Alcoholic Beverages Market Size, Share, Trends and Forecast by Category, Alcoholic Content, Flavor, Packaging Type, Distribution Channel, and Region, 2026-2034

Alcoholic Beverages Market Size and Share:

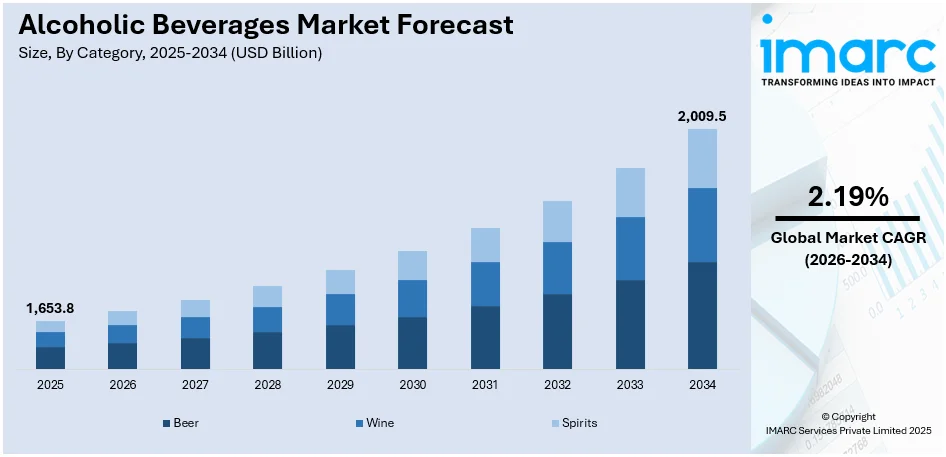

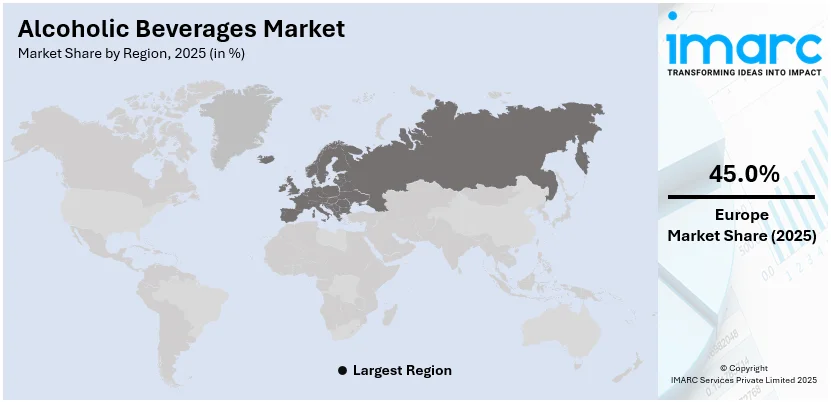

The global alcoholic beverages market size was valued at USD 1,653.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2,009.5 Billion by 2034, exhibiting a CAGR of 2.19% from 2026-2034. Europe currently dominates the market, holding a market share of over 45.0% in 2025. The market is fueled by robust cultural norms of alcohol use, established production facilities, high per capita consumption, and stable demand for high-end wines, beers, and spirits through both on-trade and off-trade.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,653.8 Billion |

|

Market Forecast in 2034

|

USD 2,009.5 Billion |

| Market Growth Rate 2026-2034 | 2.19% |

The global alcoholic drinks market is strongly influenced by growing consumer demand for premium and craft products. As incomes increase, especially in emerging economies, there is a strong trend toward drinks that provide unique taste, authenticity, and craftsmanship. Consumers are putting more emphasis on the factors of origin, production method, and ingredient openness. This trend is most evident among Gen Z and millennial consumers, who prefer special and curated experience over mass-produced options. Regionally made wines, small-batch spirits, and craft beers are becoming more popular across markets because they're perceived as having higher quality and being exclusive. Additionally, the global scope of digital technology and travel has made consumers exposed to a greater variety of drinks, driving cross-border demand faster. Moreover, the increased demand for premium and craft products continues to have a central position in influencing product innovation, marketing, and consumption trends in the global alcoholic drinks industry. For example, in March of 2023, Powers rolled out the first-ever 100% Irish rye whiskey utilizing exclusively rye sourced from County Wexford and aged across different American oak barrels, making a one-of-a-kind break through in the Irish whiskey process.

To get more information on this market Request Sample

The United States represented about 85.00% of the alcoholic beverages market share in 2024, fueled in by growth of on-premises consumption through entertainment spots, restaurants, and bars. Social drinking is a permanent part of American society, with booze widely consumed on special occasions, while dining, and recreation. The growth of cocktail culture and mixology also has continued to fuel interest in a wide range of spirits, increasing consumer participation and experimentation with brands. For instance, in August 2024, Beyoncé collaborated with Moët Hennessy to introduce SirDavis Whisky, a 44% ABV American rye (51% rye, 49% malted barley), matured in oak and sherry casks, with award-winning pre-launch acclaim. Furthermore, experiential sites like themed bars, rooftop lounges, and gastropubs have provided opportunities for high-end product exploration, fueling trends towards quality and diversity. Major events, sports venues, and music festivals are driving uniform volume growth, with social media and digital platforms boosting the visibility and popularity of alcohol across lifestyle settings. Strong on-trade presence continues to drive consumption patterns and underpin the United States as the key generator of global alcoholic beverages market growth.

Alcoholic Beverages Market Trends:

Changing Consumers Preferences

The global alcoholic drinks market has seen a dramatic change in consumer behavior towards premium and craft drinks. Consumers are looking for distinctive and high-quality alcoholic drinks because of the need for new taste experiences and authenticity. As a study shows, 52% of consumers want premium beverages to be prepared with high-quality ingredients, 33% want distinctive experience venues such as signature serves, and 31% are attracted to products that create a lot of buzz. This trend has given birth to microbreweries, craft distilleries, and boutique wineries, targeting advanced consumers. For instance, in May 2024, Goose Island Beer Co. opened the highly awaited brewpub on the Salt Shed entertainment complex, right across the river from its eponymous island. The new brewpub would have indoor and outdoor seating, a new menu, and a frequently changing beer list. Furthermore, consumers are more open to trying new and innovative alcoholic beverages, which leads to experimentation with flavor, ingredients, and brewing/distillation processes. For instance, in December 2023, the Coca-Cola Company launched a line of ready-to-serve "flavored wine cocktails" under its CSD and Minute Maid juice brands. Minute Maid Spiked would be available in three flavors: piña colada, strawberry daiquiri, and lime margarita. Also in December of 2023, Doritos partnered with beverage firm Empirical to create liquor that tastes like nacho cheese. The beverage is distilled from Belgian saison yeast and malted barley, which has a peppery, spicy flavor. The essence of the actual nacho-flavored Doritos was preserved by vacuum distillation and contributes flavors of corn tostada, umami, and acidity. These dimensions are driving alcoholic beverages market share.

Increasing Disposable Incomes

The expansion of the global alcoholic beverages market is closely associated with the increasing disposable income of consumers, especially in emerging markets. As people and families become better off, they tend to invest some of their income in discretionary spending, such as indulging in alcoholic drinks. For example, in 2021, EU consumers spent over EUR 1.035 Billion (equivalent to 7.1% of overall EU GDP) on alcoholic beverages and non-alcoholic beverages that make up almost 14.3% of overall household spending. Apart from this, with increased disposable incomes, consumers can be more inclined to pay for the convenience of buying alcoholic drinks online or through delivery services. Online shopping websites provide a broad range of products, such as high-end and specialty products, to suit the tastes of high-income consumers. For example, in October 2023, SNDL Inc. introduced a new online shopping website for Wine and Beyond, its destination liquor store brand. The website aimed to enhance accessibility and reach for the banner's wide product assortment, which comprises rare spirits, local and international breweries, and distinctive wines. These are also positively impacting the alcoholic drinks market outlook.

Rapid Product Premiumization

With increased disposable incomes across the world, consumers are ready to spend more on items that are believed to be superior quality, distinctive, or exclusive. Premium alcoholic drinks meet these demands by providing better taste, quality, and brand recognition. For example, the Distilled Spirits Council of the United States estimated that in 2021, 21.7 million 9-liter packs of premium whiskey and 21.1 million 9-liter packs of premium vodka were consumed. In addition to this, super-premium vodka and whiskey grew by 14.1% and 13.9% year-on-year, respectively. Aside from this, exotic flavors draw value-conscious customers who are willing to experiment with something new and play games with taste and dining experiences. With exotic flavors, alcohol drink corporations can capitalize on these experimental customers and secure the consumer's attention through premium drinking experience. For instance, in March 2022, United Kingdom premium gin brand Whitley Neill released a new type of gin called Oriental Spiced Gin. This Oriental Spiced Gin incorporates a range of botanicals and spices such as coriander, ginger, pepper, cumin, saffron, star anise, and grains of paradise. Similarly, in April 2024, global luxury collective D'YAVOL released D'YAVOL VORTEX, a global blended Scotch whisky. VORTEX features a wide and advanced palate which gets the rich malt flavors, sherried sweetness, and subtle peat to an ideal level. Blended by marrying fantastic single malt and single grain Scotch whiskies. These factors are complementing alcoholic beverages market revenues.

Alcoholic Beverages Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global alcoholic beverages market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on category, alcoholic content, flavor, packaging type, and distribution channel.

Analysis by Category:

- Beer

- Wine

- Still Light Wine

- Sparkling Wine

- Spirits

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

Beer stands as the largest component in 2025, holding around 43.6% of the market. As per the alcoholic drink market forecast, the growing demand for beer due to a number of important reasons, such as shifting consumer tastes and an enhancing demand for variety and unusual flavor profiles. In addition to this, the growing trend towards small-batch and craft beers in search of authenticity and quality versus mass-produced alternatives is driving the market growth. Also, the increasing trend of locally brewed and specialty beers is giving a thrust to the market growth. Furthermore, the globalisation of beer brands has increased consumer options, with foreign beers becoming more widely available, thus enhancing the market scope. For example, in December 2023, Medusa Beverages Pvt Ltd, an Indian brewery firm, introduced its new variant, Medusa Air. This latest entry is a beguiling mixture of high-grade imported two-row malted barley and quality-picked hops with a product delivering a succulent brew measuring at 4.5% alcohol.

Analysis by Alcoholic Content:

- High

- Medium

- Low

Bottled cocktails, white spirit, and pre-mixed spirits also register robust growth thanks to premiumization and increased demand for cocktail culture. Consumers look for these products to enjoy strong flavors, brand heritage, and upscale drinking experiences in both retail and hospitality settings.

Medium alcoholic drinks, including wine and fortified wine, continue to enjoy popularity because they are linked to mealtimes, social gatherings, and culture. Organic and biodynamic options are increasingly popular among consumers, with this segment being underpinned by lifestyle and ongoing innovation in packs and flavor profiles.

Low alcohol content drinks, such as beer, cider, and low-ABV mixed drinks, are seeing increasing popularity as consumers demand moderation and wellness. These categories resonate with drinkers who want lighter, sessional choices, particularly for everyday, informal social consumption, and are additionally driven by experimentation in taste and the increased number of alcohol-free versions.

Analysis by Flavor:

- Unflavored

- Flavored

Unflavored alcoholic drinks hold the largest market share of 68.8%. These drinks include traditional spirits, wines, and beers, that hold a strong market position because of their authenticity, heritage value, and broad cultural acceptability. They are popular among purists and connoisseurs who value traditional taste profiles and brand heritage over contemporary changes or additives.

Analysis by Packaging Type:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

Glass bottles are still the most popular packaging form in the alcoholic drinks industry because of their premium appeal, preservation quality, and brand image. They are particularly favored for wines and spirits, where presentation and product integrity are inextricably linked to consumer expectations and pricing strategy.

Tins, which are typically utilized for beer and ready-to-drink cocktails, provide convenience, portability, and faster chilling time. Their lightness and recyclability make them perfect for outdoor activities, everyday consumption, and bulk distribution, leading to increasing usage across both on-trade and off-trade platforms.

Plastic bottles are mainly utilized for economy and travel-oriented packaging, especially in lower-cost spirits and bulk sizes. Though less favored in premium segments, their breakage-resistant design, cost-effectiveness, and light shipping benefit render them appropriate for some retail settings and developing markets.

Others are pouches, kegs, and tetra packs, which serve niche segments and changing consumer demands. These options are gaining popularity for their sustainability, convenience, and appropriateness for certain formats such as boxed wine or event-based dispensing systems.

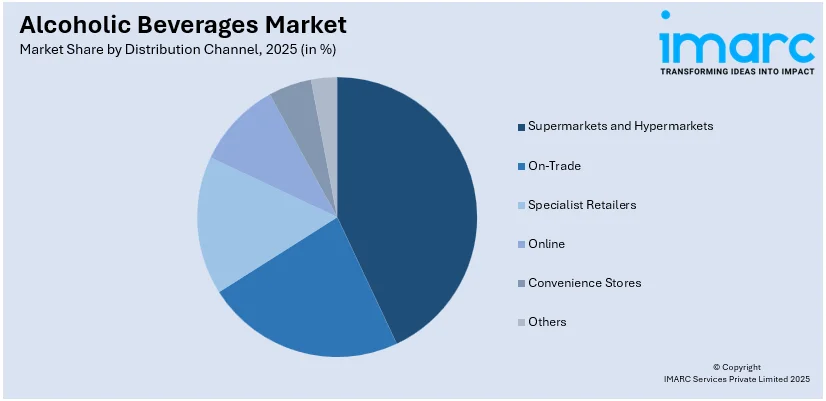

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

Supermarkets and Hypermarkets leads the market with around 42.5% of market share in 2025. The expansion of the supermarkets and hypermarkets segment in the alcohol market is supported by convenience provided by the segment. Retail formats provide customers with one-stop shopping, and it is easy for them to buy alcoholic drinks together with other domestic products. Consistent with this, superstores and hyperstores typically stock a broad range of alcoholic drink products, covering both popular brands and specialty items, to meet the tastes of multiple consumers. Such a broad assortment induces customers to try various alternatives. Further, such store formats tend to use their size and buying power to negotiate better terms with vendors, which can result in competitive alcohol prices, appealing to price-conscious consumers. Moreover, the scope to launch promotions and discounts in these stores can also boost sales further. For example, in May 2024, Ontario publicized to extend its alcohol sales in convenience stores and grocery stores.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2025, Europe accounted for the largest market share of over 45.0%. The rise in the market of alcoholic beverages in Europe is fueled by changing tastes among consumers of alcoholic products favoring premium and craft alcohol drinks. There has been an intensification in seeking high-quality, distinct, or unique alcohol by consumers, fueling the number of local wineries, breweries, and distilleries making such alcoholic beverages. In addition, the economic stability of the region and increasing disposable incomes have fueled expenditure on alcoholic drinks, especially premium and imported brands. Additionally, strict but clearly defined government regulations on the production, distribution, and labeling of alcohol have encouraged consumer confidence and product quality. Moreover, Europe's strong cultural heritage and varied drinking customs make for a dynamic and growing market, with consumers keen to try a vast array of traditional and innovative alcoholic drinks. The European alcoholic drinks market also has sustainability as a concern, with demand rising for locally sourced and eco-friendly products. Accordingly, technology growth in the processes of production and distribution has also improved the industry's efficiency, further increasing growth in the European alcoholic drinks market. For example, in February 2024, the Coca-Cola Company and Pernod Ricard joined forces to launch a new ready-to-drink cocktail: Absolut Vodka and Sprite in Europe. All these factors are further contributing positively to the alcoholic beverages market's recent price.

Key Regional Takeaways:

North America Alcoholic Beverages Market Analysis

The North America alcoholic drinks market has experienced steady growth, fueled by changing consumer tastes and increasing product variety. Premium and craft products in beer, wine, and spirits have experienced a sharp rise in demand, as consumers increasingly focus on quality, flavor innovation, and artisanal character. Younger consumers are gravitating toward lower-alcohol options, driving innovation in ready-to-drink (RTD) cocktails and hard seltzers. Health-focused trends have promoted higher demand for organic, gluten-free, and low-calorie products. Online sales and direct-to-consumer platforms have grown very quickly with the help of more lenient regulations and digital promotion. The U.S. continues to be the leading market, with the support of higher per capita consumption of alcohol and changing lifestyle trends. Canada is witnessing steady expansion, especially in craft breweries and super-premium wine segments. Seasonal and occasion-driven consumption habits remain in control of product launches and marketing strategies. On the whole, the market is led by evolving tastes, premiumization, and innovation by category, format, and retailing channels.

United States Alcoholic Beverages Market Analysis

The United States alcoholic drinks market is mainly driven by evolving consumer tastes for premium and craft spirits, mirroring a rise in interest in distinct flavors and artisanal production processes. This is in line with the development of ready-to-drink (RTD) cocktails, providing convenient solutions for social events, which is driving market growth. Likewise, growing demand for low-alcohol and non-alcoholic variants, driven by health-oriented consumers, is diversifying market offerings. Also, the growth of e-commerce websites and alcohol delivery services offering increased convenience to consumers for a vast number of products is driving the market. The continuous marketing innovations like partnerships with celebrities and social media campaigns are reinforcing brand presence and customer interaction in the market. Moreover, increasing sustainable production methods and green packaging are emerging as key market drivers since environmentally conscious consumers look for responsible brands. The increasing impact of cultural trends like experiential dining and cocktail culture is also driving the growth of the market. Apart from this, rigorous regulatory updates favoring direct-to-consumer selling is also leading to a widened market space.

Europe Alcoholic Beverages Market Analysis

The European alcoholic drinks market is growing as a result of the growing demand for premium spirits and craft beverages, as consumers are looking for high-quality, authentic experiences. Likewise, increased tourism and hospitality leading to higher consumption in bars, restaurants, and upscale establishments is widening the scope of the market. In addition, the growth of e-commerce platforms, enabling consumers to browse various product offerings, is improving market accessibility. The new trends of health awareness driving the demand for low-alcohol and alcohol-free beverages, are fueling innovation and expansion in the sector. Alongside this, increased sustainability, as manufacturers take to green practices and sustainable packaging, is fueling the market expansion. Further, expansion in cultural events, festivals, and regional traditions driving consumption of local wine, beer, and spirits, is supporting the market growth. In addition to this, government assistance in the form of positive regulations and trade policies encourages, is boosting exports and widening the global market for European alcoholic drinks.

Asia Pacific Alcoholic Beverages Market Analysis

The Asia-Pacific region is being led by increasing disposable incomes and urbanization, with customers increasing expenditure on premium and craft beverages. Correspondingly, changing social norms and the growing acceptance of alcohol consumption in emerging economies are propelling the market. India has high growth potential in the beer market, with per capita consumption of 2.15 liters, as per Euromonitor. In addition, the rising trend of international cocktail culture and high-end bars enhancing demand for imported as well as domestically produced spirits is propelling the growth of the market. In addition, ongoing product innovation, e.g., flavored alcoholic beverages and low-alcohol beverages, which meet evolving consumers' tastes, are enhancing market appeal. Besides, strategic collaborative alliances between global players and local manufacturers boost local product innovation, enlarging brand outreach and embracing a wider market coverage within the region.

Latin America Alcoholic Beverages Market Analysis

In Latin America, the alcoholic drinks market is growing, thanks to an emerging middle-class population with growing disposable incomes. Alongside this, strong cultural heritage and lively social festivities that add to the growth in consumption of domestic spirits such as cachaça, pisco, and tequila are promoting market growth. Besides this, widening online platforms and digital marketing is augmenting product visibility and accessibility. In addition, the development of tourism and hospitality sectors, especially in the mainstay locations, underpinning the demand for alcoholic drinks in resorts, restaurants, and bars, is driving market demand.

Middle East and Africa Alcoholic Beverages Market Analysis

The Middle East and African market are witnessing growth driven by growing urbanization and the rise of expatriate communities. In addition, the development of the hospitality and tourism industries, especially in Gulf nations, is driving higher consumption of beverages. Also, growing popularity of social occasions, nightlife venues, and fine dining restaurants is underpinning market demand. The swift launch of new, non-alcoholic drinks that appeal to various consumer tastes is also driving market growth. Besides this, strict regulatory overhauls in some areas are slowly relaxing alcohol sales restrictions, leading to increased market accessibility and the launch of varied product offerings.

Competitive Landscape:

The alcoholic drinks industry is extremely competitive, driven by changing consumer tastes, local consumption habits, and product innovation. Major players have a presence across segments like beer, wine, spirits, and ready-to-drink, continuously investing in marketing, packaging, and flavor diversification to reach broader consumers. The premiumization and low-alcohol trends have heightened competition, with brands diversifying portfolios to feature craft offerings, health-oriented ingredients, and eco-friendly production processes. Market players are also using digital channels and direct-to-consumer routes to amplify interaction and reach new groups. Strategic partnerships with hospitality locations and marketing initiatives through events and festivals add further exposure. Product innovation in the form of canned cocktails and flavored spirits is also contributing to keeping brands current with younger consumers. With both regional and global brands competing through on-trade and off-trade channels, the industry is dynamic, influenced by lifestyle trends, economic considerations, and changing regulatory regimes affecting sales, distribution, and promotion.

The report provides a comprehensive analysis of the competitive landscape in the alcoholic beverages market with detailed profiles of all major companies, including:

- AB InBev

- Asahi Group Holdings Ltd

- Bacardi Limited

- Beijing Yanjing Brewery Co., Ltd.

- Carlsberg Breweries A/S

- Constellation Brands, Inc.

- Diageo PLC

- Heineken N.V.

- Kirin Holdings Company, Limited

- Molson Coors Beverage Company

- Olvi PLC

- Pernod Ricard

- Tsingtao Brewery Co., Ltd.

Latest News and Developments:

- March 2025: Kraft Heinz launches Crystal Light Vodka Refreshers, the brand's foray into the alcohol category. The low-calorie RTD cocktails have 77 calories, 3.8% ABV, and zero sugar and launch in Wild Strawberry and Lemonade varieties to further Crystal Light's place in the alcoholic beverage market.

- February 2025: Diageo is releasing Smirnoff Miami Peach vodka (35% ABV) and a ready-to-drink (RTD) can-flavoured with lemonade (5% ABV).

- February 2025: ABD (Allied Blenders & Distillers) has bought Fullarton Distilleries' portfolio of premium craft spirits business for INR 40 Crore. The transaction comprises award-winning brands such as Woodburns Whisky, Pumori Small Batch Gin, and Segredo Aldeia Rum, adding strength to ABD's position in India's expanding premium liquor market.

- September 2024: Bacardi and Coca-Cola teamed up to release a ready-to-drink (RTD) rum and cola cocktail. To appeal to hectic consumers looking for convenience and taste, the offering takes advantage of Bacardi's rum experience and Coca-Cola's brand strength. The product first launches in key European markets and Mexico in 2025.

- September 2024: Maharaja Drinks entered the UK to bring Indian-made wines, beers, teas, and coffees to the UK market. Emphasizing sustainability, the brand specifically aims at UK-born Indians as well as risk-taking Gen Z and millennials, providing high-end drinks, including non-alcoholic drinks and craft beverages.

Alcoholic Beverages Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Alcoholic Contents Covered | High, Medium, Low |

| Flavors Covered | Unflavored, Flavored |

| Packaging Types Covered | Glass Bottles, Tins, Plastic Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AB InBev, Asahi Group Holdings Ltd, Bacardi Limited, Beijing Yanjing Brewery Co., Ltd., Carlsberg Breweries A/S, Constellation Brands, Inc., Diageo PLC, Heineken N.V., Kirin Holdings Company, Limited, Molson Coors Beverage Company, Olvi PLC, Pernod Ricard, Tsingtao Brewery Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the alcoholic beverages market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global alcoholic beverages market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the alcoholic beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The alcoholic beverages market was valued at USD 1,653.8 Billion in 2025

The alcoholic beverages market is projected to exhibit a CAGR of 2.19% during 2026-2034, reaching a value of USD 2,009.5 Billion by 2034

Major drivers of the alcoholic beverages market are increasing disposable incomes, social acceptance of alcohol consumption, demand for premium and craft products, growth in nightlife and hospitality industries, and product innovation in terms of flavors and packaging to appeal to younger, experimental consumers looking for lifestyle-driven drinking experiences.

Europe currently dominates the alcoholic beverages market, accounting for a share of 45.0%. The market is fueled because of its intensive culture of alcohol consumption, well-established production facilities, high per capita consumption, and demand for superior wines and spirits. The region is also supported by strong distribution chains and healthy tourism and hospitality industries.

Some of the major players in the alcoholic beverages market include AB InBev, Asahi Group Holdings Ltd, Bacardi Limited, Beijing Yanjing Brewery Co., Ltd., Carlsberg Breweries A/S, Constellation Brands, Inc., Diageo PLC, Heineken N.V., Kirin Holdings Company, Limited, Molson Coors Beverage Company, Olvi PLC, Pernod Ricard, Tsingtao Brewery Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)