Asia Pacific Automotive Lead-Acid Battery Market Size, Share, Trends and Forecast by Vehicle Type, Product, Type, Customer Segment, and Country, 2025-2033

Market Overview:

The Asia Pacific automotive lead-acid battery market size reached USD 6,178.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,270.4 Million by 2033, exhibiting a growth rate (CAGR) of 1.8% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6,178.8 Million |

|

Market Forecast in 2033

|

USD 7,270.4 Million |

| Market Growth Rate 2025-2033 | 1.8% |

Invented by Gaston Planté in 1859, lead-acid batteries represent one of the most widely utilized rechargeable batteries. They are employed in the starting, lighting and ignition (SLI) process of automobiles as they are robust, cost-effective, and can withstand abuse caused by wear and tear. In comparison with their substitutes like lithium-ion batteries, lead-acid batteries can tolerate overcharging. Moreover, these batteries are 100% recyclable, which aids in minimizing the overall manufacturing cost as well as reducing environmental pollution. In Asia Pacific, the boosting sales of luxury vehicles and advancements in vehicle technology are the key factors driving the sales of these batteries. Apart from this, the establishment of manufacturing facilities by several multinational players, such as Honda and Toyota, coupled with the expanding automotive fleet in China, Indonesia, Malaysia, Vietnam, Thailand and India, is also spurring the demand for lead-acid batteries in the region.

.webp)

To get more information on this market, Request Sample

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific automotive lead-acid battery market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on vehicle type, product, type and customer segment.

Breakup by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- HEV Cars

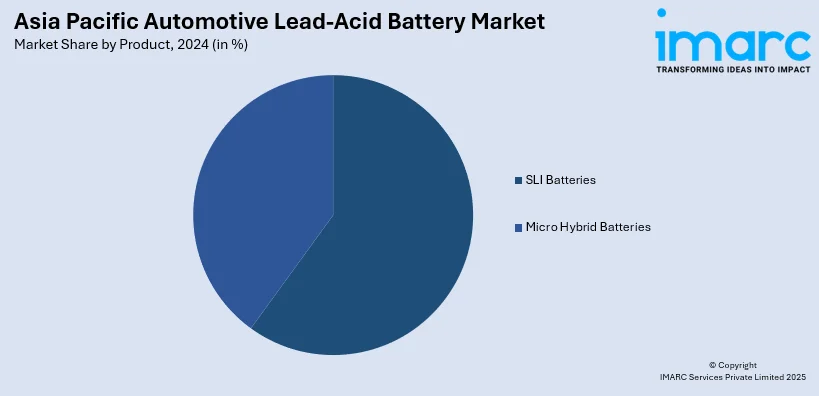

Breakup by Product:

- SLI Batteries

- Micro Hybrid Batteries

Breakup by Type:

- Flooded Batteries

- Enhanced Flooded Batteries

- VRLA Batteries

Breakup by Customer Segment:

- OEM

- Replacement

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Value Chain Analysis

Key Drivers and Challenges

Porters Five Forces Analysis

PESTEL Analysis

Government Regulations

Competitive Landscape:

- Competitive Structure

- Key Player Profiles

IMARC Group’s latest report provides a deep insight into the Asia Pacific automotive lead-acid battery market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Asia Pacific automotive lead-acid battery market in any manner.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Vehicle Type, Product, Type, Customer Segment, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Asia Pacific automotive lead-acid battery market was valued at USD 6,178.8 Million in 2024.

We expect the Asia Pacific automotive lead-acid battery market to exhibit a CAGR of 1.8% during 2025-2033.

The rising adoption of electric vehicles, along with the introduction of low-cost and energy-efficient battery variants, is currently catalyzing the Asia Pacific automotive lead-acid battery market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several Asia Pacific countries resulting in temporary closure of numerous automobile manufacturing units, thereby limiting the demand for automotive lead-acid battery.

Based on the vehicle type, the Asia Pacific automotive lead-acid battery market has been segmented into passenger cars, commercial vehicles, two wheelers, and HEV cars. Among these, commercial vehicles currently hold the majority of the total market share.

Based on the product, the Asia Pacific automotive lead-acid battery market can be divided into SLI batteries and micro hybrid batteries. Currently, SLI batteries exhibit a clear dominance in the market.

Based on the type, the Asia Pacific automotive lead-acid battery market has been categorized into flooded batteries, enhanced flooded batteries, and VRLA batteries. Among these, flooded batteries currently account for the largest market share.

Based on the customer segment, the Asia Pacific automotive lead-acid battery market can be segregated into OEM and replacement. Currently, OEM holds the majority of the total market share.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others, where China currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)