Asia Pacific PET Packaging Market Size, Share, Trends and Forecast by Packaging Type, Form, Pack Type, Filling Technology, End User, and Country, 2025-2033

Market Overview 2025-2033:

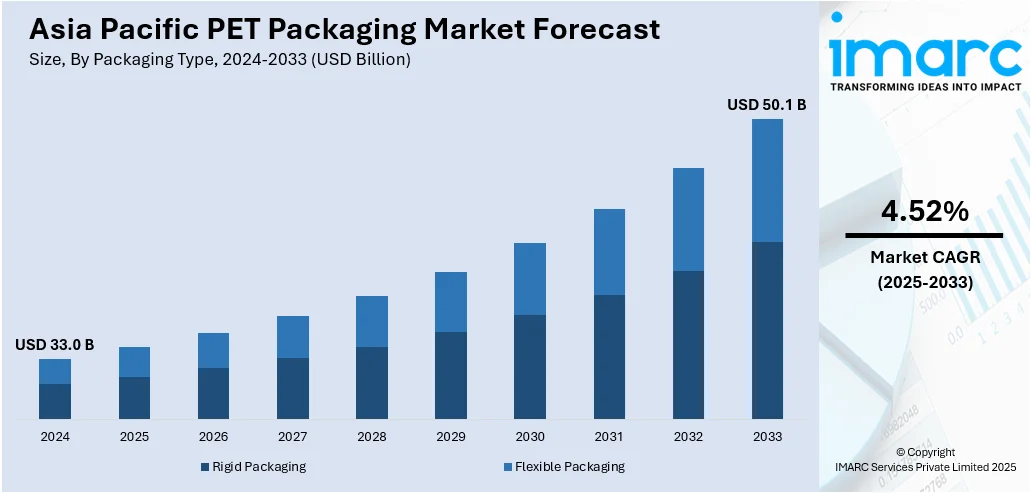

The Asia Pacific PET packaging market size reached USD 33.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 50.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.52% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 33.0 Billion |

|

Market Forecast in 2033

|

USD 50.1 Billion |

| Market Growth Rate 2025-2033 | 4.52% |

Polyethylene terephthalate, commonly known as PET, is a form of polyester that can be shaped into various packaging containers, boxes and bottles. PET packaging is produced by melting pellets of PET resin and extruding the molten liquid into the desired shape depending upon the requirement of the user. PET is thermally stable, durable, and provides moisture, solvent and alcohol resistance. It also prevents degradation of the packaged contents and ensures the maintenance of quality while providing resistance to diluted alkalis and halogenated hydrocarbons. In the Asia Pacific region, manufacturers are opting for PET packaging as it helps extend the shelf-life, does not react with the product and is resistant to attacks by micro-organisms.

To get more information on this market, Request Sample

Asia Pacific PET Packaging Market Trends:

The Asia Pacific PET packaging market is primarily driven by the emerging trend of on-the-go food consumption and the growing demand for single-serve and small-sized products. PET packaging is popular among consumers as it is price efficient and provides value for money. It is also used for packing beauty and personal care, home care, and dog and cat food products, which is propelling the growth of the market. Additionally, the increasing sales of bottled water in countries such as India and China are also significantly impacting the market. Furthermore, the leading companies are using advanced technologies to manufacture reusable and recyclable packaging solutions. For instance, they are utilizing plasma-based coating to make PET bottles more impervious.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific PET packaging market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on packaging type, form, pack type, filling technology and end user.

Breakup by Packaging Type:

- Rigid Packaging

- Flexible Packaging

Breakup by Form:

- Amorphous PET

- Crystalline PET

Breakup by Pack Type:

- Bottles and Jars

- Bags and Pouches

- Trays

- Lids/Caps and Closures

- Others

Breakup by Filling Technology:

- Hot Fill

- Cold Fill

- Aseptic Fill

- Others

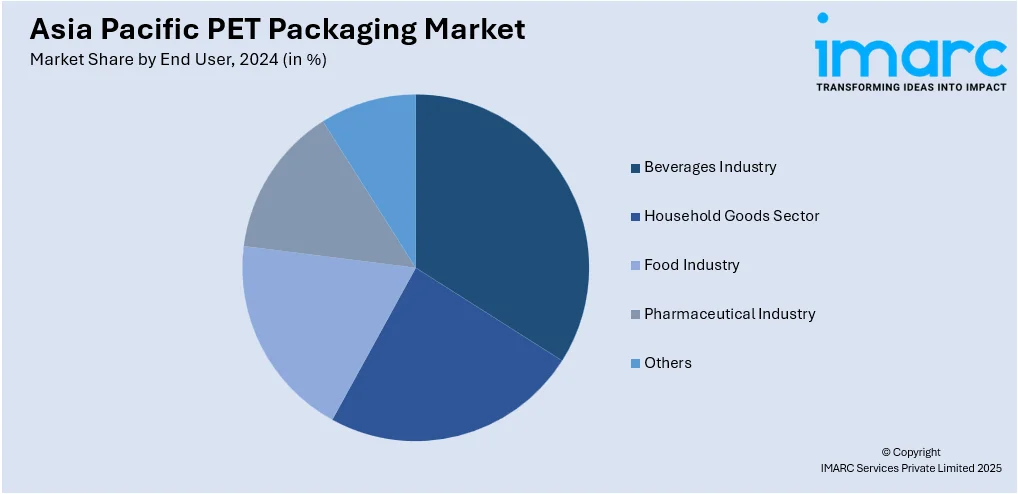

Breakup by End User:

- Beverages Industry

- Bottled Water

- Carbonated Soft Drinks

- Milk and Dairy Products

- Juices

- Beer

- Others

- Household Goods Sector

- Food Industry

- Pharmaceutical Industry

- Others

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Packaging Type, Form, Pack Type, Filling Technology, End User, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Asia Pacific PET packaging market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Asia Pacific PET packaging market?

- What are the key regional markets?

- What is the breakup of the market based on the packaging type?

- What is the breakup of the market based on the form?

- What is the breakup of the market based on the pack type?

- What is the breakup of the market based on the filling technology?

- What is the breakup of the market based on the end user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Asia Pacific PET packaging market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)