant market is driven by the growing demand for sustainable and efficient crop protection solutions, increased adoption of precision agriculture and integrated pest management (IPM) practices, rising prevalence of resistant pests, weeds, and diseases.

According to the report, activator adjuvant represented the largest segment by type, driven by their ability to enhance the efficacy, absorption, and performance of agrochemicals, leading to improved crop protection and higher yields.

Herbicides lead the market by application due to the high demand for effective weed control, which significantly impacts crop yield and quality.

Cereals and oilseeds lead the market by crop type due to their extensive cultivation, high global demand for food and biofuels, and the need for enhanced crop protection to maximize yield and quality.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global agricultural adjuvant market include Akzo Nobel N.V., Croda International PLC, Corteva Agriscience, Evonik Industries Ag, Solvay SA, Huntsman International LLC, Nufarm Limited, Helena Agri-Enterprises, LLC, Wilbur-Ellis Holdings, Inc., and Brandt Consolidated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)