Alternative Data Market Size, Share, Trends and Forecast by Data Type, End Use Industry, and Region, 2026-2034

Alternative Data Market Size and Share:

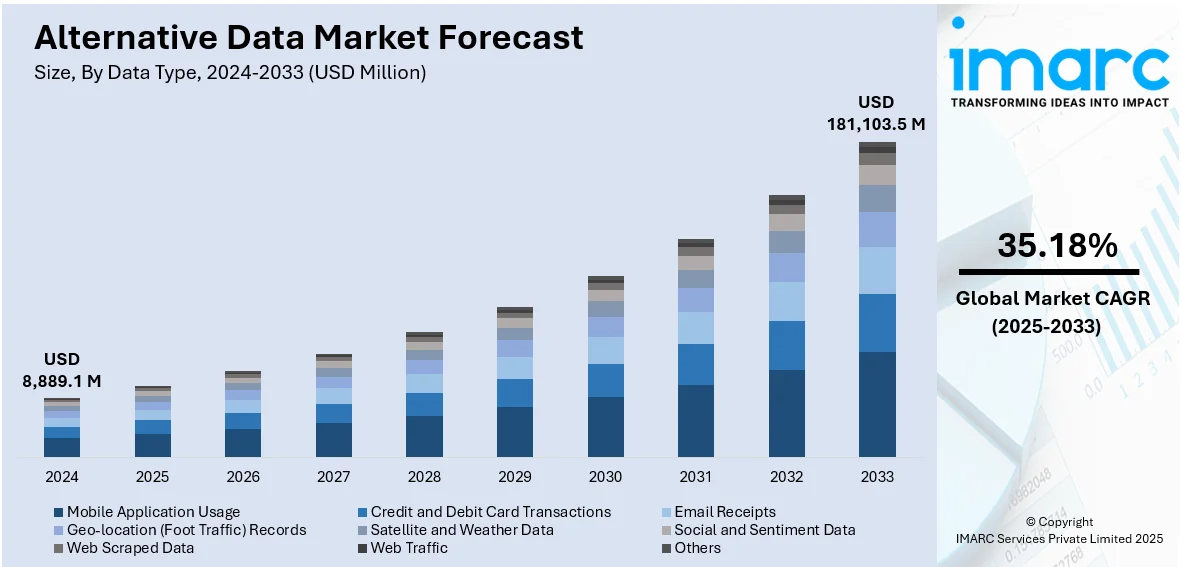

The global alternative data market size reached USD 8,889.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,81,103.5 Million by 2034, exhibiting a growth rate (CAGR) of 35.18% during 2026-2034. North America currently dominates the market, holding a market share of over 68.9% in 2024. The growing reliance of investors and firms on alternative data, increasing advancements in data analytics, artificial intelligence (AI), and machine learning (ML), growing penetration of the internet and mobile technology, better investment approaches, and greater interconnectivity among markets are some of the key drivers boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8,889.1 Million |

| Market Forecast in 2034 | USD 1,81,103.5 Million |

| Market Growth Rate 2026-2034 | 35.18% |

The global alternative data market is growing as demand for actionable insights on investment strategies and business decisions increases. With the integration of artificial intelligence and machine learning technologies, unstructured data can be analyzed and used more effectively in many industries. Furthermore, financial institutions are now implementing more alternative data sources like social media analytics, satellite imagery, and credit card transactions to gain a competitive edge, which further supports the market. Moreover, considerable rise in the amount of data generation from the rapid expansion in e-commerce and digital platforms are fueling growth in the market. According to a research report by IMARC Group, the global e-commerce market size reached USD 26.8 Trillion in 2024. The market is expected to reach USD 214.5 Trillion by 2033, exhibiting a growth rate (CAGR) of 25.83% during 2025-2033. In addition to this, regulatory shifts highlighting transparency and the requirement of real-time information are also making firms adopt alternative data into their activities, propelling the development of the market.

The United States is a standout regional market, predominantly fueled by the increasing demand for granular insights into consumer behavior and market trends in various industries. Retailers and advertisers are increasingly leaning towards alternative data, including mobile app usage and sensor data, to personalize offerings and improve customer engagement. Therefore, this is having a positive impact on the market. The healthcare industry is also embracing alternative data to enhance patient outcomes by using sophisticated predictive analytics. In addition, increased interest in environmental, social, and governance (ESG) factors is causing companies to apply alternative data towards sustainability analysis. Additionally, widespread availability of cloud-based platforms and APIs is reducing data integration and analysis costs and making them easily accessible to small and medium enterprises, further boosting the market's growth.

Alternative Data Market Trends:

Data Proliferation Fueling Market Growth

Digital transformation and the Internet of Things (IoT) are generating unprecedented volumes of diverse data, fundamentally expanding the alternative data market. This deluge includes granular insights from online user interactions, smart device telemetry, and operational sensors. Businesses are leveraging this data to gain real-time visibility into nuanced consumer behaviors, identify emerging market trends, and significantly enhance operational efficiencies. For instance, IoT data from connected machinery enables proactive predictive maintenance, while supply chain sensors provide real-time tracking for optimized logistics. Major enterprises are increasingly adopting edge computing solutions to process this extensive IoT data closer to its source, enabling instantaneous real-time analytics for faster decision-making across various industries.

Rising Competitive Advantage

In today's fast business landscape, a competitive edge is key to sustained growth and profitability. Traditional data sources such as financial statements and market reports are available to all players in the market and thus cannot be differentiated. Alternative data, however, presents unique, high-frequency insights not readily apparent through conventional data streams. These insights range from consumer sentiment gathered through social media monitoring to foot traffic analysis through geolocation data. According to Industry reports, 78% of hedge funds integrate some form of alternative data into their investment strategies in 2022, enabling managers to identify patterns that are not visible in typical data sets, hence enhancing prediction accuracy and market foresight. Hedge funds that incorporate machine learning algorithms into its trading models, typically claim a 20%–30% increase in commodity price forecast accuracy when compared to conventional analysis techniques. Alternative data market companies and financial institutions harness these alternative data points to make informed investment decisions, forecast market trends, and develop strategies that place them a step ahead of their competitors. The potential to turn insights into actionable strategies is significantly amplifying the alternative data market demand.

Significant Technological Advancements

The advent of big data analytics, artificial intelligence (AI), and machine learning (ML) is revolutionizing the way data is collected, analyzed, and interpreted. Over 70% of alternative data providers integrate AI and machine learning (ML) for data processing and analytics, enabling faster and more accurate insights. These technologies can handle large and complex datasets, providing a more nuanced understanding of market dynamics. For instance, machine learning algorithms can sift through millions of social media posts to gauge public sentiment about a particular product, brand, or market trend. Additionally, real-time streaming of alternative data through advanced platforms has increased its adoption, especially in sectors like e-commerce and stock trading. Advanced data analytics tools can then convert this information into actionable insights. As technology continues to advance, the scope for what can be achieved with alternative data is expected to broaden, further propelling the alternative data market growth.

Changing Regulatory Environments

Although the alternative data market is relatively new, regulatory bodies are beginning to understand its potential and are working to provide a legal framework for its use. This is increasing the legitimacy and trustworthiness of alternative data. Leading frameworks that prioritize data privacy include the California Consumer Privacy Act (CCPA) in the US, the General Data Protection Regulation (GDPR) in the EU, and China's Personal Information Protection Law (PIPL), which mandate that businesses secure storage, obtain consent, and anonymize personal data. To stop the misuse of material non-public information (MNPI), financial regulators such as the European Securities and Markets Authority (ESMA) and the U.S. Securities and Exchange Commission (SEC) keep an eye on how alternative data is used in investing strategies. Companies feel more secure investing in alternative data when there is clear regulatory guidance, which in turn drives its adoption rates. According to industrial news, 74% of firms surveyed agreed that alternative data is starting to have a big impact on institutional investing, demonstrating its valuable explanatory power to both quantitative and fundamental investment models. Moreover, as industry standards develop, businesses are better able to gauge the quality and reliability of alternative data sources, thus making it a more integral part of decision-making processes.

Alternative Data Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global keyword market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on data type and end use industry.

Analysis by Data Type:

- Mobile Application Usage

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

Credit and debit cards lead the market with around 17.9% of market share in 2024. Credit and debit card transactions offer high-frequency data that can be analyzed in real-time. This immediacy is important for companies and investors in making quick, informed decisions. Transactional data provides crucial information on consumer spending, preferences, and loyalty to certain brands or services. This information enables businesses to align their marketing campaigns, revise pricing strategies, and design the best products. Financial institutions use transactional data to develop sophisticated risk assessment models, particularly in credit scoring and fraud detection. From expenditure analysis, a bank is able to estimate the creditworthiness of any individual or corporate body. Investors and hedge funds use the same information to determine how sectors or firms are faring. For example, a sudden increase in transactions at a particular retail chain could be an indicator of strong performance, guiding investment decisions.

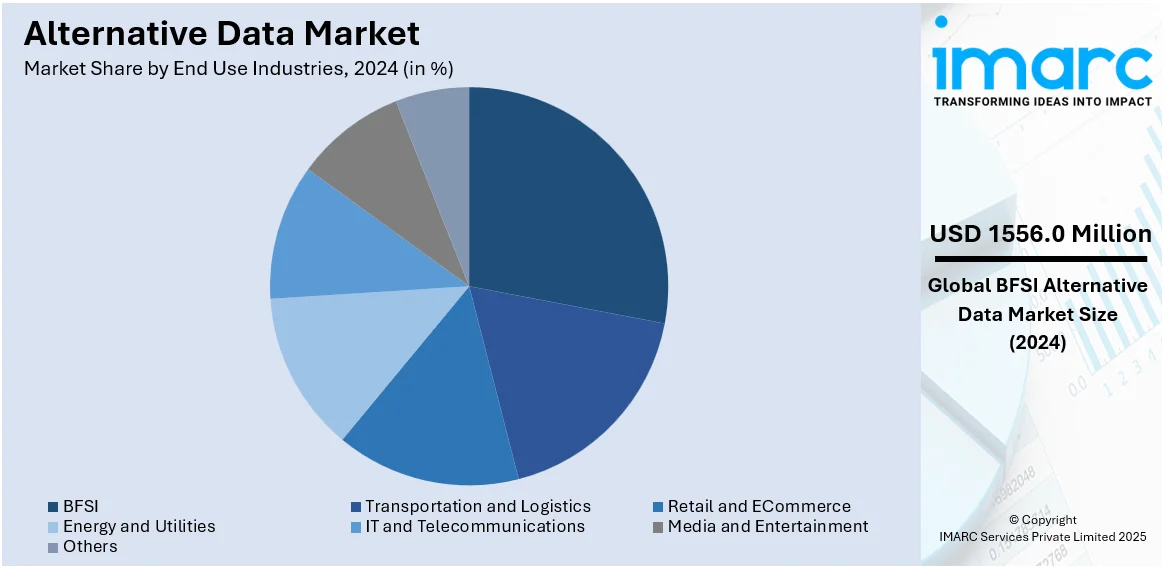

Analysis by End Use Industries:

- Transportation and Logistics

- BFSI

- Retail and ECommerce

- Energy and Utilities

- IT and Telecommunications

- Media and Entertainment

- Others

BFSI leads the market with around 17.5% of market share in 2024. On the basis of the alternative data market research, the banking, financial services, and insurance (BFSI) heavily dependent on alternative data. Alternative data has several applications within the BFSI sector; it uses alternative data for further insight and better decision-making. Traditional credit scores cannot represent an individual's or a business's overall financial stability. Alternative data that can include utility payments, rental history, and even social media activities may provide additional layers of information for more accurate credit risk profiling. Other than this, other alternative sources of data include geolocation data, device IDs, and activity on social media. The algorithms help the financial institution flag activities appropriately, thus strengthening the abilities. Hedge funds and asset managers use alternative data such as social media sentiment, web traffic, and satellite imagery to understand market trends better. This data can be important for making investment decisions that outperform the market. Understanding customer behavior through transactional data, online activity, and other non-traditional data sources enables banks and insurers to offer personalized products, thereby improving customer satisfaction and loyalty.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Russia

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 68.9%. North America is a global leader in technology and data analytics. The region's advanced infrastructure and expertise in artificial intelligence, machine learning, and big data analytics are offering a favorable alternative data market outlook. The region is home to some of the world's most sophisticated financial markets, hedge funds, and investment firms, which are among the primary consumers of alternative data. These institutions utilize alternative data to enhance investment strategies, risk assessment, and market analysis. The regulatory framework in North America is relatively stable and is constantly evolving to address the challenges and opportunities associated with alternative data. This level of certainty encourages investment in alternative data solutions. The entrepreneurial culture in North America supports the start-up ecosystem, resulting in the creation of numerous companies specializing in alternative data collection, processing, and analysis. The alternative data market revenue is expected to grow since the region is characterized by technological leadership, sophisticated financial institutions, and an evolving regulatory landscape. The alternative data market is expected to grow as the need for data evolves with emerging technologies.

Key Regional Takeaways:

United States Alternative Data Market Analysis

In 2024, the US accounted for around 88.1% of the total North America alternative data market. The financial industry's growing reliance on non-traditional data sources for risk assessment and investment insights is propelling the alternative data market's rapid growth in the US. To obtain a competitive advantage, financial businesses, asset managers, and hedge funds are using data from sensors, online traffic, social media, and satellites. The ongoing investment in sustainable funds is also bolstering the market growth. According to Morningstar, the US sustainable fund market saw net outflows of USD 13 Billion in 2023, the first such year in over ten years. The total assets in sustainable funds climbed 12% year over year in 2023, reaching USD 323 Billion at the year's end due to market appreciation.

The need for alternative data has increased due to the growth of e-commerce and developments in data analytics tools. To glean relevant insights from massive datasets, corporations such as Amazon, Microsoft, and IBM are making significant investments in AI and machine learning techniques. Another important factor is the U.S. government's backing of open data projects, which give companies access to a variety of datasets. Additionally, more alternative data is being used to assess business sustainability practices because of the growth of ESG (Environmental, Social, and Governance) investing. The alternative data industry in the United States is estimated to be worth USD 5.8 Billion in 2024, supported by ongoing advancements in analytics and data collection technology.

Europe Alternative Data Market Analysis

Growing regulatory requirements, ESG investing trends, and the growing use of data analytics in traditional industries are all driving the expansion of the alternative data market in Europe. Demand for non-financial data to assess company governance and environmental practices has increased because of the European Union's Sustainable Finance Disclosure Regulation (SFDR) and other ESG-related regulations. According to an investment banking report, sustainable ETFs in Europe attracted USD 35 Billion in inflows in 2022.

European financial institutions are using alternative datasets, like credit card transactions, online reviews, and geolocation data, to provide detailed insights into consumer behavior and market trends. Due to the presence of top financial firms and their sophisticated technology infrastructure, Germany, the UK, and France are prominent marketplaces. The General Data Protection Regulation's (GDPR) encouragement of the growth of data-sharing platforms has also improved data openness, allowing for the wider use of alternative data. As companies engage in AI-driven analytics to remain competitive, the European market, which is reaching USD 1.3 Billion in 2024, has substantial development potential.

Asia Pacific Alternative Data Market Analysis

The booming digital economy, developing financial markets, and emergence of advanced analytics technologies in Asia Pacific are driving the region's fast-growing alternative data market. The use of alternative data is being spearheaded by nations like China, Japan, India, and South Korea, especially in the financial services, real estate, and e-commerce industries. For instance, hedge funds and private equity firms in China frequently employ alternative data, primarily from satellite data and mobile app usage, to monitor economic activity like consumer spending and factory output.

Large volumes of alternative data are produced for businesses to examine owing to the region's high internet penetration and the exponential expansion of e-commerce. According to a report by the Asian Development Bank, China Japan, and the Republic of Korea dominate the East Asian e-commerce business, which is still the biggest and most developed in Asia and the Pacific. The subregion's average internet and mobile penetration rates are 87% in 2021 and 149% in 2022. Additionally, according to UNCTAD, online sales accounted for 25% of China's retail sales in 2020, up from 19% in 2019. China accounted for over half of all retail e-commerce sales global in 2021, outpacing the combined sales value of Europe and the US. The PRC's e-commerce industry is predicted to generate USD 2 Trillion in revenue by 2025.

Social media analytics and geolocation data are being used more and more by startups in India and Southeast Asia to target customers and improve operational efficiency. With adoption being driven by robust demand from sectors like fintech, retail, and logistics, the Asia-Pacific alternative data market is anticipated to expand substantially.

Latin America Alternative Data Market Analysis

The expanding populations of the region's developing nations have been fulfilled by financial technology. The market reached a value of USD 440.7 Million in 2024. Latin America has already seen several Fintech innovations, which has increased the region's need for alternative data. One of the most popular alternative data suppliers in Latin America is QueXopa, which specializes in locating, analyzing, licensing, and combining data that helps decision-makers in the fields of industry, government, and finance gain a deeper understanding of the region. Additionally, the company has been providing new markets with unique data, which is helping the local industry. During the forecast period, there is expected to be a significant increase in the use of mobile applications and social and sentiment data. The development is credited to the rising demand for cell phone utilization data from the retail business.

Middle East and Africa Alternative Data Market Analysis

The region's alternative data market is propelled by the growing fintech solutions, the growing digitization of economies, and the need for predictive analytics in sectors like logistics, retail, and oil & gas. Alternative data is frequently used in the GCC countries, especially in the UAE and Saudi Arabia, to track real-time economic activities including retail foot traffic and tourism patterns. In Sub-Saharan Africa, the growth of digital payment systems and mobile banking is creating new datasets for evaluating market trends and customer creditworthiness. For example, according to the data collected from the Global Adoption Survey 2022 and the 2022 Global Adoption Survey of Mobile Financial Services, 27% people in Kenya and 17% people in Ghana received salary payments during 2022 via mobile money, yielding a plethora of data for analysis. Weather and geospatial data are being used more and more in the oil and gas industry to improve operational efficiency. As companies use AI-powered solutions to process and evaluate different information for strategic insights, the market is anticipated to rise gradually.

Competitive Landscape:

Key players in the market are engaging in a range of activities to consolidate their market position, diversify data offerings, and cater to the increasing demand for actionable insights. Companies are actively acquiring or partnering with smaller firms and start-ups that specialize in collecting unique data sets. This expands their portfolio of alternative data, thus making them more attractive to a broader client base. Incorporation of artificial intelligence and machine learning algorithms to sift through and analyze data is becoming standard. These technologies make the extracted insights more accurate and actionable. Recognizing that different industries have varied needs, companies are offering tailored data solutions. For instance, some firms specialize in providing alternative data specifically curated for hedge funds, while others focus on consumer analytics. As the alternative data industry is still emerging, key players are investing in educational programs and resources to educate potential clients on the value and utility of alternative data.

The report provides a comprehensive analysis of the competitive landscape in the alternative data market with detailed profiles of all major companies, including:

- 1010Data Inc. (Advance Communication Corp.)

- Advan Research Corporation

- Dataminr Inc.

- Eagle Alpha

- M Science

- Nasdaq Inc.

- Preqin

- RavenPack

- The Earnest Research Company

- Thinknum Inc.

Recent Developments:

- May 2025: First Rate, a financial technology provider, launched its innovative Alts Data Management solution to transform wealth management operations. Leveraging over 15 years of alternative asset expertise, the platform simplifies managing complex alternative investment data, enhancing efficiency and insight for wealth management firms. The solution offers powerful tools to streamline data handling and improve portfolio analysis.

- April 2025: Equifax expanded its dataset and dashboard offerings on Google Cloud Marketplace, enhancing business decision-making with advanced consumer segmentation (IXI Economic Cohorts), household financial insights (Income360®, Affluence Index™, etc.), and specialized suites for automotive, financial services, and higher education sectors. New visualization tools include Campaign Insights and Portfolio Insights Dashboards. These resources leverage the Equifax Cloud™ on Google Cloud Platform, enabling secure, scalable data sharing via Google Cloud Analytics Hub.

- March 2025: Dataminr, a data analytics firm, raised USD 85 million in convertible financing and credit to fuel growth, particularly expanding internationally in Europe, the Middle East, and Asia. Founded in 2009, it monitors real-time global events using AI to aid crisis response, serving over 800 customers.

- November 2024: RavenPack launched Bigdata.com, an AI platform for financial research powered by Vespa.ai’s billion-scale vector search technology. Combining RavenPack’s proprietary Retrieval-Augmented Generation (RAG) with Vespa’s SPANN-based search, Bigdata.com enables real-time, highly accurate querying of billions of financial documents. It offers professionals a customizable API and research assistant with transparent source attribution, accessible via desktop and mobile.

- November 2024: Goldman Sachs is leveraging alternative data, such as satellite imagery and credit card transactions, to enhance its predictive capabilities regarding retail trends. By analyzing this data, the firm aims to provide more accurate forecasts on consumer behavior and spending patterns, allowing clients to make informed investment decisions in the retail sector.

Alternative Data Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Mobile Application Usage, Credit and Debit Card Transactions, Email Receipts, Geo-Location (Foot Traffic) Records, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, Others |

| End Use Industries Covered | Transportation and Logistics, BFSI, Retail and ECommerce, Energy and Utilities, IT and Telecommunications, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | The United States, Canada, Germany, France, the United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 1010Data Inc. (Advance Communication Corp.), Advan Research Corporation, Dataminr Inc., Eagle Alpha, M Science, Nasdaq Inc., Preqin, RavenPack, The Earnest Research Company, Thinknum Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, alternative data market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global alternative data market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the Alternative Data industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Alternative data refers to non-traditional data sources utilized for gaining insights into market trends, investment strategies, and decision-making processes. It includes satellite imagery, social media activity, credit card transactions, and geolocation data, offering unique and high-frequency insights that complement traditional data sources.

The global alternative data market was valued at USD 8,889.1 Million in 2024.

IMARC estimates the global alternative data market to exhibit a CAGR of 35.18% during the forecast period of 2025-2033.

The increasing reliance on alternative data for investment strategies and business insights, advances in AI and machine learning enabling effective analysis of unstructured data, and expansion of e-commerce and digital platforms generating vast data volumes are majorly driving the market.

Credit and debit card transactions represented the largest segment by data type, driven by their ability to provide real-time consumer spending insights.

The BFSI sector leads the market by end-use industry due to its reliance on alternative data for enhanced investment strategies, credit risk profiling, and fraud detection.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the global alternative data market include 1010Data Inc. (Advance Communication Corp.), Advan Research Corporation, Dataminr Inc., Eagle Alpha, M Science, Nasdaq Inc., Preqin, RavenPack, The Earnest Research Company, and Thinknum Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)