Agricultural Tires Market Size, Share, Trends and Forecast by Product, Application, Distribution, and Region 2025-2033

Agricultural Tires Market Size and Share:

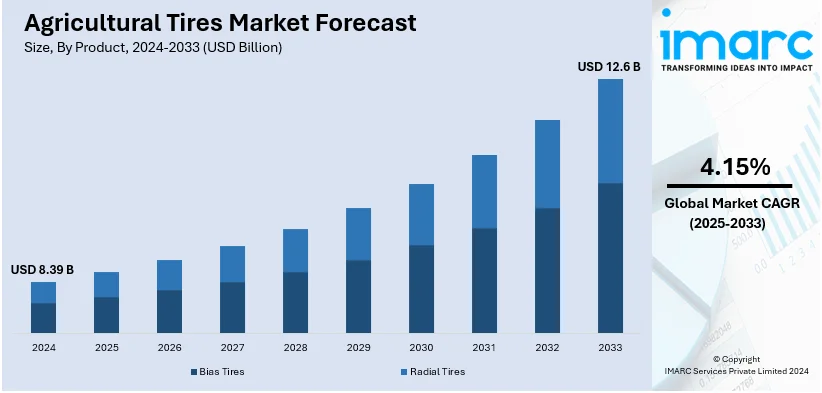

The global agricultural tires market size was valued at USD 8.39 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.6 Billion by 2033, exhibiting a CAGR of 4.15% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.1% in 2024. The rising food demand, the emerging technological advancements in tire technology, and the implementation of favorable government policies to promote modernization and mechanization in the agriculture sector are some of the major factors propelling the market across the North American region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.39 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Market Growth Rate (2025-2033) | 4.15% |

One of the primary drivers in the global agricultural tires market are the increase in demand for mechanized farming to enhance agricultural productivity and efficiency. Additionally, with the escalating population worldwide, there is increased pressure on crop yields, which, in turn, compels farmers to adopt more advanced agricultural equipment fitted with specialized tires. Moreover, the efforts and subsidies of the government aimed at encouraging the use of new and modern agricultural equipment boosts growth in the market. In line with this, the introduction of radial and low-pressure tires has improved durability, traction, and fuel efficiency in tires, thus attracting more customers. Moreover, expansion in precision farming and sustainable agricultural practices also fuels demand for specialized tires designed to minimize soil compaction and maximize field performance. According to the IMARC Group, the global precision agriculture market has reached USD 9.3 Billion in 2024 and is exhibiting a CAGR of 9.66% during 2025-2033.

The United States has emerged as a key regional market for agricultural tires. The growing use of advanced agricultural machinery for better productivity and meeting the high demand for food in the United States drives the agricultural tires market. The growth in the practice of large-scale and precision farming has increased demand for high-performance tires with superior traction, durability, and fuel efficiency. Government schemes and subsidies for mechanized farming and sustainable agriculture accelerate the growth of the market. In addition, the increasing application of low-compaction and radial tires reduces soil degradation, which is an important factor in maintaining long-term agricultural productivity. The requirement for efficient machinery in different terrains and varied climatic conditions in the United States also contributes to the increasing demand for specialized agricultural tires.

Agricultural Tires Market Trends:

Rising food demand and low availability of skilled labor

The growing population, inflating disposable incomes, and elevating standards of living have resulted in the increasing food demand. As a result, farmers are using tractors and other heavy machinery to meet the rising demand of consumers which is positively influencing the agricultural tires market growth. According to FAO, the projections show that feeding a world population of 9.1 Billion people in 2050 would require raising overall food production by some 70 percent between 2005/07 and 2050. Besides this, declining per hectare area of arable land and low availability of skilled labor are also bolstering the adoption of agricultural machinery for efficient farming operations. Moreover, with rapid urbanization, urban areas offer a plethora of job opportunities, enticing rural households to migrate. This shift has resulted in a shortage of farm labor in various regions. For instance, according to a survey by the Centre for Monitoring Indian Economy (CMIE), India witnessed a drop in the number of people employed in agriculture from 158.2 Million in 2022 to 147.9 Million in 2023. Looking ahead, the Indian Council of Food and Agriculture anticipates a 25.7% decline in the percentage of agriculture workers in India by 2050. This reliance, in turn, is resulting in an increasing cost of farm labor, prompting farmers to increasingly turn to efficient agricultural tires and machines.

Emerging technological advancements in tire industry

The ongoing developments in tire technology are improving the efficiency, productivity, and sustainability of agricultural operations. In addition to this, the integration of precision farming technologies that allow for real-time monitoring of tire pressure and tread wear, optimizing tire performance and extending their lifespan, eventually reducing the operational costs and minimizing soil compaction, leading to improved crop yields, is significantly contributing to the market growth. Various key manufacturers are offering technologically advanced tires to increase crop production and enhance its quality. For instance, CEAT Specialty, a tire manufacturer company in India, offers sprayer tires – SPRAYMAX, which are designed for larger self-propelled sprayers and are engineered to carry 40% more load than a standard radial. Moreover, it has rounded shoulders to minimize soil and crop damage. In addition to this, a portfolio of next-generation agricultural tires called the Virat range was launched in May 2022, by Apollo Tires in India. These tires are stated to have "industry-best traction" and feature a unique design to deliver a high level of performance to vehicles used within the agricultural and haulage sectors. Such innovations are anticipated to positively impact the agricultural tires market outlook.

Implementation of favorable government policies

Government authorities of various nations are taking initiatives and implementing policies to support and sustain the agricultural sector. In addition to this, the introduction of several policies, including subsidies, tax incentives, and grants to incentivize agricultural activities and alleviate financial burdens on farmers is augmenting the market growth. For instance, the Indian government implemented the 'Macro-Management Scheme of Agriculture,' which provides a 25% subsidy on tractors up to 35 PTO HP. At the same time, the Canadian government introduced the 'Canadian Agricultural Loans Act,' which offers farmers a loan of up to USD 500,000 while purchasing land or a tractor. In line with this, concerned regulatory authorities are also focusing on training programs for machinery operators. For instance, in March 2022, the Government of Canada made an investment of over USD 860,000 in six businesses under the Innovative Solutions Canada (ISC) program. The initiative offers innovators the opportunity to develop their novel solutions, products, and technologies to address challenges in the agriculture sector, resulting in a more prosperous and competitive sector. Such initiatives are projected to propel the agricultural tires market share in the coming years.

Agricultural Tires Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agricultural tires market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and distribution.

Analysis by Product:

- Bias Tires

- Radial Tires

Bias tires stand as the largest component in 2024, holding around 57.6% of the market. Bias tires are known for their robust construction and durability and are specifically designed to withstand the rugged terrain and harsh conditions commonly encountered in agriculture. Their sturdy build ensures a longer lifespan compared to other tire types, reducing the need for frequent replacements and ultimately saving farmers time and money. Moreover, ongoing advancements in bias tires are creating a positive outlook for the overall market. For instance, in March 2024, Bridgestone Americas (Bridgestone) introduced an improved Regency Plus bias tire portfolio for Firestone Ag. With extensive, cost-effective options for a variety of applications, including fronts and implements, plus solutions for utility, light construction, and lawn and garden equipment, the Regency Plus bias tire will help farmers enhance their crop yield.

Analysis by Application:

- Tractors

- Harvesters

- Forestry

- Irrigation

- Trailers

- Others

Tractors lead the market with around 32.2% of market share in 2024. Tractors are the workhorses of modern agriculture, indispensable for various farming activities such as plowing, tilling, planting, and harvesting. They are versatile machines capable of performing various tasks. Both small-scale and large-scale farmers rely heavily on tractors to improve efficiency and productivity on their farms. As a result, various manufacturers are increasingly launching tractors with advanced tire technologies. For instance, in October 2023, International Tractors Limited (ITL) launched three new series of Solis tractors for the global market. This includes a new SV Solis electric tractor that can be charged from 0-100% in 3-3.5 hours. The new launches are spread across the N series, designed for narrow farm use such as orchards and vineyards, C series with Stage-V series engine designed for robustness, S series with powerful 10hp-125hp outputs for tougher farm applications, SV series as zero-emission solutions and H series with Hydrostatic Automatic Transmission (HAT) for more comfort and ease of use.

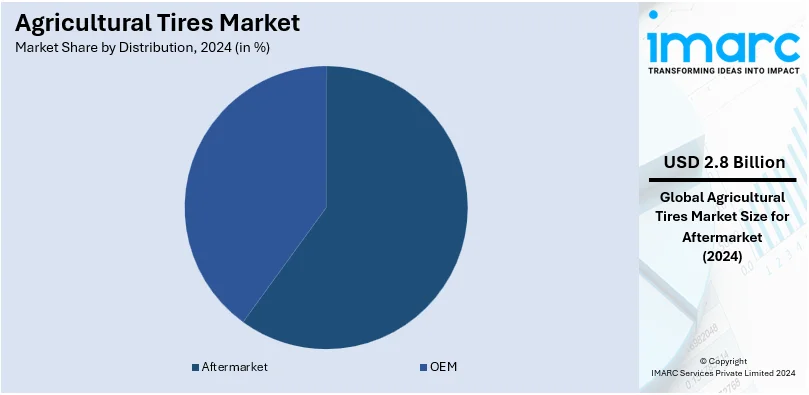

Analysis by Distribution:

- OEM

- Aftermarket

Aftermarket leads the market with around 32.8% of market share in 2024. The rising demand for the replacement of tires by farmers on account of the expansion of agricultural activities across the globe is augmenting the growth of the aftermarket segment. In addition, aftermarket tires can be tailored to suit various agricultural applications, be it for tractors, harvesters, or other specialized machinery. This customization resonates with customers seeking durability and performance tailored to their unique operational requirements.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.1%. The North America region is driven by the availability of fertile soils and an expansive agricultural sector. Moreover, a robust economy supports investments in the agricultural sector, leading to increased demand for equipment and tires in the region. In addition to this, elevated farm consolidation and greater government support through subsidies are driving sales of high-capacity agricultural machinery and equipment. According to the Association of Equipment Manufacturers (AEM), the total number of tractors and combines sold in 2021 in North America was 360,000 units. That year, there was a sales increase of over 10% in nearly every segment of agricultural tractors and combines in the United States and Canada. Furthermore, the US-based agricultural machinery giant John Deere began enhancing the AI-based innovation process in tractors by acquiring an AI start-up, Blue River Technology. Such innovations are expected to drive the demand for technologically advanced tractors in the long term.

Key Regional Takeaways:

United States Agricultural Tires Market Analysis

In 2024, the United States accounts for around 87.64% of the agricultural tires market in North America. The agricultural tire market in the United States is driven by the need for specialized solutions that enhance efficiency, productivity, and sustainability in farming across the country's diverse agricultural landscapes. The USDFA estimates, that more than 127 million acres of agricultural land in the Midwest are used to plant crops such as corn and soybeans. Mobility-enhancing tires that also protect the soil are essential for large-scale farming operations in this region. In the southern states, agricultural tires are a necessity to ensure stability on sandy soils, particularly in citrus farming where the soil conditions are challenging. For instance, companies like Trelleborg Tires have taken notice and responded to the demand by enhancing production by 20% at the company's Spartanburg, South Carolina location. Increased support for US farmers enhances their ability to offer reliable and efficient solutions to increase productivity, efficiency, and cost savings associated with increased equipment lifespan and enhanced fuel efficiency. Agricultural tires represent an essential component in promoting long-term sustainability of agriculture within the US.

Asia Pacific Agricultural Tires Market Analysis

Agricultural tires are significantly benefiting the Asia Pacific region, where agriculture is the primary driver for economies like India, China, and Indonesia. They help offer efficiency in crop growing across all terrains, from the fertile Indo-Gangetic Plains to the rugged lands of Vietnam. Thailand and the Philippines are experiencing better traction and soil protection, especially for rice paddies and sugarcane fields. For example, Thailand's agriculture sector, accounting for 12% of GDP and employing 40% of the population, covers 22 Million hectares, of which 70% is used for crop farming, such as rice and rubber. Such intensive land utilization reflects the growing need for long-lasting agricultural tires for mechanized farming on varied landscapes. Agricultural tires are also crucial for the mechanized farming activities that take place in Australia's large wheat belts and in Japan's precision farming schemes. This diversified region's climate and terrain, ranging from the tropical zones to temperate areas, needs strong and versatile tires. Agricultural tires thus contribute to higher productivity as they ensure smoother operations, meeting the rising food demand in densely populated countries in the Asia Pacific.

Europe Agricultural Tires Market Analysis

The European agriculture tire market is boosted by the robust and growing agricultural industry, estimated to have gross value added at around USD 238.14 Billion in 2023 and contributes 1.3% to the EU's GDP, according to the European Commission. Such significant economic contribution portrays agriculture as being a crucial sector for the region, thereby giving rise to a demand for speciality tires that help increase the operational efficiency and productivity of farms. This contributes to the development of numerous different farming activities and diverse soil ranges, such as arable farming, livestock, and horticulture. The tires, in turn, enhance traction, reduce soil compaction, and increase the life cycles of farm equipment. As this country remains focused on sustainable farming approaches, the need for green tires that contribute to higher efficiency through good performance on various types of soils keeps growing. Such factors are contributing to the growth of the agriculture tire market in Europe, contributing to the overall agricultural productivity in the region.

Latin America Agricultural Tires Market Analysis

The agricultural tire market in Latin America is encouraged by the region's large agricultural sector that accounts for between 5% and 18% of the regional GDP. This economic weight powers the demand for specially engineered agricultural tires to ensure high efficiency, productivity, and sustainability in farming operations. With vast agricultural landscapes spanning Millions Square Kilometers, there is a need for countries in Latin America to ensure their tires provide superior traction across terrains, reduce soil compaction, and support heavy machinery use. Agricultural tires are essential for boosting equipment performance, extending equipment life, and improving fuel efficiency—three factors that would determine high-yield farming operations. In the face of agriculture's continued importance as an economic driver for Latin America, the call for reliable and efficient agricultural tire solutions is expected to drive the demand further, ultimately supporting the region's agriculture productivity and long-term sustainability.

Middle East and Africa Agricultural Tires Market Analysis

The agriculture tire market in the Middle East and Africa (MEA) is experiencing growth, driven by the region's increasing agricultural production and the push for food self-sufficiency. According to the Food and Agriculture Organization Corporate Statistical Database (FAOSTAT), cereal production in Morocco grew from 3.3 Million Metric Tons in 2020 to more than 3.5 Million Metric Tons in 2023. Similarly, North Africa saw significant growth in the production of fruits and vegetables, with over 34.9 Million Metric Tons of vegetables and fruits produced in 2023. This rise in agricultural output is spurring demand for agricultural tires to improve efficiency and productivity.

In Egypt, the government has launched a food and agriculture project worth USD 3.3 Billion in 2022, aimed at increasing production output. Additionally, initiatives such as the South Valley Development Project (Toshka), the Egyptian Rural Development Project, and the North and Central Sinai Development Project are expected to boost fruit and vegetable production, further driving the agricultural sector in the country. These efforts are projected to contribute to a growing demand for agricultural tires, which play a crucial role in enhancing equipment performance, reducing soil compaction, and improving fuel efficiency. As food production continues to rise in the MENA region, the demand for reliable and efficient agricultural tire solutions is set to grow, supporting the long-term sustainability and productivity of the agricultural sector.

Competitive Landscape:

Key players in the global agricultural tires market are engaged in various strategies to increase their market position and address the growing demand for efficient farming solutions. The key strategy that is continuously implemented by most of the players in this market is the development of advanced tire technology, including the invention of radial tires, low-pressure tires, and environment-friendly tires, which can enhance durability, fuel efficiency, and minimize soil compaction. Leading manufacturers are also investing in R&D for better tire performance in various terrains and weather conditions-to answer the concerns of modern farmers. Collaboration with equipment manufacturers and distributors and ensuring a seamless supply chain also increase market reach. The players are also providing service value-added solutions such as tire monitoring systems and custom fitment specifically for particular agricultural machinery.

The report provides a comprehensive analysis of the competitive landscape in the agricultural tires market with detailed profiles of all major companies, including:

- Apollo Tyres Limited

- Balkrishna Industries Limited (BKT)

- Bridgestone Corporation

- CEAT Ltd. (RPG Group)

- Continental AG

- JK Tyre & Industries Ltd.

- MRF Limited

- Specialty Tires of America Inc.

- Sumitomo Rubber Industries Ltd.

- TBC Corporation (Michelin)

- The Carlstar Group LLC

- Titan International Inc.

- Trelleborg AB

- Yokohama Off-Highway Tires America Inc. (Yokohama Rubber Company)

Latest News and Developments:

- November 2024, Bridgestone Americas expanded its Firestone Ag tire range with new tractor and trailer lines tailored for modern agricultural needs. These offerings focus on enhanced stability, fuel efficiency, and soil conservation. The tires are crafted using advanced compounds to ensure longevity and consistent performance in tough terrains.

- June 2024, TVS Srichakra launched a new range of steel-belted radial agro industrial tires. Designed to enhance durability and performance, these tires cater to modern farming machinery demands. The product targets efficiency in agricultural operations with advanced traction and wear resistance. TVS aims to strengthen its agro-industrial presence through this innovation, particularly in India.

- April 2024: Hercules Tire and Rubber Company (HTR), a subsidiary of American Tire Distributors (ATD), introduced the all-new AG-TRAC F-2, a robust tire designed for optimal performance on multiple farm surfaces. This tire is offered in two key 16″ sizes for 2WD Front Tractor wheel positions, providing the flotation, durability, and steering response needed for smooth operation in various agricultural settings.

- March 2024: Bridgestone Americas (Bridgestone) introduced an improved Regency Plus bias tire portfolio for Firestone Ag. With extensive, cost-effective options for a variety of applications, including fronts and implements, plus solutions for utility, light construction, and lawn and garden equipment, the Regency Plus bias tire will help farmers enhance their crop yield.

Agricultural Tires Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bias Tires, Radial Tires |

| Applications Covered | Tractors, Harvesters, Forestry, Irrigation, Trailers, Others |

| Distributions Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apollo Tyres Limited, Balkrishna Industries Limited (BKT), Bridgestone Corporation, CEAT Ltd. (RPG Group), Continental AG, JK Tyre & Industries Ltd., MRF Limited, Specialty Tires of America Inc., Sumitomo Rubber Industries Ltd., TBC Corporation (Michelin), The Carlstar Group LLC, Titan International Inc., Trelleborg AB, Yokohama Off-Highway Tires America Inc. (Yokohama Rubber Company), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agricultural tires market from 2019-2033.

- The agricultural tires market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agricultural tires industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An agricultural tire is a specialized tire designed for use in farming equipment, such as tractors, harvesters, and sprayers, providing optimal traction, durability, and stability on various terrains, including soil, mud, and fields, while minimizing soil compaction to enhance productivity and efficiency in agricultural operations.

The agricultural tires market was valued at USD 8.39 Billion in 2024.

IMARC estimates the global agricultural tires market to exhibit a CAGR of 4.15% during 2025-2033.

Some of the key factors driving the market are the increasing adoption of mechanized farming, advancements in tire technology, growing demand for precision and sustainable farming, government support and subsidies for modern agriculture, and the expansion of large-scale farming operations worldwide.

According to the report, bias tires represented the largest segment by product, driven by their robust construction, affordability, and superior load-carrying capacity, making them ideal for heavy-duty agricultural applications on uneven terrains.

Tractors lead the market by application due to their essential role in performing a wide range of farming tasks, such as plowing, planting, and hauling, which drives consistent demand for high-performance tires.

Aftermarket represents the largest segment due to the continuous need for tire replacements, maintenance, and upgrades to existing agricultural machinery, driven by wear and tear, as well as the desire for improved performance and durability.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global agricultural tires market include Apollo Tyres Limited, Balkrishna Industries Limited (BKT), Bridgestone Corporation, CEAT Ltd. (RPG Group), Continental AG, JK Tyre & Industries Ltd., MRF Limited, Specialty Tires of America Inc., Sumitomo Rubber Industries Ltd., TBC Corporation (Michelin), The Carlstar Group LLC, Titan International Inc., Trelleborg AB, Yokohama Off-Highway Tires America Inc. (Yokohama Rubber Company), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)