Ammonia Market Size, Share, Trends and Forecast by Physical Form, Application, End Use Industry, and Region, 2025-2033

Ammonia Market Size and Share:

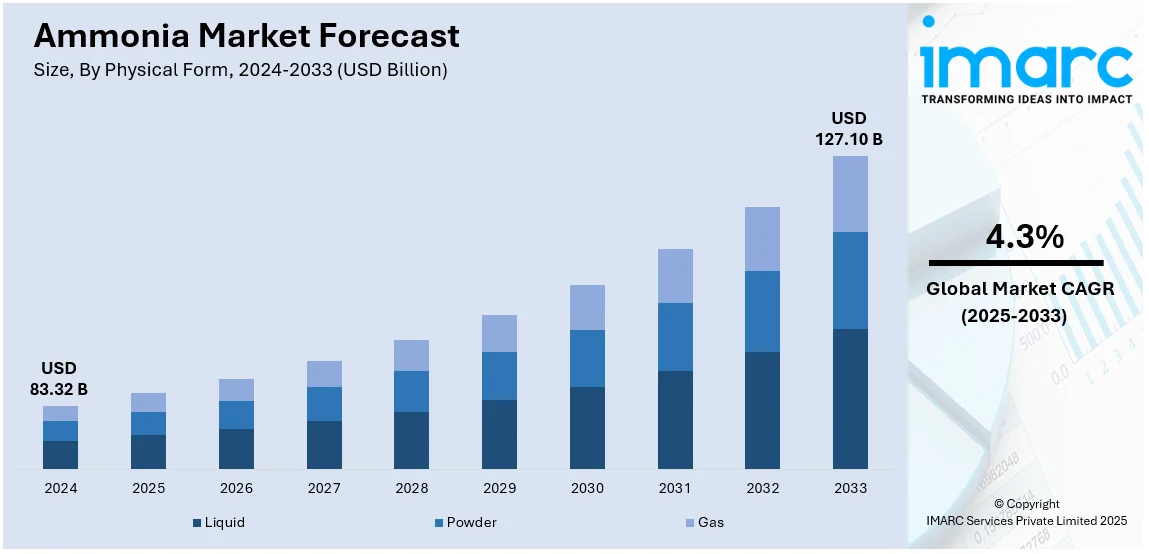

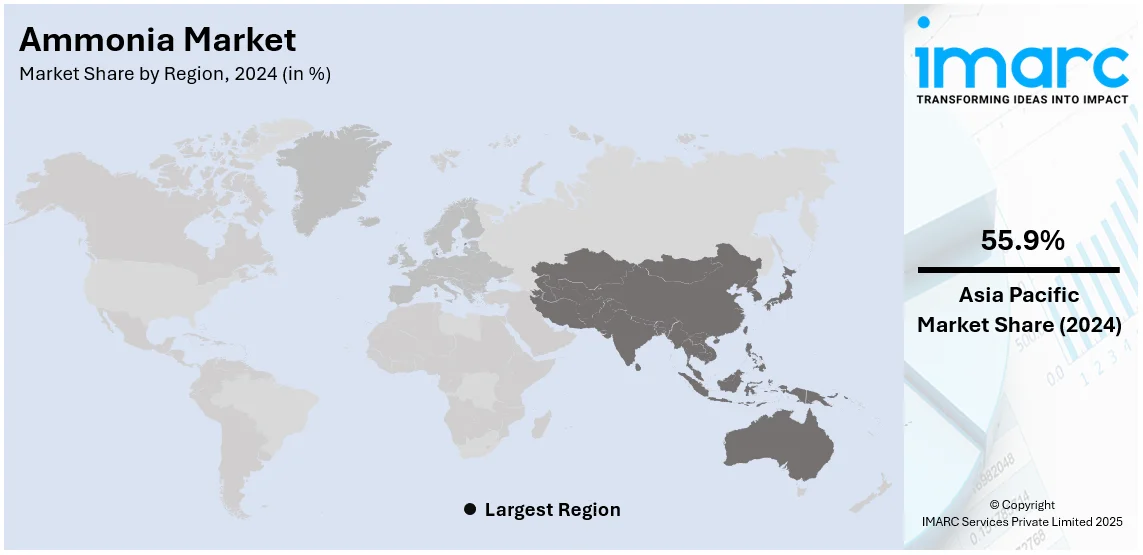

The global ammonia market size was valued at USD 83.32 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 127.10 Billion by 2033, exhibiting a CAGR of 4.3% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 55.9% in 2024. The market is driven by increasing demand for fertilizers in agriculture, growing industrial applications, rising production of chemicals and explosives, advancements in refrigeration technologies, and expanding usage in wastewater treatment. Additionally, the shift towards sustainable and eco-friendly agricultural practices further fuels market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 83.32 Billion |

| Market Forecast in 2033 | USD 127.10 Billion |

| Market Growth Rate (2025-2033) | 4.3% |

The ammonia market is evolving with increasing demand across agriculture, industrial applications, and clean energy initiatives. Fertilizer production remains the primary driver, as ammonia-based compounds such as urea and ammonium nitrate are essential for improving crop yields. Rising global food demand and pressure on arable land are pushing governments and agricultural sectors to maximize efficiency, further fueling market expansion. Beyond fertilizers, ammonia is seeing rising adoption in industrial applications, including refrigeration, plastics, and explosives manufacturing. Additionally, the shift toward low-carbon energy solutions is positioning ammonia as a key hydrogen carrier, driving investments in green ammonia production using renewable energy sources.

To get more information on this market, Request Sample

In the United States, ammonia demand is largely driven by the country’s robust agricultural sector, with major fertilizer consumption supporting crop production for both domestic use and exports. The U.S. also plays a significant role in industrial ammonia applications, particularly in chemicals and refrigerants. As per ammonia market forecast, the market dynamics are shifting with growing investments in green ammonia projects to align with national decarbonization goals. For instance, in September 2024, Ohmium International partnered with Ten08 Energy to supply green hydrogen for a 500MW clean ammonia project in Texas. The initiative aims to produce 1.4 million metric tons of clean ammonia annually, combining blue and green ammonia to meet growing global energy demands. Moreover, government policies and incentives promoting clean energy, along with advancements in carbon capture technologies, are further influencing the market’s development and long-term growth trajectory.

Ammonia Market Trends:

Increasing Demand for Green Ammonia

The global ammonia market is undergoing a notable inclination towards green ammonia, fueled by heightening environmental concerns and strict regulations on carbon emissions. According to a research article published in May 2024, the European ammonia sector is responsible for 36 million tons of carbon dioxide emission annually. Green ammonia is an eco-friendly alternative to traditionally produced ammonia as it is generated using renewable energy sources. As a result, major companies are rapidly investing in green ammonia production to reduce their carbon footprints. For instance, in July 2024, Aslan Energy Capital signed MoU to acquire 35,000 Hectors of land in Mexico for developing solar-based green ammonia production facility. The first phase is projected to produce around 600,000 Tons of green ammonia per year. The capacity is planned to double in phase two in 2030. This shift aligns with global decarbonization goals, further supported by regional incentives for green hydrogen and ammonia projects. Additionally, partnerships between energy and fertilizer companies are accelerating pilot projects and commercial-scale adoption worldwide.

Rising Product Demand for Fertilizer Production

Ammonia’s crucial role as a source of nitrogen in fertilizer production primarily drives the market growth. With the increase in global population, the food demand is propelling, necessitating elevation of agricultural production. Consequently, this drives the demand for ammonia-based fertilizers. According to the data provided by The Mosaic Company, a producer of potash and phosphate for agricultural applications, more than 80% of the ammonia produced is leveraged as fertilizer. Major agricultural economies, including Brazil and India, are heavily investing to expand the production capacity for fertilizer. This trend reinforces a stable ammonia market demand, highlighting its critical role in aiding global agricultural sustainability and food security, and emphasize the need for nitrogen-rich fertilizers to sustain crop yields globally. Furthermore, government-led agricultural subsidy programs are increasing the affordability and access to ammonia-based fertilizers in developing regions.

Advancements in Ammonia Synthesis Technology

The ammonia market outlook indicates expanding opportunities due to advancements in ammonia synthesis technology. The development of more effective and cost-efficient production techniques, including catalytic and electrochemical processes, is improving ammonia synthesis capabilities. Such advancements aid in carbon emission and energy consumption reduction. For instance, in March 2024, Jupiter Ionics secured USD 9 million to expand its electrochemical green ammonia technology, which uses an electrolysis process to produce ammonia with zero carbon emissions. With major companies rapidly adopting such advanced technologies, the market witnesses enhanced sustainability and productivity. This trend reflects the industry’s obligation to efficiency and innovation, bolstering competitiveness and growth in the ammonia market share. Research institutions are actively collaborating with private players to fast-track the commercialization of these novel technologies. Moreover, supportive regulatory frameworks in Europe and Asia are fostering a favorable environment for innovation and deployment.

Ammonia Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ammonia market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on physical form, application, and end use industry.

Analysis by Physical Form:

- Liquid

- Powder

- Gas

Liquid stand as the largest physical form in 2024. The domination of liquid as the largest segment of the market share is due to its widespread utilization in chemical manufacturing, agriculture sector, and industrial refrigeration. Liquid ammonia is comparatively easier to store and transport than its gaseous form, which further enhances its preferences across various industries. Moreover, liquid form has high efficiency and energy density in numerous applications that aids in its dominance in the market dynamics. The growth of this leading segment is further propelled by the development of production facilities and technological improvements in distribution and handling, underpinning its dominance in the ammonia market. For instance, in January 2024, INOX Air signed MoU with Government of Maharashtra, India, for setting up a liquid ammonia production facility of 500,00 million tons p.a. capacity with a proposed outlay of USD 3 billion.

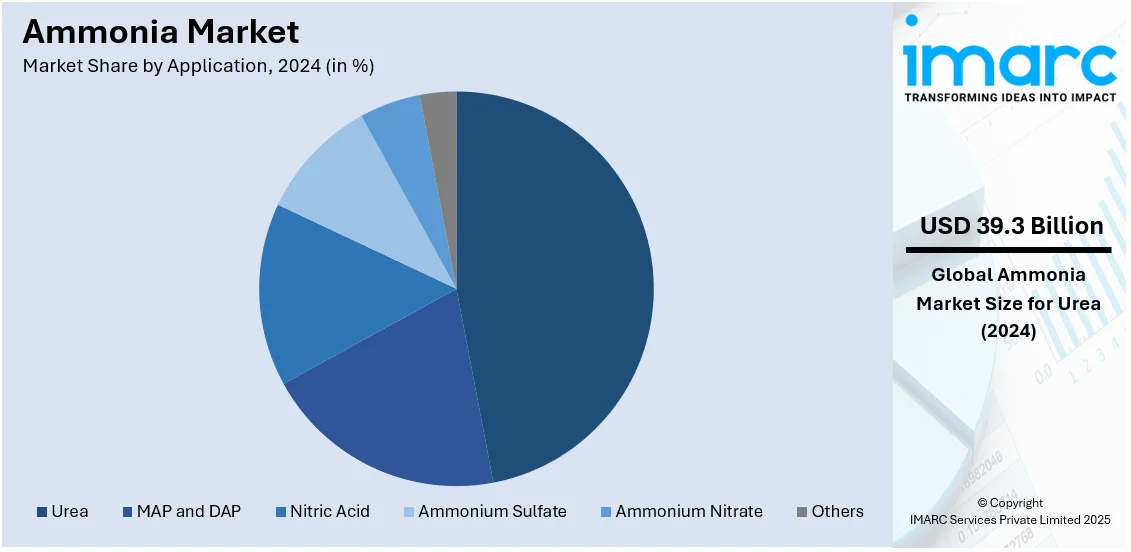

Analysis by Application:

- MAP and DAP

- Urea

- Nitric Acid

- Ammonium Sulfate

- Ammonium Nitrate

- Others

Urea leads the market with around 47.2% of market share in 2024. Urea is a crucial ammonia derivative that plays a critical role in the fertilizer market. Its production is significantly influenced by ammonia market growth factors, driving its demand and applications in both agriculture and industry. It is the most commonly utilized nitrogen fertilizer and provides a cost-efficient and effective nitrogen source to crops and plants, consequently increasing crop yields. According to research article published in 2023 edition of Sustainable Plant Nutrition journal, utilization of urea as a fertilizer is more than 50% of the global nitrogen fertilizer applications. Furthermore, urea is leveraged in numerous industrial applications, such as adhesives, resins feedstock, and in automotive sector for diesel exhaust fluid.

Analysis by End Use Industry:

- Agrochemical

- Industrial Chemical

- Mining

- Pharmaceutical

- Textiles

- Others

Agrochemical leads the market in 2024. This domination is influenced by its integral demand in fertilizer production. According to Jaysons Chemical Industries, an ammonia manufacturer, approximately 90% of ammonia produced is leveraged in agricultural sector as a fertilizer. Moreover, approximately 50% of agricultural production globally is dependent on mineral fertilization. This dominance is ascribed to the elevated demand for effective agricultural practices to improve crop yields and meet the rapidly increasing food requirements of a proliferating global population. Ammonia’s efficiency in offering vital nutrients to crops reinforces its extensive utilization in fertilizers. Resultantly, the agrochemical sector remains a crucial end-user, upholding strong ammonia demand globally.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 55.9%. Asia Pacific is dominating the ammonia market primarily due to rapid urbanization, industrialization, and escalated agricultural demand. Major markets, such as Japan, South Korea, India and China, demonstrate significant growth because of widespread use of ammonia in fertilizers, aiding the propulsion of vast agricultural sectors. According to International Energy Agency, China is the leading producer of ammonia, with 30% of total production. In addition, the proliferating chemical manufacturing sector of Asia Pacific further fuels ammonia utilization. Tactical investments, partnerships, and technological innovations in the production capacity of ammonia synthesis improve the region’s competitive landscape, fortifying its dominant position in the global market share. For instance, in December 2023, Mitsubishi Corporation, SK Innovation, and Amogy announced a strategic partnership to improve the ammonia supply chain in East Asia, particularly South Korea, and Japan. This partnership aims to focus on ammonia cracking technology for extensive hydrogen carrier applications, and cost analysis across the value chain to probe opportunities for market expansion across the ammonia supply chain.

Key Regional Takeaways:

United States Ammonia Market Analysis

In 2024, United States accounted for 83.70% of the market share in North America. The ammonia market in the United States is driven by several key factors, with agriculture being the dominant sector. According to a 2019 report by the US Department of Agriculture (Economic Research Service), the country consumes three major categories of fertilizers: nitrogen solution (43%), urea (28%), and ammonia-based fertilizers such as anhydrous, aqua, nitrate, and sulfate (28%). Ammonia, primarily used in these fertilizers, plays a vital role in meeting the growing demand for agricultural productivity. As the US remains one of the largest producers of crops like corn, wheat, and soybeans, the need for ammonia-based fertilizers continues to rise. Additionally, the petrochemical industry significantly contributes to ammonia demand, as it is used in the production of plastics, explosives, and chemicals. The shift toward sustainable agricultural practices and the adoption of more efficient fertilizers, such as controlled-release formulations, are further driving ammonia consumption. The US government’s support through subsidies and initiatives promoting sustainable farming practices strengthens ammonia demand. The well-established ammonia production infrastructure in the US ensures a reliable supply, not only to meet domestic needs but also to support exports. These factors position the US as a key player in the global ammonia market, with ongoing demand from both agriculture and industry fueling growth.

North America Ammonia Market Analysis

The North American ammonia market is influenced by strong agricultural demand, particularly for fertilizers, alongside growing industrial applications. The region benefits from abundant natural gas supplies, which serve as a key feedstock, ensuring competitive production costs. Moreover, market dynamics are shaped by fluctuations in raw material prices, regulatory pressures, and advancements in environmentally sustainable technologies such as green ammonia. Producers are focusing on improving efficiency and reducing emissions to meet sustainability targets. For instance, in July 2024, CF Industries and POET collaborated to pilot low-carbon ammonia fertilizer in U.S. corn production, aiming to reduce ethanol’s carbon intensity. The initiative used green ammonia produced with renewable energy to decarbonize both fertilizer and ethanol production. Additionally, regional trade policies, infrastructure developments, and evolving environmental standards play critical roles in shaping ammonia supply and demand within the broader North American landscape.

Europe Ammonia Market Analysis

The ammonia market in Europe is influenced by several key factors, with agriculture remaining the primary driver. Ammonia, a vital component of nitrogen fertilizers, supports the region's agricultural industry, which is crucial for food security and competitiveness. According to IFOAM Organics Europe, in 2022, the EU's total area of farmland under organic production grew to 16.9 Million Hectares, and the number of organic producers increased by 10.8% to 419,112 compared to 2021. This growth reflects a rising demand for sustainable farming practices, which, in turn, is driving the use of ammonia-based fertilizers designed for organic and efficient farming. Additionally, the petrochemical industry’s demand for ammonia in the production of chemicals, plastics, and explosives also supports market growth. Europe's focus on reducing its carbon footprint and adopting green technologies is further shaping ammonia production trends, with innovations in green ammonia and low-emission processes becoming increasingly important. As sustainability continues to be a priority, the ammonia market in Europe is evolving with an emphasis on environmentally friendly and high-efficiency solutions. These factors, coupled with government regulations and agricultural demand, position Europe for continued growth in ammonia consumption.

Asia Pacific Ammonia Market Analysis

The ammonia market in the Asia-Pacific (APAC) region is primarily driven by the agricultural sector, which remains a major consumer of ammonia-based fertilizers. According to the International Labour Organization (ILO), in 2021, 563 Million people were employed in agriculture in the APAC region, underscoring the sector's significance. As the demand for food increases due to the rapidly growing population, ammonia remains essential for enhancing agricultural productivity, particularly through nitrogen-based fertilizers. In addition, the region's expanding industrial base, including chemicals and petrochemicals, further drives ammonia consumption for applications such as plastics and explosives. The adoption of modern farming practices and the need for high-efficiency fertilizers are also fueling ammonia demand. Furthermore, growing environmental concerns and the push for sustainable agriculture are leading to innovations in ammonia production and fertilizer technologies. With major agricultural markets like China and India continuing to focus on boosting crop yields, the ammonia market in APAC is poised for significant growth.

Latin America Ammonia Market Analysis

The ammonia market in Latin America is driven by the region's strong agricultural sector, with Brazil being a key player. The country’s fertilizers market is projected to exhibit a compound annual growth rate (CAGR) of 7.20% from 2024 to 2032, reflecting increasing demand for ammonia-based fertilizers to support crop production. As Brazil remains one of the world’s leading producers of soybeans, corn, and sugarcane, the need for efficient fertilizers is expected to rise. Additionally, the region's expanding industrial base, including chemicals and petrochemicals, further boosts ammonia consumption, supporting long-term market growth in Latin America.

Middle East and Africa Ammonia Market Analysis

The ammonia market in the Middle East and Africa is influenced by the agricultural sector, especially in regions like North Africa, where ammonia-based fertilizers are essential for improving crop yields. According to OPEC, the member countries in the Middle East and North Africa (MENA) collectively hold 840 Billion Barrels of proven crude oil reserves, which provides a reliable source of natural gas for ammonia production. This access to abundant feedstock supports both domestic fertilizer needs and ammonia exports. The growing emphasis on sustainable farming practices and expanding infrastructure is expected to further drive ammonia demand across the region.

Competitive Landscape:

The ammonia market competitive landscape is represented by the presence of major companies that are dominating the market through large-scale production capacities and strategic partnerships. For instance, in May 2024, Johnson Matthey (JM) and thyssenkrupp Uhde signed MoU to develop a fully integrated blue ammonia solution. As per the agreement, the duo will merge thyssenkrupp Uhde’s ammonia process and JM’s LCH technology to produce blue ammonia with up to 99% of carbon dioxide capture. Heightening demand for the product in industrial and agricultural applications further accelerates competition and expands business opportunities in the ammonia market. Moreover, market participants are actively investing in superior technologies and sustainable processing practices to improve effectiveness and lower adverse impacts on environment. In addition, strategic mergers are common, targeting to strengthen market position and amplify geographic reach.

The report provides a comprehensive analysis of the competitive landscape in the ammonia market with detailed profiles of all major companies, including:

- AB Achema

- Acron Group

- BASF SE

- CF Industries Holdings, Inc.

- JSC Togliattiazot

- Koch Fertilizer, LLC

- Mitsui Chemicals, Inc

- Nutrien

- OCI

- Orica Limited

- Qatar Fertiliser Company

- Saudi Basic Industries Corporation (SABIC)

- Yara International ASA

Latest News and Developments:

- October 2024: Hygenco Green Energies has issued a tender for 1.1 GW of renewable energy to support its green ammonia project, sourcing 625 MW from solar and 500 MW from wind power. This marks India's largest renewable energy procurement for a green ammonia project. The initiative supports the National Green Hydrogen Mission, aiming to establish India as a Green Hydrogen Hub by 2030.

- May 2024: Johnson Matthey (JM) and thyssenkrupp Uhde signed MoU to develop a fully integrated blue ammonia solution. As per the agreement, the duo will merge thyssenkrupp Uhde’s ammonia process and JM’s LCH technology to produce blue ammonia with up to 99% of carbon dioxide capture.

- May 2024: Yara Clean Ammonia and Greenko ZeroC, part of India’s AM Green, signed a deal to supply renewable ammonia from AM Green’s Kakinada facility in India. The offtake agreement and term sheet secure up to 50% of renewable ammonia supply from Phase 1 of AM Green's production site, set to produce and export ammonia by 2027. This ammonia will be leveraged in production of low-emission fertilizer and for decarbonizing power, shipping, and other energy intensive sectors.

- May 2024: North Ammonia AS, a green ammonia production firm, secured 171 MW of grid capacity through Glitre Nett, an energy company, for a large-scale green ammonia production plant in Norway.

- December 2023: NYK, JERA Co., Inc., and Resonac Holdings Corporation signed an agreement to jointly explore the use of ammonia as a fuel for ships. The collaboration aims to assess ammonia’s feasibility as a sustainable maritime fuel. This initiative supports efforts to reduce emissions in the shipping industry.

Ammonia Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Physical Forms Covered | Liquid, Powder, Gas |

| Applications Covered | MAP and DAP, Urea, Nitric Acid, Ammonium Sulfate, Ammonium Nitrate, Others |

| End Use Industries Covered | Agrochemical, Industrial Chemical, Mining, Pharmaceutical, Textiles, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Achema, Acron Group, BASF SE, CF Industries Holdings, Inc., JSC Togliattiazot, Koch Fertilizer, LLC, Mitsui Chemicals, Inc, Nutrien, OCI, Orica Limited, Qatar Fertiliser Company, Saudi Basic Industries Corporation (SABIC), Yara International ASA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ammonia market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ammonia market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ammonia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ammonia market was valued at USD 83.32 Billion in 2024.

IMARC estimates the global ammonia market to reach USD 127.10 Billion in 2033, exhibiting a CAGR of 4.3% during 2025-2033.

The market is growing due to rising fertilizer demand, industrial applications, and clean energy initiatives. Agriculture relies on ammonia-based fertilizers for higher yields, while industries use it in chemicals and refrigeration. Investments in blue and green ammonia, driven by sustainability targets and government incentives, are accelerating market expansion.

Asia Pacific currently dominates the market, holding a market share of over 55.9% in 2024. This leadership can be attributed to high fertilizer consumption, industrial expansion, and strong production capacity. Countries like China and India lead in ammonia manufacturing and usage, driven by agricultural demand and chemical applications. Additionally, government policies, technological advancements, and investments in low-carbon ammonia projects further strengthen the region’s market position.

Some of the major players in the ammonia market include AB Achema, Acron Group, BASF SE, CF Industries Holdings, Inc., JSC Togliattiazot, Koch Fertilizer, LLC, Mitsui Chemicals, Inc, Nutrien, OCI, Orica Limited, Qatar Fertiliser Company, Saudi Basic Industries Corporation (SABIC), Yara International ASA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)